Basic Stats

| Portfolio Value | $ 1,052,847,423 |

| Current Positions | 59 |

Latest Holdings, Performance, AUM (from 13F, 13D)

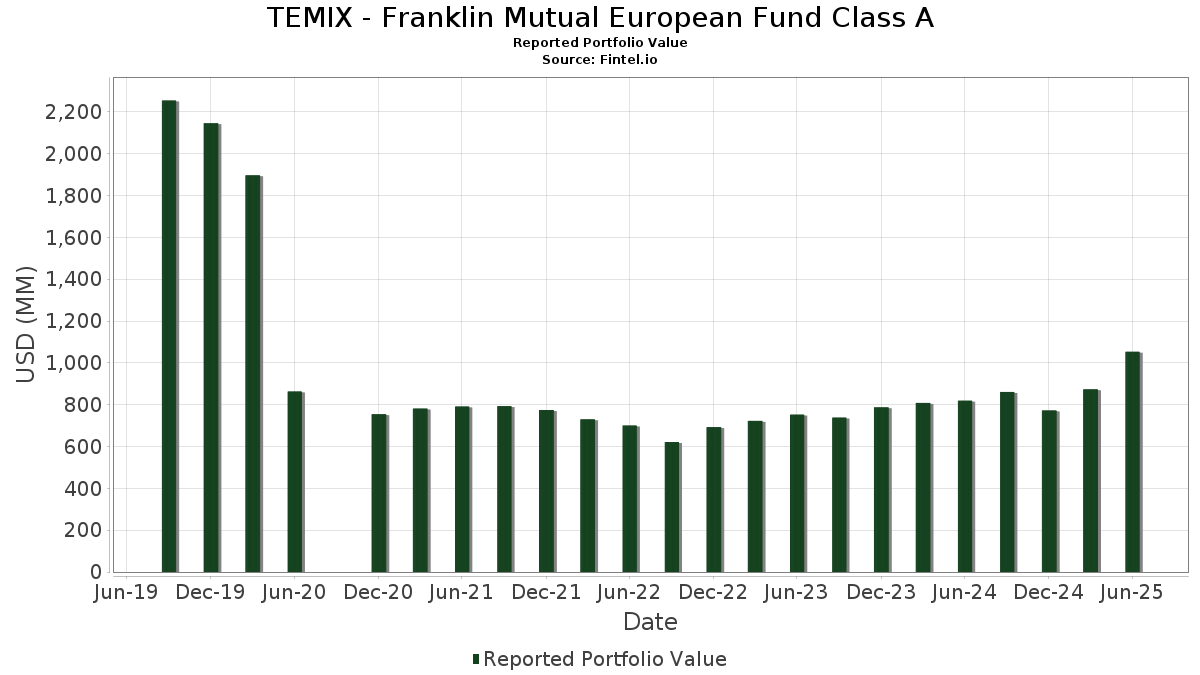

TEMIX - Franklin Mutual European Fund Class A has disclosed 59 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,052,847,423 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). TEMIX - Franklin Mutual European Fund Class A’s top holdings are Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio (US:INFXX) , BNP Paribas SA (CH:BNP) , Deutsche Bank Aktiengesellschaft (AT:DBK) , Roche Holding AG (CH:ROG) , and Prudential plc (DE:PRU) . TEMIX - Franklin Mutual European Fund Class A’s new positions include Coca-Cola Bottlers Japan Holdings Inc. (JP:2579) , Mondi plc (GB:MNDI) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 41.62 | 41.62 | 3.9126 | 2.3136 | |

| 1.24 | 20.09 | 1.8883 | 1.8883 | |

| 1.03 | 16.86 | 1.5848 | 1.5848 | |

| 1.54 | 20.65 | 1.9411 | 0.7068 | |

| 0.25 | 17.10 | 1.6078 | 0.6192 | |

| 0.10 | 21.35 | 2.0071 | 0.4803 | |

| 0.83 | 15.77 | 1.4828 | 0.4031 | |

| 0.13 | 21.58 | 2.0291 | 0.3978 | |

| 1.07 | 17.14 | 1.6117 | 0.3942 | |

| 0.86 | 29.94 | 2.8149 | 0.3773 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.43 | 8.10 | 0.7619 | -1.2624 | |

| 0.30 | 11.01 | 1.0353 | -1.1566 | |

| 0.14 | 9.14 | 0.8593 | -1.0851 | |

| 0.22 | 10.18 | 0.9568 | -0.9181 | |

| 0.58 | 19.53 | 1.8360 | -0.8637 | |

| 4.94 | 24.63 | 2.3156 | -0.7853 | |

| 1.67 | 22.83 | 2.1466 | -0.6176 | |

| 0.21 | 10.30 | 0.9683 | -0.4321 | |

| 0.69 | 23.94 | 2.2507 | -0.4257 | |

| 0.70 | 24.66 | 2.3180 | -0.3631 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| INFXX / Institutional Fiduciary Trust - Institutional Fiduciary Trust Money Market Portfolio | 41.62 | 270.10 | 41.62 | 270.09 | 3.9126 | 2.3136 | |||

| BNP / BNP Paribas SA | 0.43 | 2.57 | 38.75 | 10.09 | 3.6428 | -0.2917 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 1.27 | -13.13 | 37.74 | 8.03 | 3.5478 | -0.3569 | |||

| ROG / Roche Holding AG | 0.11 | 32.71 | 35.83 | 31.62 | 3.3684 | 0.3254 | |||

| PRU / Prudential plc | 2.75 | -4.32 | 34.44 | 10.98 | 3.2375 | -0.2312 | |||

| NOVN / Novartis AG | 0.25 | 5.42 | 29.97 | 15.20 | 2.8174 | -0.0905 | |||

| ZOF / SBI Holdings, Inc. | 0.86 | 6.40 | 29.94 | 37.31 | 2.8149 | 0.3773 | |||

| AER / AerCap Holdings N.V. | 0.22 | 4.03 | 25.39 | 19.13 | 2.3872 | 0.0045 | |||

| STJPF / St. James's Place plc | 1.54 | -4.07 | 25.14 | 22.97 | 2.3631 | 0.0781 | |||

| DEVL / DBS Group Holdings Ltd | 0.70 | 0.00 | 24.66 | 2.80 | 2.3180 | -0.3631 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 4.94 | 0.00 | 24.63 | -11.21 | 2.3156 | -0.7853 | |||

| SHEL / Shell plc | 0.69 | 4.32 | 23.94 | -0.01 | 2.2507 | -0.4257 | |||

| MFZ / Mitsubishi UFJ Financial Group, Inc. | 1.67 | -7.66 | 22.83 | -7.67 | 2.1466 | -0.6176 | |||

| CABK / CaixaBank, S.A. | 2.54 | 0.00 | 22.03 | 11.24 | 2.0711 | -0.1428 | |||

| CAP / Capgemini SE | 0.13 | 29.78 | 21.58 | 47.89 | 2.0291 | 0.3978 | |||

| AIR / Airbus SE | 0.10 | 31.57 | 21.35 | 56.30 | 2.0071 | 0.4803 | |||

| ASRNL / ASR Nederland N.V. | 0.32 | -11.22 | 21.26 | 2.62 | 1.9987 | -0.3172 | |||

| ZAB / Zabka Group S.A. | 3.50 | 13.82 | 21.06 | 28.08 | 1.9802 | 0.1419 | |||

| 2502 / Asahi Group Holdings, Ltd. | 1.54 | 78.72 | 20.65 | 86.99 | 1.9411 | 0.7068 | |||

| 2579 / Coca-Cola Bottlers Japan Holdings Inc. | 1.24 | 20.09 | 1.8883 | 1.8883 | |||||

| SLB / Schlumberger Limited | 0.58 | 0.00 | 19.53 | -19.14 | 1.8360 | -0.8637 | |||

| DNO / DENSO Corporation | 1.43 | 25.76 | 19.35 | 36.79 | 1.8195 | 0.2380 | |||

| KPN / Koninklijke KPN N.V. | 3.96 | 15.56 | 19.31 | 33.09 | 1.8158 | 0.1936 | |||

| NG. / National Grid plc | 1.28 | 3.19 | 18.82 | 16.12 | 1.7697 | -0.0424 | |||

| TEP / Teleperformance SE | 0.19 | 5.90 | 18.66 | 2.30 | 1.7544 | -0.2847 | |||

| CFR / Compagnie Financière Richemont SA | 0.10 | 0.00 | 18.65 | 8.41 | 1.7533 | -0.1698 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 3.48 | 7.90 | 17.90 | 9.81 | 1.6824 | -0.1393 | |||

| NOH1 / Norsk Hydro ASA | 3.12 | 20.35 | 17.87 | 19.22 | 1.6804 | 0.0045 | |||

| 6503 / Mitsubishi Electric Corporation | 0.80 | 0.00 | 17.24 | 16.63 | 1.6208 | -0.0316 | |||

| S6M / Seven & i Holdings Co., Ltd. | 1.07 | 41.62 | 17.14 | 57.41 | 1.6117 | 0.3942 | |||

| UCG / UniCredit S.p.A. | 0.25 | 16.18 | 17.10 | 110.58 | 1.6078 | 0.6192 | |||

| MNDI / Mondi plc | 1.03 | 16.86 | 1.5848 | 1.5848 | |||||

| NNND / Tencent Holdings Limited | 0.26 | 9.65 | 16.52 | 10.57 | 1.5535 | -0.1170 | |||

| 37C / CNH Industrial N.V. | 1.23 | 3.07 | 15.95 | 8.78 | 1.4999 | -0.1395 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.36 | 24.04 | 15.90 | 38.36 | 1.4944 | 0.2101 | |||

| 27M / Melrose Industries PLC | 2.17 | 0.00 | 15.80 | 18.00 | 1.4851 | -0.0115 | |||

| HTO / Hellenic Telecommunications Organization S.A. | 0.83 | 39.73 | 15.77 | 63.29 | 1.4828 | 0.4031 | |||

| BAB / Babcock International Group PLC | 0.98 | -31.83 | 15.41 | 14.10 | 1.4489 | -0.0610 | |||

| NEN / Renesas Electronics Corporation | 1.24 | 9.69 | 15.39 | 1.18 | 1.4472 | -0.2536 | |||

| HEIA / Heineken N.V. | 0.17 | 23.82 | 15.21 | 32.48 | 1.4296 | 0.1465 | |||

| MDLZ / Mondelez International, Inc. | 0.23 | 14.51 | 15.20 | 13.82 | 1.4289 | -0.0638 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.86 | 0.77 | 14.87 | -1.82 | 1.3980 | -0.2950 | |||

| RIO / Rio Tinto Group | 0.24 | 0.00 | 14.11 | -3.01 | 1.3262 | -0.2996 | |||

| OLY1 / Olympus Corporation | 1.15 | 24.93 | 13.67 | 13.36 | 1.2848 | -0.0628 | |||

| KER / Kering SA | 0.06 | 0.00 | 13.48 | 4.72 | 1.2674 | -0.1716 | |||

| RKT / Reckitt Benckiser Group plc | 0.19 | 0.00 | 13.26 | 0.75 | 1.2465 | -0.2246 | |||

| 6981 / Murata Manufacturing Co., Ltd. | 0.87 | 0.00 | 12.88 | -4.17 | 1.2111 | -0.2917 | |||

| 6758 / Sony Group Corporation | 0.48 | 0.00 | 12.47 | 2.75 | 1.1719 | -0.1841 | |||

| DTE / Deutsche Telekom AG | 0.30 | -43.36 | 11.01 | -43.84 | 1.0353 | -1.1566 | |||

| BAS / Leverage Shares Plc - Corporate Bond/Note | 0.21 | 12.00 | 10.30 | -2.94 | 0.9683 | -0.4321 | |||

| DPW / Deutsche Post AG | 0.22 | -43.76 | 10.18 | -39.33 | 0.9568 | -0.9181 | |||

| NN / NN Group N.V. | 0.14 | -56.06 | 9.14 | -47.45 | 0.8593 | -1.0851 | |||

| GSK / GSK plc | 0.43 | -55.15 | 8.10 | -55.25 | 0.7619 | -1.2624 | |||

| DLG / Direct Line Insurance Group plc | 1.38 | 0.00 | 5.82 | 15.90 | 0.5471 | -0.0142 | |||

| U.S. Treasury Bills / STIV (US912797RC34) | 1.98 | 0.1857 | 0.1857 | ||||||

| U.S. Treasury Bills / STIV (US912797PP64) | 0.99 | 1.02 | 0.0934 | -0.0165 | |||||

| U.S. Treasury Bills / STIV (US912797NA14) | 0.99 | 0.0927 | 0.0927 | ||||||

| U.S. Treasury Bills / STIV (US912797PE18) | 0.50 | 1.22 | 0.0469 | -0.0083 | |||||

| AIVAF / Aviva plc | Short | -0.40 | -0.00 | -3.36 | 17.96 | -0.3162 | 0.0025 |