Basic Stats

| Portfolio Value | $ 176,484,000 |

| Current Positions | 18 |

Latest Holdings, Performance, AUM (from 13F, 13D)

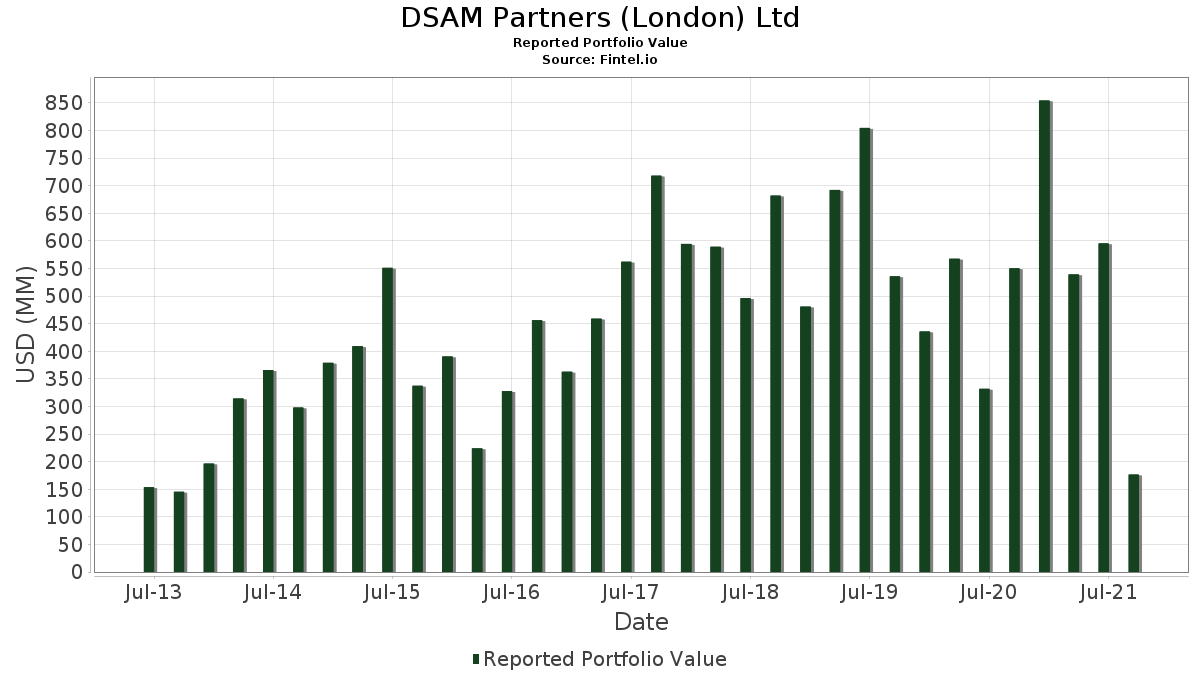

DSAM Partners (London) Ltd has disclosed 18 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 176,484,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). DSAM Partners (London) Ltd’s top holdings are GFL Environmental Inc. (US:GFL) , Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOGL) , Antero Resources Corporation (US:AR) , and Lucid Group, Inc. (US:LCID) . DSAM Partners (London) Ltd’s new positions include GXO Logistics, Inc. (US:GXO) , Xos, Inc. (US:XOS) , Doma Holdings Inc. (US:DOMA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.70 | 26.00 | 14.7350 | 8.0230 | |

| 0.15 | 11.61 | 6.5779 | 6.5779 | |

| 0.55 | 13.99 | 7.9254 | 6.3265 | |

| 0.01 | 17.67 | 10.0128 | 4.0712 | |

| 0.06 | 18.18 | 10.3035 | 3.8827 | |

| 0.91 | 17.09 | 9.6808 | 3.3599 | |

| 1.20 | 5.57 | 3.1561 | 3.1561 | |

| 0.20 | 10.40 | 5.8952 | 3.1532 | |

| 0.65 | 12.41 | 7.0346 | 2.8059 | |

| 0.68 | 5.85 | 3.3130 | 2.2419 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -6.3239 | ||

| 0.00 | 0.00 | -5.0147 | ||

| 0.00 | 0.00 | -3.7960 | ||

| 0.00 | 0.00 | -3.7493 | ||

| 0.00 | 0.00 | -3.5811 | ||

| 0.00 | 0.00 | -2.6629 | ||

| 0.00 | 0.00 | -2.4845 | ||

| 0.00 | 0.00 | -2.1483 | ||

| 0.22 | 6.59 | 3.7357 | -2.0018 | |

| 0.00 | 0.00 | -1.6842 |

13F and Fund Filings

This form was filed on 2021-11-15 for the reporting period 2021-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GFL / GFL Environmental Inc. | 0.70 | -44.09 | 26.00 | -34.93 | 14.7350 | 8.0230 | |||

| MSFT / Microsoft Corporation | 0.06 | -54.29 | 18.18 | -52.44 | 10.3035 | 3.8827 | |||

| GOOGL / Alphabet Inc. | 0.01 | -53.03 | 17.67 | -50.05 | 10.0128 | 4.0712 | |||

| AR / Antero Resources Corporation | 0.91 | -63.73 | 17.09 | -54.60 | 9.6808 | 3.3599 | |||

| LCID / Lucid Group, Inc. | 0.55 | 66.84 | 13.99 | 46.92 | 7.9254 | 6.3265 | |||

| ACI09N1H7 / Fiat Chrysler Automobiles N.V | 0.65 | -49.12 | 12.41 | -50.69 | 7.0346 | 2.8059 | |||

| GXO / GXO Logistics, Inc. | 0.15 | 11.61 | 6.5779 | 6.5779 | |||||

| CARR / Carrier Global Corporation | 0.20 | -40.17 | 10.40 | -36.27 | 5.8952 | 3.1532 | |||

| STEM / Stem, Inc. | 0.37 | -57.95 | 8.85 | -72.10 | 5.0152 | -0.3131 | |||

| VNT / Vontier Corporation | 0.24 | -77.16 | 8.12 | -76.45 | 4.5999 | -1.1894 | |||

| OXY / Occidental Petroleum Corporation | 0.22 | -79.60 | 6.59 | -80.70 | 3.7357 | -2.0018 | |||

| XPO / XPO, Inc. | 0.08 | -45.72 | 6.52 | -69.12 | 3.6933 | 0.1481 | |||

| VLTA / Volta Inc - Class A | 0.68 | 6.29 | 5.85 | -8.33 | 3.3130 | 2.2419 | |||

| XOS / Xos, Inc. | 1.20 | 5.57 | 3.1561 | 3.1561 | |||||

| MKFG / Markforged Holding Corporation | 0.43 | -56.57 | 2.83 | -71.45 | 1.6041 | -0.0613 | |||

| HYZN / Hyzon Motors Inc. | 0.36 | -49.28 | 2.50 | -65.87 | 1.4154 | 0.1862 | |||

| ALLO / Allogene Therapeutics, Inc. | 0.05 | -62.50 | 1.39 | -63.05 | 0.7865 | 0.1556 | |||

| DOMA / Doma Holdings Inc. | 0.12 | 0.91 | 0.5156 | 0.5156 | |||||

| ARYD / ARYA Sciences Acquisition Corp IV | 0.00 | -100.00 | 0.00 | -100.00 | -0.0359 | ||||

| EXP / Eagle Materials Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2294 | ||||

| AFIB / Acutus Medical, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2049 | ||||

| CVE / Cenovus Energy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2751 | ||||

| CLDX / Celldex Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7633 | ||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.7960 | ||||

| KRYS / Krystal Biotech, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8026 | ||||

| EXPE / Expedia Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -6.3239 | ||||

| MELI / MercadoLibre, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6540 | ||||

| BBIO / BridgeBio Pharma, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8230 | ||||

| AON / Aon plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.6842 | ||||

| VMC / Vulcan Materials Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.3697 | ||||

| PTON / Peloton Interactive, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.7493 | ||||

| INTU / Intuit Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.5811 | ||||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4761 | ||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.4845 | ||||

| EPAM / EPAM Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5578 | ||||

| IMTX / Immatics N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2983 | ||||

| DMYI.U / dMY Technology Group, Inc. III Units, each consisting of one share of Class A common stock and one-f | 0.00 | -100.00 | 0.00 | -100.00 | -0.7662 | ||||

| SUM / Summit Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2560 | ||||

| YNDX / Yandex N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6535 | ||||

| NCR / NCR Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -5.0147 | ||||

| NEXI / NexImmune, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2454 | ||||

| CSTM / Constellium SE | 0.00 | -100.00 | 0.00 | -100.00 | -2.1483 | ||||

| IOVA / Iovance Biotherapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3567 | ||||

| RCKT / Rocket Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0435 | ||||

| OVV / Ovintiv Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2738 | ||||

| AEVA / Aeva Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.6629 | ||||

| OPCH / Option Care Health, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2739 | ||||

| APLT / Applied Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2343 |