Basic Stats

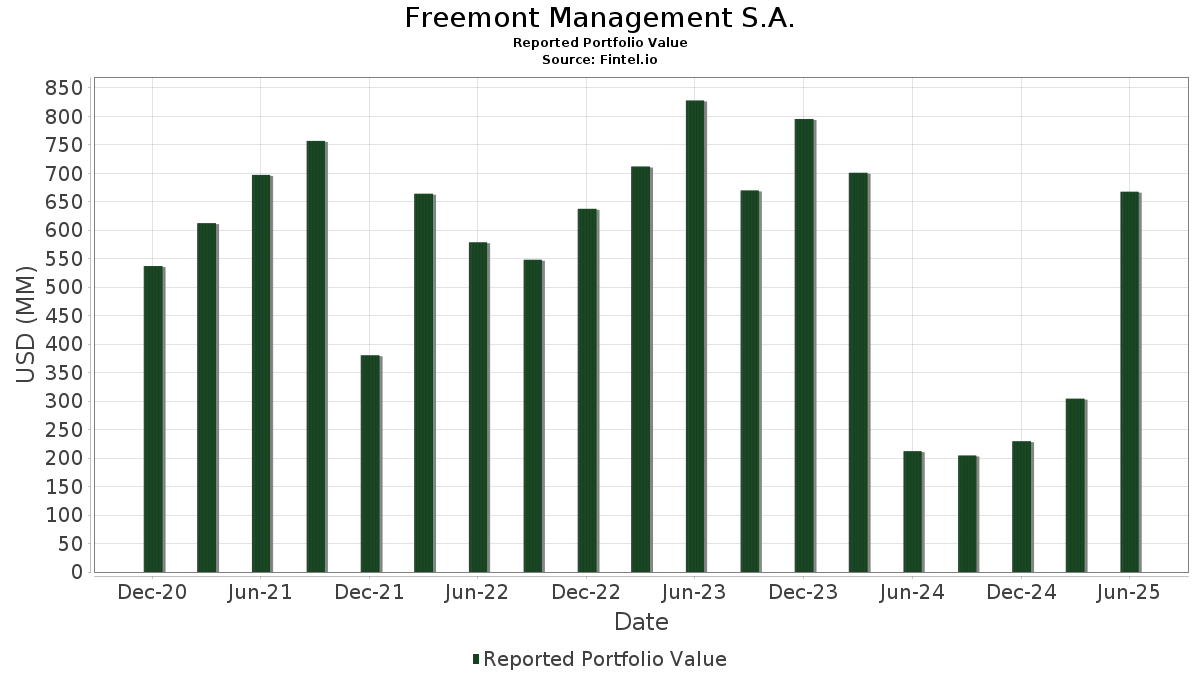

| Portfolio Value | $ 667,438,817 |

| Current Positions | 95 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Freemont Management S.A. has disclosed 95 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 667,438,817 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Freemont Management S.A.’s top holdings are NVIDIA Corporation (US:NVDA) , Arista Networks Inc (US:ANET) , Atlassian Corporation (US:TEAM) , Tesla, Inc. (US:TSLA) , and Chevron Corporation (US:CVX) . Freemont Management S.A.’s new positions include Atlassian Corporation (US:TEAM) , AutoZone, Inc. (US:AZO) , Ecolab Inc. (US:ECL) , Berkshire Hathaway Inc. (US:BRK.A) , and L3Harris Technologies, Inc. (US:LHX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.40 | 62.47 | 9.3595 | 4.0289 | |

| 0.34 | 35.10 | 5.2593 | 3.2494 | |

| 0.11 | 21.39 | 3.2041 | 3.2041 | |

| 0.14 | 20.05 | 3.0035 | 3.0035 | |

| 0.01 | 19.30 | 2.8922 | 2.8922 | |

| 0.07 | 20.93 | 3.1364 | 2.2418 | |

| 0.05 | 14.09 | 2.1113 | 2.1113 | |

| 0.03 | 12.68 | 1.8996 | 1.8996 | |

| 0.04 | 10.03 | 1.5033 | 1.5033 | |

| 0.62 | 12.67 | 1.8981 | 1.4339 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.22 | 16.67 | 2.4975 | -2.6640 | |

| 0.07 | 15.10 | 2.2625 | -1.8565 | |

| 0.00 | 0.00 | -1.2220 | ||

| 0.00 | 0.00 | -1.1767 | ||

| 0.00 | 0.00 | -0.8222 | ||

| 0.12 | 6.25 | 0.9360 | -0.7565 | |

| 0.09 | 6.08 | 0.9114 | -0.7511 | |

| 0.19 | 8.06 | 1.2077 | -0.7337 | |

| 0.05 | 10.38 | 1.5548 | -0.7096 | |

| 0.03 | 17.06 | 2.5562 | -0.6897 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.40 | 164.30 | 62.47 | 285.30 | 9.3595 | 4.0289 | |||

| ANET / Arista Networks Inc | 0.34 | 334.85 | 35.10 | 474.22 | 5.2593 | 3.2494 | |||

| TEAM / Atlassian Corporation | 0.11 | 21.39 | 3.2041 | 3.2041 | |||||

| TSLA / Tesla, Inc. | 0.07 | 527.62 | 20.93 | 669.31 | 3.1364 | 2.2418 | |||

| CVX / Chevron Corporation | Call | 0.14 | 20.05 | 3.0035 | 3.0035 | ||||

| AZO / AutoZone, Inc. | 0.01 | 19.30 | 2.8922 | 2.8922 | |||||

| AXON / Axon Enterprise, Inc. | 0.02 | 31.01 | 17.14 | 106.23 | 2.5678 | -0.1643 | |||

| MSFT / Microsoft Corporation | 0.03 | 30.42 | 17.06 | 72.82 | 2.5562 | -0.6897 | |||

| SRE / Sempra | Call | 0.22 | 0.00 | 16.67 | 6.18 | 2.4975 | -2.6640 | ||

| AVGO / Broadcom Inc. | 0.06 | 150.62 | 16.65 | 312.61 | 2.4945 | 1.1679 | |||

| AAPL / Apple Inc. | 0.07 | 30.50 | 15.10 | 20.53 | 2.2625 | -1.8565 | |||

| ELF / e.l.f. Beauty, Inc. | 0.12 | 22.45 | 14.93 | 142.68 | 2.2373 | 0.2142 | |||

| ECL / Ecolab Inc. | 0.05 | 14.09 | 2.1113 | 2.1113 | |||||

| BRK.A / Berkshire Hathaway Inc. | 0.03 | 12.68 | 1.8996 | 1.8996 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.62 | 577.05 | 12.67 | 797.80 | 1.8981 | 1.4339 | |||

| META / Meta Platforms, Inc. | 0.02 | 30.77 | 12.55 | 67.47 | 1.8800 | -0.5835 | |||

| FICO / Fair Isaac Corporation | 0.01 | 415.38 | 12.25 | 410.93 | 1.8350 | 1.0468 | |||

| CDNS / Cadence Design Systems, Inc. | 0.04 | 330.77 | 12.08 | 422.00 | 1.8098 | 1.0489 | |||

| ALAB / Astera Labs, Inc. | 0.12 | 30.60 | 10.81 | 97.93 | 1.6189 | -0.1761 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 30.66 | 10.38 | 50.68 | 1.5548 | -0.7096 | |||

| VRT / Vertiv Holdings Co | 0.08 | 30.59 | 10.20 | 132.29 | 1.5276 | 0.0844 | |||

| LHX / L3Harris Technologies, Inc. | 0.04 | 10.03 | 1.5033 | 1.5033 | |||||

| STZ / Constellation Brands, Inc. | 0.03 | 104.38 | 9.04 | 227.19 | 1.3540 | 0.4458 | |||

| MSI / Motorola Solutions, Inc. | 0.02 | 67.19 | 9.00 | 60.57 | 1.3481 | -0.4943 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | 244.83 | 8.90 | 216.76 | 1.3341 | 0.4096 | |||

| HES / Hess Corporation | Call | 0.06 | 8.87 | 1.3284 | 1.3284 | ||||

| KNF / Knife River Corporation | 0.10 | 8.16 | 1.2232 | 1.2232 | |||||

| TFC / Truist Financial Corporation | 0.19 | 30.66 | 8.06 | 36.49 | 1.2077 | -0.7337 | |||

| COHR / Coherent Corp. | 0.09 | 34.98 | 8.02 | 85.41 | 1.2016 | -0.2203 | |||

| RTX / RTX Corporation | 0.05 | 30.55 | 7.99 | 43.91 | 1.1967 | -0.6280 | |||

| GOOGL / Alphabet Inc. | 0.04 | 30.58 | 7.53 | 48.83 | 1.1274 | -0.5351 | |||

| WMB / The Williams Companies, Inc. | 0.12 | 30.59 | 7.48 | 37.25 | 1.1208 | -0.6711 | |||

| HWM / Howmet Aerospace Inc. | 0.04 | 30.29 | 6.64 | 86.94 | 0.9956 | -0.1731 | |||

| GDXJ / VanEck ETF Trust - VanEck Junior Gold Miners ETF | 0.12 | 33.33 | 6.25 | 21.35 | 0.9360 | -0.7565 | |||

| NOW / ServiceNow, Inc. | 0.01 | 30.43 | 6.17 | 68.43 | 0.9242 | -0.2799 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.09 | -18.18 | 6.08 | 20.31 | 0.9114 | -0.7511 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.02 | 30.60 | 5.80 | 53.06 | 0.8696 | -0.3773 | |||

| HUBS / HubSpot, Inc. | 0.01 | 30.14 | 5.29 | 26.79 | 0.7923 | -0.5788 | |||

| MP Materials Corp. / ETD Equity Option (553368951) | Put | 0.15 | 4.99 | 0.0000 | |||||

| BC / Brunswick Corporation | Call | 0.09 | 4.97 | 0.7449 | 0.7449 | ||||

| LAZ / Lazard, Inc. | 0.10 | 30.62 | 4.93 | 44.76 | 0.7390 | -0.3814 | |||

| B / Barrick Mining Corporation | 0.23 | 4.81 | 0.7207 | 0.7207 | |||||

| ADI / Analog Devices, Inc. | 0.02 | 0.00 | 4.76 | 18.03 | 0.7132 | -0.6128 | |||

| IQV / IQVIA Holdings Inc. | Call | 0.03 | 4.73 | 0.7083 | 0.7083 | ||||

| LNG / Cheniere Energy, Inc. | 0.02 | 30.14 | 4.63 | 36.94 | 0.6932 | -0.4175 | |||

| TRGP / Targa Resources Corp. | 0.03 | 30.69 | 4.60 | 13.48 | 0.6886 | -0.6428 | |||

| APH / Amphenol Corporation | 0.05 | 4.54 | 0.6806 | 0.6806 | |||||

| FI / Fiserv, Inc. | 0.03 | 645.71 | 4.50 | 482.77 | 0.6742 | 0.4201 | |||

| ABT / Abbott Laboratories | 0.03 | 30.38 | 4.20 | 33.69 | 0.6297 | -0.4039 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 4.18 | 0.6265 | 0.6265 | |||||

| BA / The Boeing Company | 0.02 | 4.06 | 0.6090 | 0.6090 | |||||

| TOST / Toast, Inc. | 0.09 | 3.90 | 0.5840 | 0.5840 | |||||

| FLS / Flowserve Corporation | 0.07 | 30.47 | 3.74 | 39.87 | 0.5608 | -0.3191 | |||

| SYM / Symbotic Inc. | 0.10 | 30.60 | 3.71 | 151.12 | 0.5565 | 0.0701 | |||

| VST / Vistra Corp. | 0.02 | 30.66 | 3.47 | 115.73 | 0.5198 | -0.0092 | |||

| SPOT / Spotify Technology S.A. | 0.00 | 32.35 | 3.45 | 84.65 | 0.5174 | -0.0975 | |||

| MTZ / MasTec, Inc. | 0.02 | 30.67 | 3.34 | 90.86 | 0.5005 | -0.0751 | |||

| CW / Curtiss-Wright Corporation | 0.01 | 31.37 | 3.27 | 102.29 | 0.4904 | -0.0416 | |||

| AVAV / AeroVironment, Inc. | 0.01 | 29.76 | 3.11 | 210.19 | 0.4654 | 0.1362 | |||

| FN / Fabrinet | 0.01 | 30.77 | 3.01 | 95.13 | 0.4503 | -0.0562 | |||

| WFC / Wells Fargo & Company | 0.04 | 30.63 | 2.97 | 45.83 | 0.4454 | -0.2250 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | 29.85 | 2.72 | 97.97 | 0.4082 | -0.0444 | |||

| URA / Global X Funds - Global X Uranium ETF | 0.07 | 0.00 | 2.72 | 69.33 | 0.4070 | -0.1205 | |||

| VIK / Viking Holdings Ltd | 0.05 | 2.66 | 0.3992 | 0.3992 | |||||

| JPM / JPMorgan Chase & Co. | 0.01 | 30.43 | 2.61 | 54.20 | 0.3909 | -0.1655 | |||

| BSX / Boston Scientific Corporation | 0.02 | 30.60 | 2.57 | 39.06 | 0.3846 | -0.2223 | |||

| LYV / Live Nation Entertainment, Inc. | 0.02 | 30.47 | 2.53 | 51.17 | 0.3785 | -0.1710 | |||

| MET / MetLife, Inc. | 0.03 | 30.51 | 2.48 | 30.73 | 0.3711 | -0.2519 | |||

| GLNG / Golar LNG Limited | 0.06 | 30.70 | 2.45 | 41.69 | 0.3678 | -0.2017 | |||

| PWR / Quanta Services, Inc. | 0.01 | 31.25 | 2.38 | 95.16 | 0.3569 | -0.0443 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 33.33 | 2.35 | 40.71 | 0.3518 | -0.1969 | |||

| TT / Trane Technologies plc | 0.01 | 29.27 | 2.32 | 67.85 | 0.3473 | -0.1068 | |||

| WMT / Walmart Inc. | 0.02 | 30.34 | 2.27 | 45.20 | 0.3399 | -0.1739 | |||

| BKR / Baker Hughes Company | 0.06 | 30.61 | 2.14 | 13.93 | 0.3211 | -0.2973 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 30.88 | 2.12 | 16.93 | 0.3177 | -0.2786 | |||

| FAST / Fastenal Company | 0.05 | 2.10 | 0.3146 | 0.3146 | |||||

| AMBA / Ambarella, Inc. | 0.03 | 27.94 | 2.09 | 67.90 | 0.3128 | -0.0959 | |||

| BWXT / BWX Technologies, Inc. | 0.01 | 29.91 | 2.00 | 89.76 | 0.3000 | -0.0470 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 31.00 | 1.86 | 80.92 | 0.2785 | -0.0593 | |||

| PGR / The Progressive Corporation | 0.01 | 30.00 | 1.73 | 22.54 | 0.2599 | -0.2053 | |||

| NRG / NRG Energy, Inc. | 0.01 | 1.62 | 0.2429 | 0.2429 | |||||

| ABBV / AbbVie Inc. | 0.01 | 30.30 | 1.60 | 15.48 | 0.2392 | -0.2155 | |||

| WSO / Watsco, Inc. | 0.00 | 33.33 | 1.59 | 15.82 | 0.2382 | -0.2130 | |||

| ACA / Arcosa, Inc. | 0.02 | 30.37 | 1.53 | 46.59 | 0.2286 | -0.1136 | |||

| AA / Alcoa Corporation | 0.05 | 0.00 | 1.48 | -3.28 | 0.2211 | -0.2803 | |||

| FCX / Freeport-McMoRan Inc. | 0.03 | 0.00 | 1.30 | 14.54 | 0.1948 | -0.1786 | |||

| REMX / VanEck ETF Trust - VanEck Rare Earth/Strategic Metals ETF | 0.03 | 0.00 | 1.21 | 2.71 | 0.1818 | -0.2068 | |||

| MRVL / Marvell Technology, Inc. | 0.01 | 30.91 | 1.11 | 64.55 | 0.1670 | -0.0557 | |||

| INTU / Intuit Inc. | 0.00 | 30.00 | 1.02 | 66.88 | 0.1534 | -0.0485 | |||

| PAAS / Pan American Silver Corp. | 0.04 | 30.88 | 1.01 | 44.02 | 0.1515 | -0.0795 | |||

| V / Visa Inc. | 0.00 | 33.33 | 0.85 | 35.24 | 0.1277 | -0.0797 | |||

| EQIX / Equinix, Inc. | 0.00 | 42.86 | 0.80 | 39.47 | 0.1192 | -0.0685 | |||

| ATI / ATI Inc. | 0.00 | 30.77 | 0.29 | 117.04 | 0.0440 | -0.0005 | |||

| FTAI / FTAI Aviation Ltd. | 0.00 | 0.20 | 0.0293 | 0.0293 | |||||

| BLDP / Ballard Power Systems Inc. | 0.03 | 0.00 | 0.05 | 42.42 | 0.0071 | -0.0037 | |||

| AVTR / Avantor, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PSTG / Pure Storage, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ADSK / Autodesk, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TTD / The Trade Desk, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8222 | ||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRBR / BellRing Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDB / MongoDB, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AVGO / Broadcom Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.2220 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CCCS / CCC Intelligent Solutions Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| S / SentinelOne, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TER / Teradyne, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| Arista Networks, Inc. / Call (040413905) | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JCI / Johnson Controls International plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ELF / e.l.f. Beauty, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.1767 | |||

| DXCM / DexCom, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AER / AerCap Holdings N.V. | Call | 0.00 | -100.00 | 0.00 | 0.0000 |