Basic Stats

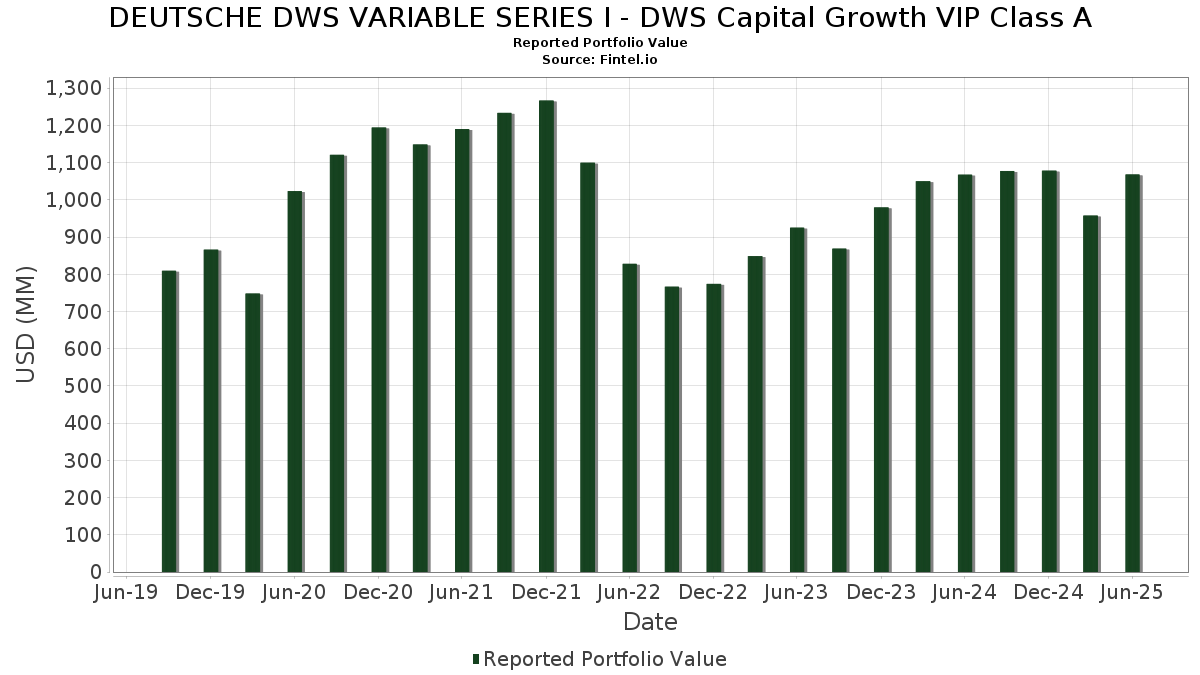

| Portfolio Value | $ 1,068,140,172 |

| Current Positions | 72 |

Latest Holdings, Performance, AUM (from 13F, 13D)

DEUTSCHE DWS VARIABLE SERIES I - DWS Capital Growth VIP Class A has disclosed 72 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,068,140,172 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). DEUTSCHE DWS VARIABLE SERIES I - DWS Capital Growth VIP Class A’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . DEUTSCHE DWS VARIABLE SERIES I - DWS Capital Growth VIP Class A’s new positions include Oracle Corporation (US:ORCL) , Vertiv Holdings Co (US:VRT) , Waystar Holding Corp. (US:WAY) , Samsara Inc. (US:IOT) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.82 | 130.21 | 12.2174 | 2.4404 | |

| 0.24 | 118.79 | 11.1461 | 1.3333 | |

| 0.10 | 28.09 | 2.6356 | 0.7681 | |

| 0.05 | 10.41 | 0.9765 | 0.6012 | |

| 0.03 | 6.35 | 0.5958 | 0.5958 | |

| 0.02 | 26.53 | 2.4889 | 0.4671 | |

| 0.10 | 10.56 | 0.9910 | 0.3818 | |

| 0.03 | 3.89 | 0.3652 | 0.3652 | |

| 0.06 | 40.87 | 3.8353 | 0.3416 | |

| 9.74 | 9.74 | 0.9135 | 0.3309 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.34 | 69.47 | 6.5181 | -1.9752 | |

| 0.01 | 3.62 | 0.3399 | -0.8581 | |

| 0.10 | 26.32 | 2.4693 | -0.8190 | |

| 0.10 | 18.33 | 1.7198 | -0.4912 | |

| 2.01 | 2.01 | 0.1884 | -0.4245 | |

| 0.01 | 2.88 | 0.2698 | -0.4175 | |

| 0.02 | 6.83 | 0.6406 | -0.3559 | |

| 0.05 | 11.21 | 1.0520 | -0.3217 | |

| 0.04 | 24.02 | 2.2540 | -0.3108 | |

| 0.02 | 7.24 | 0.6794 | -0.2932 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.82 | -3.98 | 130.21 | 39.97 | 12.2174 | 2.4404 | |||

| MSFT / Microsoft Corporation | 0.24 | -3.98 | 118.79 | 27.23 | 11.1461 | 1.3333 | |||

| AAPL / Apple Inc. | 0.34 | -6.93 | 69.47 | -14.04 | 6.5181 | -1.9752 | |||

| AMZN / Amazon.com, Inc. | 0.29 | -3.98 | 63.69 | 10.72 | 5.9761 | -0.0697 | |||

| META / Meta Platforms, Inc. | 0.06 | -3.98 | 40.87 | 22.96 | 3.8353 | 0.3416 | |||

| AVGO / Broadcom Inc. | 0.10 | -3.98 | 28.09 | 58.07 | 2.6356 | 0.7681 | |||

| NFLX / Netflix, Inc. | 0.02 | -3.98 | 26.53 | 37.89 | 2.4889 | 0.4671 | |||

| PGR / The Progressive Corporation | 0.10 | -10.80 | 26.32 | -15.89 | 2.4693 | -0.8190 | |||

| GOOGL / Alphabet Inc. | 0.14 | -3.98 | 24.83 | 9.42 | 2.3295 | -0.0551 | |||

| MA / Mastercard Incorporated | 0.04 | -3.98 | 24.02 | -1.57 | 2.2540 | -0.3108 | |||

| SPF / Spotify Technology S.A. | 0.03 | -15.67 | 20.28 | 17.64 | 1.9026 | 0.0912 | |||

| GOOG / Alphabet Inc. | 0.10 | -23.27 | 18.33 | -12.88 | 1.7198 | -0.4912 | |||

| NOW / ServiceNow, Inc. | 0.02 | -3.99 | 17.68 | 23.98 | 1.6587 | 0.1602 | |||

| SNPS / Synopsys, Inc. | 0.03 | -3.99 | 17.46 | 14.78 | 1.6387 | 0.0396 | |||

| V / Visa Inc. | 0.04 | -3.98 | 14.98 | -2.73 | 1.4054 | -0.2129 | |||

| BSX / Boston Scientific Corporation | 0.13 | -3.98 | 13.91 | 2.23 | 1.3053 | -0.1248 | |||

| UBER / Uber Technologies, Inc. | 0.15 | -3.98 | 13.57 | 22.95 | 1.2735 | 0.1134 | |||

| CYBR / CyberArk Software Ltd. | 0.03 | -3.98 | 12.87 | 15.59 | 1.2074 | 0.0374 | |||

| ETN / Eaton Corporation plc | 0.04 | -3.98 | 12.77 | 26.09 | 1.1981 | 0.1339 | |||

| SYK / Stryker Corporation | 0.03 | -3.99 | 12.29 | 2.04 | 1.1534 | -0.1126 | |||

| COST / Costco Wholesale Corporation | 0.01 | -3.99 | 12.00 | 0.50 | 1.1257 | -0.1289 | |||

| ICE / Intercontinental Exchange, Inc. | 0.06 | -3.98 | 11.88 | 2.12 | 1.1147 | -0.1079 | |||

| INTU / Intuit Inc. | 0.01 | -3.98 | 11.39 | 23.18 | 1.0689 | 0.0969 | |||

| AME / AMETEK, Inc. | 0.06 | -3.98 | 11.28 | 0.93 | 1.0587 | -0.1161 | |||

| TMUS / T-Mobile US, Inc. | 0.05 | -3.98 | 11.21 | -14.22 | 1.0520 | -0.3217 | |||

| HD / The Home Depot, Inc. | 0.03 | -3.98 | 10.97 | -3.94 | 1.0293 | -0.1709 | |||

| GWRE / Guidewire Software, Inc. | 0.05 | -3.98 | 10.73 | 20.67 | 1.0069 | 0.0722 | |||

| PLNT / Planet Fitness, Inc. | 0.10 | 61.42 | 10.56 | 82.21 | 0.9910 | 0.3818 | |||

| DT / Dynatrace, Inc. | 0.19 | 12.49 | 10.41 | 31.71 | 0.9771 | 0.1462 | |||

| TEAM / Atlassian Corporation | 0.05 | 127.29 | 10.41 | 161.02 | 0.9765 | 0.6012 | |||

| DXCM / DexCom, Inc. | 0.12 | -3.98 | 10.35 | 22.74 | 0.9710 | 0.0848 | |||

| ISRG / Intuitive Surgical, Inc. | 0.02 | -3.99 | 10.16 | 5.34 | 0.9530 | -0.0603 | |||

| PWR / Quanta Services, Inc. | 0.03 | -3.98 | 9.97 | 42.82 | 0.9357 | 0.2019 | |||

| US25160K3068 / DWS Central Cash Management Government Fund | 9.74 | 75.61 | 9.74 | 75.63 | 0.9135 | 0.3309 | |||

| RBLX / Roblox Corporation | 0.09 | -22.54 | 9.20 | 39.78 | 0.8629 | 0.1715 | |||

| NET / Cloudflare, Inc. | 0.05 | -3.98 | 8.98 | 66.85 | 0.8425 | 0.2769 | |||

| LLY / Eli Lilly and Company | 0.01 | -3.99 | 8.95 | -9.38 | 0.8401 | -0.1983 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | -3.99 | 8.77 | -11.83 | 0.8232 | -0.2226 | |||

| LYV / Live Nation Entertainment, Inc. | 0.06 | -3.98 | 8.36 | 11.23 | 0.7846 | -0.0054 | |||

| ZTS / Zoetis Inc. | 0.05 | -3.98 | 7.30 | -9.06 | 0.6848 | -0.1586 | |||

| MCO / Moody's Corporation | 0.01 | -3.99 | 7.29 | 3.41 | 0.6839 | -0.0569 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | -3.98 | 7.24 | -21.76 | 0.6794 | -0.2932 | |||

| AMAT / Applied Materials, Inc. | 0.04 | -3.98 | 7.01 | 21.13 | 0.6578 | 0.0495 | |||

| ACN / Accenture plc | 0.02 | -24.83 | 6.83 | -28.00 | 0.6406 | -0.3559 | |||

| AXP / American Express Company | 0.02 | -3.98 | 6.71 | 13.84 | 0.6299 | 0.0101 | |||

| TDG / TransDigm Group Incorporated | 0.00 | -3.96 | 6.49 | 5.58 | 0.6093 | -0.0371 | |||

| SN / SharkNinja, Inc. | 0.06 | 17.51 | 6.38 | 39.47 | 0.5982 | 0.1178 | |||

| ORCL / Oracle Corporation | 0.03 | 6.35 | 0.5958 | 0.5958 | |||||

| DHR / Danaher Corporation | 0.03 | -3.98 | 6.15 | -7.48 | 0.5771 | -0.1216 | |||

| VMC / Vulcan Materials Company | 0.02 | -3.98 | 6.12 | 7.35 | 0.5741 | -0.0249 | |||

| DKNG / DraftKings Inc. | 0.13 | -3.98 | 5.72 | 24.02 | 0.5364 | 0.0519 | |||

| TXN / Texas Instruments Incorporated | 0.03 | -3.98 | 5.66 | 10.95 | 0.5315 | -0.0051 | |||

| BURL / Burlington Stores, Inc. | 0.02 | 26.25 | 5.34 | 23.22 | 0.5009 | 0.0457 | |||

| VRSK / Verisk Analytics, Inc. | 0.02 | -3.99 | 5.26 | 0.50 | 0.4937 | -0.0566 | |||

| EXAS / Exact Sciences Corporation | 0.10 | -3.98 | 5.18 | 17.87 | 0.4858 | 0.0241 | |||

| CSGP / CoStar Group, Inc. | 0.06 | 27.42 | 5.17 | 29.31 | 0.4853 | 0.0649 | |||

| CBRE / CBRE Group, Inc. | 0.04 | -3.98 | 4.96 | 2.86 | 0.4653 | -0.0413 | |||

| ADI / Analog Devices, Inc. | 0.02 | -3.99 | 4.89 | 13.33 | 0.4587 | 0.0053 | |||

| COO / The Cooper Companies, Inc. | 0.07 | -3.98 | 4.88 | -19.01 | 0.4578 | -0.1752 | |||

| TRU / TransUnion | 0.05 | -3.98 | 4.72 | 1.81 | 0.4424 | -0.0443 | |||

| MDB / MongoDB, Inc. | 0.02 | -3.98 | 4.67 | 14.98 | 0.4379 | 0.0112 | |||

| VRT / Vertiv Holdings Co | 0.03 | 3.89 | 0.3652 | 0.3652 | |||||

| STVN / Stevanato Group S.p.A. | 0.16 | -3.98 | 3.82 | 14.87 | 0.3582 | 0.0089 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -46.65 | 3.62 | -68.22 | 0.3399 | -0.8581 | |||

| CFLT / Confluent, Inc. | 0.14 | 38.55 | 3.57 | 47.40 | 0.3350 | 0.0804 | |||

| GLOB / Globant S.A. | 0.04 | 12.66 | 3.55 | -13.08 | 0.3331 | -0.0961 | |||

| TREX / Trex Company, Inc. | 0.06 | -3.99 | 3.19 | -10.12 | 0.2992 | -0.0737 | |||

| WAY / Waystar Holding Corp. | 0.08 | 3.12 | 0.2926 | 0.2926 | |||||

| LULU / lululemon athletica inc. | 0.01 | -3.99 | 2.98 | -19.42 | 0.2800 | -0.1092 | |||

| IOT / Samsara Inc. | 0.07 | 2.93 | 0.2752 | 0.2752 | |||||

| ADBE / Adobe Inc. | 0.01 | -56.41 | 2.88 | -56.03 | 0.2698 | -0.4175 | |||

| US1475396701 / DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs | 2.01 | -65.56 | 2.01 | -65.57 | 0.1884 | -0.4245 |