Basic Stats

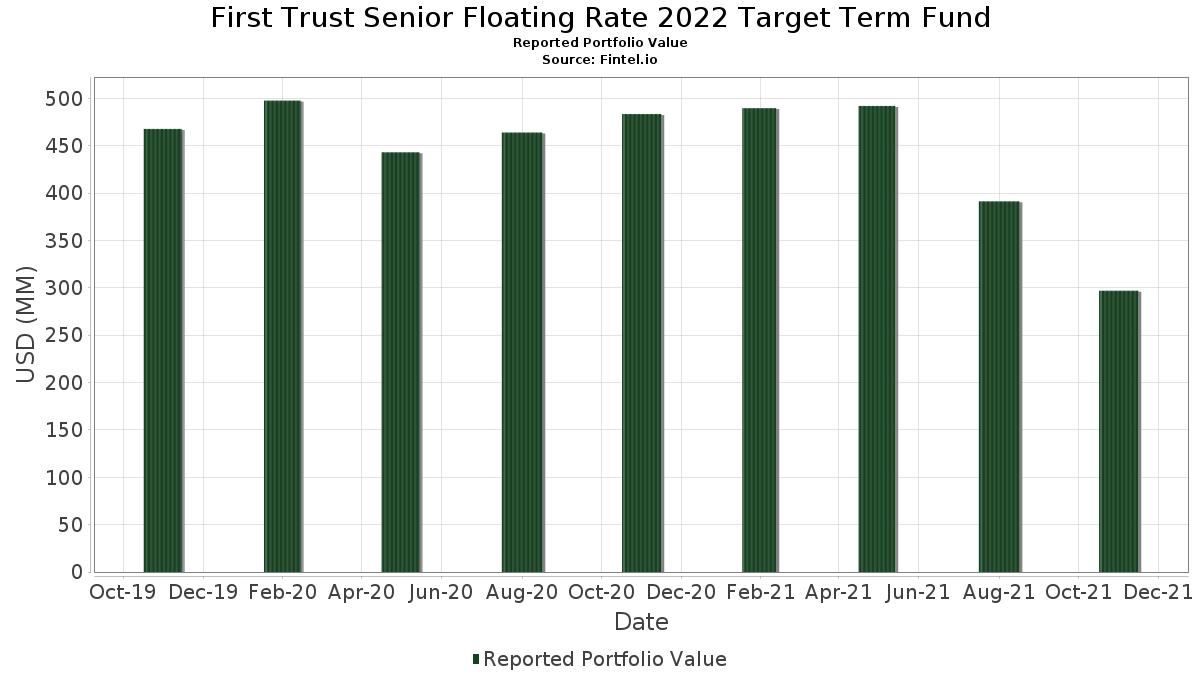

| Portfolio Value | $ 296,969,034 |

| Current Positions | 44 |

Latest Holdings, Performance, AUM (from 13F, 13D)

First Trust Senior Floating Rate 2022 Target Term Fund has disclosed 44 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 296,969,034 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). First Trust Senior Floating Rate 2022 Target Term Fund’s top holdings are ARROW ELECTRONICS 4/2 144A CP 0.2500 20211203 (US:US04273LZ326) , ARROW ELECTRONICS 4/2 144A CP 0.0000 20211208 (US:US04273LZ813) , and Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio (US:US61747C5821) . First Trust Senior Floating Rate 2022 Target Term Fund’s new positions include ARROW ELECTRONICS 4/2 144A CP 0.2500 20211203 (US:US04273LZ326) , ARROW ELECTRONICS 4/2 144A CP 0.0000 20211208 (US:US04273LZ813) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 14.00 | 4.0057 | 3.6986 | ||

| 14.00 | 4.0055 | 3.6984 | ||

| 13.50 | 3.8625 | 3.5554 | ||

| 12.00 | 3.4334 | 3.4334 | ||

| 12.20 | 3.4904 | 3.1834 | ||

| 11.80 | 3.3761 | 3.0690 | ||

| 11.40 | 3.2618 | 2.9547 | ||

| 11.40 | 3.2618 | 2.9547 | ||

| 10.00 | 2.8612 | 2.5541 | ||

| 9.00 | 2.5749 | 2.2678 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 0.18 | 0.0511 | -0.3088 |

13F and Fund Filings

This form was filed on 2022-01-21 for the reporting period 2021-11-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Alexandria Real Estate Equities In / DBT (000000000) | 14.00 | 1,235.78 | 4.0057 | 3.6986 | |||||

| WEC ENERGY GROUP INC 0%, due 12/15/2021 / DBT (000000000) | 14.00 | 1,235.78 | 4.0055 | 3.6984 | |||||

| HARLEY-DAVIDSON FINL SER 4/2 144A CP 0.2600 20211209 / DBT (000000000) | 13.50 | 1,188.07 | 3.8625 | 3.5554 | |||||

| ENERGY TRANSFER LP 0%, due 12/09/2021 / DBT (000000000) | 12.20 | 1,064.03 | 3.4904 | 3.1834 | |||||

| US04273LZ326 / ARROW ELECTRONICS 4/2 144A CP 0.2500 20211203 | 12.00 | 3.4334 | 3.4334 | ||||||

| INTERCONTINENTALEXCHANGE 0%, due 12/10/2021 / DBT (000000000) | 11.80 | 1,025.86 | 3.3761 | 3.0690 | |||||

| HEALTHPEAK PROPERTIE / DBT (000000000) | 11.40 | 987.69 | 3.2618 | 2.9547 | |||||

| ENBRIDGE US INC 0% due 12/02/2021 / DBT (000000000) | 11.40 | 987.69 | 3.2618 | 2.9547 | |||||

| WELLTOWER INC 0%, due 12/01/2021 / DBT (000000000) | 10.00 | 854.10 | 2.8612 | 2.5541 | |||||

| BAT INTL FINANCE PLC 0%, due 12/08/2021 / DBT (000000000) | 9.00 | 758.68 | 2.5749 | 2.2678 | |||||

| CONSTELLATION BRANDS INC 0%, due 12/10/2021 / DBT (000000000) | 8.80 | 739.60 | 2.5177 | 2.2106 | |||||

| CABOT CORP 0%, due 12/07/2021 / DBT (000000000) | 8.70 | 730.06 | 2.4892 | 2.1821 | |||||

| ONTARIO POWER GENERATION 0%, due 12/01/2021 / DBT (000000000) | 8.40 | 701.43 | 2.4034 | 2.0964 | |||||

| FISERV INC 0%, due 1 / DBT (000000000) | 8.40 | 701.43 | 2.4034 | 2.0963 | |||||

| HITACHI CAP AMER COR / DBT (000000000) | 8.30 | 691.89 | 2.3747 | 2.0677 | |||||

| CNPC FINANCE HK LTD 0% due 12/01/2021 / DBT (000000000) | 8.20 | 682.35 | 2.3462 | 2.0391 | |||||

| PARKER-HANNIFIN CORP 0% due 12/07/2021 / DBT (000000000) | 7.70 | 634.64 | 2.2031 | 1.8960 | |||||

| HYUNDAI CAPITAL AMERICA 0% due 12/10/2021 / DBT (000000000) | 7.50 | 615.55 | 2.1459 | 1.8388 | |||||

| CENTERPOINT ENERGY INC 0%, due 12/08/2021 / DBT (000000000) | 7.50 | 615.55 | 2.1459 | 1.8388 | |||||

| WALGREENS BOOTS ALLIANCE 0%, due 12/03/2021 / DBT (000000000) | 7.30 | 596.47 | 2.0887 | 1.7816 | |||||

| VW CREDIT INC 0% due 12/03/2021 / DBT (000000000) | 6.80 | 548.76 | 1.9456 | 1.6385 | |||||

| CNPC FINANCE HK LTD / DBT (000000000) | 5.80 | 453.34 | 1.6595 | 1.3524 | |||||

| HITACHI AMERICA CAPITAL 0%, due 12/08/2021 / DBT (000000000) | 5.70 | 443.80 | 1.6309 | 1.3238 | |||||

| FISERV INC 0%, due 12/15/2021 / DBT (000000000) | 5.60 | 434.26 | 1.6022 | 1.2951 | |||||

| CABOT CORP 0%, due 12/08/2021 / DBT (000000000) | 5.30 | 405.63 | 1.5164 | 1.2093 | |||||

| CONSTELLATION BRANDS INC 0%, due 12/03/2021 / DBT (000000000) | 5.20 | 396.09 | 1.4878 | 1.1807 | |||||

| VW CREDIT INC 0%, due 12/09/2021 / DBT (000000000) | 5.20 | 396.09 | 1.4878 | 1.1807 | |||||

| CIGNA CORP 0%, due 12/01/2021 / DBT (000000000) | 5.10 | 386.55 | 1.4592 | 1.1521 | |||||

| CENTERPOINT ENERGY RESOU 0%, due 12/08/2021 / DBT (000000000) | 5.00 | 377.00 | 1.4306 | 1.1235 | |||||

| BAT INTL FINANCE PLC 0%, due 12/09/2021 / DBT (000000000) | 5.00 | 377.00 | 1.4306 | 1.1235 | |||||

| ONEOK INC 0%, due 12/07/2021 / DBT (000000000) | 5.00 | 377.00 | 1.4305 | 1.1235 | |||||

| FIDELITY NATL INFO SERV 0% due 12/03/2021 / DBT (000000000) | 4.90 | 367.46 | 1.4020 | 1.0949 | |||||

| WELLTOWER INC 0%, due 12/10/2021 / DBT (000000000) | 4.00 | 281.58 | 1.1445 | 0.8374 | |||||

| ELECTRICITE DE FRANCE 0%, due 12/03/2021 / DBT (000000000) | 3.90 | 272.04 | 1.1159 | 0.8088 | |||||

| CROWN CASTLE INTL CORP 0%, due 12/02/2021 / DBT (000000000) | 3.80 | 262.50 | 1.0873 | 0.7802 | |||||

| SEMPRA ENERGY 0%, due 12/15/2021 / DBT (000000000) | 3.65 | 248.19 | 1.0443 | 0.7372 | |||||

| CROWN CASTLE INTL CORP 4/2 144A CP 0.2800 20211208 / DBT (000000000) | 3.50 | 233.87 | 1.0014 | 0.6943 | |||||

| GENERAL MOTORS FINL CO 0% due 12/02/2021 / DBT (000000000) | 3.00 | 186.16 | 0.8584 | 0.5513 | |||||

| DOMINION RES INC 12/06/21 / DBT (000000000) | 3.00 | 186.16 | 0.8584 | 0.5513 | |||||

| VW CREDIT INC / DBT (000000000) | 2.00 | 90.74 | 0.5722 | 0.2652 | |||||

| US04273LZ813 / ARROW ELECTRONICS 4/2 144A CP 0.0000 20211208 | 2.00 | 0.5722 | 0.5722 | ||||||

| AT&T INC (12/14/2021) / DBT (000000000) | 1.75 | 66.89 | 0.5007 | 0.1936 | |||||

| CENTERPOINT ENERGY INC 0%, due 12/06/2021 / DBT (000000000) | 1.50 | 43.03 | 0.4292 | 0.1221 | |||||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 0.18 | -85.70 | 0.18 | -85.74 | 0.0511 | -0.3088 |