Basic Stats

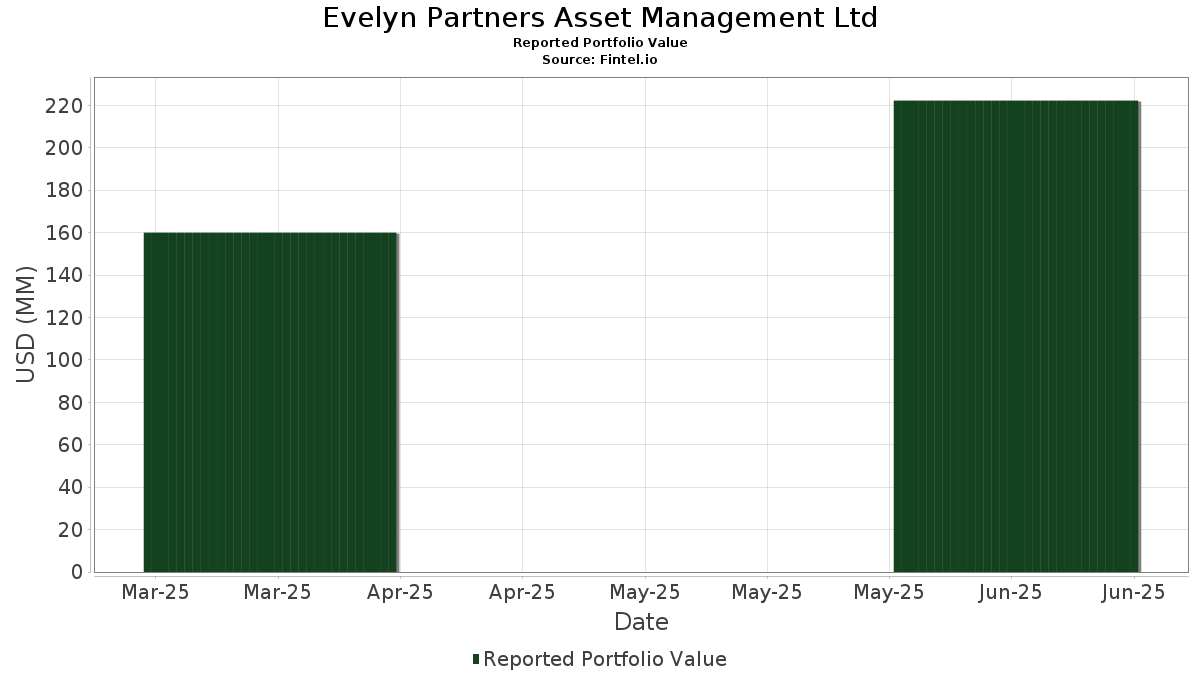

| Portfolio Value | $ 222,265,111 |

| Current Positions | 136 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Evelyn Partners Asset Management Ltd has disclosed 136 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 222,265,111 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Evelyn Partners Asset Management Ltd’s top holdings are Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , Visa Inc. (US:V) , and Stryker Corporation (US:SYK) . Evelyn Partners Asset Management Ltd’s new positions include PayPal Holdings, Inc. (US:PYPL) , RELX PLC - Depositary Receipt (Common Stock) (US:RELX) , ASML Holding N.V. - Depositary Receipt (Common Stock) (US:ASML) , Novo Nordisk A/S - Depositary Receipt (Common Stock) (US:NVO) , and Unilever PLC - Depositary Receipt (Common Stock) (US:UL) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 6.27 | 2.8209 | 2.8209 | |

| 0.16 | 10.25 | 3.5202 | 2.7809 | |

| 0.21 | 5.81 | 2.6159 | 2.6159 | |

| 0.01 | 5.78 | 2.5996 | 2.5996 | |

| 0.08 | 5.56 | 2.5036 | 2.5036 | |

| 0.09 | 5.40 | 2.4309 | 2.4309 | |

| 0.05 | 3.92 | 1.7630 | 1.7630 | |

| 0.01 | 3.01 | 1.3538 | 1.3538 | |

| 0.02 | 1.55 | 0.6958 | 0.6958 | |

| 0.01 | 1.29 | 0.5814 | 0.5814 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 8.23 | 2.8246 | -3.5379 | |

| 0.11 | 11.27 | 3.8699 | -3.4886 | |

| 0.07 | 12.51 | 4.2954 | -3.4164 | |

| 0.03 | 10.70 | 3.6741 | -2.8014 | |

| 0.06 | 11.32 | 3.8867 | -2.7583 | |

| 0.03 | 9.23 | 3.1693 | -2.4677 | |

| 0.01 | 8.44 | 2.8993 | -2.4290 | |

| 0.04 | 6.29 | 2.1604 | -2.1432 | |

| 0.01 | 1.34 | 0.4592 | -1.3395 | |

| 0.20 | 14.68 | 5.0415 | -1.3072 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.08 | 124,819.40 | 20.82 | 32.28 | 9.3652 | -0.4702 | |||

| AMZN / Amazon.com, Inc. | 0.20 | 354.96 | 14.68 | 44.54 | 5.0415 | -1.3072 | |||

| GOOGL / Alphabet Inc. | 0.16 | 139,381.74 | 14.13 | 45.24 | 4.8536 | -1.2287 | |||

| V / Visa Inc. | 0.07 | 102.98 | 12.51 | 1.38 | 4.2954 | -3.4164 | |||

| SYK / Stryker Corporation | 0.06 | 2,368.80 | 11.32 | 6.45 | 3.8867 | -2.7583 | |||

| ADP / Automatic Data Processing, Inc. | 0.11 | 17,429.60 | 11.27 | -4.28 | 3.8699 | -3.4886 | |||

| INTU / Intuit Inc. | 0.03 | 2,039.21 | 10.70 | 3.27 | 3.6741 | -2.8014 | |||

| DIS / The Walt Disney Company | 0.16 | 343.06 | 10.25 | 767.26 | 3.5202 | 2.7809 | |||

| MA / Mastercard Incorporated | 0.03 | 110.52 | 9.23 | 2.33 | 3.1693 | -2.4677 | |||

| AZO / AutoZone, Inc. | 0.01 | 581.90 | 8.44 | -0.96 | 2.8993 | -2.4290 | |||

| WAT / Waters Corporation | 0.05 | 329.49 | 8.23 | -19.20 | 2.8246 | -3.5379 | |||

| ADBE / Adobe Inc. | 0.04 | 8,662.73 | 7.46 | 23.25 | 2.5612 | -1.2211 | |||

| ZTS / Zoetis Inc. | 0.04 | -10.47 | 6.29 | -8.63 | 2.1604 | -2.1432 | |||

| PYPL / PayPal Holdings, Inc. | 0.17 | 6.27 | 2.8209 | 2.8209 | |||||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.21 | 5.81 | 2.6159 | 2.6159 | |||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 5.78 | 2.5996 | 2.5996 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.08 | 5.56 | 2.5036 | 2.5036 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.09 | 5.40 | 2.4309 | 2.4309 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | 1,492.63 | 4.09 | 14.86 | 1.4044 | -0.8208 | |||

| PG / The Procter & Gamble Company | 0.05 | 3.92 | 1.7630 | 1.7630 | |||||

| META / Meta Platforms, Inc. | 0.00 | 28.34 | 3.11 | 32.02 | 1.0663 | -0.4038 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 3.01 | 1.3538 | 1.3538 | |||||

| ANET / Arista Networks Inc | 0.05 | 361.41 | 2.65 | 105.74 | 0.9116 | 0.1052 | |||

| NVDA / NVIDIA Corporation | 0.02 | 65.59 | 2.49 | 47.98 | 0.8540 | -0.1961 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.02 | 19,423.58 | 2.09 | -24.34 | 0.7166 | -1.0065 | |||

| JNJ / Johnson & Johnson | 0.01 | 594.51 | 1.89 | -4.10 | 0.6503 | -0.5841 | |||

| CL / Colgate-Palmolive Company | 0.02 | 1,450.11 | 1.87 | -6.36 | 0.6421 | -0.6055 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -69.77 | 1.71 | 16.42 | 0.5869 | -0.3312 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -92.77 | 1.68 | 30.64 | 0.5785 | -0.2277 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 111.70 | 1.57 | 2.75 | 0.5400 | -0.4163 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.02 | 1.55 | 0.6958 | 0.6958 | |||||

| MCD / McDonald's Corporation | 0.00 | -2.80 | 1.34 | -3.39 | 0.4603 | -0.4069 | |||

| AAPL / Apple Inc. | 0.01 | -71.97 | 1.34 | -53.53 | 0.4592 | -1.3395 | |||

| PEP / PepsiCo, Inc. | 0.01 | 1.29 | 0.5814 | 0.5814 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 681.96 | 1.07 | 655.63 | 0.3687 | 0.2799 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.02 | 7,163.26 | 0.91 | 2.59 | 0.3128 | -0.2422 | |||

| BAC / Bank of America Corporation | 0.02 | 3,097.98 | 0.90 | 8.83 | 0.3092 | -0.2081 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 7.22 | 0.89 | 9.53 | 0.3983 | -0.1069 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -87.91 | 0.60 | 0.50 | 0.2070 | -0.1677 | |||

| GOOG / Alphabet Inc. | 0.00 | 4,395.83 | 0.57 | -70.53 | 0.1972 | -1.0204 | |||

| CTVA / Corteva, Inc. | 0.01 | 16.68 | 0.57 | 18.46 | 0.1964 | -0.1054 | |||

| MU / Micron Technology, Inc. | 0.00 | -69.28 | 0.57 | 40.15 | 0.1955 | -0.0586 | |||

| KO / The Coca-Cola Company | 0.01 | -56.98 | 0.52 | -1.14 | 0.1787 | -0.1506 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 79.07 | 0.48 | -9.42 | 0.1653 | -0.1666 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.01 | 24.53 | 0.43 | 10.82 | 0.1477 | -0.0950 | |||

| NEE / NextEra Energy, Inc. | 0.00 | -1.25 | 0.30 | -4.43 | 0.1037 | -0.0942 | |||

| NFLX / Netflix, Inc. | 0.00 | -91.47 | 0.28 | 44.10 | 0.0966 | -0.0258 | |||

| ABBV / AbbVie Inc. | 0.00 | -83.45 | 0.28 | -11.25 | 0.0948 | -0.1000 | |||

| MATX / Matson, Inc. | 0.00 | 0.26 | 0.1152 | 0.1152 | |||||

| TTWO / Take-Two Interactive Software, Inc. | 0.00 | 0.25 | 0.1146 | 0.1146 | |||||

| NOW / ServiceNow, Inc. | 0.00 | -88.88 | 0.21 | 29.09 | 0.0734 | -0.0301 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 21.61 | 0.21 | 18.50 | 0.0706 | -0.0381 | |||

| NKE / NIKE, Inc. | 0.00 | -89.28 | 0.20 | 9.09 | 0.0702 | -0.0472 | |||

| RTX / RTX Corporation | 0.00 | -82.40 | 0.19 | 10.34 | 0.0660 | -0.0430 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | 1.45 | 0.17 | -8.51 | 0.0594 | -0.0583 | |||

| BX / Blackstone Inc. | 0.00 | -75.11 | 0.14 | 6.98 | 0.0475 | -0.0333 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | -0.08 | 0.13 | -5.15 | 0.0445 | -0.0408 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.79 | 0.12 | 4.24 | 0.0425 | -0.0314 | |||

| DOW / Dow Inc. | 0.00 | -94.55 | 0.12 | -24.05 | 0.0413 | -0.0578 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | 0.00 | 0.12 | 5.31 | 0.0410 | -0.0303 | |||

| MS / Morgan Stanley | 0.00 | -98.58 | 0.09 | 19.74 | 0.0316 | -0.0160 | |||

| CRM / Salesforce, Inc. | 0.00 | 195.28 | 0.09 | 2.41 | 0.0293 | -0.0232 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | -18.17 | 0.08 | 6.41 | 0.0287 | -0.0204 | |||

| EA / Electronic Arts Inc. | 0.00 | -97.81 | 0.08 | 10.96 | 0.0280 | -0.0181 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -49.77 | 0.08 | -90.45 | 0.0263 | -0.4716 | |||

| HD / The Home Depot, Inc. | 0.00 | -98.88 | 0.07 | 0.00 | 0.0242 | -0.0198 | |||

| AMT / American Tower Corporation | 0.00 | 925.00 | 0.06 | 1.61 | 0.0218 | -0.0172 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | 0.06 | 0.0276 | 0.0276 | |||||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.06 | 0.0267 | 0.0267 | |||||

| WMT / Walmart Inc. | 0.00 | -96.33 | 0.06 | 12.24 | 0.0189 | -0.0120 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 1.25 | 0.05 | -8.77 | 0.0179 | -0.0181 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.05 | 0.0230 | 0.0230 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -96.53 | 0.05 | -96.20 | 0.0167 | -0.7728 | |||

| GBX / The Greenbrier Companies, Inc. | 0.00 | 0.05 | 0.0213 | 0.0213 | |||||

| TSCO / Tractor Supply Company | 0.00 | 0.05 | 0.0208 | 0.0208 | |||||

| L / Loews Corporation | 0.00 | 0.05 | 0.0207 | 0.0207 | |||||

| SBUX / Starbucks Corporation | 0.00 | -98.97 | 0.04 | -6.67 | 0.0146 | -0.0139 | |||

| MTZ / MasTec, Inc. | 0.00 | 0.04 | 0.0192 | 0.0192 | |||||

| EQIX / Equinix, Inc. | 0.00 | 0.04 | 0.0175 | 0.0175 | |||||

| ABT / Abbott Laboratories | 0.00 | -98.76 | 0.04 | 2.70 | 0.0134 | -0.0104 | |||

| CC / The Chemours Company | 0.00 | 0.04 | 0.0165 | 0.0165 | |||||

| ON / ON Semiconductor Corporation | 0.00 | 0.03 | 0.0157 | 0.0157 | |||||

| NDAQ / Nasdaq, Inc. | 0.00 | 268.57 | 0.03 | 17.24 | 0.0119 | -0.0065 | |||

| MNST / Monster Beverage Corporation | 0.00 | 3.69 | 0.03 | 6.45 | 0.0115 | -0.0080 | |||

| FHTX / Foghorn Therapeutics Inc. | 0.01 | 0.03 | 0.0150 | 0.0150 | |||||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.03 | 0.0149 | 0.0149 | |||||

| PFE / Pfizer Inc. | 0.00 | 0.03 | 0.0147 | 0.0147 | |||||

| CBRE / CBRE Group, Inc. | 0.00 | 0.03 | 0.0144 | 0.0144 | |||||

| NOC / Northrop Grumman Corporation | 0.00 | -94.05 | 0.03 | -3.12 | 0.0108 | -0.0093 | |||

| ADSK / Autodesk, Inc. | 0.00 | -93.97 | 0.03 | 20.00 | 0.0105 | -0.0057 | |||

| CMCSA / Comcast Corporation | 0.00 | -9.10 | 0.03 | -3.33 | 0.0103 | -0.0091 | |||

| DHI / D.R. Horton, Inc. | 0.00 | 7.44 | 0.03 | 0.00 | 0.0102 | -0.0081 | |||

| ANSS / ANSYS, Inc. | 0.00 | -94.70 | 0.03 | 8.70 | 0.0088 | -0.0056 | |||

| ALEX / Alexander & Baldwin, Inc. | 0.00 | 0.03 | 0.0113 | 0.0113 | |||||

| SBAC / SBA Communications Corporation | 0.00 | -55.27 | 0.02 | 4.35 | 0.0085 | -0.0060 | |||

| CSX / CSX Corporation | 0.00 | 87.03 | 0.02 | 9.09 | 0.0084 | -0.0054 | |||

| HON / Honeywell International Inc. | 0.00 | -41.34 | 0.02 | 9.09 | 0.0084 | -0.0055 | |||

| CNC / Centene Corporation | 0.00 | -1.93 | 0.02 | -8.33 | 0.0099 | -0.0055 | |||

| DHR / Danaher Corporation | 0.00 | -97.99 | 0.02 | -4.76 | 0.0072 | -0.0064 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -63.20 | 0.02 | -69.84 | 0.0067 | -0.0330 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | 0.02 | 0.0086 | 0.0086 | |||||

| RQI / Cohen & Steers Quality Income Realty Fund, Inc. | 0.00 | 0.02 | 0.0072 | 0.0072 | |||||

| IGR / CBRE Global Real Estate Income Fund | 0.00 | 0.01 | 0.0067 | 0.0067 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.01 | 0.0059 | 0.0059 | |||||

| APH / Amphenol Corporation | 0.00 | -92.05 | 0.01 | 50.00 | 0.0042 | -0.0009 | |||

| FLO / Flowers Foods, Inc. | 0.00 | 0.01 | 0.0052 | 0.0052 | |||||

| PJT / PJT Partners Inc. | 0.00 | 0.01 | 0.0048 | 0.0048 | |||||

| TSLA / Tesla, Inc. | 0.00 | 25.00 | 0.01 | 28.57 | 0.0043 | -0.0006 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 0.01 | 0.0036 | 0.0036 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.01 | 0.0036 | 0.0036 | |||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | 0.01 | 0.0035 | 0.0035 | |||||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.00 | 0.01 | 40.00 | 0.0026 | -0.0011 | |||

| CAT / Caterpillar Inc. | 0.00 | -99.15 | 0.01 | 16.67 | 0.0025 | -0.0014 | |||

| GPN / Global Payments Inc. | 0.00 | 0.01 | 0.0033 | 0.0033 | |||||

| DE / Deere & Company | 0.00 | -92.47 | 0.01 | 16.67 | 0.0024 | -0.0017 | |||

| FCX / Freeport-McMoRan Inc. | 0.00 | 16.79 | 0.01 | 0.00 | 0.0024 | -0.0014 | |||

| ECL / Ecolab Inc. | 0.00 | -99.17 | 0.01 | 0.00 | 0.0023 | -0.0016 | |||

| SPGI / S&P Global Inc. | 0.00 | 9.09 | 0.01 | 0.00 | 0.0022 | -0.0016 | |||

| ADI / Analog Devices, Inc. | 0.00 | 13.04 | 0.01 | 20.00 | 0.0021 | -0.0012 | |||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.01 | 66.67 | 0.0020 | -0.0002 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | -50.00 | 0.01 | 0.00 | 0.0020 | -0.0013 | |||

| BALL / Ball Corporation | 0.00 | -91.62 | 0.00 | 0.00 | 0.0017 | -0.0012 | |||

| MCO / Moody's Corporation | 0.00 | -99.77 | 0.00 | 0.00 | 0.0016 | -0.0011 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -64.00 | 0.00 | 0.00 | 0.0014 | -0.0014 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.0018 | 0.0018 | |||||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0013 | -0.0010 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -99.38 | 0.00 | 0.00 | 0.0013 | -0.0012 | |||

| VLTO / Veralto Corporation | 0.00 | 8.82 | 0.00 | 0.00 | 0.0013 | -0.0010 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | -11.11 | 0.00 | 0.00 | 0.0008 | -0.0008 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0008 | -0.0005 | |||

| COP / ConocoPhillips | 0.00 | -8.33 | 0.00 | -50.00 | 0.0007 | -0.0008 | |||

| DBRG / DigitalBridge Group, Inc. | 0.00 | 0.00 | 0.0008 | 0.0008 | |||||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.0007 | 0.0007 | |||||

| OXY / Occidental Petroleum Corporation | 0.00 | 0.00 | 0.0006 | 0.0006 | |||||

| HUM / Humana Inc. | 0.00 | -99.74 | 0.00 | 0.00 | 0.0004 | -0.0004 | |||

| HAL / Halliburton Company | 0.00 | 0.00 | 0.0004 | 0.0004 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IP / International Paper Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RMD / ResMed Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RSG / Republic Services, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BA / The Boeing Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MKL / Markel Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |