Basic Stats

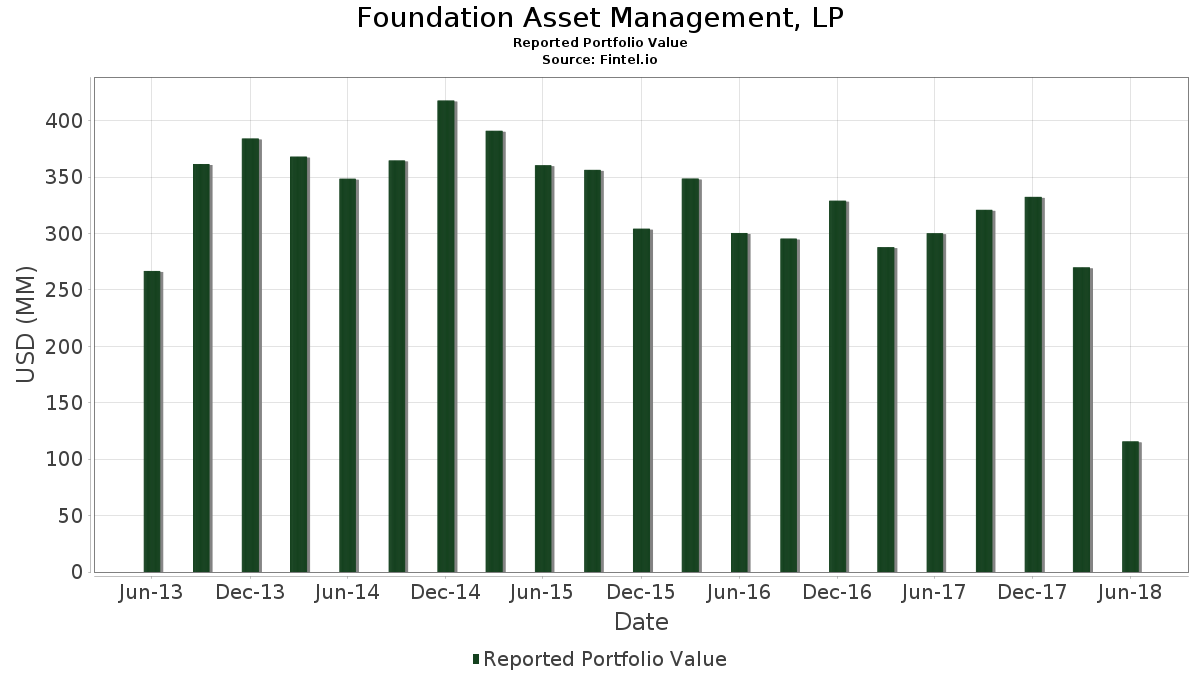

| Portfolio Value | $ 115,710,000 |

| Current Positions | 19 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Foundation Asset Management, LP has disclosed 19 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 115,710,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Foundation Asset Management, LP’s top holdings are Booz Allen Hamilton Holding Corporation (US:BAH) , Copart, Inc. (US:CPRT) , Energizer Holdings, Inc. (US:ENR) , Keysight Technologies, Inc. (US:KEYS) , and W.R. Grace & Co. (US:GRA) . Foundation Asset Management, LP’s new positions include W.R. Grace & Co. (US:GRA) , Meta Platforms, Inc. (US:META) , Chipotle Mexican Grill, Inc. (US:CMG) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 12.73 | 11.0042 | 11.0042 | |

| 0.18 | 11.08 | 9.5783 | 9.5783 | |

| 0.16 | 9.27 | 8.0140 | 8.0140 | |

| 0.12 | 8.78 | 7.5879 | 7.5879 | |

| 0.11 | 8.63 | 7.4592 | 7.4592 | |

| 0.03 | 5.99 | 5.1733 | 5.1733 | |

| 0.11 | 4.67 | 4.0403 | 4.0403 | |

| 0.22 | 3.81 | 3.2884 | 3.2884 | |

| 0.02 | 3.11 | 2.6886 | 2.6886 | |

| 0.12 | 3.01 | 2.5996 | 2.5996 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 11.37 | 9.8280 | -7.4268 | |

| 0.00 | 0.00 | -5.0456 | ||

| 0.00 | 0.00 | -5.0219 | ||

| 0.03 | 0.62 | 0.5324 | -3.0570 | |

| 0.00 | 0.00 | -1.5004 | ||

| 0.25 | 6.46 | 5.5786 | -0.2213 | |

| 0.06 | 6.12 | 5.2848 | -0.1917 |

13F and Fund Filings

This form was filed on 2018-08-14 for the reporting period 2018-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BAH / Booz Allen Hamilton Holding Corporation | 0.29 | -14.36 | 12.73 | -3.28 | 11.0042 | 11.0042 | |||

| CPRT / Copart, Inc. | 0.20 | -78.01 | 11.37 | -75.58 | 9.8280 | -7.4268 | |||

| ENR / Energizer Holdings, Inc. | 0.18 | -55.69 | 11.08 | -53.17 | 9.5783 | 9.5783 | |||

| KEYS / Keysight Technologies, Inc. | 0.16 | -51.57 | 9.27 | -45.43 | 8.0140 | 8.0140 | |||

| GRA / W.R. Grace & Co. | 0.12 | 8.78 | 7.5879 | 7.5879 | |||||

| BCO / The Brink's Company | 0.11 | -72.99 | 8.63 | -69.82 | 7.4592 | 7.4592 | |||

| VMC / Vulcan Materials Company | 0.06 | -49.79 | 7.13 | -43.24 | 6.1611 | 1.5085 | |||

| 98235T107 / Wright Medical Group N.V. | 0.25 | -68.49 | 6.46 | -58.77 | 5.5786 | -0.2213 | |||

| VRSK / Verisk Analytics, Inc. | 0.06 | -60.03 | 6.12 | -58.63 | 5.2848 | -0.1917 | |||

| TDY / Teledyne Technologies Incorporated | 0.03 | -43.94 | 5.99 | -40.37 | 5.1733 | 5.1733 | |||

| NLSN / Nielsen Holdings plc | 0.15 | -49.89 | 4.78 | -51.25 | 4.1327 | 0.4989 | |||

| CF / CF Industries Holdings, Inc. | 0.11 | -54.22 | 4.67 | -46.13 | 4.0403 | 4.0403 | |||

| TRIP / Tripadvisor, Inc. | 0.08 | -65.78 | 4.47 | -53.37 | 3.8640 | 0.3120 | |||

| ARNC / Arconic Corporation | 0.22 | 3.81 | 3.2884 | 3.2884 | |||||

| META / Meta Platforms, Inc. | 0.02 | 3.11 | 2.6886 | 2.6886 | |||||

| 14161H108 / Cardtronics PLC | 0.12 | -25.51 | 3.01 | -19.27 | 2.5996 | 2.5996 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 2.23 | 1.9238 | 1.9238 | |||||

| TRTN / Triton International Limited | 0.05 | -76.21 | 1.46 | -76.16 | 1.2609 | 1.2609 | |||

| TBPH / Theravance Biopharma, Inc. | 0.03 | -93.20 | 0.62 | -93.64 | 0.5324 | -3.0570 | |||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.0456 | ||||

| FI / Fiserv, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5004 | ||||

| UNVR / Univar Solutions Inc | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| LEN / Lennar Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -5.0219 |