Basic Stats

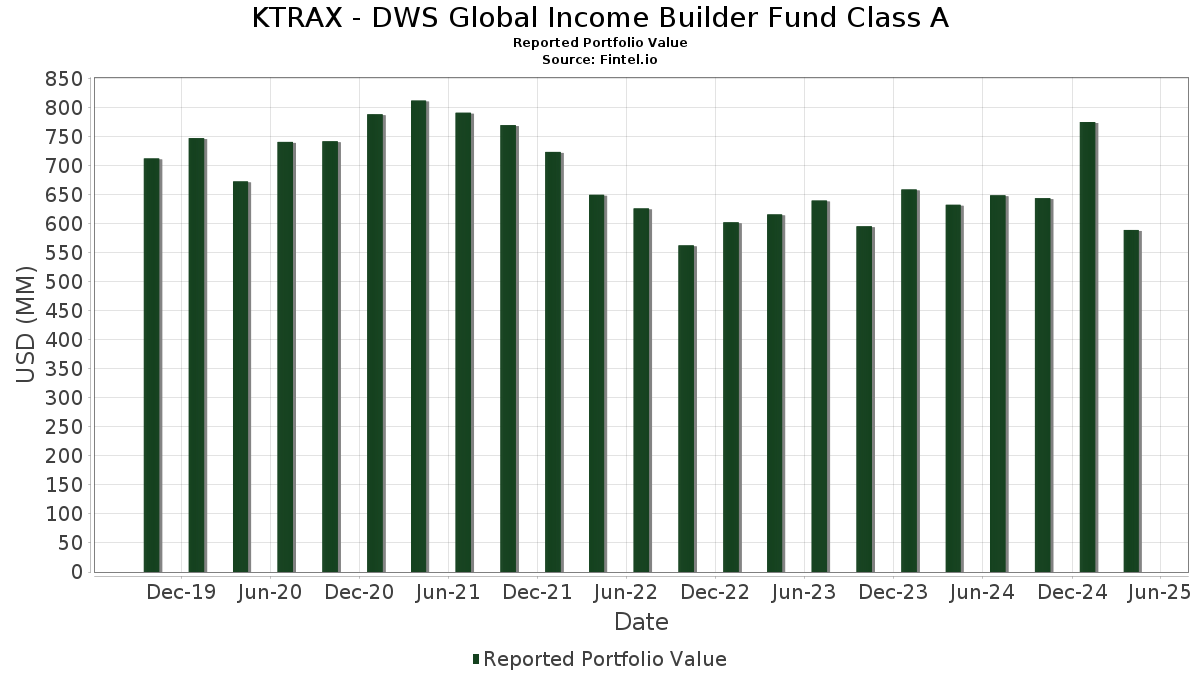

| Portfolio Value | $ 589,052,171 |

| Current Positions | 401 |

Latest Holdings, Performance, AUM (from 13F, 13D)

KTRAX - DWS Global Income Builder Fund Class A has disclosed 401 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 589,052,171 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). KTRAX - DWS Global Income Builder Fund Class A’s top holdings are DWS Central Cash Management Government Fund (US:US25160K3068) , iShares Trust - iShares Core International Aggregate Bond ETF (US:IAGG) , Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , Fannie Mae REMICS (US:US3136BQUM99) , and The Progressive Corporation (US:PGR) . KTRAX - DWS Global Income Builder Fund Class A’s new positions include iShares Trust - iShares Core International Aggregate Bond ETF (US:IAGG) , Uniform Mortgage-Backed Security, TBA (US:US01F0606594) , Fannie Mae REMICS (US:US3136BQUM99) , Ginnie Mae (US:US21H0526523) , and NuStar Logistics LP (US:US67059TAH86) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 19.70 | 3.5256 | 3.5256 | ||

| 35.19 | 35.19 | 6.2990 | 3.1739 | |

| 0.34 | 17.13 | 3.0656 | 3.0656 | |

| 15.72 | 2.8144 | 1.5514 | ||

| 0.07 | 4.43 | 0.7924 | 0.7444 | |

| 0.00 | 4.49 | 0.8032 | 0.6702 | |

| 0.03 | 8.57 | 1.5337 | 0.5715 | |

| 0.01 | 3.13 | 0.5600 | 0.5600 | |

| 0.15 | 3.33 | 0.5955 | 0.5222 | |

| 0.01 | 5.81 | 1.0407 | 0.4982 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 22.80 | 4.0815 | -7.2751 | ||

| 2.69 | 0.4822 | -1.1679 | ||

| 5.25 | 5.25 | 0.9399 | -0.9680 | |

| -3.51 | -0.6277 | -0.6277 | ||

| 0.00 | 0.75 | 0.1341 | -0.5689 | |

| 0.00 | 0.76 | 0.1362 | -0.5443 | |

| 0.00 | 0.00 | -0.4282 | ||

| 0.01 | 1.09 | 0.1957 | -0.4176 | |

| 6.99 | 1.2518 | -0.4147 | ||

| 0.00 | 0.36 | 0.0642 | -0.3372 |

13F and Fund Filings

This form was filed on 2025-06-11 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US25160K3068 / DWS Central Cash Management Government Fund | 35.19 | 91.13 | 35.19 | 91.14 | 6.2990 | 3.1739 | |||

| U.S. Treasury Floating Rate Notes / DBT (US91282CJU62) | 22.80 | -65.92 | 4.0815 | -7.2751 | |||||

| U.S. Treasury Floating Rate Notes / DBT (US91282CLA70) | 20.01 | -0.10 | 3.5828 | 0.1820 | |||||

| U.S. Treasury Bills / STIV (US912797PW16) | 19.70 | 3.5256 | 3.5256 | ||||||

| IAGG / iShares Trust - iShares Core International Aggregate Bond ETF | 0.34 | 17.13 | 3.0656 | 3.0656 | |||||

| US01F0606594 / Uniform Mortgage-Backed Security, TBA | 15.72 | 111.60 | 2.8144 | 1.5514 | |||||

| US3136BQUM99 / Fannie Mae REMICS | 13.15 | -7.07 | 2.3536 | -0.0481 | |||||

| PGR / The Progressive Corporation | 0.03 | 32.22 | 8.57 | 51.15 | 1.5337 | 0.5715 | |||

| US21H0526523 / Ginnie Mae | 6.99 | -28.67 | 1.2518 | -0.4147 | |||||

| MSFT / Microsoft Corporation | 0.01 | 91.03 | 5.81 | 81.94 | 1.0407 | 0.4982 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -22.16 | 5.30 | -22.28 | 0.9490 | -0.2090 | |||

| APH / Amphenol Corporation | 0.07 | 15.70 | 5.29 | 25.78 | 0.9466 | 0.2330 | |||

| US1475396701 / DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs | 5.25 | -53.29 | 5.25 | -53.29 | 0.9399 | -0.9680 | |||

| AVGO / Broadcom Inc. | 0.02 | 15.70 | 4.75 | 0.66 | 0.8506 | 0.0491 | |||

| PFE / Pfizer Inc. | 0.19 | -23.78 | 4.67 | -29.85 | 0.8359 | -0.2940 | |||

| COST / Costco Wholesale Corporation | 0.00 | 464.00 | 4.49 | 473.05 | 0.8032 | 0.6702 | |||

| TCEHY / Tencent Holdings Limited - Depositary Receipt (Common Stock) | 0.07 | 1,032.81 | 4.43 | 1,405.44 | 0.7924 | 0.7444 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 3.97 | -1.29 | 0.7110 | 0.0280 | |||||

| QCOM / QUALCOMM Incorporated | 0.03 | 15.70 | 3.81 | -0.68 | 0.6826 | 0.0309 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.03 | 15.70 | 3.69 | 4.95 | 0.6609 | 0.0638 | |||

| RNMBY / Rheinmetall AG - Depositary Receipt (Common Stock) | 0.00 | -45.01 | 3.53 | 20.10 | 0.6311 | 0.1328 | |||

| RAD CLO 23 Ltd / ABS-CBDO (US75009CAA45) | 3.50 | -1.02 | 0.6262 | 0.0262 | |||||

| GFI / Gold Fields Limited - Depositary Receipt (Common Stock) | 0.15 | 463.31 | 3.33 | 640.76 | 0.5955 | 0.5222 | |||

| TOELY / Tokyo Electron Limited - Depositary Receipt (Common Stock) | 0.02 | 15.43 | 3.25 | 3.43 | 0.5826 | 0.0484 | |||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 3.21 | -4.06 | 0.5748 | 0.0066 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 3.19 | 1.14 | 0.5718 | 0.0357 | |||||

| CHTR / Charter Communications, Inc. | 0.01 | 3.13 | 0.5600 | 0.5600 | |||||

| US67059TAH86 / NuStar Logistics LP | 3.09 | -0.32 | 0.5534 | 0.0270 | |||||

| US61773KAA07 / Morgan Stanley Eaton Vance Clo 2021-1 Ltd | 3.00 | -0.17 | 0.5369 | 0.0270 | |||||

| US064159VJ25 / Bank of Nova Scotia/The | 2.94 | -0.10 | 0.5267 | 0.0267 | |||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.03 | 15.70 | 2.90 | 25.43 | 0.5184 | 0.1266 | |||

| ADSK / Autodesk, Inc. | 0.01 | 218.73 | 2.88 | 180.82 | 0.5164 | 0.3420 | |||

| SUK / Suzuki Motor Corporation | 0.24 | 141.48 | 2.79 | 137.94 | 0.4997 | 0.3004 | |||

| US163851AE83 / Chemours Co/The | 2.78 | -0.61 | 0.4977 | 0.0228 | |||||

| US12530MAG06 / CF Hippolyta LLC | 2.78 | 0.47 | 0.4969 | 0.0280 | |||||

| TGOPY / 3i Group plc - Depositary Receipt (Common Stock) | 0.05 | 15.70 | 2.73 | 35.84 | 0.4885 | 0.1475 | |||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 2.69 | -72.26 | 0.4822 | -1.1679 | |||||

| US87256GAC69 / 2023-MIC Trust/THE | 2.60 | 0.35 | 0.4655 | 0.0256 | |||||

| NRG / NRG Energy, Inc. | 0.02 | 68.55 | 2.59 | 80.26 | 0.4629 | 0.2194 | |||

| CLX / The Clorox Company | 0.02 | 1,783.78 | 2.53 | 2,197.27 | 0.4525 | 0.4321 | |||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.51 | 0.4485 | 0.4485 | ||||||

| US816851BM02 / Sempra Energy | 2.46 | -3.35 | 0.4396 | 0.0084 | |||||

| US808513AR62 / Charles Schwab Corp/The | 2.45 | -4.04 | 0.4384 | 0.0051 | |||||

| SRLN / SSGA Active Trust - SPDR Blackstone Senior Loan ETF | 0.06 | 0.00 | 2.45 | -2.82 | 0.4380 | 0.0106 | |||

| SU N / Schneider Electric S.E. | 0.01 | 2.43 | 0.4353 | 0.4353 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2.43 | -1.54 | 0.4343 | 0.0160 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBK09) | 2.41 | -27.68 | 0.4314 | -0.1341 | |||||

| US854502AM31 / Stanley Black & Decker Inc | 2.40 | -3.88 | 0.4299 | 0.0058 | |||||

| SPG / Simon Property Group, Inc. | 0.01 | -44.12 | 2.36 | -36.56 | 0.4226 | -0.2011 | |||

| OXY / Occidental Petroleum Corporation | 0.06 | 210.94 | 2.35 | 144.49 | 0.4212 | 0.2615 | |||

| INWI / Inwido AB (publ) | 2.34 | -27.42 | 0.4190 | -0.1283 | |||||

| Government National Mortgage Association / ABS-MBS (US38385FE317) | 2.34 | 0.4187 | 0.4187 | ||||||

| CM / Canadian Imperial Bank of Commerce | 0.04 | 2.33 | 0.4177 | 0.4177 | |||||

| TBB / AT&T Inc. - Corporate Bond/Note | 0.10 | 0.00 | 2.27 | -4.54 | 0.4062 | 0.0027 | |||

| US125896BV12 / CMS Energy Corp | 2.25 | -1.23 | 0.4025 | 0.0162 | |||||

| SYF / Synchrony Financial | 0.04 | 15.70 | 2.22 | -12.89 | 0.3970 | -0.0351 | |||

| Allegro CLO V-S Ltd / ABS-CBDO (US01750RAG56) | 2.20 | -0.72 | 0.3943 | 0.0178 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 2.15 | -3.45 | 0.3856 | 0.0068 | |||||

| CSLLY / CSL Limited - Depositary Receipt (Common Stock) | 0.01 | 106.84 | 2.13 | 91.96 | 0.3804 | 0.1925 | |||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 2.06 | -1.29 | 0.3688 | 0.0144 | |||||

| US01F0506687 / Fannie Mae or Freddie Mac | 2.05 | 0.3678 | 0.3678 | ||||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 2.02 | 0.3625 | 0.3625 | ||||||

| ANET / Arista Networks Inc | 0.02 | 15.70 | 2.02 | -17.40 | 0.3612 | -0.0534 | |||

| NCBDY / BANDAI NAMCO Holdings Inc. - Depositary Receipt (Common Stock) | 0.06 | 15.60 | 2.01 | 61.82 | 0.3590 | 0.1485 | |||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 2.00 | 0.3584 | 0.3584 | ||||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 2.00 | 0.3576 | 0.3576 | ||||||

| US01F0526644 / Uniform Mortgage-Backed Security, TBA | 1.99 | 0.3570 | 0.3570 | ||||||

| US04016DAU90 / Ares XLI Clo Ltd | 1.99 | -0.85 | 0.3557 | 0.0155 | |||||

| US89832QAD16 / Truist Financial Corp | 1.96 | -1.26 | 0.3516 | 0.0139 | |||||

| ADBE / Adobe Inc. | 0.01 | 33.49 | 1.95 | 14.42 | 0.3494 | 0.0599 | |||

| US064058AL44 / Bank of New York Mellon Corp/The | 1.94 | -1.02 | 0.3470 | 0.0146 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1.93 | -3.46 | 0.3452 | 0.0061 | |||||

| FITBI / Fifth Third Bancorp - FXDFR PRF PERPETUAL USD 25 - Ser I | 0.07 | 0.00 | 1.92 | -1.39 | 0.3429 | 0.0132 | |||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1.91 | 0.3418 | 0.3418 | ||||||

| US674599EA94 / Occidental Petroleum Corp | 1.90 | -2.06 | 0.3410 | 0.0108 | |||||

| Octagon 63 Ltd / ABS-CBDO (US67578VAC63) | 1.90 | -0.26 | 0.3402 | 0.0168 | |||||

| KEY.PRI / KeyCorp - Preferred Stock | 0.07 | 0.00 | 1.89 | 1.83 | 0.3391 | 0.0234 | |||

| SCHW.PRD / The Charles Schwab Corporation - Preferred Stock | 0.07 | 0.00 | 1.87 | -1.32 | 0.3350 | 0.0131 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 1.86 | 0.3329 | 0.3329 | |||||

| 5 / HSBC Holdings plc | 0.16 | 15.70 | 1.79 | 23.79 | 0.3196 | 0.0748 | |||

| US37046US851 / General Motors Financial Co Inc | 1.75 | 0.34 | 0.3140 | 0.0172 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 1.75 | -0.11 | 0.3139 | 0.0160 | |||||

| US16411RAK59 / Cheniere Energy Inc | 1.75 | 1.10 | 0.3129 | 0.0193 | |||||

| US58547DAA72 / MCE FINANCE LTD 4.875% 06/06/2025 144A | 1.74 | 0.06 | 0.3113 | 0.0162 | |||||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.09 | 79.88 | 1.73 | 82.33 | 0.3105 | 0.1554 | |||

| US42806MBU27 / Hertz Vehicle Financing III LLC, Series 2023-1A, Class C | 1.73 | -0.35 | 0.3103 | 0.0150 | |||||

| Bell Telephone Co of Canada or Bell Canada / DBT (US0778FPAP47) | 1.71 | 0.3070 | 0.3070 | ||||||

| 30064K105 / Exacttarget, Inc. | 1.71 | -32.39 | 0.3066 | -0.1234 | |||||

| WFC.PRY / Wells Fargo & Company - Preferred Stock | 0.07 | 0.00 | 1.71 | -6.20 | 0.3062 | -0.0033 | |||

| XS1895571328 / Perusahaan Listrik Negara PT | 1.71 | 9.44 | 0.3053 | 0.0407 | |||||

| MS.PRK / Morgan Stanley - Preferred Stock | 0.07 | 0.00 | 1.70 | -6.84 | 0.3048 | -0.0055 | |||

| US29273VAL45 / Energy Transfer LP | 1.69 | 0.00 | 0.3033 | 0.0157 | |||||

| US577081BD37 / Mattel Inc | 1.69 | 0.3024 | 0.3024 | ||||||

| JW Commercial Mortgage Trust 2024-MRCO / ABS-MBS (US46657XAC02) | 1.68 | -1.00 | 0.3013 | 0.0126 | |||||

| META / Meta Platforms, Inc. | 0.00 | -6.00 | 1.65 | -25.12 | 0.2956 | -0.0787 | |||

| PTPP / PT PP (Persero) Tbk | 1.65 | 1.79 | 0.2952 | 0.0200 | |||||

| US29336TAD28 / EnLink Midstream LLC | 1.64 | 0.43 | 0.2931 | 0.0163 | |||||

| AGNCN / AGNC Investment Corp. - Preferred Stock | 0.06 | 0.00 | 1.64 | -0.85 | 0.2930 | 0.0128 | |||

| DFS / Discover Financial Services | 0.01 | 15.70 | 1.63 | 5.10 | 0.2913 | 0.0285 | |||

| E1CO34 / Ecopetrol S.A. - Depositary Receipt (Common Stock) | 1.62 | -2.99 | 0.2901 | 0.0066 | |||||

| X5S8VL105 / Nordea Bank Abp | 1.62 | -0.98 | 0.2899 | 0.0123 | |||||

| GM / General Motors Company | 0.04 | 1.58 | 0.2834 | 0.2834 | |||||

| Sixth Street CLO XIV Ltd / ABS-CBDO (US83013NAE04) | 1.58 | 0.2834 | 0.2834 | ||||||

| TT / Trane Technologies plc | 0.00 | 15.69 | 1.55 | 22.30 | 0.2778 | 0.0623 | |||

| US35104AAD00 / Foursight Capital Automobile Receivables Trust 2023-2 | 1.54 | 0.65 | 0.2751 | 0.0159 | |||||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.09 | 15.70 | 1.54 | -7.25 | 0.2748 | -0.0061 | |||

| BGC / BGC Group, Inc. | 1.53 | 0.2743 | 0.2743 | ||||||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.03 | 1.53 | 0.2737 | 0.2737 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.52 | 0.2714 | 0.2714 | ||||||

| US58518N2B76 / MEGlobal Canada ULC | 1.51 | 0.07 | 0.2705 | 0.0143 | |||||

| KIM.PRL / Kimco Realty Corporation - Preferred Stock | 0.07 | 0.00 | 1.50 | -4.21 | 0.2692 | 0.0029 | |||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RFX70) | 1.50 | -0.40 | 0.2689 | 0.0128 | |||||

| US05567SAA06 / Bnsf Funding Tru 6.613 12/15 Bond | 1.50 | -0.20 | 0.2686 | 0.0134 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.49 | -41.61 | 0.2667 | -0.1663 | |||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 1.47 | 0.2622 | 0.2622 | ||||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 1.46 | -2.01 | 0.2616 | 0.0083 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.46 | -4.77 | 0.2611 | 0.0011 | |||||

| US124857AZ68 / ViacomCBS Inc | 1.45 | 1.54 | 0.2592 | 0.0173 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.44 | 0.2587 | 0.2587 | ||||||

| US14040HCF01 / Capital One Financial Corp | 1.44 | -1.57 | 0.2584 | 0.0096 | |||||

| PRX / Prosus N.V. | 0.03 | -43.02 | 1.44 | -30.32 | 0.2583 | -0.0932 | |||

| US83370RAA68 / Societe Generale SA | 1.44 | -0.76 | 0.2579 | 0.0115 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.43 | 0.2569 | 0.2569 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.42 | -3.27 | 0.2544 | 0.0050 | |||||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.04 | -9.52 | 1.41 | 5.86 | 0.2522 | 0.0264 | |||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 1.40 | -10.49 | 0.2505 | -0.0149 | |||||

| US43289DAK90 / HILTON HOTELS 11/30/30 | 1.39 | -0.93 | 0.2482 | 0.0106 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 1.38 | -31.85 | 0.2464 | -0.0964 | |||||

| US693475BP99 / PNC Financial Services Group Inc/The | 1.36 | -2.08 | 0.2439 | 0.0078 | |||||

| LLY / Eli Lilly and Company | 0.00 | 0.27 | 1.35 | 11.18 | 0.2420 | 0.0355 | |||

| Sequoia Mortgage Trust 2024-INV1 / ABS-MBS (US816939AC68) | 1.35 | -5.53 | 0.2418 | -0.0008 | |||||

| US46650FAA03 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES T JPMCC 2018-PHH A | 1.34 | -1.69 | 0.2390 | 0.0084 | |||||

| US90932LAJ61 / United Airlines 2023-1 Class A Pass Through Trust | 1.33 | -1.70 | 0.2383 | 0.0084 | |||||

| NFLX / Netflix, Inc. | 0.00 | 15.70 | 1.31 | 34.12 | 0.2344 | 0.0686 | |||

| US83368RBL50 / Societe Generale SA | 1.29 | 0.54 | 0.2318 | 0.0133 | |||||

| US629377CP59 / NRG Energy Inc | 1.29 | 1.33 | 0.2312 | 0.0148 | |||||

| WRB / W. R. Berkley Corporation | 0.02 | 1.28 | 0.2297 | 0.2297 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.28 | -0.47 | 0.2294 | 0.0108 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 1.28 | 0.2283 | 0.2283 | |||||

| Magnetite XXVI Ltd / ABS-CBDO (US55954YBA29) | 1.24 | -1.12 | 0.2213 | 0.0091 | |||||

| EQT / EQT Corporation | 1.23 | -36.88 | 0.2210 | -0.1110 | |||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 1.23 | -1.04 | 0.2209 | 0.0093 | |||||

| U.S. Treasury Notes / DBT (US91282CKX82) | 1.23 | -61.56 | 0.2201 | -0.3226 | |||||

| US03759CAS98 / Apidos CLO XXIV | 1.22 | -2.25 | 0.2176 | 0.0066 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 1.21 | 0.33 | 0.2170 | 0.0119 | |||||

| US84574TP340 / SOUTHWESTERN PUBLIC SERVICE CO. | 1.21 | -0.08 | 0.2169 | 0.0111 | |||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAG95) | 1.21 | 1.09 | 0.2163 | 0.0134 | |||||

| US842587DJ36 / Southern Co/The | 1.20 | -0.25 | 0.2151 | 0.0105 | |||||

| TRMLF / Tourmaline Oil Corp. | 0.03 | 1.19 | 0.2135 | 0.2135 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 1.18 | 1.82 | 0.2109 | 0.0145 | |||||

| US61945VAB71 / Mosaic Solar Loan Trust 2023-1 | 1.16 | -1.53 | 0.2080 | 0.0079 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1.16 | 218.08 | 0.2078 | 0.1458 | |||||

| BAHA Trust 2024-MAR / ABS-MBS (US05493XAA81) | 1.15 | 1.50 | 0.2059 | 0.0135 | |||||

| 30064K105 / Exacttarget, Inc. | 1.14 | -3.14 | 0.2044 | 0.0044 | |||||

| AXP / American Express Company | 0.00 | 15.68 | 1.14 | -2.90 | 0.2041 | 0.0047 | |||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 1.14 | 1.79 | 0.2041 | 0.0138 | |||||

| D / Dominion Energy, Inc. | 0.02 | 75.22 | 1.14 | 16.24 | 0.2038 | 0.0489 | |||

| RCKT Mortgage Trust 2024-CES7 / ABS-MBS (US749414AA67) | 1.12 | -4.85 | 0.2005 | 0.0008 | |||||

| US55903VBC63 / Warnermedia Holdings Inc | 1.11 | -2.96 | 0.1993 | 0.0044 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1.11 | 0.45 | 0.1991 | 0.0112 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.11 | 0.1988 | 0.1988 | ||||||

| Vistra Operations Co LLC / DBT (US92840VAU61) | 1.11 | 0.73 | 0.1979 | 0.0117 | |||||

| 8ZQ / Ferrovial SE | 0.02 | 1.11 | 0.1978 | 0.1978 | |||||

| Government National Mortgage Association / ABS-MBS (US38384CTB53) | 1.11 | 0.1978 | 0.1978 | ||||||

| ROST / Ross Stores, Inc. | 0.01 | -67.22 | 1.09 | -69.75 | 0.1957 | -0.4176 | |||

| US09261HAC16 / Blackstone Private Credit Fund | 1.08 | -0.37 | 0.1939 | 0.0093 | |||||

| US845467AR03 / CORP. NOTE | 1.08 | 0.75 | 0.1925 | 0.0113 | |||||

| US05565A5R02 / BNP PARIBAS REGD V/R /PERP/ 144A P/P 8.50000000 | 1.06 | -0.84 | 0.1903 | 0.0083 | |||||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 1.05 | 0.1873 | 0.1873 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.04 | -3.90 | 0.1854 | 0.0025 | |||||

| TSN / Tyson Foods, Inc. | 0.02 | -43.85 | 1.03 | -39.18 | 0.1853 | -0.1034 | |||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 1.03 | 0.98 | 0.1842 | 0.0111 | |||||

| US89364MCA09 / TRANSDIGM INC | 1.03 | -1.53 | 0.1839 | 0.0067 | |||||

| US35564KRF83 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.02 | -0.39 | 0.1827 | 0.0089 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 1.02 | 0.1821 | 0.1821 | ||||||

| TRGP / Targa Resources Corp. | 0.01 | -55.04 | 1.01 | -60.98 | 0.1802 | -0.2574 | |||

| Mission Lane Credit Card Master Trust / ABS-O (US60510MBE75) | 1.01 | 0.60 | 0.1801 | 0.0102 | |||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 1.00 | 0.40 | 0.1789 | 0.0099 | |||||

| Carlyle Global Market Strategies CLO 2012-4 Ltd / ABS-CBDO (US14309YCE23) | 1.00 | -0.30 | 0.1787 | 0.0087 | |||||

| SPG.PRJ / Simon Property Group, Inc. - Preferred Stock | 0.02 | 0.00 | 1.00 | -1.38 | 0.1786 | 0.0070 | |||

| RR 35 LTD / ABS-CBDO (US74988DAE22) | 1.00 | -0.60 | 0.1786 | 0.0082 | |||||

| Apidos CLO XVIII-R / ABS-CBDO (US03767NAY22) | 1.00 | -0.80 | 0.1783 | 0.0078 | |||||

| Allegro CLO XV Ltd / ABS-CBDO (US01749WAQ69) | 1.00 | 0.1782 | 0.1782 | ||||||

| Mars Inc / DBT (US571676BA26) | 0.99 | 0.1777 | 0.1777 | ||||||

| US680665AK27 / Olin Corp | 0.99 | -0.40 | 0.1765 | 0.0085 | |||||

| RS / Reliance, Inc. | 0.00 | 0.98 | 0.1754 | 0.1754 | |||||

| Golub Capital Partners CLO 53B Ltd / ABS-CBDO (US38177YAQ52) | 0.98 | 0.1752 | 0.1752 | ||||||

| ASAZY / ASSA ABLOY AB (publ) - Depositary Receipt (Common Stock) | 0.03 | 0.98 | 0.1748 | 0.1748 | |||||

| US1248EPBT92 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.98 | 0.51 | 0.1748 | 0.0098 | |||||

| SCGLY / Société Générale Société anonyme - Depositary Receipt (Common Stock) | 0.02 | 0.97 | 0.1742 | 0.1742 | |||||

| US808513BK01 / Charles Schwab Corp/The | 0.97 | -0.72 | 0.1733 | 0.0077 | |||||

| SCE.PRK / SCE Trust V - Preferred Security | 0.96 | 0.1727 | 0.1727 | ||||||

| RACE / Ferrari N.V. | 0.00 | 1,231.21 | 0.96 | 1,334.33 | 0.1722 | 0.1607 | |||

| US55821KAG13 / Madison Park Funding Ltd. | 0.95 | -0.32 | 0.1698 | 0.0083 | |||||

| US105756CF53 / Brazilian Government International Bond | 0.94 | 2.75 | 0.1675 | 0.0129 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0.91 | 0.1628 | 0.1628 | ||||||

| US95763PNC13 / Western Mortgage Reference Notes Series 2021-CL2 | 0.91 | -4.33 | 0.1620 | 0.0013 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 0.90 | -63.11 | 0.1618 | -0.2538 | |||||

| US49461MAB63 / Kinetik Holdings LP | 0.90 | 0.1612 | 0.1612 | ||||||

| U.S. Treasury Notes / DBT (US91282CMU26) | 0.89 | 0.1591 | 0.1591 | ||||||

| Towd Point Mortgage Trust 2025-CRM1 / ABS-MBS (US891946AA31) | 0.88 | 0.1577 | 0.1577 | ||||||

| STOXX EUROPE 600 JUN25 / DE (000000000) | 0.88 | 0.1574 | 0.1574 | ||||||

| NZM2 / Novozymes A/S | 0.01 | 1,088.95 | 0.86 | 1,263.49 | 0.1539 | 0.1430 | |||

| CVS / CVS Health Corporation | 0.85 | 1.68 | 0.1521 | 0.0103 | |||||

| US35564LAH06 / CORP CMO | 0.84 | -7.26 | 0.1509 | -0.0034 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 0.83 | 0.1487 | 0.1487 | ||||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0.83 | -0.84 | 0.1487 | 0.0065 | |||||

| US92556HAB33 / ViacomCBS Inc | 0.82 | 2.11 | 0.1472 | 0.0105 | |||||

| US46654BAA52 / JP Morgan Chase Commercial Mortgage Securities Trust 2021-1MEM | 0.82 | 4.99 | 0.1470 | 0.0142 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.82 | 0.1462 | 0.1462 | ||||||

| Switch ABS Issuer LLC / ABS-O (US871044AA18) | 0.81 | -0.37 | 0.1455 | 0.0071 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 0.81 | -1.82 | 0.1452 | 0.0049 | |||||

| Mercury Financial Credit Card Master Trust / ABS-O (US58940BAZ94) | 0.81 | -0.12 | 0.1449 | 0.0073 | |||||

| US247361ZT81 / Delta Air Lines Inc | 0.80 | -1.35 | 0.1437 | 0.0057 | |||||

| JP Morgan Mortgage Trust Series 2025-DSC1 / ABS-MBS (US46593TAA07) | 0.80 | 0.1436 | 0.1436 | ||||||

| Ares LIX CLO Ltd / ABS-CBDO (US04018EAL56) | 0.80 | -0.62 | 0.1434 | 0.0064 | |||||

| TICP CLO XI Ltd / ABS-CBDO (US87249QAL41) | 0.80 | 0.1429 | 0.1429 | ||||||

| EAI / Entergy Arkansas, LLC - Corporate Bond/Note | 0.80 | -0.50 | 0.1424 | 0.0066 | |||||

| 2914 / Japan Tobacco Inc. | 0.79 | 0.1420 | 0.1420 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.79 | 0.51 | 0.1420 | 0.0079 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA / ABS-MBS (US78489CAA71) | 0.79 | 0.1407 | 0.1407 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.77 | -53.76 | 0.1375 | -0.1446 | |||||

| GOOG / Alphabet Inc. | 0.00 | -75.75 | 0.76 | -81.04 | 0.1362 | -0.5443 | |||

| CBRE Services Inc / DBT (US12505BAK61) | 0.76 | 0.1361 | 0.1361 | ||||||

| US159864AG27 / Charles River Laboratories International Inc | 0.76 | -0.91 | 0.1360 | 0.0059 | |||||

| Government National Mortgage Association / ABS-MBS (US38385EQJ63) | 0.75 | 0.1347 | 0.1347 | ||||||

| Beacon Funding Trust / DBT (US073952AB93) | 0.75 | 0.53 | 0.1347 | 0.0076 | |||||

| US75513ECX76 / RTX CORP SR UNSEC 6.4% 03-15-54 | 0.75 | 0.1345 | 0.1345 | ||||||

| GOOGL / Alphabet Inc. | 0.00 | -76.76 | 0.75 | -81.91 | 0.1341 | -0.5689 | |||

| Charter Communications Operating LLC / Charter Communications Operating Capital / DBT (US161175CQ56) | 0.75 | 1.22 | 0.1335 | 0.0085 | |||||

| BlueMountain CLO XXXIV Ltd / ABS-CBDO (US09631JAC09) | 0.74 | -1.06 | 0.1333 | 0.0056 | |||||

| US46646GAA58 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SE SER 2016-NINE CL A V/R REGD 144A P/P 2.94923700 | 0.73 | 0.83 | 0.1305 | 0.0076 | |||||

| RR 37 LTD / ABS-CBDO (US78110XAG51) | 0.73 | -2.93 | 0.1305 | 0.0031 | |||||

| US21871XAS80 / Corebridge Financial Inc | 0.71 | 0.14 | 0.1277 | 0.0069 | |||||

| US92852LAD10 / VITERRA FINANCE B.V. | 0.70 | 2.92 | 0.1261 | 0.0100 | |||||

| CBRE Services Inc / DBT (US12505BAJ98) | 0.69 | 0.1235 | 0.1235 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AH62) | 0.68 | 0.1218 | 0.1218 | ||||||

| SYY / Sysco Corporation | 0.01 | 15.70 | 0.68 | 13.40 | 0.1213 | 0.0198 | |||

| US90137LAE02 / 20 Times Square Trust 2018-20TS | 0.67 | -0.74 | 0.1203 | 0.0052 | |||||

| JP Morgan Mortgage Trust Series 2024-6 / ABS-MBS (US46657YAP97) | 0.67 | -7.96 | 0.1203 | -0.0036 | |||||

| US00928QAW15 / Aircastle Ltd | 0.67 | -1.47 | 0.1200 | 0.0045 | |||||

| XS2262961076 / ZF Finance GmbH | 0.67 | -1.03 | 0.1200 | 0.0050 | |||||

| IRV Trust 2025-200P / ABS-MBS (US45006HAE18) | 0.66 | 0.1178 | 0.1178 | ||||||

| AMP / Ameriprise Financial, Inc. | 0.00 | 15.67 | 0.65 | 0.15 | 0.1170 | 0.0064 | |||

| US05606FAL76 / BX TRUST BX 2019 OC11 D 144A | 0.65 | 1.56 | 0.1162 | 0.0077 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 0.65 | 1.25 | 0.1158 | 0.0075 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 0.65 | 0.1157 | 0.1157 | ||||||

| Apidos CLO LI Ltd / ABS-CBDO (US03771JAG40) | 0.64 | -1.23 | 0.1150 | 0.0046 | |||||

| US902613AD01 / UBS Group AG | 0.64 | -1.85 | 0.1139 | 0.0037 | |||||

| USU1227TAC28 / BXP TRUST 2017-GM | 0.64 | 2.42 | 0.1137 | 0.0084 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 0.63 | 0.80 | 0.1127 | 0.0067 | |||||

| US21987BBG23 / Corp Nacional del Cobre de Chile | 0.63 | 1.94 | 0.1126 | 0.0078 | |||||

| US911365BQ63 / United Rentals North America, Inc. | 0.63 | -0.48 | 0.1124 | 0.0054 | |||||

| 388 / Hong Kong Exchanges and Clearing Limited | 0.01 | 123.81 | 0.62 | 231.18 | 0.1104 | 0.0800 | |||

| US345397A860 / Ford Motor Credit Co LLC | 0.61 | -1.14 | 0.1090 | 0.0045 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.61 | 1.17 | 0.1085 | 0.0068 | |||||

| Cloud Capital Holdco LP / ABS-O (US102104AA49) | 0.60 | -0.50 | 0.1077 | 0.0051 | |||||

| Aircastle Ltd / Aircastle Ireland DAC / DBT (US00929JAA43) | 0.60 | 0.17 | 0.1072 | 0.0057 | |||||

| US654579AH48 / Nippon Life Insurance Co | 0.60 | 0.34 | 0.1072 | 0.0060 | |||||

| Jersey Mike's Funding LLC / ABS-O (US476681AD37) | 0.60 | 0.00 | 0.1069 | 0.0055 | |||||

| US05592AAG58 / BPR Trust 2021-TY | 0.59 | -0.67 | 0.1060 | 0.0048 | |||||

| C1OG34 / Coterra Energy Inc. - Depositary Receipt (Common Stock) | 0.59 | -3.62 | 0.1050 | 0.0017 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.58 | 0.1047 | 0.1047 | ||||||

| Mars Inc / DBT (US571676BC81) | 0.57 | 0.1022 | 0.1022 | ||||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 0.56 | -56.69 | 0.1009 | -0.1200 | |||||

| US37046US851 / General Motors Financial Co Inc | 0.56 | -0.71 | 0.1008 | 0.0045 | |||||

| SU / Suncor Energy Inc. | 0.02 | -72.20 | 0.56 | -74.02 | 0.1005 | -0.2577 | |||

| Fontainebleau Miami Beach Mortgage Trust 2024-FBLU / ABS-MBS (US34461WAC47) | 0.56 | -1.59 | 0.1000 | 0.0037 | |||||

| LNG / Cheniere Energy, Inc. | 0.56 | -0.36 | 0.0998 | 0.0048 | |||||

| US00928QAX97 / Aircastle Ltd. | 0.55 | 0.00 | 0.0984 | 0.0051 | |||||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAC18) | 0.54 | 0.18 | 0.0975 | 0.0052 | |||||

| FCT / Fincantieri S.p.A. | 0.54 | 0.56 | 0.0972 | 0.0054 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.54 | -1.28 | 0.0971 | 0.0039 | |||||

| BPR Trust 2024-PMDW / ABS-MBS (US05592VAA26) | 0.54 | 1.12 | 0.0971 | 0.0060 | |||||

| Neuberger Berman Loan Advisers Clo 44 Ltd / ABS-CBDO (US64133VAN73) | 0.54 | -1.82 | 0.0968 | 0.0033 | |||||

| XS2262961076 / ZF Finance GmbH | 0.53 | -0.56 | 0.0953 | 0.0043 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.53 | 0.0949 | 0.0949 | ||||||

| DEVL / DBS Group Holdings Ltd | 0.02 | 19.12 | 0.53 | 18.88 | 0.0947 | 0.0190 | |||

| RCKT Mortgage Trust 2024-CES9 / ABS-MBS (US749426AB88) | 0.53 | -3.12 | 0.0946 | 0.0020 | |||||

| US226373AT56 / Crestwood Midstream Partners LP | 0.52 | 0.00 | 0.0937 | 0.0047 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0.52 | 0.0936 | 0.0936 | ||||||

| US641423CG18 / Nevada Power Co. | 0.52 | -0.58 | 0.0924 | 0.0042 | |||||

| NXG / NEXT plc | 0.00 | -21.55 | 0.51 | 1.78 | 0.0922 | 0.0083 | |||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 0.51 | 0.0916 | 0.0916 | ||||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.51 | -0.20 | 0.0912 | 0.0046 | |||||

| SREN / Swiss Re AG | 0.00 | 106.52 | 0.51 | 144.23 | 0.0911 | 0.0557 | |||

| US35910EAA29 / Frontier Issuer LLC | 0.51 | -0.39 | 0.0909 | 0.0045 | |||||

| MVW 2025-1 LLC / ABS-O (US627924AB91) | 0.50 | 0.0899 | 0.0899 | ||||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.50 | 0.0896 | 0.0896 | ||||||

| Balboa Bay Loan Funding 2024-1 Ltd / ABS-CBDO (US05766NAA00) | 0.50 | 0.0896 | 0.0896 | ||||||

| US958254AA26 / Western Gas Partners 5.375% 06/01/21 | 0.50 | -45.15 | 0.0893 | -0.0649 | |||||

| Mars Inc / DBT (US571676BB09) | 0.49 | 0.0876 | 0.0876 | ||||||

| US12636MAJ71 / CSAIL 2016-C6 Commercial Mortgage Trust | 0.48 | 0.84 | 0.0865 | 0.0052 | |||||

| DXCM / DexCom, Inc. | 0.01 | 0.47 | 0.0843 | 0.0843 | |||||

| US46651EAA29 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2019-OSB | 0.47 | 1.74 | 0.0840 | 0.0057 | |||||

| Government National Mortgage Association / ABS-MBS (US38383FVU47) | 0.47 | 0.0834 | 0.0834 | ||||||

| US87264ADD46 / T-Mobile USA Inc | 0.46 | -1.29 | 0.0822 | 0.0032 | |||||

| WELL / Welltower Inc. | 0.00 | 0.46 | 0.0819 | 0.0819 | |||||

| US19828TAA43 / CORP. NOTE | 0.45 | 1.35 | 0.0805 | 0.0052 | |||||

| DT Midstream Inc / DBT (US23345MAD92) | 0.43 | -0.92 | 0.0775 | 0.0034 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.43 | 0.0770 | 0.0770 | ||||||

| USP3143NBK92 / Corp Nacional del Cobre de Chile | 0.42 | -0.47 | 0.0759 | 0.0036 | |||||

| BYDDY / BYD Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.41 | 0.0732 | 0.0732 | |||||

| US80285XAE58 / Santander Drive Auto Receivables Trust, Series 2023-3, Class C | 0.41 | 0.49 | 0.0732 | 0.0041 | |||||

| Wingstop Funding LLC / ABS-O (US974153AE88) | 0.41 | 0.75 | 0.0726 | 0.0043 | |||||

| US223928AC60 / CPS Auto Receivables Trust 2023-C | 0.40 | -0.25 | 0.0725 | 0.0036 | |||||

| Government National Mortgage Association / ABS-MBS (US38382MA664) | 0.40 | 0.0723 | 0.0723 | ||||||

| Huntington Bank Auto Credit-Linked Notes Series 2024-2 / ABS-O (US44644NAG43) | 0.40 | -11.04 | 0.0723 | -0.0047 | |||||

| Brex Commercial Charge Card Master Trust / ABS-O (US05601DAE31) | 0.40 | -0.25 | 0.0723 | 0.0036 | |||||

| Continental Finance Credit Card ABS Master Trust / ABS-O (US66981PAQ19) | 0.40 | 0.50 | 0.0723 | 0.0042 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AE30) | 0.40 | 0.51 | 0.0711 | 0.0039 | |||||

| Securitized Term Auto Receivables Trust / ABS-O (US81378RAC88) | 0.39 | -12.44 | 0.0706 | -0.0058 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 0.39 | -8.18 | 0.0704 | -0.0024 | |||||

| US482606AA89 / KNDR Trust 21-KIND Class A | 0.39 | -0.51 | 0.0699 | 0.0034 | |||||

| US02005NBM11 / Ally Financial Inc | 0.39 | -81.08 | 0.0699 | -0.2800 | |||||

| US00206RLJ94 / AT&T, Inc. | 0.38 | -0.26 | 0.0683 | 0.0034 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0.38 | -42.05 | 0.0679 | -0.0433 | |||||

| KNEBV / KONE Oyj | 0.01 | -0.26 | 0.38 | 26.69 | 0.0672 | 0.0168 | |||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0.37 | 0.0665 | 0.0665 | ||||||

| US20030NEG25 / COMCAST CORPORATION | 0.37 | -0.27 | 0.0659 | 0.0033 | |||||

| HESAY / Hermès International Société en commandite par actions - Depositary Receipt (Common Stock) | 0.00 | -84.44 | 0.36 | -84.86 | 0.0642 | -0.3372 | |||

| US345397D591 / FORD MOTOR CREDIT CO LLC SR UNSEC 6.798% 11-07-28 | 0.36 | -1.65 | 0.0639 | 0.0022 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.35 | -1.94 | 0.0635 | 0.0021 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 0.35 | -37.14 | 0.0632 | -0.0320 | |||||

| US694308HY69 / Pacific Gas & Electric Co. | 0.35 | -1.69 | 0.0627 | 0.0022 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.34 | -5.49 | 0.0617 | -0.0001 | |||||

| US08162QAE98 / BENCHMARK 2020-IG3 MORTGAGE TRUST BMARK 2020-IG3 A4 | 0.34 | 2.99 | 0.0616 | 0.0047 | |||||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.34 | -3.40 | 0.0611 | 0.0011 | |||||

| EONGY / E.ON SE - Depositary Receipt (Common Stock) | 0.02 | 15.54 | 0.34 | 52.91 | 0.0611 | 0.0230 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.00 | 4,546.46 | 0.34 | 4,125.00 | 0.0606 | 0.0594 | |||

| ARGX / argenx SE | 0.00 | 26.23 | 0.33 | 23.79 | 0.0597 | 0.0140 | |||

| Huntington Bank Auto Credit-Linked Notes Series 2024-1 / ABS-O (US44644NAA72) | 0.32 | -12.50 | 0.0578 | -0.0048 | |||||

| POLI / Bank Hapoalim B.M. | 0.02 | 6.71 | 0.32 | 21.84 | 0.0570 | 0.0127 | |||

| GRMN / Garmin Ltd. | 0.00 | -75.72 | 0.32 | -55.79 | 0.0569 | -0.0751 | |||

| US11135FBF71 / Broadcom, Inc. | 0.30 | 2.43 | 0.0528 | 0.0038 | |||||

| US87264AAX37 / T-MOBILE USA INC 4.375% 04/15/2040 | 0.29 | 0.34 | 0.0524 | 0.0029 | |||||

| Sierra Pacific Power Co / DBT (US826418BQ78) | 0.29 | -1.03 | 0.0515 | 0.0022 | |||||

| US832696AZ12 / J M Smucker Co/The | 0.29 | -0.35 | 0.0514 | 0.0025 | |||||

| FTSE 100 IDX FUT JUN25 / DE (000000000) | 0.28 | 0.0509 | 0.0509 | ||||||

| US548661EM57 / Lowe's Cos., Inc. | 0.28 | -2.78 | 0.0503 | 0.0013 | |||||

| US15089QAW42 / Celanese US Holdings LLC | 0.27 | -1.81 | 0.0489 | 0.0017 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 0.27 | 0.0482 | 0.0482 | ||||||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0.26 | -1.88 | 0.0469 | 0.0017 | |||||

| HINNT 2024-A LLC / ABS-O (US40472QAB32) | 0.26 | -11.30 | 0.0464 | -0.0032 | |||||

| US87166FAE34 / Synchrony Bank | 0.25 | 0.00 | 0.0452 | 0.0025 | |||||

| Evergreen Credit Card Trust / ABS-O (US30023JCY29) | 0.25 | 0.40 | 0.0451 | 0.0025 | |||||

| US3137F6K554 / Federal Home Loan Mortgage Corp. REMICS | 0.25 | -5.68 | 0.0446 | -0.0003 | |||||

| FCT / Fincantieri S.p.A. | 0.25 | 0.82 | 0.0443 | 0.0026 | |||||

| LULU / lululemon athletica inc. | 0.00 | 0.24 | 0.0436 | 0.0436 | |||||

| US124857AN39 / ViacomCBS Inc | 0.23 | -2.93 | 0.0416 | 0.0009 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | -1.78 | 0.23 | 32.57 | 0.0416 | 0.0093 | |||

| Hudson Yards 2025-SPRL Mortgage Trust / ABS-MBS (US44855PAE88) | 0.23 | 1.76 | 0.0414 | 0.0027 | |||||

| EURO-OAT FUTURE JUN25 / DIR (000000000) | 0.21 | 0.0384 | 0.0384 | ||||||

| AAL / American Airlines Group Inc. | 0.21 | -20.54 | 0.0367 | -0.0071 | |||||

| FCT / Fincantieri S.p.A. | 0.21 | 1.99 | 0.0367 | 0.0025 | |||||

| D1NC / DNB Bank ASA | 0.01 | 9.61 | 0.20 | 29.94 | 0.0366 | 0.0098 | |||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4D28) | 0.20 | -10.67 | 0.0361 | -0.0021 | |||||

| Ally Bank Auto Credit-Linked Notes Series 2024-B / ABS-O (US02007G4E01) | 0.20 | -10.67 | 0.0360 | -0.0022 | |||||

| RCRRF / Recruit Holdings Co., Ltd. | 0.00 | 16.13 | 0.20 | -9.13 | 0.0357 | -0.0015 | |||

| AI N / L'Air Liquide S.A. | 0.00 | 0.19 | 0.0336 | 0.0336 | |||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | 0.19 | 0.0333 | 0.0333 | ||||||

| XS2075924048 / MDGH - GMTN BV | 0.18 | 1.13 | 0.0321 | 0.0019 | |||||

| ACO5 / Atlas Copco AB (publ) | 0.01 | 0.17 | 0.0302 | 0.0302 | |||||

| Long: SDWDRJX50 IRS USD R F 3.90650 BDWDRJX68 CCPVANILLA / Short: SDWDRJX50 IRS USD P V 06MSOFR BDWDRJX76 CCPVANILLA / DIR (000000000) | 0.17 | 0.0301 | 0.0301 | ||||||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 11.90 | 0.17 | 45.22 | 0.0299 | 0.0086 | |||

| RYCEY / Rolls-Royce Holdings plc - Depositary Receipt (Common Stock) | 0.02 | -82.53 | 0.16 | -76.40 | 0.0280 | -0.0843 | |||

| AJINF / Ajinomoto Co., Inc. | 0.01 | 0.16 | 0.0280 | 0.0280 | |||||

| BURL / Burlington Stores, Inc. | 0.00 | 15.67 | 0.16 | -8.24 | 0.0280 | -0.0010 | |||

| Bayview Opportunity Master Fund VII 2024-CAR1 LLC / ABS-O (US07336QAB86) | 0.15 | -12.35 | 0.0267 | -0.0023 | |||||

| US292487AA37 / Empresa de los Ferrocarriles del Estado | 0.14 | 0.00 | 0.0250 | 0.0012 | |||||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 0.01 | -86.27 | 0.11 | -82.62 | 0.0203 | -0.0905 | |||

| US 2YR NOTE (CBT) JUN25 / DIR (000000000) | 0.11 | 0.0193 | 0.0193 | ||||||

| KRYAY / Kerry Group plc - Depositary Receipt (Common Stock) | 0.00 | -24.31 | 0.10 | -14.29 | 0.0183 | -0.0012 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | 0.09 | 0.0154 | 0.0154 | |||||

| SVKB / Sandvik AB (publ) | 0.00 | -41.94 | 0.09 | -54.05 | 0.0153 | -0.0102 | |||

| DWAHF / Daiwa House Industry Co., Ltd. | 0.00 | 0.08 | 0.0149 | 0.0149 | |||||

| QBE / QBE Insurance Group Limited | 0.01 | -94.87 | 0.08 | -87.80 | 0.0138 | -0.0777 | |||

| EBS / Erste Group Bank AG | 0.00 | -8.73 | 0.07 | 0.00 | 0.0127 | 0.0008 | |||

| Government National Mortgage Association / ABS-MBS (US38384KPD71) | 0.05 | -91.43 | 0.0087 | -0.0864 | |||||

| US36290S6G12 / GNMA II 6.50% 8/34 #616571 | 0.01 | -7.14 | 0.0025 | 0.0001 | |||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0.01 | 0.0023 | 0.0023 | ||||||

| PLDGP / Prologis, Inc. - Preferred Stock | 0.00 | 0.00 | 0.01 | -7.69 | 0.0023 | 0.0000 | |||

| US31393ENQ88 / Fannie Mae REMICS | 0.01 | -8.33 | 0.0020 | -0.0001 | |||||

| US4270981164 / HERCULES TR II WTS EXP 31MAR29 | 0.00 | 0.00 | 0.01 | 66.67 | 0.0011 | 0.0005 | |||

| US003CVR0169 / CONTRA ABIOMED INC | 0.00 | 0.00 | 0.00 | 0.00 | 0.0002 | 0.0000 | |||

| MO / Altria Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4282 | ||||

| CBRE / CBRE Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0270 | ||||

| US LONG BOND(CBT) JUN25 / DIR (000000000) | -0.01 | -0.0015 | -0.0015 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | -0.01 | -0.0023 | -0.0023 | ||||||

| Long: SDWDRJX84 IRS USD R F 3.75700 BDWDRJX92 CCPVANILLA / Short: SDWDRJX84 IRS USD P V 06MSOFR BDWDRJXA9 CCPVANILLA / DIR (000000000) | -0.02 | -0.0028 | -0.0028 | ||||||

| NIKKEI 225 (OSE) JUN25 / DE (000000000) | -0.07 | -0.0119 | -0.0119 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0.10 | -0.0183 | -0.0183 | ||||||

| US ULTRA BOND CBT JUN25 / DIR (000000000) | -0.15 | -0.0262 | -0.0262 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | -0.17 | -0.0296 | -0.0296 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | -0.19 | -0.0333 | -0.0333 | ||||||

| US 10YR ULTRA FUT JUN25 / DIR (000000000) | -0.20 | -0.0355 | -0.0355 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0.25 | -0.0443 | -0.0443 | ||||||

| MSCI EMGMKT JUN25 / DE (000000000) | -0.29 | -0.0516 | -0.0516 | ||||||

| DAX INDEX FUTURE JUN25 / DE (000000000) | -0.33 | -0.0591 | -0.0591 | ||||||

| US 5YR NOTE (CBT) JUN25 / DIR (000000000) | -0.48 | -0.0856 | -0.0856 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | -0.69 | -0.1240 | -0.1240 | ||||||

| EURO STOXX 50 JUN25 / DE (000000000) | -0.86 | -0.1536 | -0.1536 | ||||||

| MSCI WORLD INDEX JUN25 / DE (000000000) | -3.51 | -0.6277 | -0.6277 |