Basic Stats

| Portfolio Value | $ 36,244,096 |

| Current Positions | 82 |

Latest Holdings, Performance, AUM (from 13F, 13D)

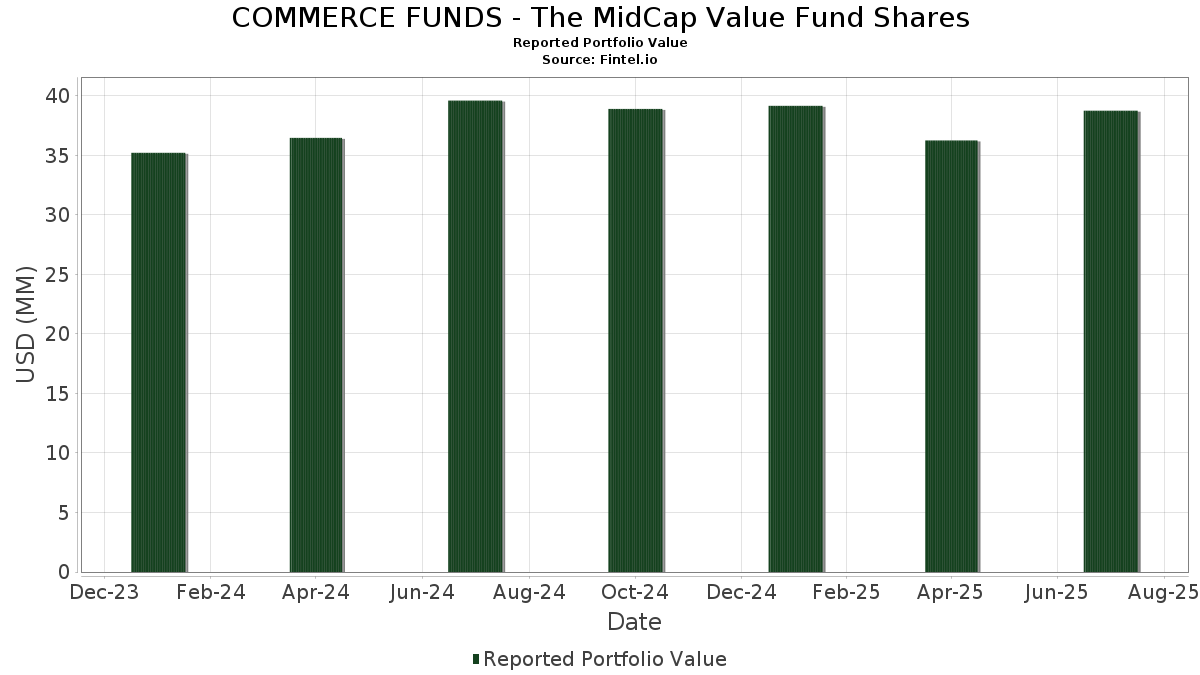

COMMERCE FUNDS - The MidCap Value Fund Shares has disclosed 82 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 36,244,096 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). COMMERCE FUNDS - The MidCap Value Fund Shares’s top holdings are iShares Trust - iShares Russell Mid-Cap Value ETF (US:IWS) , State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls (US:GVMXX) , Allegion plc (US:ALLE) , ResMed Inc. (US:RMD) , and Digital Realty Trust, Inc. (US:DLR) . COMMERCE FUNDS - The MidCap Value Fund Shares’s new positions include Motorola Solutions, Inc. (US:MSI) , Lowe's Companies, Inc. (US:LOW) , Gen Digital Inc. (US:GEN) , Prologis, Inc. (US:PLD) , and Regions Financial Corporation (US:RF) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.46 | 1.2779 | 1.2779 | |

| 0.00 | 0.44 | 1.2110 | 1.2110 | |

| 0.00 | 0.44 | 1.2073 | 1.2073 | |

| 0.02 | 0.42 | 1.1704 | 1.1704 | |

| 0.00 | 0.42 | 1.1594 | 1.1594 | |

| 0.02 | 0.42 | 1.1563 | 1.1563 | |

| 0.01 | 0.41 | 1.1446 | 1.1446 | |

| 0.00 | 0.41 | 1.1260 | 1.1260 | |

| 0.93 | 0.93 | 2.5700 | 0.9725 | |

| 0.00 | 0.47 | 1.3111 | 0.2614 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.0468 | ||

| 0.01 | 1.10 | 3.0531 | -0.7077 | |

| 0.01 | 0.34 | 0.9272 | -0.3114 | |

| 0.00 | 0.39 | 1.0752 | -0.2732 | |

| 0.00 | 0.40 | 1.1046 | -0.2346 | |

| 0.01 | 0.41 | 1.1247 | -0.1705 | |

| 0.01 | 0.39 | 1.0672 | -0.1665 | |

| 0.00 | 0.45 | 1.2338 | -0.1617 | |

| 0.01 | 0.39 | 1.0743 | -0.1592 | |

| 0.01 | 0.38 | 1.0417 | -0.1581 |

13F and Fund Filings

This form was filed on 2025-06-17 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.01 | -18.18 | 1.10 | -24.90 | 3.0531 | -0.7077 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 0.93 | 48.86 | 0.93 | 48.88 | 2.5700 | 0.9725 | |||

| ALLE / Allegion plc | 0.00 | 4.95 | 0.49 | 10.18 | 1.3464 | 0.2145 | |||

| RMD / ResMed Inc. | 0.00 | 5.19 | 0.48 | 5.51 | 1.3240 | 0.1614 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | 17.96 | 0.47 | 15.61 | 1.3111 | 0.2614 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | -11.04 | 0.47 | -2.67 | 1.3101 | 0.0631 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 4.15 | 0.47 | 8.06 | 1.2982 | 0.1868 | |||

| CME / CME Group Inc. | 0.00 | -15.08 | 0.47 | -0.43 | 1.2941 | 0.0905 | |||

| ED / Consolidated Edison, Inc. | 0.00 | -17.09 | 0.47 | -0.21 | 1.2853 | 0.0928 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.01 | -1.00 | 0.46 | 4.27 | 1.2848 | 0.1452 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.46 | 1.2779 | 1.2779 | |||||

| RS / Reliance, Inc. | 0.00 | 4.58 | 0.46 | 4.30 | 1.2745 | 0.1418 | |||

| LH / Labcorp Holdings Inc. | 0.00 | -4.76 | 0.46 | -8.23 | 1.2655 | -0.0089 | |||

| SO / The Southern Company | 0.00 | -10.99 | 0.46 | -2.56 | 1.2647 | 0.0636 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | -14.21 | 0.46 | -5.20 | 1.2606 | 0.0283 | |||

| LAMR / Lamar Advertising Company | 0.00 | 11.73 | 0.46 | 0.66 | 1.2581 | 0.1008 | |||

| HAS / Hasbro, Inc. | 0.01 | 1.17 | 0.45 | 8.35 | 1.2565 | 0.1827 | |||

| EXR / Extra Space Storage Inc. | 0.00 | 8.03 | 0.45 | 2.72 | 1.2532 | 0.1250 | |||

| INGR / Ingredion Incorporated | 0.00 | 3.33 | 0.45 | 0.44 | 1.2517 | 0.1003 | |||

| STE / STERIS plc | 0.00 | -7.78 | 0.45 | -6.22 | 1.2515 | 0.0186 | |||

| PNW / Pinnacle West Capital Corporation | 0.00 | -9.01 | 0.45 | -0.44 | 1.2481 | 0.0885 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | -1.41 | 0.45 | -1.96 | 1.2467 | 0.0691 | |||

| JCI / Johnson Controls International plc | 0.01 | -4.36 | 0.45 | 2.74 | 1.2463 | 0.1253 | |||

| REG / Regency Centers Corporation | 0.01 | -1.35 | 0.45 | -0.88 | 1.2408 | 0.0825 | |||

| SYY / Sysco Corporation | 0.01 | 7.47 | 0.45 | 5.19 | 1.2343 | 0.1490 | |||

| DOX / Amdocs Limited | 0.01 | -7.44 | 0.45 | -7.08 | 1.2338 | 0.0059 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | -20.39 | 0.45 | -18.17 | 1.2338 | -0.1617 | |||

| K / Kellanova | 0.01 | -7.94 | 0.45 | -6.69 | 1.2329 | 0.0092 | |||

| AVB / AvalonBay Communities, Inc. | 0.00 | 2.17 | 0.45 | -3.05 | 1.2303 | 0.0549 | |||

| CNA / CNA Financial Corporation | 0.01 | -4.75 | 0.44 | -6.60 | 1.2152 | 0.0127 | |||

| UGI / UGI Corporation | 0.01 | -19.54 | 0.44 | -14.09 | 1.2148 | -0.0944 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.44 | 1.2110 | 1.2110 | |||||

| WMB / The Williams Companies, Inc. | 0.01 | -13.50 | 0.44 | -8.58 | 1.2083 | -0.0149 | |||

| PPG / PPG Industries, Inc. | 0.00 | 7.93 | 0.44 | 1.86 | 1.2079 | 0.1103 | |||

| CLX / The Clorox Company | 0.00 | 0.44 | 1.2073 | 1.2073 | |||||

| STT / State Street Corporation | 0.00 | 3.58 | 0.43 | -10.17 | 1.1967 | -0.0364 | |||

| LNT / Alliant Energy Corporation | 0.01 | -8.91 | 0.43 | -5.70 | 1.1901 | 0.0240 | |||

| MSCI / MSCI Inc. | 0.00 | 3.95 | 0.43 | -5.08 | 1.1901 | 0.0303 | |||

| HBAN / Huntington Bancshares Incorporated | 0.03 | 8.50 | 0.43 | -8.32 | 1.1898 | -0.0114 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.01 | -0.51 | 0.43 | -11.39 | 1.1833 | -0.0525 | |||

| OZK / Bank OZK | 0.01 | 0.55 | 0.43 | -15.78 | 1.1820 | -0.1148 | |||

| ZTS / Zoetis Inc. | 0.00 | 3.02 | 0.43 | -5.75 | 1.1778 | 0.0219 | |||

| SWKS / Skyworks Solutions, Inc. | 0.01 | 25.76 | 0.43 | -8.80 | 1.1751 | -0.0188 | |||

| UNM / Unum Group | 0.01 | -14.13 | 0.42 | -12.58 | 1.1740 | -0.0681 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 8.54 | 0.42 | -3.42 | 1.1739 | 0.0490 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 2.91 | 0.42 | -4.72 | 1.1735 | 0.0337 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 25.56 | 0.42 | -4.93 | 1.1722 | 0.0316 | |||

| GEN / Gen Digital Inc. | 0.02 | 0.42 | 1.1704 | 1.1704 | |||||

| DOV / Dover Corporation | 0.00 | 6.00 | 0.42 | -11.16 | 1.1672 | -0.0489 | |||

| SEE / Sealed Air Corporation | 0.02 | 20.63 | 0.42 | -4.54 | 1.1646 | 0.0356 | |||

| PLD / Prologis, Inc. | 0.00 | 0.42 | 1.1594 | 1.1594 | |||||

| USB / U.S. Bancorp | 0.01 | 12.94 | 0.42 | -4.78 | 1.1578 | 0.0343 | |||

| RF / Regions Financial Corporation | 0.02 | 0.42 | 1.1563 | 1.1563 | |||||

| OMC / Omnicom Group Inc. | 0.01 | 7.97 | 0.42 | -5.23 | 1.1545 | 0.0270 | |||

| TNL / Travel + Leisure Co. | 0.01 | 7.83 | 0.41 | -12.84 | 1.1449 | -0.0708 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.41 | 1.1446 | 1.1446 | |||||

| APD / Air Products and Chemicals, Inc. | 0.00 | 2.35 | 0.41 | -17.23 | 1.1425 | -0.1349 | |||

| TGT / Target Corporation | 0.00 | 22.67 | 0.41 | -13.96 | 1.1425 | -0.0866 | |||

| ESS / Essex Property Trust, Inc. | 0.00 | -5.43 | 0.41 | -7.19 | 1.1418 | 0.0029 | |||

| EMR / Emerson Electric Co. | 0.00 | 8.71 | 0.41 | -11.94 | 1.1416 | -0.0597 | |||

| TFC / Truist Financial Corporation | 0.01 | 6.54 | 0.41 | -14.37 | 1.1385 | -0.0896 | |||

| KEY / KeyCorp | 0.03 | 8.25 | 0.41 | -10.72 | 1.1301 | -0.0403 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.41 | 1.1260 | 1.1260 | |||||

| THO / THOR Industries, Inc. | 0.01 | 26.12 | 0.41 | -11.14 | 1.1258 | -0.0471 | |||

| MET / MetLife, Inc. | 0.01 | -5.84 | 0.41 | -18.15 | 1.1248 | -0.1439 | |||

| GLW / Corning Incorporated | 0.01 | -5.71 | 0.41 | -19.76 | 1.1247 | -0.1705 | |||

| FDX / FedEx Corporation | 0.00 | 14.54 | 0.41 | -9.19 | 1.1219 | -0.0194 | |||

| CMI / Cummins Inc. | 0.00 | 12.20 | 0.41 | -7.53 | 1.1206 | 0.0001 | |||

| BBY / Best Buy Co., Inc. | 0.01 | 11.93 | 0.40 | -13.15 | 1.1151 | -0.0717 | |||

| LSTR / Landstar System, Inc. | 0.00 | 17.52 | 0.40 | -4.31 | 1.1067 | 0.0372 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -8.75 | 0.40 | -23.71 | 1.1046 | -0.2346 | |||

| PFG / Principal Financial Group, Inc. | 0.01 | -6.47 | 0.40 | -15.92 | 1.0953 | -0.1096 | |||

| VLO / Valero Energy Corporation | 0.00 | -3.57 | 0.39 | -15.88 | 1.0844 | -0.1077 | |||

| OSK / Oshkosh Corporation | 0.00 | 2.54 | 0.39 | -26.19 | 1.0752 | -0.2732 | |||

| AAP / Advance Auto Parts, Inc. | 0.01 | 19.46 | 0.39 | -19.50 | 1.0743 | -0.1592 | |||

| LFUS / Littelfuse, Inc. | 0.00 | 14.29 | 0.39 | -12.67 | 1.0681 | -0.0625 | |||

| EMN / Eastman Chemical Company | 0.01 | 6.36 | 0.39 | -17.70 | 1.0672 | -0.1343 | |||

| TKR / The Timken Company | 0.01 | 0.00 | 0.39 | -19.92 | 1.0672 | -0.1665 | |||

| LAZ / Lazard, Inc. | 0.01 | 12.28 | 0.38 | -19.83 | 1.0417 | -0.1581 | |||

| NXST / Nexstar Media Group, Inc. | 0.00 | -10.83 | 0.38 | -12.99 | 1.0381 | -0.0648 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.00 | 0.37 | -15.40 | 1.0184 | -0.0961 | |||

| SWK / Stanley Black & Decker, Inc. | 0.01 | 1.64 | 0.34 | -30.79 | 0.9272 | -0.3114 | |||

| BC / Brunswick Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0468 |