Basic Stats

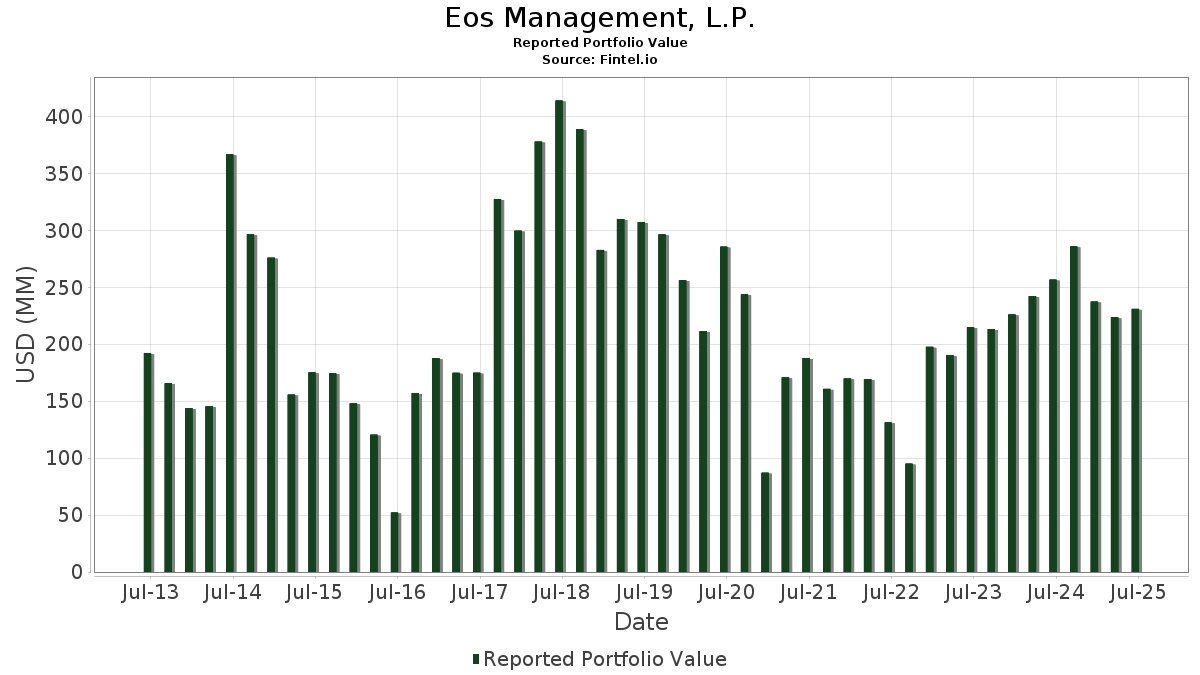

| Portfolio Value | $ 230,985,831 |

| Current Positions | 38 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Eos Management, L.P. has disclosed 38 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 230,985,831 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Eos Management, L.P.’s top holdings are SPDR S&P 500 ETF (US:SPY) , Berkshire Hathaway Inc. (US:BRK.B) , Meta Platforms, Inc. (US:META) , Microsoft Corporation (US:MSFT) , and O'Reilly Automotive, Inc. (US:ORLY) . Eos Management, L.P.’s new positions include Booking Holdings Inc. (US:BKNG) , BWX Technologies, Inc. (US:BWXT) , Constellation Energy Corporation (US:CEG) , CONVERTIBLE ZERO (US:US009066AB74) , and UnitedHealth Group Incorporated (US:UNH) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 68.42 | 29.6201 | 1.9063 | |

| 0.00 | 3.30 | 1.4286 | 1.4286 | |

| 0.02 | 2.92 | 1.2629 | 1.2629 | |

| 0.02 | 11.65 | 5.0444 | 1.1102 | |

| 0.02 | 11.97 | 5.1836 | 1.0005 | |

| 0.01 | 2.12 | 0.9178 | 0.9178 | |

| 0.05 | 7.25 | 3.1395 | 0.9138 | |

| 0.00 | 1.57 | 0.6800 | 0.6800 | |

| 0.02 | 7.12 | 3.0813 | 0.6712 | |

| 0.00 | 1.51 | 0.6541 | 0.6541 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 5.04 | 2.1837 | -1.5370 | |

| 0.03 | 16.15 | 6.9926 | -0.9300 | |

| 0.00 | 0.00 | -0.8414 | ||

| 0.03 | 7.60 | 3.2908 | -0.6712 | |

| 0.01 | 4.43 | 1.9189 | -0.5816 | |

| 0.03 | 7.15 | 3.0936 | -0.3677 | |

| 0.07 | 7.76 | 3.3606 | -0.2543 | |

| 0.05 | 1.73 | 0.7473 | -0.2256 | |

| 0.01 | 6.67 | 2.8857 | -0.2161 | |

| 0.01 | 3.54 | 1.5314 | -0.0781 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.11 | 0.00 | 68.42 | 10.45 | 29.6201 | 1.9063 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.03 | 0.00 | 16.15 | -8.79 | 6.9926 | -0.9300 | |||

| META / Meta Platforms, Inc. | 0.02 | 0.00 | 11.97 | 28.07 | 5.1836 | 1.0005 | |||

| MSFT / Microsoft Corporation | 0.02 | 0.00 | 11.65 | 32.50 | 5.0444 | 1.1102 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.09 | 1,878.82 | 7.96 | 24.51 | 3.4445 | 0.5853 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.07 | 12.02 | 7.76 | -3.92 | 3.3606 | -0.2543 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -25.56 | 7.60 | -14.16 | 3.2908 | -0.6712 | |||

| NVDA / NVIDIA Corporation | 0.05 | 0.00 | 7.25 | 45.78 | 3.1395 | 0.9138 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 0.00 | 7.25 | 18.18 | 3.1377 | 0.3941 | |||

| AAPL / Apple Inc. | 0.03 | 0.00 | 7.15 | -7.64 | 3.0936 | -0.3677 | |||

| APP / AppLovin Corporation | 0.02 | 0.00 | 7.12 | 32.11 | 3.0813 | 0.6712 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 0.00 | 6.67 | -3.85 | 2.8857 | -0.2161 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 0.00 | 6.55 | 9.93 | 2.8367 | 0.1700 | |||

| HEI / HEICO Corporation | 0.02 | 0.00 | 5.10 | 22.77 | 2.2058 | 0.3489 | |||

| DHR / Danaher Corporation | 0.03 | -37.06 | 5.04 | -39.36 | 2.1837 | -1.5370 | |||

| GOOGL / Alphabet Inc. | 0.03 | 0.00 | 4.62 | 13.98 | 2.0019 | 0.1865 | |||

| WAT / Waters Corporation | 0.01 | -16.26 | 4.43 | -20.69 | 1.9189 | -0.5816 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 3.54 | -1.67 | 1.5314 | -0.0781 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 3.30 | 1.4286 | 1.4286 | |||||

| DOV / Dover Corporation | 0.02 | 0.00 | 3.10 | 4.28 | 1.3407 | 0.0123 | |||

| GOOG / Alphabet Inc. | 0.02 | 0.00 | 3.00 | 13.52 | 1.2979 | 0.1166 | |||

| BWXT / BWX Technologies, Inc. | 0.02 | 2.92 | 1.2629 | 1.2629 | |||||

| CART / Maplebear Inc. | 0.06 | 0.00 | 2.51 | 13.41 | 1.0876 | 0.0966 | |||

| FSV / FirstService Corporation | 0.01 | 0.00 | 2.30 | 5.21 | 0.9965 | 0.0178 | |||

| CEG / Constellation Energy Corporation | 0.01 | 2.12 | 0.9178 | 0.9178 | |||||

| UBER / Uber Technologies, Inc. | 0.02 | 0.00 | 2.11 | 28.02 | 0.9120 | 0.1760 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 1.73 | -20.61 | 0.7473 | -0.2256 | |||

| US009066AB74 / CONVERTIBLE ZERO | 1.69 | 1.02 | 0.7315 | -0.0166 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 1.58 | 36.42 | 0.6831 | 0.1657 | |||

| SPGI / S&P Global Inc. | 0.00 | 1.57 | 0.6800 | 0.6800 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 1.51 | 0.6541 | 0.6541 | |||||

| VRT / Vertiv Holdings Co | 0.01 | 1.46 | 0.6325 | 0.6325 | |||||

| ANET / Arista Networks Inc | 0.01 | 1.21 | 0.5256 | 0.5256 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 1.08 | 29.50 | 0.4679 | 0.0947 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 0.66 | 29.08 | 0.2849 | 0.0569 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 0.00 | 0.57 | 11.07 | 0.2478 | 0.0169 | |||

| HOUS / Anywhere Real Estate Inc. | 0.06 | 0.00 | 0.22 | 9.05 | 0.0940 | 0.0046 | |||

| ATUS / Altice USA, Inc. | 0.06 | 0.00 | 0.13 | -19.87 | 0.0545 | -0.0155 | |||

| BAX / Baxter International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DDOG / Datadog, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PYPL / PayPal Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8414 | ||||

| OXY / Occidental Petroleum Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |