Basic Stats

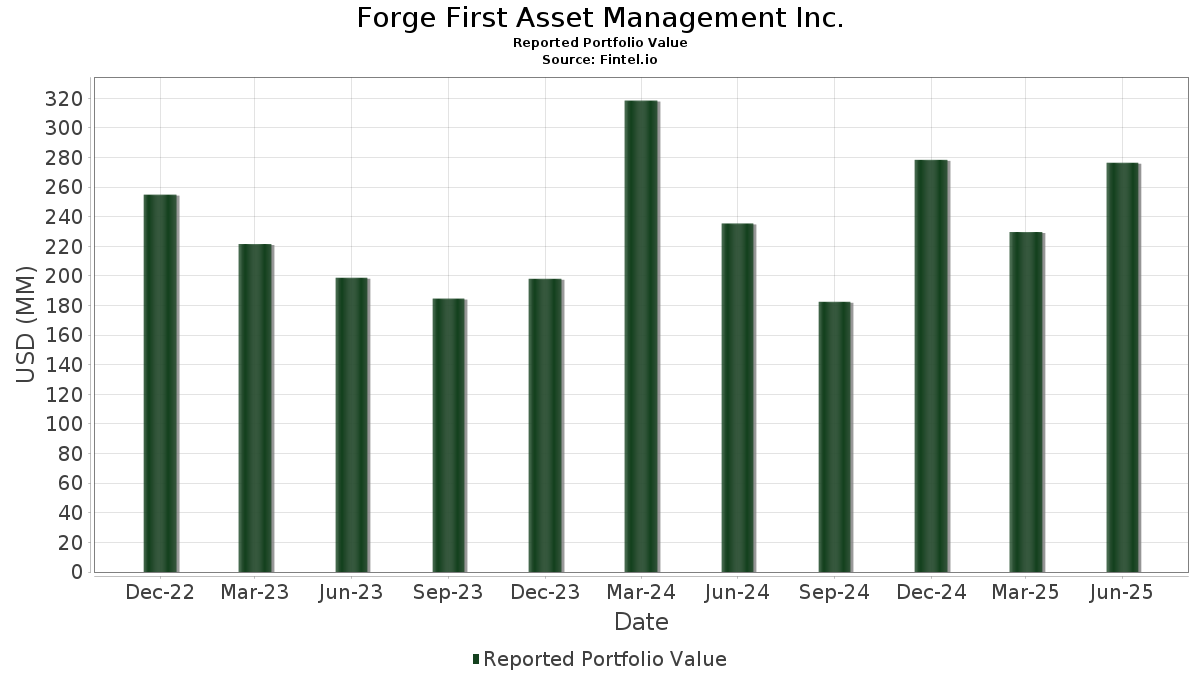

| Portfolio Value | $ 276,504,731 |

| Current Positions | 36 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Forge First Asset Management Inc. has disclosed 36 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 276,504,731 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Forge First Asset Management Inc.’s top holdings are Canadian Pacific Kansas City Limited (US:CP) , Gildan Activewear Inc. (US:GIL) , Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF (US:BKLN) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , and JPMorgan Chase & Co. (US:JPM) . Forge First Asset Management Inc.’s new positions include JPMorgan Chase & Co. (US:JPM) , Vizsla Silver Corp. (US:VZLA) , XPO, Inc. (US:XPO) , i-80 Gold Corp. (US:IAUX) , and Bank of America Corporation (US:BAC) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 14.88 | 5.3814 | 5.3814 | |

| 3.30 | 9.68 | 3.4991 | 3.4991 | |

| 0.10 | 8.03 | 2.9041 | 2.9041 | |

| 0.34 | 9.09 | 3.2862 | 2.8912 | |

| 0.05 | 6.08 | 2.1985 | 2.1985 | |

| 0.03 | 5.73 | 2.0723 | 2.0723 | |

| 0.04 | 5.39 | 1.9500 | 1.9500 | |

| 0.09 | 9.40 | 3.3999 | 1.7895 | |

| 7.91 | 4.87 | 1.7615 | 1.7615 | |

| 0.10 | 4.87 | 1.7612 | 1.7612 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 13.70 | 4.9552 | -4.7723 | |

| 0.00 | 2.88 | 1.0409 | -2.8549 | |

| 0.29 | 14.68 | 5.3078 | -2.5259 | |

| 0.01 | 3.25 | 1.1759 | -1.6539 | |

| 0.96 | 20.15 | 7.2882 | -1.3926 | |

| 0.08 | 2.69 | 0.9723 | -0.9594 | |

| 0.01 | 2.49 | 0.9001 | -0.9393 | |

| 0.01 | 1.06 | 0.3817 | -0.8246 | |

| 0.01 | 2.49 | 0.9003 | -0.7226 | |

| 0.03 | 7.47 | 2.7018 | -0.6657 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CP / Canadian Pacific Kansas City Limited | 0.37 | 17.41 | 29.37 | 32.22 | 10.6229 | 0.9521 | |||

| GIL / Gildan Activewear Inc. | 0.46 | 20.86 | 22.54 | 34.30 | 8.1507 | 0.8452 | |||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0.96 | 0.00 | 20.15 | 1.06 | 7.2882 | -1.3926 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.07 | -5.59 | 15.68 | 28.76 | 5.6713 | 0.3694 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 14.88 | 5.3814 | 5.3814 | |||||

| GFL / GFL Environmental Inc. | 0.29 | -21.72 | 14.68 | -18.44 | 5.3078 | -2.5259 | |||

| CNI / Canadian National Railway Company | 0.13 | -42.48 | 13.70 | -38.68 | 4.9552 | -4.7723 | |||

| NVDA / NVIDIA Corporation | 0.08 | 0.00 | 13.00 | 45.14 | 4.7029 | 0.8025 | |||

| VZLA / Vizsla Silver Corp. | 3.30 | 9.68 | 3.4991 | 3.4991 | |||||

| STN / Stantec Inc. | 0.09 | 94.21 | 9.40 | 154.15 | 3.3999 | 1.7895 | |||

| BBU / Brookfield Business Partners L.P. - Limited Partnership | 0.36 | -3.79 | 9.33 | 6.90 | 3.3753 | -0.4256 | |||

| AGI / Alamos Gold Inc. | 0.34 | 909.19 | 9.09 | 901.76 | 3.2862 | 2.8912 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.03 | 0.00 | 8.03 | 17.17 | 2.9047 | -0.0794 | |||

| MRVL / Marvell Technology, Inc. | 0.10 | 8.03 | 2.9041 | 2.9041 | |||||

| AMZN / Amazon.com, Inc. | 0.03 | -16.24 | 7.47 | -3.43 | 2.7018 | -0.6657 | |||

| GOOG / Alphabet Inc. | 0.04 | 55.65 | 6.35 | 76.82 | 2.2961 | 0.7330 | |||

| XPO / XPO, Inc. | 0.05 | 6.08 | 2.1985 | 2.1985 | |||||

| CHKP / Check Point Software Technologies Ltd. | 0.03 | 5.73 | 2.0723 | 2.0723 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.04 | 5.39 | 1.9500 | 1.9500 | |||||

| IAUX / i-80 Gold Corp. | 7.91 | 4.87 | 1.7615 | 1.7615 | |||||

| BAC / Bank of America Corporation | 0.10 | 4.87 | 1.7612 | 1.7612 | |||||

| UAL / United Airlines Holdings, Inc. | 0.06 | 4.62 | 1.6697 | 1.6697 | |||||

| FIX / Comfort Systems USA, Inc. | 0.01 | 4.61 | 1.6673 | 1.6673 | |||||

| GRND / Grindr Inc. | 0.15 | -30.47 | 3.47 | -11.70 | 1.2555 | -0.4560 | |||

| MSFT / Microsoft Corporation | 0.01 | -62.28 | 3.25 | -49.98 | 1.1759 | -1.6539 | |||

| META / Meta Platforms, Inc. | 0.00 | -74.88 | 2.88 | -67.84 | 1.0409 | -2.8549 | |||

| ITRI / Itron, Inc. | 0.02 | 2.72 | 0.9826 | 0.9826 | |||||

| BIP / Brookfield Infrastructure Partners L.P. - Limited Partnership | 0.08 | -46.00 | 2.69 | -39.42 | 0.9723 | -0.9594 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 28.71 | 2.49 | -33.22 | 0.9003 | -0.7226 | |||

| SITM / SiTime Corporation | 0.01 | -57.87 | 2.49 | -41.11 | 0.9001 | -0.9393 | |||

| OR / OR Royalties Inc. | 0.09 | 2.38 | 0.8624 | 0.8624 | |||||

| PANW / Palo Alto Networks, Inc. | 0.01 | 10.89 | 2.29 | 33.04 | 0.8287 | 0.0787 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.01 | 1.82 | 0.6568 | 0.6568 | |||||

| MYRG / MYR Group Inc. | 0.01 | -76.28 | 1.06 | -61.91 | 0.3817 | -0.8246 | |||

| CLS / Celestica Inc. | 0.01 | 0.92 | 0.3330 | 0.3330 | |||||

| META / Meta Platforms, Inc. | 0.00 | 0.50 | 0.1816 | 0.1816 | |||||

| PBA / Pembina Pipeline Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NBIS / Nebius Group N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2753 | ||||

| TU / TELUS Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MA / Mastercard Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| V / Visa Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GPN / Global Payments Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DSGX / The Descartes Systems Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GRP.U / Granite Real Estate Investment Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PTON / Peloton Interactive, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SQ / Block, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |