Basic Stats

| Portfolio Value | $ 1,107,331 |

| Current Positions | 4 |

Latest Holdings, Performance, AUM (from 13F, 13D)

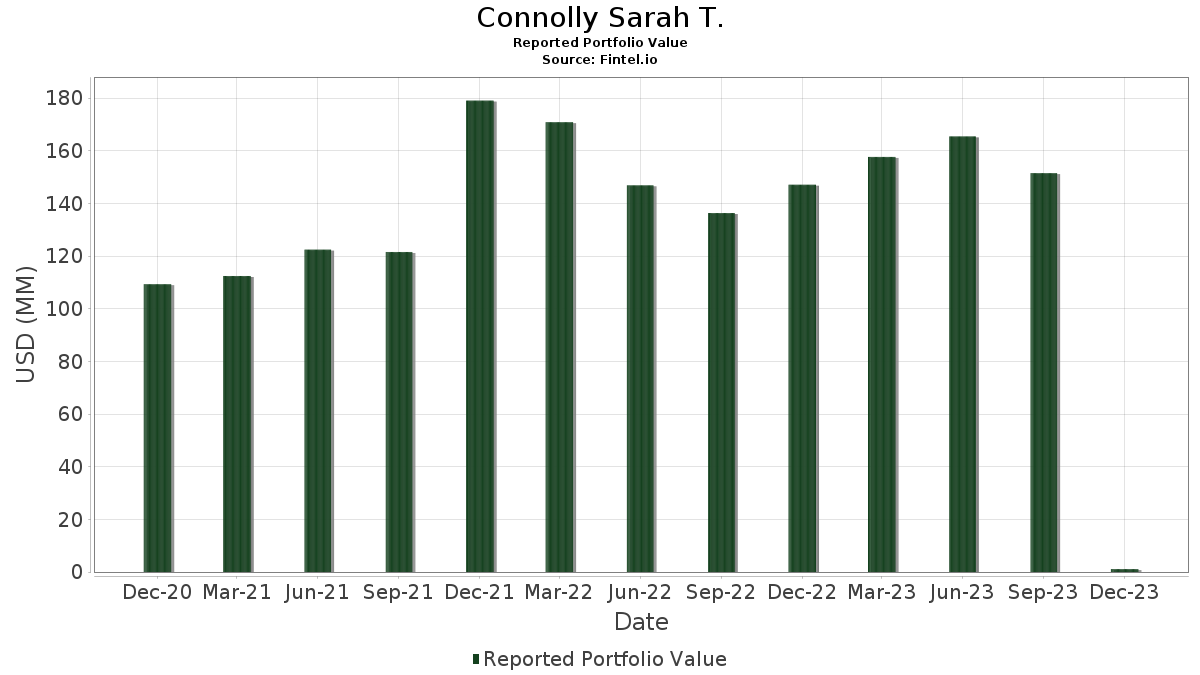

Connolly Sarah T. has disclosed 4 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,107,331 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Connolly Sarah T.’s top holdings are Microsoft Corporation (US:MSFT) , NextEra Energy, Inc. (US:NEE) , The Procter & Gamble Company (US:PG) , Abbott Laboratories (US:ABT) , and NVIDIA Corporation (US:NVDA) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.39 | 35.1477 | 28.4874 | |

| 0.00 | 0.28 | 25.6436 | 23.9599 | |

| 0.00 | 0.23 | 21.0680 | 18.4613 | |

| 0.00 | 0.20 | 18.1407 | 17.0558 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -5.7413 | ||

| 0.00 | 0.00 | -3.4253 | ||

| 0.00 | 0.00 | -3.4096 | ||

| 0.00 | 0.00 | -3.2100 | ||

| 0.00 | 0.00 | -2.9491 | ||

| 0.00 | 0.00 | -2.8955 | ||

| 0.00 | 0.00 | -2.3237 | ||

| 0.00 | 0.00 | -2.3217 | ||

| 0.00 | 0.00 | -2.2666 | ||

| 0.00 | 0.00 | -2.1914 |

13F and Fund Filings

This form was filed on 2024-02-09 for the reporting period 2023-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.00 | -96.76 | 0.39 | -96.15 | 35.1477 | 28.4874 | |||

| NEE / NextEra Energy, Inc. | 0.00 | -89.50 | 0.28 | -88.91 | 25.6436 | 23.9599 | |||

| PG / The Procter & Gamble Company | 0.00 | -94.12 | 0.23 | -94.10 | 21.0680 | 18.4613 | |||

| ABT / Abbott Laboratories | 0.00 | -89.25 | 0.20 | -87.83 | 18.1407 | 17.0558 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.2147 | ||||

| PANW / Palo Alto Networks, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5724 | ||||

| SO / The Southern Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1597 | ||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.4253 | ||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9919 | ||||

| KMB / Kimberly-Clark Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6779 | ||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1904 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2040 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6572 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -2.1914 | ||||

| C.WSA / Citigroup, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8844 | ||||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.5408 | ||||

| LOW / Lowe's Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4177 | ||||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -100.00 | 0.00 | -100.00 | -2.3237 | ||||

| XOM / Exxon Mobil Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.8955 | ||||

| GPC / Genuine Parts Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.2820 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.2378 | ||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.9491 | ||||

| BKNG / Booking Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5183 | ||||

| IQV / IQVIA Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4964 | ||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6409 | ||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.8582 | ||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.5162 | ||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1342 | ||||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2268 | ||||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8406 | ||||

| LIN / Linde plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.4129 | ||||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.3714 | ||||

| PAYX / Paychex, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2991 | ||||

| ITW / Illinois Tool Works Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6650 | ||||

| VTIAX / Vanguard Star Funds - Vanguard Total International Stock Index Fund Admiral | 0.00 | -100.00 | 0.00 | -100.00 | -0.7216 | ||||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.1719 | ||||

| SYY / Sysco Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.5004 | ||||

| ATO / Atmos Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1391 | ||||

| SLB / Schlumberger Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.1885 | ||||

| VMW / Vmware Inc. - Class A | 0.00 | -100.00 | 0.00 | -100.00 | -2.0551 | ||||

| VXF / Vanguard Index Funds - Vanguard Extended Market ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.2743 | ||||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.7361 | ||||

| ACN / Accenture plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.2807 | ||||

| ROK / Rockwell Automation, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1025 | ||||

| EMR / Emerson Electric Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2890 | ||||

| DHR / Danaher Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.5717 | ||||

| ADI / Analog Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4828 | ||||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.2082 | ||||

| MDT / Medtronic plc | 0.00 | -100.00 | 0.00 | -100.00 | -1.1125 | ||||

| EL / The Estée Lauder Companies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5254 | ||||

| APD / Air Products and Chemicals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3825 | ||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.6678 | ||||

| FDS / FactSet Research Systems Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3232 | ||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4196 | ||||

| GOOGL / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.3217 | ||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7193 | ||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0184 | ||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.7413 | ||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.3407 | ||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | -100.00 | -3.2100 | ||||

| JPM / JPMorgan Chase & Co. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2839 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.2119 | ||||

| HPQ / HP Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2162 | ||||

| ICE / Intercontinental Exchange, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3809 | ||||

| AXP / American Express Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.7089 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8350 | ||||

| GOOG / Alphabet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2666 | ||||

| INTU / Intuit Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4535 | ||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2621 | ||||

| ADP / Automatic Data Processing, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9987 | ||||

| HPE / Hewlett Packard Enterprise Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1462 | ||||

| GD / General Dynamics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0077 | ||||

| MA / Mastercard Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -1.9700 | ||||

| WM / Waste Management, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3175 | ||||

| ROP / Roper Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2346 | ||||

| TRV / The Travelers Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0079 | ||||

| HUBB / Hubbell Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.5045 | ||||

| AMT / American Tower Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8517 | ||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.4096 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1173 | ||||

| TJX / The TJX Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8081 | ||||

| NVDA / NVIDIA Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.7365 | ||||

| QCOM / QUALCOMM Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.2939 | ||||

| BAX / Baxter International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1494 | ||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1110 | ||||

| DE / Deere & Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.3807 |