Basic Stats

| Insider Profile | CUSHING MLP ASSET MANAGEMENT, LP |

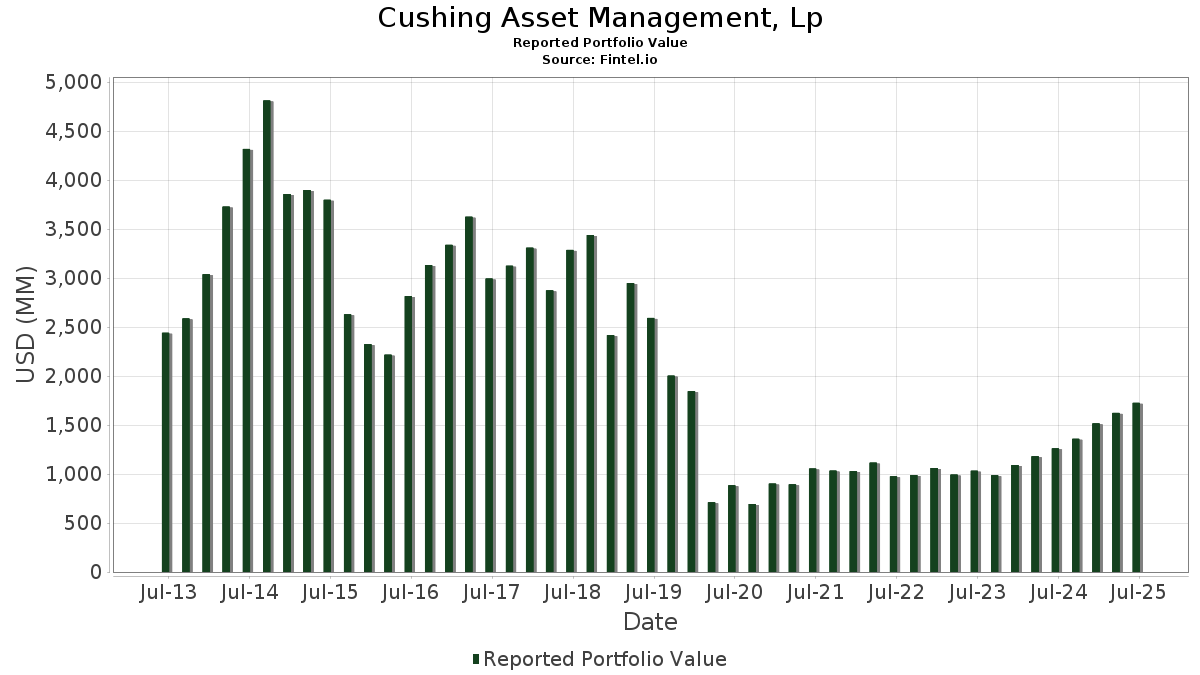

| Portfolio Value | $ 1,726,317,018 |

| Current Positions | 68 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Cushing Asset Management, Lp has disclosed 68 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,726,317,018 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Cushing Asset Management, Lp’s top holdings are Energy Transfer LP - Limited Partnership (US:ET) , Targa Resources Corp. (US:TRGP) , Cheniere Energy, Inc. (US:LNG) , ONEOK, Inc. (US:OKE) , and Hess Midstream LP (US:HESM) . Cushing Asset Management, Lp’s new positions include Talen Energy Corporation (US:TLNE) , Constellation Energy Corporation (US:CEG) , Talen Energy Corporation (US:TLNE) , Constellation Energy Corporation (US:CEG) , and Vistra Corp. (US:VST) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.53 | 39.54 | 2.2905 | 1.9708 | |

| 0.11 | 35.50 | 2.0566 | 1.1563 | |

| 0.06 | 17.45 | 1.0106 | 1.0106 | |

| 0.05 | 16.14 | 0.9348 | 0.9348 | |

| 0.05 | 14.54 | 0.8422 | 0.8422 | |

| 0.04 | 12.91 | 0.7479 | 0.7479 | |

| 0.11 | 30.82 | 1.7854 | 0.6946 | |

| 0.45 | 10.64 | 0.6165 | 0.6165 | |

| 0.20 | 39.54 | 2.2903 | 0.5543 | |

| 0.40 | 9.57 | 0.5542 | 0.5542 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.67 | 115.99 | 6.7189 | -1.7330 | |

| 3.54 | 68.84 | 3.9877 | -1.3179 | |

| 0.46 | 111.99 | 6.4875 | -1.2248 | |

| 1.25 | 61.01 | 3.5342 | -1.0011 | |

| 0.35 | 20.60 | 1.1934 | -0.9974 | |

| 7.18 | 130.22 | 7.5433 | -0.9487 | |

| 1.72 | 88.38 | 5.1196 | -0.8885 | |

| 2.51 | 73.92 | 4.2821 | -0.7593 | |

| 1.69 | 63.28 | 3.6658 | -0.7359 | |

| 1.32 | 108.15 | 6.2649 | -0.6943 |

13F and Fund Filings

This form was filed on 2025-07-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ET / Energy Transfer LP - Limited Partnership | 7.18 | -3.16 | 130.22 | -5.55 | 7.5433 | -0.9487 | |||

| TRGP / Targa Resources Corp. | 0.67 | -2.66 | 115.99 | -15.48 | 6.7189 | -1.7330 | |||

| LNG / Cheniere Energy, Inc. | 0.46 | -15.01 | 111.99 | -10.56 | 6.4875 | -1.2248 | |||

| OKE / ONEOK, Inc. | 1.32 | 16.34 | 108.15 | -4.29 | 6.2649 | -0.6943 | |||

| HESM / Hess Midstream LP | 2.30 | 25.84 | 88.47 | 14.59 | 5.1245 | 0.3698 | |||

| MPLX / MPLX LP - Limited Partnership | 1.72 | -5.87 | 88.38 | -9.40 | 5.1196 | -0.8885 | |||

| DTM / DT Midstream, Inc. | 0.75 | -0.31 | 82.25 | 13.57 | 4.7642 | 0.3039 | |||

| WMB / The Williams Companies, Inc. | 1.19 | -11.58 | 74.81 | -7.06 | 4.3337 | -0.6243 | |||

| KMI / Kinder Morgan, Inc. | 2.51 | -12.36 | 73.92 | -9.69 | 4.2821 | -0.7593 | |||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 3.54 | -12.15 | 68.84 | -20.09 | 3.9877 | -1.3179 | |||

| PBA / Pembina Pipeline Corporation | 1.69 | -5.50 | 63.28 | -11.45 | 3.6658 | -0.7359 | |||

| TRP / TC Energy Corporation | 1.25 | -19.83 | 61.01 | -17.15 | 3.5342 | -1.0011 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1.96 | 1.64 | 60.70 | -7.67 | 3.5163 | -0.5331 | |||

| WES / Western Midstream Partners, LP - Limited Partnership | 1.20 | -9.73 | 46.59 | -14.71 | 2.6989 | -0.6655 | |||

| SOBO / South Bow Corporation | 1.53 | 650.40 | 39.54 | 661.87 | 2.2905 | 1.9708 | |||

| VST / Vistra Corp. | 0.20 | -15.00 | 39.54 | 40.28 | 2.2903 | 0.5543 | |||

| CEG / Constellation Energy Corporation | 0.11 | 51.72 | 35.50 | 142.87 | 2.0566 | 1.1563 | |||

| KNTK / Kinetik Holdings Inc. | 0.78 | 32.03 | 34.31 | 11.98 | 1.9878 | 0.1004 | |||

| TLNE / Talen Energy Corporation | 0.11 | 19.50 | 30.82 | 74.03 | 1.7854 | 0.6946 | |||

| PSX / Phillips 66 | 0.20 | 9.01 | 23.82 | 5.33 | 1.3801 | -0.0131 | |||

| EQT / EQT Corporation | 0.35 | -46.94 | 20.60 | -42.08 | 1.1934 | -0.9974 | |||

| TLNE / Talen Energy Corporation | Call | 0.06 | 17.45 | 1.0106 | 1.0106 | ||||

| GEV / GE Vernova Inc. | 0.03 | 33.33 | 16.93 | 131.12 | 0.9809 | 0.5296 | |||

| CEG / Constellation Energy Corporation | Call | 0.05 | 16.14 | 0.9348 | 0.9348 | ||||

| AM / Antero Midstream Corporation | 0.77 | 0.00 | 14.67 | 5.28 | 0.8496 | -0.0084 | |||

| TLNE / Talen Energy Corporation | Put | 0.05 | 14.54 | 0.8422 | 0.8422 | ||||

| MPC / Marathon Petroleum Corporation | 0.09 | -1.19 | 14.20 | 12.66 | 0.8227 | 0.0463 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.30 | 0.00 | 13.66 | 2.28 | 0.7915 | -0.0313 | |||

| CEG / Constellation Energy Corporation | Put | 0.04 | 12.91 | 0.7479 | 0.7479 | ||||

| CWEN / Clearway Energy, Inc. | 0.40 | -23.37 | 12.80 | -18.99 | 0.7415 | -0.2317 | |||

| GEL / Genesis Energy, L.P. - Limited Partnership | 0.69 | 60.27 | 11.81 | 76.01 | 0.6844 | 0.2709 | |||

| NRG / NRG Energy, Inc. | 0.07 | -7.59 | 11.72 | 55.44 | 0.6790 | 0.2146 | |||

| PWR / Quanta Services, Inc. | 0.03 | 11.11 | 11.34 | 65.29 | 0.6570 | 0.2343 | |||

| ARIS / Aris Water Solutions, Inc. | 0.45 | 10.64 | 0.6165 | 0.6165 | |||||

| VNOM / Viper Energy, Inc. | 0.25 | 0.00 | 9.69 | -15.55 | 0.5610 | -0.1453 | |||

| BE / Bloom Energy Corporation | 0.40 | 9.57 | 0.5542 | 0.5542 | |||||

| FSLR / First Solar, Inc. | 0.06 | 77.42 | 9.10 | 132.30 | 0.5274 | 0.2860 | |||

| VST / Vistra Corp. | Call | 0.04 | 8.72 | 0.5052 | 0.5052 | ||||

| MSTR / Strategy Inc | 0.02 | 8.08 | 0.4683 | 0.4683 | |||||

| TXO / TXO Partners, L.P. | 0.53 | 307.69 | 7.97 | 220.12 | 0.4617 | 0.3083 | |||

| VST / Vistra Corp. | Put | 0.04 | 6.78 | 0.3929 | 0.3929 | ||||

| ARLP / Alliance Resource Partners, L.P. - Limited Partnership | 0.24 | -3.60 | 6.30 | -7.64 | 0.3649 | -0.0551 | |||

| PANW / Palo Alto Networks, Inc. | 0.03 | 15.38 | 6.14 | 38.39 | 0.3556 | 0.0824 | |||

| PRIM / Primoris Services Corporation | 0.07 | 40.82 | 5.38 | 91.15 | 0.3115 | 0.1383 | |||

| NEE / NextEra Energy, Inc. | 0.08 | 0.00 | 5.35 | -2.07 | 0.3096 | -0.0265 | |||

| ITRI / Itron, Inc. | 0.04 | 0.00 | 5.27 | 25.66 | 0.3050 | 0.0469 | |||

| MTZ / MasTec, Inc. | 0.03 | 66.67 | 5.11 | 143.43 | 0.2962 | 0.1668 | |||

| NXT / Nextracker Inc. | 0.09 | 45.00 | 4.73 | 87.10 | 0.2740 | 0.1183 | |||

| CVE / Cenovus Energy Inc. | 0.34 | 0.00 | 4.68 | -2.24 | 0.2710 | -0.0237 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 35.71 | 4.53 | 21.24 | 0.2622 | 0.0323 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | -53.33 | 3.57 | -32.58 | 0.2065 | -0.1192 | |||

| EQIX / Equinix, Inc. | 0.00 | 33.33 | 3.18 | 30.05 | 0.1843 | 0.0337 | |||

| SO / The Southern Company | 0.03 | 0.00 | 3.03 | -0.13 | 0.1755 | -0.0113 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | 21.43 | 2.96 | 47.71 | 0.1717 | 0.0481 | |||

| NET / Cloudflare, Inc. | 0.01 | 2.94 | 0.1702 | 0.1702 | |||||

| RSG / Republic Services, Inc. | 0.01 | 0.00 | 2.71 | 1.84 | 0.1571 | -0.0069 | |||

| NTNX / Nutanix, Inc. | 0.04 | 0.00 | 2.68 | 9.50 | 0.1550 | 0.0045 | |||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.15 | -21.08 | 2.66 | -27.73 | 0.1542 | -0.0726 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.03 | 0.00 | 2.44 | 2.31 | 0.1414 | -0.0056 | |||

| NRG / NRG Energy, Inc. | Call | 0.01 | 2.41 | 0.1395 | 0.1395 | ||||

| MSI / Motorola Solutions, Inc. | 0.01 | 0.00 | 2.10 | -3.97 | 0.1218 | -0.0130 | |||

| ETR / Entergy Corporation | 0.03 | 0.00 | 2.08 | -2.76 | 0.1204 | -0.0113 | |||

| CYBR / CyberArk Software Ltd. | 0.01 | 0.00 | 2.03 | 20.36 | 0.1178 | 0.0138 | |||

| AEP / American Electric Power Company, Inc. | 0.02 | 0.00 | 1.76 | -5.06 | 0.1022 | -0.0122 | |||

| AGX / Argan, Inc. | 0.01 | 1.76 | 0.1022 | 0.1022 | |||||

| NRG / NRG Energy, Inc. | Put | 0.01 | 1.61 | 0.0930 | 0.0930 | ||||

| NGL / NGL Energy Partners LP - Limited Partnership | 0.28 | 37.50 | 1.17 | 29.30 | 0.0680 | 0.0121 | |||

| VTLE / Vital Energy, Inc. | 0.01 | 0.00 | 0.24 | -24.21 | 0.0140 | -0.0056 | |||

| CORZ / Core Scientific, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MSFT / Microsoft Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SRE / Sempra | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CLSK / CleanSpark, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| S / SentinelOne, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |