Basic Stats

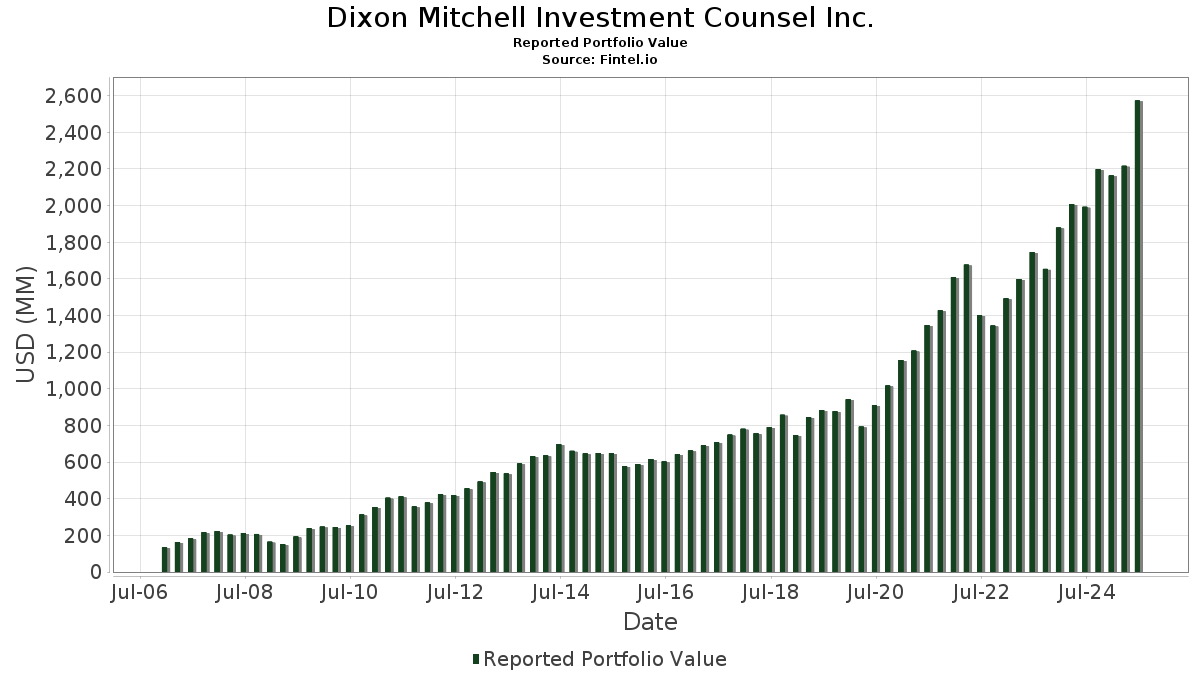

| Portfolio Value | $ 2,573,140,058 |

| Current Positions | 70 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Dixon Mitchell Investment Counsel Inc. has disclosed 70 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,573,140,058 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Dixon Mitchell Investment Counsel Inc.’s top holdings are iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , Microsoft Corporation (US:MSFT) , Visa Inc. (US:V) , The Toronto-Dominion Bank (US:TD) , and Intercontinental Exchange, Inc. (US:ICE) . Dixon Mitchell Investment Counsel Inc.’s new positions include The Descartes Systems Group Inc. (US:DSGX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.50 | 83.74 | 3.2543 | 0.9637 | |

| 0.82 | 73.71 | 2.8648 | 0.8699 | |

| 0.28 | 140.29 | 5.4521 | 0.8448 | |

| 2.04 | 67.58 | 2.6262 | 0.6850 | |

| 0.06 | 46.59 | 1.8106 | 0.6185 | |

| 0.08 | 8.54 | 0.3318 | 0.3318 | |

| 1.64 | 120.78 | 4.6941 | 0.3060 | |

| 0.20 | 65.98 | 2.5644 | 0.2284 | |

| 0.02 | 23.63 | 0.9183 | 0.2250 | |

| 0.89 | 116.94 | 4.5447 | 0.1725 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.22 | 106.09 | 4.1230 | -0.9362 | |

| 0.65 | 120.06 | 4.6657 | -0.8661 | |

| 0.38 | 135.44 | 5.2635 | -0.6048 | |

| 0.18 | 25.71 | 0.9992 | -0.5319 | |

| 0.26 | 57.61 | 2.2388 | -0.3772 | |

| 0.00 | 0.03 | 0.0011 | -0.3625 | |

| 0.13 | 59.33 | 2.3056 | -0.3457 | |

| 0.50 | 17.99 | 0.6992 | -0.3412 | |

| 0.09 | 53.29 | 2.0711 | -0.3264 | |

| 2.17 | 69.09 | 2.6851 | -0.2335 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 1.96 | 5.37 | 163.42 | 16.28 | 6.3510 | 0.0110 | |||

| MSFT / Microsoft Corporation | 0.28 | 3.66 | 140.29 | 37.36 | 5.4521 | 0.8448 | |||

| V / Visa Inc. | 0.38 | 2.77 | 135.44 | 4.11 | 5.2635 | -0.6048 | |||

| TD / The Toronto-Dominion Bank | 1.64 | 1.35 | 120.78 | 24.17 | 4.6941 | 0.3060 | |||

| ICE / Intercontinental Exchange, Inc. | 0.65 | -7.96 | 120.06 | -2.10 | 4.6657 | -0.8661 | |||

| RY / Royal Bank of Canada | 0.89 | 3.32 | 116.94 | 20.65 | 4.5447 | 0.1725 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.22 | 3.71 | 106.09 | -5.41 | 4.1230 | -0.9362 | |||

| BN / Brookfield Corporation | 1.71 | 2.26 | 105.71 | 20.71 | 4.1082 | 0.1576 | |||

| GOOGL / Alphabet Inc. | 0.54 | 3.80 | 95.88 | 18.28 | 3.7261 | 0.0696 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.21 | 38.56 | 85.14 | 12.93 | 3.3090 | -0.0921 | |||

| BIP / Brookfield Infrastructure Partners L.P. - Limited Partnership | 2.50 | 46.73 | 83.74 | 64.91 | 3.2543 | 0.9637 | |||

| WPM / Wheaton Precious Metals Corp. | 0.83 | 1.49 | 74.52 | 17.10 | 2.8960 | 0.0253 | |||

| TFII / TFI International Inc. | 0.82 | 44.35 | 73.71 | 66.69 | 2.8648 | 0.8699 | |||

| AME / AMETEK, Inc. | 0.40 | 2.92 | 72.13 | 8.19 | 2.8031 | -0.2043 | |||

| CNQ / Canadian Natural Resources Limited | 2.17 | 4.72 | 69.09 | 6.79 | 2.6851 | -0.2335 | |||

| MEOH / Methanex Corporation | 2.04 | 66.44 | 67.58 | 57.03 | 2.6262 | 0.6850 | |||

| HEI / HEICO Corporation | 0.20 | 3.80 | 65.98 | 27.42 | 2.5644 | 0.2284 | |||

| AMZN / Amazon.com, Inc. | 0.28 | 6.71 | 61.63 | 23.04 | 2.3952 | 0.1355 | |||

| DPZ / Domino's Pizza, Inc. | 0.13 | 2.92 | 59.33 | 0.94 | 2.3056 | -0.3457 | |||

| LOW / Lowe's Companies, Inc. | 0.26 | 4.43 | 57.61 | -0.66 | 2.2388 | -0.3772 | |||

| CNI / Canadian National Railway Company | 0.52 | 2.14 | 54.20 | 9.16 | 2.1062 | -0.1334 | |||

| ROP / Roper Technologies, Inc. | 0.09 | 4.30 | 53.29 | 0.27 | 2.0711 | -0.3264 | |||

| TXN / Texas Instruments Incorporated | 0.25 | 3.14 | 52.81 | 19.16 | 2.0525 | 0.0531 | |||

| META / Meta Platforms, Inc. | 0.06 | 37.67 | 46.59 | 76.30 | 1.8106 | 0.6185 | |||

| TRI / Thomson Reuters Corporation | 0.21 | 1.40 | 42.65 | 17.94 | 1.6575 | 0.0262 | |||

| DHR / Danaher Corporation | 0.18 | 6.90 | 35.09 | 3.01 | 1.3636 | -0.1729 | |||

| FTNT / Fortinet, Inc. | 0.32 | 6.83 | 34.18 | 17.34 | 1.3282 | 0.0143 | |||

| CSL / Carlisle Companies Incorporated | 0.08 | 6.71 | 31.37 | 17.01 | 1.2193 | 0.0098 | |||

| HCA / HCA Healthcare, Inc. | 0.07 | 6.88 | 27.56 | 18.48 | 1.0710 | 0.0218 | |||

| BLD / TopBuild Corp. | 0.08 | 6.85 | 26.07 | 13.42 | 1.0130 | -0.0237 | |||

| MIDD / The Middleby Corporation | 0.18 | -20.06 | 25.71 | -24.25 | 0.9992 | -0.5319 | |||

| AAPL / Apple Inc. | 0.12 | 3.44 | 25.38 | -4.47 | 0.9863 | -0.2121 | |||

| JPM / JPMorgan Chase & Co. | 0.09 | 7.54 | 24.87 | 27.07 | 0.9664 | 0.0836 | |||

| NFLX / Netflix, Inc. | 0.02 | 7.08 | 23.63 | 53.75 | 0.9183 | 0.2250 | |||

| CP / Canadian Pacific Kansas City Limited | 0.30 | 2.90 | 23.40 | 16.00 | 0.9094 | -0.0006 | |||

| WCN / Waste Connections, Inc. | 0.11 | 2.90 | 20.36 | -1.57 | 0.7912 | -0.1418 | |||

| MFC / Manulife Financial Corporation | 0.62 | 3.11 | 19.83 | 5.60 | 0.7707 | -0.0765 | |||

| CMCSA / Comcast Corporation | 0.50 | -19.37 | 17.99 | -21.99 | 0.6992 | -0.3412 | |||

| ORCL / Oracle Corporation | 0.06 | 3.78 | 14.32 | 62.24 | 0.5567 | 0.1584 | |||

| ZTS / Zoetis Inc. | 0.09 | 6.84 | 14.31 | 1.19 | 0.5563 | -0.0818 | |||

| TFPM / Triple Flag Precious Metals Corp. | 0.56 | 0.00 | 13.35 | 23.72 | 0.5187 | 0.0320 | |||

| MA / Mastercard Incorporated | 0.02 | 6.78 | 12.92 | 9.45 | 0.5021 | -0.0304 | |||

| ATS / ATS Corporation | 0.40 | 12.92 | 12.80 | 44.21 | 0.4974 | 0.0970 | |||

| NTR / Nutrien Ltd. | 0.21 | 2.58 | 12.44 | 20.03 | 0.4833 | 0.0159 | |||

| CIGI / Colliers International Group Inc. | 0.09 | -2.20 | 11.64 | 5.66 | 0.4522 | -0.0446 | |||

| SHOP / Shopify Inc. | 0.08 | 3.34 | 8.78 | 24.71 | 0.3413 | 0.0236 | |||

| DSGX / The Descartes Systems Group Inc. | 0.08 | 8.54 | 0.3318 | 0.3318 | |||||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.02 | 0.00 | 1.55 | 0.26 | 0.0602 | -0.0095 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.70 | 13.55 | 0.0274 | -0.0006 | |||

| BNS / The Bank of Nova Scotia | 0.01 | -10.38 | 0.36 | 5.87 | 0.0140 | -0.0014 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -4.76 | 0.31 | 20.95 | 0.0119 | 0.0005 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -8.79 | 0.26 | 0.78 | 0.0100 | -0.0015 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.00 | 0.00 | 0.15 | 0.00 | 0.0058 | -0.0009 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.00 | -11.33 | 0.12 | 0.00 | 0.0047 | -0.0008 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | 0.00 | 0.11 | 5.88 | 0.0042 | -0.0004 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.11 | -0.92 | 0.0042 | -0.0007 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -71.01 | 0.06 | -65.91 | 0.0023 | -0.0056 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.00 | 0.00 | 0.06 | 0.00 | 0.0022 | -0.0003 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.04 | 0.00 | 0.0015 | -0.0002 | |||

| GBTC / Grayscale Bitcoin Trust (BTC) | 0.00 | 0.00 | 0.04 | 33.33 | 0.0014 | 0.0002 | |||

| LSPD / Lightspeed Commerce Inc. | 0.00 | 0.00 | 0.03 | 38.10 | 0.0011 | 0.0001 | |||

| SPGI / S&P Global Inc. | 0.00 | -99.86 | 0.03 | -99.64 | 0.0011 | -0.3625 | |||

| SLF / Sun Life Financial Inc. | 0.00 | -60.67 | 0.02 | -54.76 | 0.0008 | -0.0012 | |||

| ENB / Enbridge Inc. | 0.00 | -86.23 | 0.02 | -62.22 | 0.0007 | -0.0014 | |||

| SU / Suncor Energy Inc. | 0.00 | -49.32 | 0.01 | -53.57 | 0.0005 | -0.0007 | |||

| RCI / Rogers Communications Inc. | 0.00 | -57.64 | 0.01 | -20.00 | 0.0005 | -0.0002 | |||

| ARKK / ARK ETF Trust - ARK Innovation ETF | 0.00 | -93.91 | 0.01 | -91.92 | 0.0003 | -0.0041 | |||

| BTE / Baytex Energy Corp. | 0.00 | 0.00 | 0.01 | -16.67 | 0.0002 | -0.0001 | |||

| BTC / Grayscale Bitcoin Mini Trust | 0.00 | 0.00 | 0.00 | 33.33 | 0.0002 | 0.0000 | |||

| MOGO / Mogo Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| LLY / Eli Lilly and Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TU / TELUS Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PBA / Pembina Pipeline Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OSKGF / Osisko Gold Royalties Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GFL / GFL Environmental Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AEM / Agnico Eagle Mines Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FTS / Fortis Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BMO / Bank of Montreal | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DHI / D.R. Horton, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLK / BlackRock, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MS / Morgan Stanley | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GIB / CGI Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EGO N / Eldorado Gold Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| C / Citigroup Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FSV / FirstService Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| STN / Stantec Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TRP / TC Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TECK / Teck Resources Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PANW / Palo Alto Networks, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ARKG / ARK ETF Trust - ARK Genomic Revolution ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CM / Canadian Imperial Bank of Commerce | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CLS / Celestica Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WFG / West Fraser Timber Co. Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COST / Costco Wholesale Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLCO / Bausch + Lomb Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AGI / Alamos Gold Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |