Basic Stats

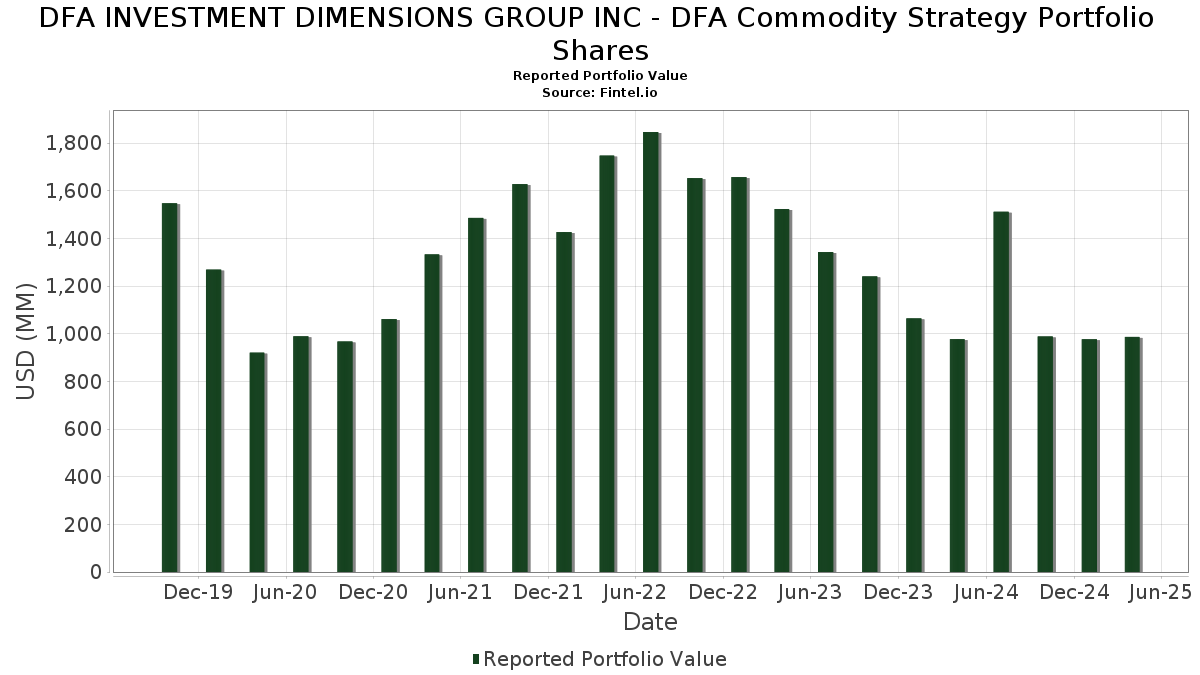

| Portfolio Value | $ 986,425,233 |

| Current Positions | 278 |

Latest Holdings, Performance, AUM (from 13F, 13D)

DFA INVESTMENT DIMENSIONS GROUP INC - DFA Commodity Strategy Portfolio Shares has disclosed 278 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 986,425,233 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). DFA INVESTMENT DIMENSIONS GROUP INC - DFA Commodity Strategy Portfolio Shares’s top holdings are Inter-American Development Bank (XX:US4581X0EG91) , American Express Co (US:US025816DD86) , U.S. Treasury Floating Rate Notes (US:US91282CJD48) , International Bank for Reconstruction & Development (XX:US459058JF11) , and Charles Schwab Corp/The (US:US808513BQ70) . DFA INVESTMENT DIMENSIONS GROUP INC - DFA Commodity Strategy Portfolio Shares’s new positions include Inter-American Development Bank (XX:US4581X0EG91) , American Express Co (US:US025816DD86) , U.S. Treasury Floating Rate Notes (US:US91282CJD48) , International Bank for Reconstruction & Development (XX:US459058JF11) , and Charles Schwab Corp/The (US:US808513BQ70) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 64.26 | 6.1250 | 6.1250 | ||

| 33.31 | 3.1746 | 3.1746 | ||

| 30.97 | 2.9524 | 2.9524 | ||

| 22.01 | 2.0979 | 2.0979 | ||

| 19.97 | 1.9037 | 1.9037 | ||

| 19.68 | 1.8760 | 1.8760 | ||

| 19.35 | 1.8441 | 1.8441 | ||

| 16.96 | 1.6163 | 1.6163 | ||

| 16.01 | 1.5256 | 1.5256 | ||

| 15.55 | 1.4821 | 1.4821 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 8.00 | 0.7628 | -11.2568 | ||

| 24.28 | 2.3141 | -9.4342 | ||

| 13.00 | 1.2393 | -0.4506 | ||

| -4.37 | -0.4166 | -0.4166 | ||

| -2.01 | -0.1916 | -0.1916 | ||

| -1.88 | -0.1791 | -0.1791 | ||

| -1.88 | -0.1789 | -0.1789 | ||

| -1.77 | -0.1686 | -0.1686 | ||

| 0.94 | 0.0895 | -0.1679 | ||

| 0.01 | 0.13 | 0.0124 | -0.1570 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Bills / DBT (US912797MG92) | 64.26 | 6.1250 | 6.1250 | ||||||

| U.S. Treasury Bills / DBT (US912797NA14) | 33.31 | 3.1746 | 3.1746 | ||||||

| U.S. Treasury Bills / DBT (US912797NE36) | 30.97 | 2.9524 | 2.9524 | ||||||

| U.S. Treasury Floating Rate Notes / DBT (US91282CJU62) | 24.28 | -80.62 | 2.3141 | -9.4342 | |||||

| US4581X0EG91 / Inter-American Development Bank | 22.01 | 2.0979 | 2.0979 | ||||||

| D05 / DBS Group Holdings Ltd | 19.97 | 1.9037 | 1.9037 | ||||||

| U.S. Treasury Bills / DBT (US912797PX98) | 19.68 | 1.8760 | 1.8760 | ||||||

| ANZ / ANZ Group Holdings Limited | 19.35 | 1.8441 | 1.8441 | ||||||

| NAB / National Australia Bank Limited | 16.96 | 1.6163 | 1.6163 | ||||||

| International Bank for Reconstruction & Development / DBT (US459058LH49) | 16.01 | 1.5256 | 1.5256 | ||||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 15.55 | 1.4821 | 1.4821 | ||||||

| Chevron USA, Inc. / DBT (US166756BC91) | 14.19 | 1.3522 | 1.3522 | ||||||

| U.S. Treasury Floating Rate Notes / DBT (US91282CKM28) | 13.00 | -27.83 | 1.2393 | -0.4506 | |||||

| P1SA34 / Public Storage - Depositary Receipt (Common Stock) | 10.04 | -1.07 | 0.9572 | 0.0050 | |||||

| European Bank for Reconstruction & Development / DBT (US29875BAK26) | 10.01 | 0.9539 | 0.9539 | ||||||

| US025816DD86 / American Express Co | 8.89 | -0.09 | 0.8478 | 0.0127 | |||||

| US91282CJD48 / U.S. Treasury Floating Rate Notes | 8.00 | -93.76 | 0.7628 | -11.2568 | |||||

| E1MR34 / Emerson Electric Co. - Depositary Receipt (Common Stock) | 7.97 | 0.7593 | 0.7593 | ||||||

| US89233FHN15 / Toyota Motor Credit Corporation | 7.90 | -0.20 | 0.7530 | 0.0104 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 7.80 | -0.32 | 0.7438 | 0.0095 | |||||

| National Grid North America, Inc. / STIV (US63627AS824) | 7.74 | 0.7379 | 0.7379 | ||||||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 7.74 | 0.7379 | 0.7379 | ||||||

| CNIC34 / Canadian National Railway Company - Depositary Receipt (Common Stock) | 7.72 | 0.7361 | 0.7361 | ||||||

| Consolidated Edison Co. of New York, Inc. / DBT (US209111GL10) | 7.58 | 0.7223 | 0.7223 | ||||||

| EIDP, Inc. / STIV (US28249KSL25) | 7.48 | 0.7130 | 0.7130 | ||||||

| Mizuho Bank Ltd. / STIV (US60689FT329) | 7.47 | 0.7119 | 0.7119 | ||||||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 7.46 | 0.7109 | 0.7109 | ||||||

| US05353BZ185 / Avangrid Inc | 7.45 | 0.7104 | 0.7104 | ||||||

| INWI / Inwido AB (publ) | 7.45 | 0.7098 | 0.7098 | ||||||

| Lloyds Bank PLC / STIV (US53943RU728) | 7.44 | 1.10 | 0.7090 | 0.0188 | |||||

| US459058JF11 / International Bank for Reconstruction & Development | 7.39 | 0.7046 | 0.7046 | ||||||

| ACA / Crédit Agricole S.A. | 7.26 | -0.26 | 0.6915 | 0.0092 | |||||

| US808513BQ70 / Charles Schwab Corp/The | 7.19 | -0.04 | 0.6857 | 0.0106 | |||||

| US30161MAS26 / Exelon Generation Co LLC | 7.19 | 0.34 | 0.6849 | 0.0132 | |||||

| US65535HAR03 / Nomura Holdings Inc | 7.07 | 551.29 | 0.6742 | 0.5723 | |||||

| MOSD / The Mosaic Company - Depositary Receipt (Common Stock) | 6.99 | 0.6659 | 0.6659 | ||||||

| John Deere Capital Corp. / DBT (US24422EYA18) | 6.99 | 0.6658 | 0.6658 | ||||||

| US63906EB929 / NatWest Markets PLC | 6.98 | 0.6657 | 0.6657 | ||||||

| US7562E0EU66 / Reckitt Benckiser Treasury Services plc | 6.98 | 0.6656 | 0.6656 | ||||||

| LSEGA Financing PLC / STIV (US50221FSK11) | 6.98 | 0.6656 | 0.6656 | ||||||

| BAS / BASF SE | 6.96 | 0.6634 | 0.6634 | ||||||

| US36962GW752 / General Electric Co. Floating Rate Bond Due 5/5/2026 | 6.70 | -0.49 | 0.6388 | 0.0071 | |||||

| MG / Magna International Inc. | 6.60 | 0.6286 | 0.6286 | ||||||

| CA14913LAA85 / CATERP FIN S LTD | 6.52 | -0.21 | 0.6217 | 0.0085 | |||||

| TotalEnergies Capital SA / STIV (US89152ES585) | 6.50 | 0.6192 | 0.6192 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 6.49 | 0.6189 | 0.6189 | ||||||

| 081437AG0 / Bemis Inc Notes 5.65% 08/01/14 | 6.48 | 0.6180 | 0.6180 | ||||||

| NTR / Nutrien Ltd. | 6.48 | 0.6179 | 0.6179 | ||||||

| US87165BAS25 / Synchrony Financial | 6.32 | -0.02 | 0.6023 | 0.0094 | |||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 6.29 | 0.5992 | 0.5992 | ||||||

| US49327M3E23 / KeyBank NA/Cleveland OH | 6.24 | 0.5946 | 0.5946 | ||||||

| CBT / Cabot Corporation | 6.00 | 0.5719 | 0.5719 | ||||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 6.00 | 0.5715 | 0.5715 | ||||||

| US94988J6G76 / Wells Fargo Bank NA | 5.96 | 0.5684 | 0.5684 | ||||||

| HON / Honeywell International Inc. - Depositary Receipt (Common Stock) | 5.96 | 0.5676 | 0.5676 | ||||||

| US04517PBK75 / Asian Development Bank | 5.91 | 0.5637 | 0.5637 | ||||||

| E1SE34 / Eversource Energy - Depositary Receipt (Common Stock) | 5.75 | 0.5477 | 0.5477 | ||||||

| Cooperatieve Rabobank UA / DBT (US21688ABL52) | 5.66 | 0.5395 | 0.5395 | ||||||

| US65473PAK12 / NiSource Inc | 5.64 | 0.5376 | 0.5376 | ||||||

| US858119BL37 / Steel Dynamics Inc | 5.49 | 0.5237 | 0.5237 | ||||||

| Enel Finance America LLC / STIV (US29279GT640) | 5.47 | 0.5217 | 0.5217 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 5.45 | 0.5195 | 0.5195 | ||||||

| US48125LRV61 / JPMorgan Chase Bank NA | 5.28 | 0.5030 | 0.5030 | ||||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 5.25 | 0.5003 | 0.5003 | ||||||

| J2BL34 / Jabil Inc. - Depositary Receipt (Common Stock) | 5.25 | 0.5003 | 0.5003 | ||||||

| CRH America Finance, Inc. / STIV (US12636CT912) | 5.22 | 0.4978 | 0.4978 | ||||||

| MA / Mastercard Incorporated - Depositary Receipt (Common Stock) | 5.09 | 0.4850 | 0.4850 | ||||||

| US86959LAN38 / Svenska Handelsbanken AB | 5.03 | 0.4795 | 0.4795 | ||||||

| US55608PBS20 / Macquarie Bank Ltd. | 5.02 | 0.4786 | 0.4786 | ||||||

| C1AG34 / Conagra Brands, Inc. - Depositary Receipt (Common Stock) | 4.99 | 0.4760 | 0.4760 | ||||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 4.99 | 0.4753 | 0.4753 | ||||||

| Intesa Sanpaolo Funding LLC / STIV (US4611K0TD99) | 4.97 | 1.18 | 0.4738 | 0.0130 | |||||

| Aon Corp. / STIV (US03739NU902) | 4.96 | 0.4723 | 0.4723 | ||||||

| US126650CL25 / CVS Health Corp | 4.89 | 0.14 | 0.4658 | 0.0080 | |||||

| Daimler Truck Finance North America LLC / DBT (US233853BB50) | 4.80 | -0.62 | 0.4579 | 0.0045 | |||||

| S1WK34 / Stanley Black & Decker, Inc. - Depositary Receipt (Common Stock) | 4.72 | 0.4495 | 0.4495 | ||||||

| US42217KBF21 / Welltower Inc | 4.62 | 131.78 | 0.4408 | 0.2536 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 4.39 | 0.4182 | 0.4182 | ||||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 4.22 | 0.4022 | 0.4022 | ||||||

| US00774MAN56 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 4.01 | 62.05 | 0.3822 | 0.1501 | |||||

| ANZ / ANZ Group Holdings Limited | 4.01 | 0.3822 | 0.3822 | ||||||

| US56585ABH41 / Marathon Petroleum Corp | 4.00 | 0.03 | 0.3813 | 0.0061 | |||||

| US0255E2S500 / American Electric Power Company, Inc. | 4.00 | 0.3810 | 0.3810 | ||||||

| US548661EK91 / Lowe's Cos., Inc. | 4.00 | 0.3810 | 0.3810 | ||||||

| Boston Properties LP / STIV (US10113BSE91) | 3.99 | 0.3806 | 0.3806 | ||||||

| ERP Operating LP / STIV (US26885TSM44) | 3.99 | 0.3802 | 0.3802 | ||||||

| A1PH34 / Amphenol Corporation - Depositary Receipt (Common Stock) | 3.99 | 0.3799 | 0.3799 | ||||||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 3.99 | 0.3799 | 0.3799 | ||||||

| T / TELUS Corporation | 3.97 | 0.3788 | 0.3788 | ||||||

| US693656AC47 / PVH Corp | 3.80 | 0.3624 | 0.3624 | ||||||

| Mercedes-Benz Finance North America LLC / DBT (US58769JAN72) | 3.80 | -0.24 | 0.3623 | 0.0049 | |||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 3.72 | 0.3547 | 0.3547 | ||||||

| US61690U7U83 / CORP. NOTE | 3.62 | 0.3455 | 0.3455 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 3.61 | -0.44 | 0.3442 | 0.0039 | |||||

| BAT International Finance PLC / STIV (US05531MS584) | 3.50 | 0.3334 | 0.3334 | ||||||

| Enbridge U.S., Inc. / STIV (US29251USN99) | 3.49 | 0.3327 | 0.3327 | ||||||

| Cargill, Inc. / DBT (US141781CC68) | 3.49 | 0.3326 | 0.3326 | ||||||

| US40434LAA35 / HP Inc | 3.41 | 0.3247 | 0.3247 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 3.40 | 0.3239 | 0.3239 | ||||||

| B1DX34 / Becton, Dickinson and Company - Depositary Receipt (Common Stock) | 3.40 | 0.3237 | 0.3237 | ||||||

| GlaxoSmithKline Capital PLC / DBT (US377373AN53) | 3.35 | 0.3189 | 0.3189 | ||||||

| US58013MEU45 / McDonald's Corp | 3.26 | 180.00 | 0.3110 | 0.2017 | |||||

| US12621EAK91 / CNO Financial Group Inc | 3.20 | -0.03 | 0.3050 | 0.0047 | |||||

| US369550BG20 / General Dynamics Corp | 3.10 | 0.2953 | 0.2953 | ||||||

| US670346AX38 / NUCOR CORP REGD 3.95000000 | 3.10 | 0.13 | 0.2952 | 0.0050 | |||||

| US713448FP87 / PepsiCo, Inc. | 3.02 | 0.00 | 0.2883 | 0.0045 | |||||

| US86563VBG32 / Sumitomo Mitsui Trust Bank Ltd | 3.00 | 0.2864 | 0.2864 | ||||||

| CNQ / Canadian Natural Resources Limited | 3.00 | 0.2857 | 0.2857 | ||||||

| US37046US851 / General Motors Financial Co Inc | 2.99 | 0.2846 | 0.2846 | ||||||

| Aon Corp. / STIV (US03739NT508) | 2.99 | 0.2846 | 0.2846 | ||||||

| National Securities Clearing Corp. / STIV (US63763PTG45) | 2.98 | 0.2843 | 0.2843 | ||||||

| Telstra Group Ltd. / STIV (US8796VQTT00) | 2.98 | 0.2839 | 0.2839 | ||||||

| Telstra Group Ltd. / STIV (US8796VQU356) | 2.98 | 0.2836 | 0.2836 | ||||||

| US89115A2T89 / Toronto-Dominion Bank/The | 2.92 | 0.2779 | 0.2779 | ||||||

| VW Credit, Inc. / STIV (US91842JS594) | 2.75 | 0.2620 | 0.2620 | ||||||

| VW Credit, Inc. / STIV (US91842JT253) | 2.74 | 0.2610 | 0.2610 | ||||||

| US37046US851 / General Motors Financial Co Inc | 2.72 | 1.15 | 0.2597 | 0.0070 | |||||

| US98978VAU70 / Zoetis Inc | 2.51 | 0.2392 | 0.2392 | ||||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2.51 | 0.2389 | 0.2389 | ||||||

| John Deere Capital Corp. / DBT (US24422EXL81) | 2.50 | -0.24 | 0.2383 | 0.0033 | |||||

| US96949LAB18 / Williams Companies Inc | 2.49 | 0.2375 | 0.2375 | ||||||

| B1DX34 / Becton, Dickinson and Company - Depositary Receipt (Common Stock) | 2.49 | 0.2374 | 0.2374 | ||||||

| US744573AP19 / Public Service Enterprise Group Inc | 2.27 | 0.2168 | 0.2168 | ||||||

| US458140AS90 / Intel Corp | 2.24 | 0.2131 | 0.2131 | ||||||

| US89788MAA09 / Truist Financial Corp | 2.21 | 0.2111 | 0.2111 | ||||||

| US13607LWU33 / Canadian Imperial Bank of Commerce | 2.21 | -0.36 | 0.2110 | 0.0026 | |||||

| US06368LNU60 / BANK OF MONTREAL QUE FRN SOFR+133 06/05/2026 | 2.12 | -0.28 | 0.2016 | 0.0026 | |||||

| Boston Properties LP / STIV (US10113BST60) | 2.09 | 0.1995 | 0.1995 | ||||||

| US06368LWV43 / Bank of Montreal | 2.00 | -0.30 | 0.1909 | 0.0025 | |||||

| US637639AJ49 / National Securities Clearing Corp | 2.00 | 0.1907 | 0.1907 | ||||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 2.00 | 0.1905 | 0.1905 | ||||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 2.00 | 0.1905 | 0.1905 | ||||||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 2.00 | 0.1904 | 0.1904 | ||||||

| BMW U.S. Capital LLC / DBT (US05565ECL74) | 2.00 | -0.35 | 0.1903 | 0.0024 | |||||

| MUFG Bank Ltd. / STIV (US62479LSF30) | 2.00 | 1.11 | 0.1903 | 0.0051 | |||||

| US29251USL34 / Enbridge US, Inc. | 1.99 | 0.1901 | 0.1901 | ||||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.99 | 0.1901 | 0.1901 | ||||||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 1.99 | 0.1901 | 0.1901 | ||||||

| CRH America Finance, Inc. / STIV (US12636CSU52) | 1.99 | 0.1899 | 0.1899 | ||||||

| P1HC34 / Parker-Hannifin Corporation - Depositary Receipt (Common Stock) | 1.99 | 0.1897 | 0.1897 | ||||||

| S1WK34 / Stanley Black & Decker, Inc. - Depositary Receipt (Common Stock) | 1.99 | 0.1893 | 0.1893 | ||||||

| US25179MAV54 / Devon Energy Corp Bond | 1.98 | 0.1887 | 0.1887 | ||||||

| Glencore Funding LLC / DBT (USU37818AW82) | 1.98 | 0.1885 | 0.1885 | ||||||

| US68389XBC83 / Oracle Corp | 1.93 | 123.15 | 0.1838 | 0.1326 | |||||

| US446150AM64 / Huntington Bancshares Inc. | 1.90 | 0.1815 | 0.1815 | ||||||

| US716973AA02 / Pfizer Investment Enterprises Pte Ltd | 1.90 | 0.1811 | 0.1811 | ||||||

| US02209SBH58 / Altria Group Inc | 1.80 | 0.56 | 0.1715 | 0.0037 | |||||

| US04010LAY92 / ARES CAPITAL CORP | 1.79 | 261.69 | 0.1710 | 0.1244 | |||||

| US86563VBL27 / Sumitomo Mitsui Trust Bank Ltd | 1.76 | -0.28 | 0.1679 | 0.0021 | |||||

| US526057BV57 / Lennar Corp | 1.75 | 0.1668 | 0.1668 | ||||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 1.74 | 0.1658 | 0.1658 | ||||||

| US02665WES61 / American Honda Finance Corp. | 1.73 | -0.06 | 0.1651 | 0.0025 | |||||

| US00774MAG06 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 1.72 | 0.1640 | 0.1640 | ||||||

| Volkswagen Group of America Finance LLC / DBT (US928668CD24) | 1.70 | -0.12 | 0.1620 | 0.0024 | |||||

| US30161NAN12 / Exelon Corp | 1.70 | 0.1618 | 0.1618 | ||||||

| US72650RBJ05 / Plains All American Pipeline LP / PAA Finance Corp | 1.70 | 0.1618 | 0.1618 | ||||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.64 | 0.1567 | 0.1567 | ||||||

| US761713BG06 / Reynolds American Inc | 1.62 | 0.06 | 0.1546 | 0.0025 | |||||

| US37046US851 / General Motors Financial Co Inc | 1.59 | -1.80 | 0.1511 | -0.0003 | |||||

| US42225UAJ34 / Healthcare Realty Holdings LP | 1.57 | 828.99 | 0.1496 | 0.1337 | |||||

| US0255E2S682 / American Electric Power Company, Inc. | 1.50 | 0.1429 | 0.1429 | ||||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 1.50 | 0.1426 | 0.1426 | ||||||

| US29278NAP87 / ENERGY TRANSFER OPERATNG COMPANY GUAR 05/25 2.9 | 1.48 | 15.67 | 0.1415 | 0.0211 | |||||

| US87165BAG86 / Synchrony Financial | 1.40 | 0.00 | 0.1332 | 0.0022 | |||||

| US91159HHZ64 / US Bancorp | 1.36 | 0.1301 | 0.1301 | ||||||

| US89236TKV60 / Toyota Motor Credit Corp | 1.30 | -0.31 | 0.1243 | 0.0016 | |||||

| MDLZ / Mondelez International, Inc. - Depositary Receipt (Common Stock) | 1.24 | 0.1183 | 0.1183 | ||||||

| HON / Honeywell International Inc. - Depositary Receipt (Common Stock) | 1.23 | 0.1176 | 0.1176 | ||||||

| US286181AD43 / Element Fleet Management Corp | 1.16 | 0.1106 | 0.1106 | ||||||

| US23311VAG23 / DCP Midstream Operating LP | 1.12 | -0.09 | 0.1064 | 0.0015 | |||||

| US13607H6M92 / Canadian Imperial Bank of Commerce | 1.10 | 0.1046 | 0.1046 | ||||||

| US471048CJ53 / Japan Bank for International Cooperation | 1.09 | 0.93 | 0.1040 | 0.0026 | |||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1.06 | 0.1006 | 0.1006 | ||||||

| US06418GAB32 / Bank of Nova Scotia/The | 1.00 | -0.20 | 0.0954 | 0.0013 | |||||

| US69047QAA04 / Ovintiv Inc | 1.00 | 0.0953 | 0.0953 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 1.00 | 0.0953 | 0.0953 | ||||||

| US46625HMN79 / Jpmorgan Chase & Bond | 1.00 | 0.0952 | 0.0952 | ||||||

| MUFG Bank Ltd. / STIV (US62479LSG13) | 1.00 | 1.11 | 0.0951 | 0.0025 | |||||

| US025816CY33 / American Express Co. | 1.00 | 0.0951 | 0.0951 | ||||||

| US40434PSK39 / HSBC USA, Inc. | 1.00 | 1.12 | 0.0951 | 0.0026 | |||||

| S1HW34 / The Sherwin-Williams Company - Depositary Receipt (Common Stock) | 0.99 | 0.0948 | 0.0948 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.99 | 0.0948 | 0.0948 | ||||||

| S1WK34 / Stanley Black & Decker, Inc. - Depositary Receipt (Common Stock) | 0.99 | 0.0946 | 0.0946 | ||||||

| BAT International Finance PLC / STIV (US05531MVR68) | 0.98 | 0.0939 | 0.0939 | ||||||

| US412822AD08 / Harley-Davidson, Inc. | 0.98 | 0.0938 | 0.0938 | ||||||

| T / TELUS Corporation | 0.98 | 0.0937 | 0.0937 | ||||||

| US830505AY91 / Skandinaviska Enskilda Banken AB | 0.98 | 0.0935 | 0.0935 | ||||||

| US03027XAG51 / American Tower Corp | 0.94 | -72.24 | 0.0895 | -0.1679 | |||||

| US65339KCG31 / NextEra Energy Capital Holdings Inc | 0.90 | 0.0857 | 0.0857 | ||||||

| US80282KBB17 / Santander Holdings USA Inc | 0.87 | 0.35 | 0.0828 | 0.0016 | |||||

| A1PH34 / Amphenol Corporation - Depositary Receipt (Common Stock) | 0.85 | 0.0809 | 0.0809 | ||||||

| US256746AG33 / Dollar Tree, Inc. | 0.85 | 0.12 | 0.0807 | 0.0014 | |||||

| US86562MCU27 / Sumitomo Mitsui Financial Group Inc | 0.84 | 0.0796 | 0.0796 | ||||||

| US89114QCH92 / Toronto-Dominion Bank/The | 0.81 | 0.75 | 0.0769 | 0.0018 | |||||

| US913017DD80 / United Technologies Corp | 0.80 | 0.0761 | 0.0761 | ||||||

| Boston Properties LP / STIV (US10113BS587) | 0.75 | 0.0714 | 0.0714 | ||||||

| LSEGA Financing PLC / STIV (US50221FS622) | 0.75 | 0.0714 | 0.0714 | ||||||

| T / TELUS Corporation | 0.74 | 1.23 | 0.0708 | 0.0019 | |||||

| US655844AW86 / Norfolk Southern Corp 5.59% Notes 05/17/25 | 0.70 | 0.0668 | 0.0668 | ||||||

| Future / DCO (000000000) | 0.69 | 0.0653 | 0.0653 | ||||||

| US824348BR69 / Sherwin-Williams Co/The | 0.68 | 0.0647 | 0.0647 | ||||||

| US808513AX31 / The Charles Schw Bond | 0.64 | 0.0610 | 0.0610 | ||||||

| US33938EAU10 / Flex Ltd | 0.60 | 0.00 | 0.0572 | 0.0009 | |||||

| US69353REQ74 / PNC BANK NA SR UNSECURED 06/25 3.25 | 0.60 | 0.0571 | 0.0571 | ||||||

| USG08820CH69 / BAT International Finance PLC | 0.58 | 0.35 | 0.0552 | 0.0010 | |||||

| US863667BA85 / Stryker Corp | 0.58 | 0.0551 | 0.0551 | ||||||

| US49456BAF85 / Kinder Morgan Inc/DE | 0.55 | 180.51 | 0.0522 | 0.0338 | |||||

| Glencore Funding LLC / DBT (US378272BW77) | 0.52 | 0.19 | 0.0495 | 0.0008 | |||||

| US06418GAC15 / BANK OF NOVA SCOTIA REGD 5.45000000 | 0.51 | -0.20 | 0.0484 | 0.0007 | |||||

| US26244HS613 / DUKE ENERGY CORP | 0.50 | 0.0476 | 0.0476 | ||||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.50 | 0.0474 | 0.0474 | ||||||

| US136385AZ48 / Canadian Natural Resources Ltd | 0.50 | 0.0474 | 0.0474 | ||||||

| US87974PTG80 / SHORT TERMS | 0.50 | 0.0474 | 0.0474 | ||||||

| US7562E0EU66 / Reckitt Benckiser Treasury Services plc | 0.50 | 0.0473 | 0.0473 | ||||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 0.50 | 0.0473 | 0.0473 | ||||||

| HON / Honeywell International Inc. - Depositary Receipt (Common Stock) | 0.49 | 0.0470 | 0.0470 | ||||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 0.44 | -0.45 | 0.0419 | 0.0005 | |||||

| US233331BG16 / DTE Energy Co | 0.44 | 0.0418 | 0.0418 | ||||||

| US78081BAH69 / Royalty Pharma PLC | 0.41 | 0.0393 | 0.0393 | ||||||

| US00287YAQ26 / AbbVie Inc | 0.41 | 86.76 | 0.0391 | 0.0185 | |||||

| US609207AU94 / Mondelez International Inc | 0.40 | 0.0381 | 0.0381 | ||||||

| US747525AF05 / QUALCOMM Inc | 0.32 | 0.00 | 0.0308 | 0.0006 | |||||

| US718172CN75 / Philip Morris International, Inc. | 0.30 | 1.01 | 0.0286 | 0.0007 | |||||

| US00928QAT85 / Aircastle Ltd | 0.26 | 0.0247 | 0.0247 | ||||||

| US42218SAD09 / Health Care Service Corp A Mutual Legal Reserve Co | 0.25 | 0.0241 | 0.0241 | ||||||

| US907818ES36 / Union Pacific Corp. | 0.25 | 0.0238 | 0.0238 | ||||||

| US58769JAJ60 / Mercedes-Benz Finance North America LLC | 0.24 | 0.0229 | 0.0229 | ||||||

| US92556VAB27 / CORP. NOTE | 0.20 | 0.0189 | 0.0189 | ||||||

| US29364GAM50 / ENTERGY CORP NEW 0.9% 09/15/2025 | 0.20 | 0.0188 | 0.0188 | ||||||

| US867914BS12 / Truist Financial Corp | 0.20 | 0.0186 | 0.0186 | ||||||

| US438516CB04 / HONEYWELL INTL INC 1.35% 06/01/2025 | 0.19 | 0.0177 | 0.0177 | ||||||

| Future / DCO (000000000) | 0.17 | 0.0164 | 0.0164 | ||||||

| DFA Short Term Investment Fund / STIV (000000000) | 0.16 | 0.16 | 0.0155 | 0.0155 | |||||

| US06051GFS30 / Bank of America Corp | 0.16 | 0.0152 | 0.0152 | ||||||

| Future / DCO (000000000) | 0.16 | 0.0149 | 0.0149 | ||||||

| US23320U4058 / The DFA Investment Trust Company | 0.01 | -92.78 | 0.13 | -92.80 | 0.0124 | -0.1570 | |||

| Future / DCO (000000000) | 0.12 | 0.0118 | 0.0118 | ||||||

| Future / DCO (000000000) | 0.11 | 0.0104 | 0.0104 | ||||||

| Future / DCO (000000000) | 0.08 | 0.0075 | 0.0075 | ||||||

| Future / DCO (000000000) | 0.05 | 0.0052 | 0.0052 | ||||||

| Future / DCO (000000000) | 0.03 | 0.0025 | 0.0025 | ||||||

| Future / DCO (000000000) | 0.02 | 0.0024 | 0.0024 | ||||||

| Future / DCO (000000000) | 0.02 | 0.0019 | 0.0019 | ||||||

| Future / DCO (000000000) | 0.02 | 0.0018 | 0.0018 | ||||||

| Future / DCO (000000000) | 0.01 | 0.0009 | 0.0009 | ||||||

| Future / DCO (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| Future / DCO (000000000) | -0.01 | -0.0008 | -0.0008 | ||||||

| Future / DCO (000000000) | -0.01 | -0.0013 | -0.0013 | ||||||

| Future / DCO (000000000) | -0.02 | -0.0020 | -0.0020 | ||||||

| Future / DCO (000000000) | -0.02 | -0.0022 | -0.0022 | ||||||

| Future / DCO (000000000) | -0.02 | -0.0023 | -0.0023 | ||||||

| Future / DCO (000000000) | -0.03 | -0.0025 | -0.0025 | ||||||

| Future / DCO (000000000) | -0.03 | -0.0025 | -0.0025 | ||||||

| Future / DCO (000000000) | -0.03 | -0.0033 | -0.0033 | ||||||

| Future / DCO (000000000) | -0.07 | -0.0067 | -0.0067 | ||||||

| Future / DCO (000000000) | -0.07 | -0.0070 | -0.0070 | ||||||

| Future / DCO (000000000) | -0.10 | -0.0099 | -0.0099 | ||||||

| Future / DCO (000000000) | -0.11 | -0.0102 | -0.0102 | ||||||

| Future / DCO (000000000) | -0.12 | -0.0116 | -0.0116 | ||||||

| Future / DCO (000000000) | -0.13 | -0.0121 | -0.0121 | ||||||

| Future / DCO (000000000) | -0.13 | -0.0121 | -0.0121 | ||||||

| Future / DCO (000000000) | -0.13 | -0.0124 | -0.0124 | ||||||

| Future / DCO (000000000) | -0.13 | -0.0125 | -0.0125 | ||||||

| Future / DCO (000000000) | -0.13 | -0.0128 | -0.0128 | ||||||

| Future / DCO (000000000) | -0.18 | -0.0175 | -0.0175 | ||||||

| Future / DCO (000000000) | -0.23 | -0.0219 | -0.0219 | ||||||

| Future / DCO (000000000) | -0.30 | -0.0285 | -0.0285 | ||||||

| Future / DCO (000000000) | -0.49 | -0.0466 | -0.0466 | ||||||

| Future / DCO (000000000) | -0.52 | -0.0498 | -0.0498 | ||||||

| Swap / DCO (000000000) | -0.73 | -0.0693 | -0.0693 | ||||||

| BNP / BNP Paribas SA | -1.03 | -0.0978 | -0.0978 | ||||||

| Swap / DCO (000000000) | -1.40 | -0.1337 | -0.1337 | ||||||

| BNP / BNP Paribas SA | -1.48 | -0.1409 | -0.1409 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -1.77 | -0.1686 | -0.1686 | ||||||

| Swap / DCO (000000000) | -1.88 | -0.1789 | -0.1789 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -1.88 | -0.1791 | -0.1791 | ||||||

| Swap / DCO (000000000) | -2.01 | -0.1916 | -0.1916 | ||||||

| Swap / DCO (000000000) | -4.37 | -0.4166 | -0.4166 |