Basic Stats

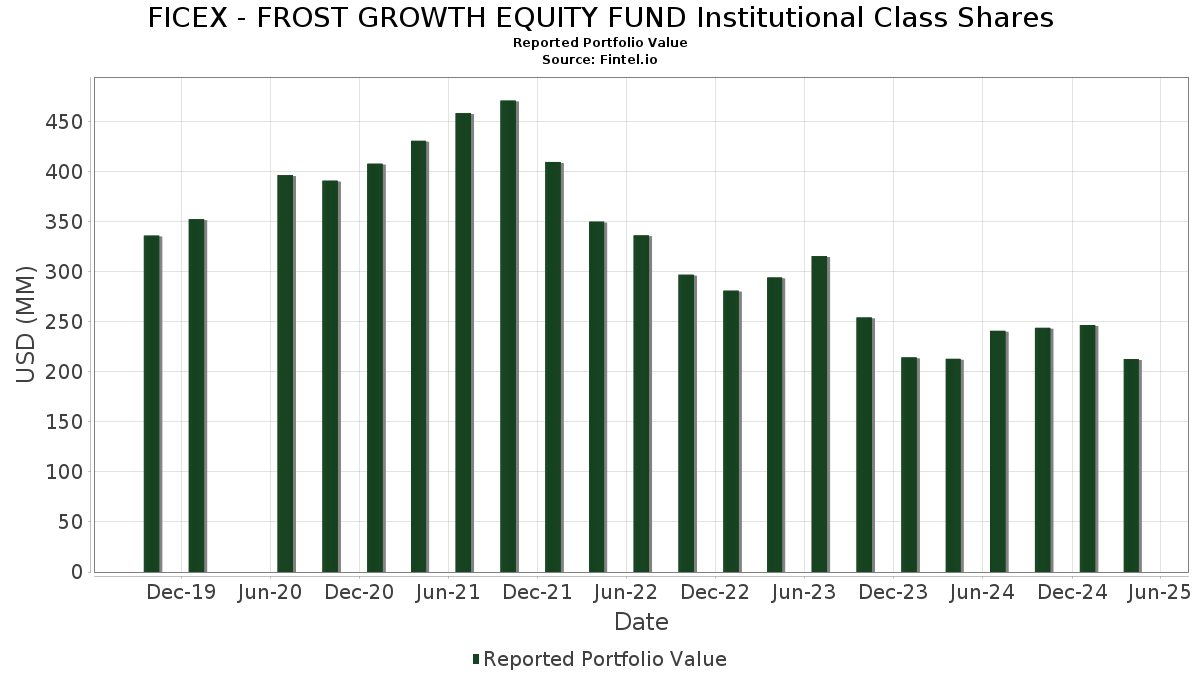

| Portfolio Value | $ 212,678,546 |

| Current Positions | 57 |

Latest Holdings, Performance, AUM (from 13F, 13D)

FICEX - FROST GROWTH EQUITY FUND Institutional Class Shares has disclosed 57 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 212,678,546 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). FICEX - FROST GROWTH EQUITY FUND Institutional Class Shares’s top holdings are Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . FICEX - FROST GROWTH EQUITY FUND Institutional Class Shares’s new positions include Trane Technologies plc (US:TT) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.96 | 0.9225 | 0.9225 | ||

| 0.01 | 5.96 | 2.8049 | 0.8781 | |

| 0.01 | 9.15 | 4.3050 | 0.8161 | |

| 0.00 | 1.34 | 0.6311 | 0.6311 | |

| 0.01 | 1.92 | 0.9027 | 0.6021 | |

| 0.01 | 1.55 | 0.7312 | 0.5065 | |

| 0.02 | 8.01 | 3.7689 | 0.4045 | |

| 0.01 | 1.65 | 0.7750 | 0.3050 | |

| 0.01 | 6.51 | 3.0608 | 0.2935 | |

| 0.00 | 2.29 | 1.0794 | 0.2905 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 14.58 | 6.8561 | -1.3563 | |

| 0.00 | 0.53 | 0.2509 | -0.7969 | |

| 0.02 | 10.76 | 5.0617 | -0.7434 | |

| 0.04 | 6.08 | 2.8597 | -0.6499 | |

| 0.00 | 1.18 | 0.5566 | -0.3409 | |

| 0.04 | 6.73 | 3.1673 | -0.3397 | |

| 0.01 | 1.09 | 0.5132 | -0.2990 | |

| 0.02 | 0.93 | 0.4367 | -0.2910 | |

| 0.01 | 2.60 | 1.2230 | -0.2884 | |

| 0.16 | 17.90 | 8.4181 | -0.2294 |

13F and Fund Filings

This form was filed on 2025-06-27 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.06 | -7.14 | 23.14 | -11.57 | 10.8825 | 0.2766 | |||

| NVDA / NVIDIA Corporation | 0.16 | -7.51 | 17.90 | -16.10 | 8.4181 | -0.2294 | |||

| AAPL / Apple Inc. | 0.08 | -4.70 | 17.52 | -14.19 | 8.2407 | -0.0355 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -7.27 | 14.58 | -28.05 | 6.8561 | -1.3563 | |||

| META / Meta Platforms, Inc. | 0.02 | -5.66 | 10.76 | -24.86 | 5.0617 | -0.7434 | |||

| LLY / Eli Lilly and Company | 0.01 | -4.05 | 9.15 | 6.34 | 4.3050 | 0.8161 | |||

| V / Visa Inc. | 0.02 | -4.49 | 8.01 | -3.46 | 3.7689 | 0.4045 | |||

| GOOGL / Alphabet Inc. | 0.04 | 0.00 | 6.73 | -22.17 | 3.1673 | -0.3397 | |||

| MA / Mastercard Incorporated | 0.01 | -3.39 | 6.51 | -4.67 | 3.0608 | 0.2935 | |||

| GOOG / Alphabet Inc. | 0.04 | -10.26 | 6.08 | -29.78 | 2.8597 | -0.6499 | |||

| NFLX / Netflix, Inc. | 0.01 | 8.28 | 5.96 | 25.48 | 2.8049 | 0.8781 | |||

| AVGO / Broadcom Inc. | 0.03 | 10.02 | 5.93 | -4.29 | 2.7900 | 0.2775 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -9.60 | 4.18 | -18.47 | 1.9643 | -0.1120 | |||

| NOW / ServiceNow, Inc. | 0.00 | -13.70 | 3.58 | -19.06 | 1.6859 | -0.1095 | |||

| BSX / Boston Scientific Corporation | 0.03 | -11.38 | 3.28 | -10.93 | 1.5445 | 0.0499 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | -10.80 | 3.27 | -2.50 | 1.5390 | 0.1789 | |||

| COST / Costco Wholesale Corporation | 0.00 | -7.24 | 3.18 | -5.86 | 1.4974 | 0.1266 | |||

| GE / General Electric Company | 0.01 | 0.00 | 2.90 | -0.99 | 1.3640 | 0.1766 | |||

| SPOT / Spotify Technology S.A. | 0.00 | -32.64 | 2.80 | -24.61 | 1.3161 | -0.1883 | |||

| HD / The Home Depot, Inc. | 0.01 | -3.03 | 2.77 | -15.13 | 1.3029 | -0.0205 | |||

| UBER / Uber Technologies, Inc. | 0.03 | -10.95 | 2.67 | 7.92 | 1.2569 | 0.2530 | |||

| MCO / Moody's Corporation | 0.01 | -7.23 | 2.62 | -15.82 | 1.2315 | -0.0295 | |||

| TSLA / Tesla, Inc. | 0.01 | 0.00 | 2.60 | -30.26 | 1.2230 | -0.2884 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.05 | -11.11 | 2.55 | -23.04 | 1.1974 | -0.1435 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -4.24 | 2.30 | 3.04 | 1.0842 | 0.1777 | |||

| INTU / Intuit Inc. | 0.00 | 13.04 | 2.29 | 17.94 | 1.0794 | 0.2905 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 1.97 | 6.08 | 0.9283 | 0.1742 | |||

| BROWN BROTHERS HARRIMAN SWEEP INTEREST / STIV (N/A) | 1.96 | 0.9225 | 0.9225 | ||||||

| AMT / American Tower Corporation | 0.01 | 112.37 | 1.92 | 158.97 | 0.9027 | 0.6021 | |||

| KO / The Coca-Cola Company | 0.03 | 0.00 | 1.89 | 14.27 | 0.8894 | 0.2187 | |||

| ADBE / Adobe Inc. | 0.00 | -8.18 | 1.85 | -21.29 | 0.8694 | -0.0826 | |||

| ORCL / Oracle Corporation | 0.01 | -10.65 | 1.80 | -26.07 | 0.8488 | -0.1406 | |||

| DHR / Danaher Corporation | 0.01 | -14.71 | 1.75 | -23.69 | 0.8216 | -0.1061 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | 40.22 | 1.65 | 42.11 | 0.7750 | 0.3050 | |||

| SNOW / Snowflake Inc. | 0.01 | 219.16 | 1.55 | 180.51 | 0.7312 | 0.5065 | |||

| WDAY / Workday, Inc. | 0.01 | 0.00 | 1.55 | -6.50 | 0.7311 | 0.0571 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -5.95 | 1.52 | -0.07 | 0.7147 | 0.0983 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -27.61 | 1.48 | -28.65 | 0.6981 | -0.1454 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.00 | 1.45 | 3.12 | 0.6838 | 0.1123 | |||

| TEAM / Atlassian Corporation | 0.01 | 0.00 | 1.40 | -25.59 | 0.6583 | -0.1040 | |||

| TT / Trane Technologies plc | 0.00 | 1.34 | 0.6311 | 0.6311 | |||||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 1.21 | -21.40 | 0.5673 | -0.0544 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -29.53 | 1.18 | -46.54 | 0.5566 | -0.3409 | |||

| SNPS / Synopsys, Inc. | 0.00 | 0.00 | 1.12 | -12.66 | 0.5260 | 0.0070 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | 0.00 | 1.09 | -19.40 | 0.5145 | -0.0356 | |||

| DDOG / Datadog, Inc. | 0.01 | -23.93 | 1.09 | -45.53 | 0.5132 | -0.2990 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 1.08 | -9.87 | 0.5071 | 0.0224 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 15.94 | 1.03 | 4.76 | 0.4868 | 0.0864 | |||

| CP / Canadian Pacific Kansas City Limited | 0.01 | -15.81 | 0.97 | -23.36 | 0.4557 | -0.0567 | |||

| HES / Hess Corporation | 0.01 | -9.99 | 0.95 | -16.48 | 0.4463 | -0.0141 | |||

| MNST / Monster Beverage Corporation | 0.02 | -9.34 | 0.94 | 11.92 | 0.4419 | 0.1015 | |||

| MRVL / Marvell Technology, Inc. | 0.02 | 0.00 | 0.93 | -48.30 | 0.4367 | -0.2910 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -11.73 | 0.83 | -24.27 | 0.3894 | -0.0535 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -12.16 | 0.65 | -21.81 | 0.3053 | -0.0314 | |||

| GLOB / Globant S.A. | 0.00 | -62.55 | 0.53 | -79.37 | 0.2509 | -0.7969 | |||

| NKE / NIKE, Inc. | 0.01 | -19.75 | 0.38 | -41.24 | 0.1786 | -0.0829 | |||

| LULU / lululemon athletica inc. | 0.00 | -41.64 | 0.33 | -61.95 | 0.1547 | -0.1948 |