Basic Stats

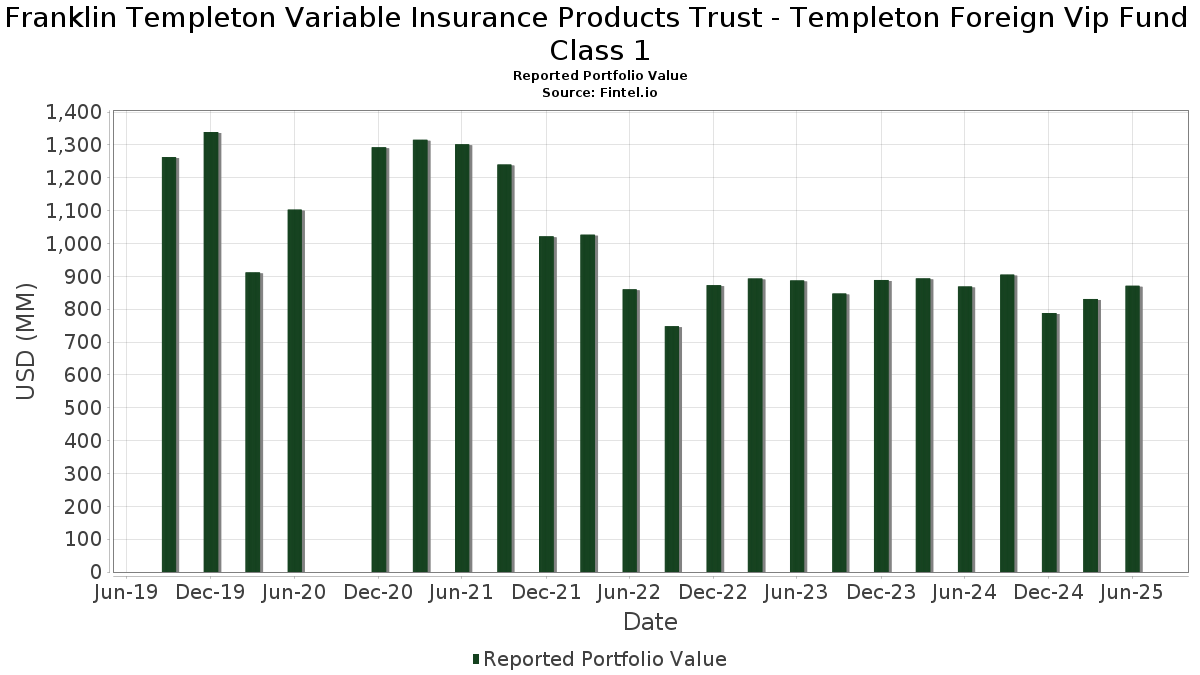

| Portfolio Value | $ 871,342,784 |

| Current Positions | 43 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Franklin Templeton Variable Insurance Products Trust - Templeton Foreign Vip Fund Class 1 has disclosed 43 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 871,342,784 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Franklin Templeton Variable Insurance Products Trust - Templeton Foreign Vip Fund Class 1’s top holdings are Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio (US:INFXX) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Shell plc (GB:SHEL) , Sumitomo Mitsui Financial Group, Inc. (JP:8316) , and CNH Industrial N.V. (DE:37C) . Franklin Templeton Variable Insurance Products Trust - Templeton Foreign Vip Fund Class 1’s new positions include SSE plc - Depositary Receipt (Common Stock) (US:SSEZY) , Akzo Nobel N.V. (NL:AKZA) , ASM International NV (NL:ASM) , Vinci SA (FR:DG) , and Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.78 | 19.67 | 2.2514 | 2.2514 | |

| 49.32 | 49.32 | 5.6456 | 2.2480 | |

| 0.22 | 15.69 | 1.7959 | 1.7959 | |

| 0.02 | 13.64 | 1.5617 | 1.5617 | |

| 0.09 | 13.38 | 1.5318 | 1.5318 | |

| 20.42 | 24.90 | 2.8505 | 1.4293 | |

| 0.16 | 11.33 | 1.2973 | 1.2973 | |

| 0.55 | 10.56 | 1.2092 | 1.2092 | |

| 1.13 | 26.31 | 3.0116 | 0.8098 | |

| 0.15 | 14.99 | 1.7157 | 0.7502 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 15.16 | 1.7354 | -1.3460 | |

| 1.56 | 22.03 | 2.5217 | -1.3220 | |

| 0.59 | 26.05 | 2.9816 | -0.9050 | |

| 0.13 | 11.96 | 1.3690 | -0.8141 | |

| 0.15 | 12.74 | 1.4589 | -0.6355 | |

| 6.39 | 31.83 | 3.6432 | -0.6129 | |

| 0.04 | 14.53 | 1.6631 | -0.5893 | |

| 1.16 | 17.38 | 1.9893 | -0.5605 | |

| 18.26 | 19.20 | 2.1980 | -0.5002 | |

| 1.18 | 10.65 | 1.2188 | -0.3809 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| INFXX / Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio | 49.32 | 72.36 | 49.32 | 72.35 | 5.6456 | 2.2480 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.97 | -5.72 | 35.58 | 22.42 | 4.0731 | 0.6222 | |||

| SHEL / Shell plc | 0.95 | 0.00 | 33.12 | -4.15 | 3.7913 | -0.3115 | |||

| 8316 / Sumitomo Mitsui Financial Group, Inc. | 1.31 | 16.76 | 33.05 | 14.34 | 3.7830 | 0.3511 | |||

| 37C / CNH Industrial N.V. | 2.46 | -4.38 | 31.89 | 0.92 | 3.6509 | -0.1016 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 6.39 | 0.00 | 31.83 | -11.21 | 3.6432 | -0.6129 | |||

| AZN / Astrazeneca plc | 0.22 | 13.48 | 31.21 | 7.54 | 3.5721 | 0.1268 | |||

| IFNNY / Infineon Technologies AG - Depositary Receipt (Common Stock) | 0.69 | 0.00 | 29.42 | 28.01 | 3.3676 | 0.6389 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 1.22 | -8.91 | 26.67 | 1.91 | 3.0528 | -0.0545 | |||

| Smurfit WestRock plc / EC (IE00028FXN24) | 0.62 | 27.07 | 26.64 | 22.44 | 3.0490 | 0.4661 | |||

| SCBFY / Standard Chartered PLC - Depositary Receipt (Common Stock) | 1.61 | -13.28 | 26.59 | -3.29 | 3.0437 | -0.2208 | |||

| HDFCB / HDFC Bank Ltd | 1.13 | 29.54 | 26.31 | 41.87 | 3.0116 | 0.8098 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.59 | -28.66 | 26.05 | -20.43 | 2.9816 | -0.9050 | |||

| PRU / Prudential plc | 2.02 | 0.00 | 25.29 | 15.99 | 2.8944 | 0.3060 | |||

| JD. / JD Sports Fashion Plc | 20.42 | 50.85 | 24.90 | 108.05 | 2.8505 | 1.4293 | |||

| D2G / Ørsted A/S | 0.54 | 5.19 | 23.29 | 3.76 | 2.6664 | 0.0010 | |||

| 2RR / Alibaba Group Holding Limited | 1.56 | -20.46 | 22.03 | -31.95 | 2.5217 | -1.3220 | |||

| ADEN / Adecco Group AG | 0.68 | 0.00 | 20.21 | -0.91 | 2.3131 | -0.1081 | |||

| SSEZY / SSE plc - Depositary Receipt (Common Stock) | 0.78 | 19.67 | 2.2514 | 2.2514 | |||||

| LLOY / Lloyds Banking Group plc | 18.26 | -24.63 | 19.20 | -15.50 | 2.1980 | -0.5002 | |||

| STMPA / STMicroelectronics N.V. | 0.59 | -2.14 | 18.13 | 36.84 | 2.0756 | 0.5023 | |||

| S7MB / Securitas AB (publ) | 1.16 | -23.52 | 17.38 | -19.08 | 1.9893 | -0.5605 | |||

| BDEV / Barratt Developments plc | 2.73 | -17.16 | 17.09 | -5.70 | 1.9565 | -0.1955 | |||

| PSN / Persimmon Plc | 0.95 | -23.63 | 16.83 | -12.16 | 1.9263 | -0.3482 | |||

| FG1 / Antofagasta plc | 0.67 | -24.10 | 16.77 | -13.32 | 1.9198 | -0.3775 | |||

| CA / Carrefour SA | 1.16 | 0.00 | 16.31 | -1.37 | 1.8673 | -0.0964 | |||

| GALP / Galp Energia, SGPS, S.A. | 0.88 | 0.00 | 16.05 | 4.48 | 1.8371 | 0.0134 | |||

| AKZA / Akzo Nobel N.V. | 0.22 | 15.69 | 1.7959 | 1.7959 | |||||

| SREN / Swiss Re AG | 0.09 | -42.53 | 15.16 | -41.58 | 1.7354 | -1.3460 | |||

| SAN / Santander UK plc - Preferred Stock | 0.15 | 18.74 | 14.99 | 16.27 | 1.7157 | 0.7502 | |||

| AM / Dassault Aviation société anonyme | 0.04 | -28.58 | 14.53 | -23.41 | 1.6631 | -0.5893 | |||

| KER / Kering SA | 0.07 | 0.00 | 14.36 | 4.72 | 1.6439 | 0.0156 | |||

| ASM / ASM International NV | 0.02 | 13.64 | 1.5617 | 1.5617 | |||||

| DG / Vinci SA | 0.09 | 13.38 | 1.5318 | 1.5318 | |||||

| TKOBF / TBS Holdings,Inc. | 0.37 | 0.00 | 13.04 | 21.55 | 1.4926 | 0.2189 | |||

| CON / Continental Aktiengesellschaft | 0.15 | -41.62 | 12.74 | -27.75 | 1.4589 | -0.6355 | |||

| CRH / CRH plc | 0.13 | -38.24 | 11.96 | -34.96 | 1.3690 | -0.8141 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.16 | 11.33 | 1.2973 | 1.2973 | |||||

| 1299 / AIA Group Limited | 1.18 | -33.96 | 10.65 | -20.97 | 1.2188 | -0.3809 | |||

| 6361 / Ebara Corporation | 0.55 | 10.56 | 1.2092 | 1.2092 | |||||

| VIE / Veolia Environnement SA | 0.25 | -25.92 | 8.93 | 25.27 | 1.0227 | 0.2864 | |||

| ALB / Albemarle Corporation | 0.10 | 0.00 | 6.35 | -12.98 | 0.7267 | -0.1395 | |||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.10 | 0.00 | 3.21 | -9.96 | 0.3674 | -0.0558 |