Basic Stats

| Portfolio Value | $ 344,310,162 |

| Current Positions | 89 |

Latest Holdings, Performance, AUM (from 13F, 13D)

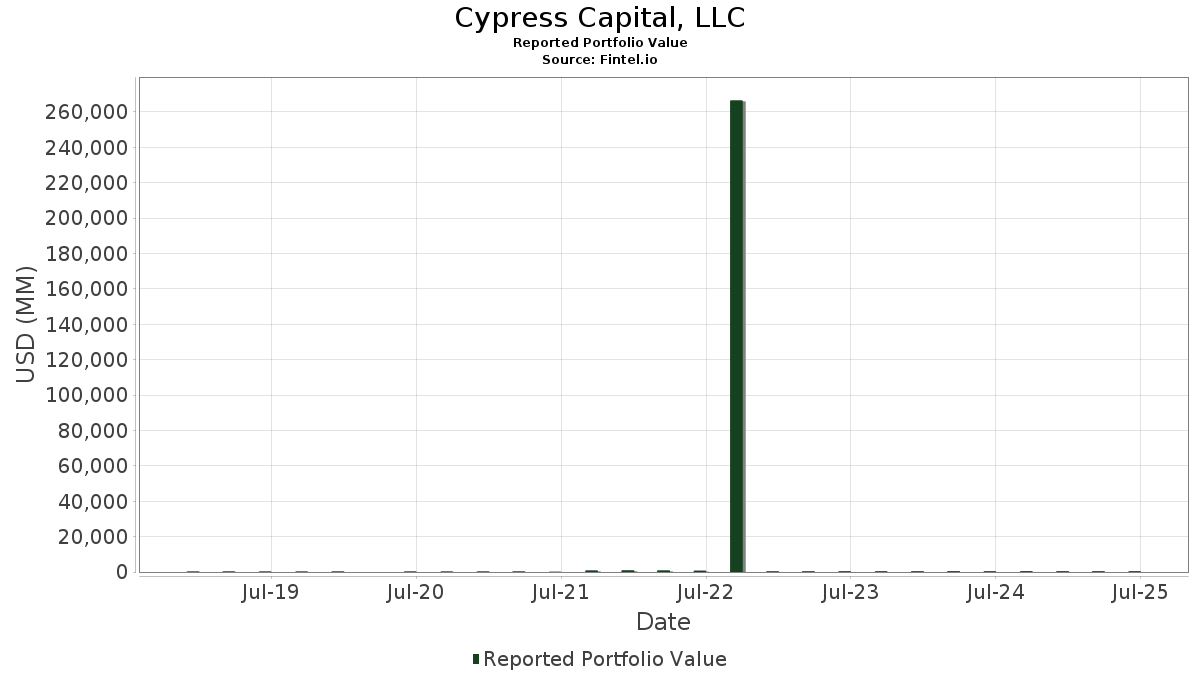

Cypress Capital, LLC has disclosed 89 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 344,310,162 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Cypress Capital, LLC’s top holdings are Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) , SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF (US:BIL) , WisdomTree Trust - WisdomTree Floating Rate Treasury Fund (US:USFR) , Vanguard Institutional Index Fund - 0-3 Months Treasury Bill ETF (US:VBIL) , and iShares Trust - iShares TIPS Bond ETF (US:TIP) . Cypress Capital, LLC’s new positions include Vanguard Institutional Index Fund - 0-3 Months Treasury Bill ETF (US:VBIL) , Elastic N.V. (US:ESTC) , W.W. Grainger, Inc. (US:GWW) , Illinois Tool Works Inc. (US:ITW) , and Ford Motor Company (US:F) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.30 | 22.74 | 6.6042 | 6.6042 | |

| 0.15 | 45.38 | 13.1811 | 1.2664 | |

| 0.16 | 11.18 | 3.2475 | 1.2185 | |

| 0.03 | 3.26 | 0.9454 | 0.6195 | |

| 0.60 | 30.23 | 8.7803 | 0.5902 | |

| 0.01 | 3.72 | 1.0806 | 0.4353 | |

| 0.03 | 2.66 | 0.7714 | 0.2848 | |

| 0.01 | 3.26 | 0.9456 | 0.2404 | |

| 0.01 | 3.73 | 1.0842 | 0.2003 | |

| 0.04 | 2.18 | 0.6331 | 0.1942 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.45 | 40.96 | 11.8967 | -6.6726 | |

| 0.18 | 9.04 | 2.6253 | -2.7509 | |

| 0.00 | 0.25 | 0.0728 | -2.2160 | |

| 0.09 | 4.31 | 1.2527 | -0.3126 | |

| 0.03 | 5.94 | 1.7264 | -0.2271 | |

| 0.07 | 7.03 | 2.0413 | -0.2059 | |

| 0.05 | 2.22 | 0.6448 | -0.2003 | |

| 0.02 | 2.84 | 0.8262 | -0.1121 | |

| 0.00 | 0.43 | 0.1246 | -0.1055 | |

| 0.04 | 2.12 | 0.6152 | -0.0946 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.15 | -0.70 | 45.38 | 9.80 | 13.1811 | 1.2664 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.45 | -36.41 | 40.96 | -36.41 | 11.8967 | -6.6726 | |||

| USFR / WisdomTree Trust - WisdomTree Floating Rate Treasury Fund | 0.60 | 6.45 | 30.23 | 6.41 | 8.7803 | 0.5902 | |||

| VBIL / Vanguard Institutional Index Fund - 0-3 Months Treasury Bill ETF | 0.30 | 22.74 | 6.6042 | 6.6042 | |||||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.17 | -1.26 | 18.76 | -2.20 | 5.4480 | -0.0808 | |||

| SPY / SPDR S&P 500 ETF | 0.03 | -8.81 | 16.20 | 0.71 | 4.7050 | 0.0681 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.23 | -3.20 | 13.57 | -3.05 | 3.9405 | -0.0938 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.16 | 42.79 | 11.18 | 58.87 | 3.2475 | 1.2185 | |||

| SGOL / abrdn Gold ETF Trust - abrdn Physical Gold Shares ETF | 0.33 | -8.79 | 10.33 | -3.53 | 3.0010 | -0.0865 | |||

| TFLO / iShares Trust - iShares Treasury Floating Rate Bond ETF | 0.18 | -51.52 | 9.04 | -51.53 | 2.6253 | -2.7509 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.07 | -9.86 | 7.03 | -9.84 | 2.0413 | -0.2059 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.07 | 1.66 | 6.86 | 0.19 | 1.9924 | 0.0184 | |||

| AAPL / Apple Inc. | 0.03 | -5.03 | 5.94 | -12.28 | 1.7264 | -0.2271 | |||

| TBIL / The RBB Fund, Inc. - F/m US Treasury 3 Month Bill ETF | 0.09 | -20.54 | 4.31 | -20.56 | 1.2527 | -0.3126 | |||

| IBM / International Business Machines Corporation | 0.01 | 2.70 | 3.73 | 21.75 | 1.0842 | 0.2003 | |||

| AVGO / Broadcom Inc. | 0.01 | 0.96 | 3.72 | 66.22 | 1.0806 | 0.4353 | |||

| HEFA / iShares Trust - iShares Currency Hedged MSCI EAFE ETF | 0.10 | -0.76 | 3.71 | 3.78 | 1.0769 | 0.0472 | |||

| V / Visa Inc. | 0.01 | 2.45 | 3.60 | 3.77 | 1.0467 | 0.0458 | |||

| KR / The Kroger Co. | 0.05 | 0.22 | 3.40 | 6.19 | 0.9863 | 0.0645 | |||

| ETN / Eaton Corporation plc | 0.01 | 1.34 | 3.26 | 33.07 | 0.9456 | 0.2404 | |||

| NTAP / NetApp, Inc. | 0.03 | 137.37 | 3.26 | 188.05 | 0.9454 | 0.6195 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.56 | 2.85 | 2.59 | 0.8271 | 0.0270 | |||

| ABBV / AbbVie Inc. | 0.02 | -1.35 | 2.84 | -12.60 | 0.8262 | -0.1121 | |||

| MDT / Medtronic plc | 0.03 | 62.20 | 2.66 | 57.29 | 0.7714 | 0.2848 | |||

| PG / The Procter & Gamble Company | 0.02 | 2.25 | 2.56 | -4.41 | 0.7435 | -0.0285 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.03 | -0.94 | 2.49 | -0.52 | 0.7232 | 0.0016 | |||

| GOOGL / Alphabet Inc. | 0.01 | -1.38 | 2.49 | 12.39 | 0.7223 | 0.0844 | |||

| MCD / McDonald's Corporation | 0.01 | -0.39 | 2.47 | -6.81 | 0.7159 | -0.0468 | |||

| LMT / Lockheed Martin Corporation | 0.01 | -2.03 | 2.44 | 1.59 | 0.7074 | 0.0162 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -1.30 | 2.40 | 2.30 | 0.6982 | 0.0210 | |||

| AMGN / Amgen Inc. | 0.01 | -0.05 | 2.40 | -10.44 | 0.6978 | -0.0754 | |||

| SBUX / Starbucks Corporation | 0.03 | -1.28 | 2.38 | -7.81 | 0.6926 | -0.0528 | |||

| MSFT / Microsoft Corporation | 0.00 | 2.70 | 2.38 | 36.09 | 0.6921 | 0.1873 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -1.24 | 2.30 | -6.05 | 0.6682 | -0.0377 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | -0.22 | 2.22 | -24.26 | 0.6448 | -0.2003 | |||

| PULS / PGIM ETF Trust - PGIM Ultra Short Bond ETF | 0.04 | 43.08 | 2.18 | 43.17 | 0.6331 | 0.1942 | |||

| LRCX / Lam Research Corporation | 0.02 | 1.63 | 2.13 | 36.12 | 0.6195 | 0.1676 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.76 | 2.13 | -8.66 | 0.6187 | -0.0537 | |||

| GIS / General Mills, Inc. | 0.04 | -0.72 | 2.12 | -13.97 | 0.6152 | -0.0946 | |||

| CMCSA / Comcast Corporation | 0.06 | -3.11 | 2.10 | -6.29 | 0.6099 | -0.0361 | |||

| MRK / Merck & Co., Inc. | 0.03 | -0.13 | 2.09 | -11.94 | 0.6067 | -0.0770 | |||

| VTIP / Vanguard Malvern Funds - Vanguard Short-Term Inflation-Protected Securities ETF | 0.04 | 1.58 | 1.81 | 2.37 | 0.5260 | 0.0158 | |||

| CL / Colgate-Palmolive Company | 0.02 | 2.47 | 1.77 | -0.62 | 0.5148 | 0.0008 | |||

| GOOG / Alphabet Inc. | 0.01 | -10.79 | 1.63 | 1.24 | 0.4731 | 0.0095 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.02 | 6.47 | 1.46 | 7.22 | 0.4227 | 0.0314 | |||

| NXT / Nextracker Inc. | 0.02 | -1.78 | 1.33 | 26.74 | 0.3855 | 0.0836 | |||

| TPR / Tapestry, Inc. | 0.01 | -7.24 | 1.23 | 15.77 | 0.3561 | 0.0506 | |||

| FOXA / Fox Corporation | 0.02 | 0.73 | 1.20 | -0.25 | 0.3483 | 0.0017 | |||

| LEN / Lennar Corporation | 0.01 | -0.44 | 1.17 | -4.10 | 0.3397 | -0.0117 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.61 | 1.16 | 46.66 | 0.3379 | 0.1092 | |||

| SHOP / Shopify Inc. | 0.01 | 0.00 | 1.15 | 20.86 | 0.3350 | 0.0598 | |||

| PTRB / PGIM ETF Trust - PGIM Total Return Bond ETF | 0.02 | 16.11 | 0.95 | 16.36 | 0.2750 | 0.0404 | |||

| KFY / Korn Ferry | 0.01 | -7.23 | 0.87 | 0.35 | 0.2519 | 0.0026 | |||

| HPQ / HP Inc. | 0.03 | -6.71 | 0.73 | -17.65 | 0.2116 | -0.0433 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.01 | -6.82 | 0.70 | -7.51 | 0.2040 | -0.0149 | |||

| META / Meta Platforms, Inc. | 0.00 | 14.81 | 0.69 | 47.21 | 0.1994 | 0.0648 | |||

| MBB / iShares Trust - iShares MBS ETF | 0.01 | -1.01 | 0.65 | -0.91 | 0.1898 | -0.0003 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.02 | -0.98 | 0.64 | -6.05 | 0.1850 | -0.0107 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 8.71 | 0.62 | 15.38 | 0.1787 | 0.0251 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.61 | 10.49 | 0.1776 | 0.0181 | |||

| TGNA / TEGNA Inc. | 0.04 | -7.06 | 0.59 | -14.62 | 0.1716 | -0.0276 | |||

| LLY / Eli Lilly and Company | 0.00 | 33.20 | 0.53 | 25.71 | 0.1535 | 0.0323 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.53 | 5.63 | 0.1527 | 0.0094 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.49 | 3.16 | 0.1422 | 0.0055 | |||

| CRM / Salesforce, Inc. | 0.00 | 37.98 | 0.44 | 40.32 | 0.1264 | 0.0369 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -9.78 | 0.43 | -46.37 | 0.1246 | -0.1055 | |||

| OMC / Omnicom Group Inc. | 0.01 | -6.89 | 0.40 | -19.22 | 0.1149 | -0.0263 | |||

| IONS / Ionis Pharmaceuticals, Inc. | 0.01 | 0.00 | 0.40 | 31.23 | 0.1148 | 0.0278 | |||

| ESTC / Elastic N.V. | 0.00 | 0.39 | 0.1130 | 0.1130 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 10.48 | 0.34 | 15.81 | 0.0980 | 0.0141 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.93 | 0.33 | 16.38 | 0.0970 | 0.0143 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 22.48 | 0.32 | 43.95 | 0.0934 | 0.0291 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -18.37 | 0.32 | -25.52 | 0.0934 | -0.0311 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.93 | 0.31 | 11.55 | 0.0899 | 0.0099 | |||

| TSLA / Tesla, Inc. | 0.00 | -0.55 | 0.29 | 21.61 | 0.0836 | 0.0155 | |||

| ORCL / Oracle Corporation | 0.00 | 0.28 | 0.0810 | 0.0810 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | -97.32 | 0.25 | -96.85 | 0.0728 | -2.2160 | |||

| MA / Mastercard Incorporated | 0.00 | 0.25 | 0.0723 | 0.0723 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.25 | 0.0713 | 0.0713 | |||||

| COP / ConocoPhillips | 0.00 | 34.91 | 0.24 | 14.90 | 0.0697 | 0.0097 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.24 | 0.0696 | 0.0696 | |||||

| T / AT&T Inc. | 0.01 | 0.07 | 0.23 | 2.18 | 0.0681 | 0.0021 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.00 | 0.00 | 0.23 | 11.00 | 0.0676 | 0.0071 | |||

| USNA / USANA Health Sciences, Inc. | 0.01 | -3.01 | 0.23 | 9.57 | 0.0667 | 0.0064 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.23 | 0.0656 | 0.0656 | |||||

| CTSH / Cognizant Technology Solutions Corporation | 0.00 | 0.20 | 0.0591 | 0.0591 | |||||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.20 | 0.0584 | 0.0584 | |||||

| RIVN / Rivian Automotive, Inc. | 0.01 | -15.39 | 0.16 | -6.51 | 0.0460 | -0.0029 | |||

| F / Ford Motor Company | Call | 0.01 | 0.03 | 0.0089 | 0.0089 |