Basic Stats

| Portfolio Value | $ 5,861,024,959 |

| Current Positions | 64 |

Latest Holdings, Performance, AUM (from 13F, 13D)

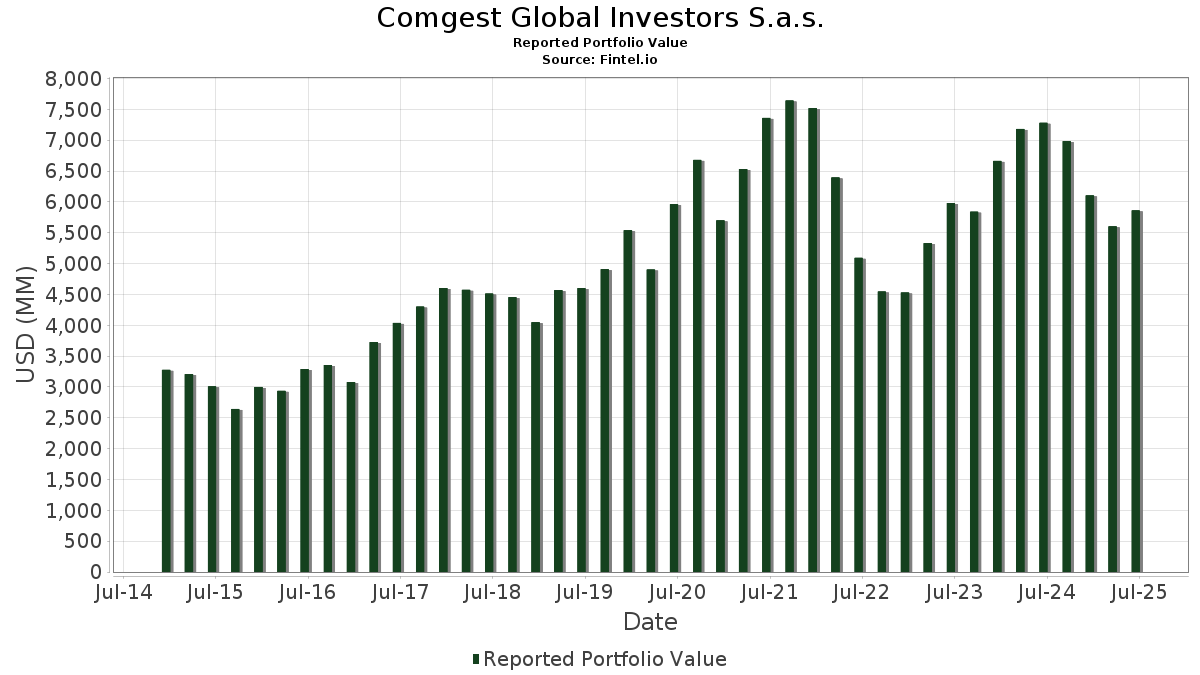

Comgest Global Investors S.a.s. has disclosed 64 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 5,861,024,959 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Comgest Global Investors S.a.s.’s top holdings are Microsoft Corporation (US:MSFT) , Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Linde plc (US:LIN) , Visa Inc. (US:V) , and Intuit Inc. (US:INTU) . Comgest Global Investors S.a.s.’s new positions include MakeMyTrip Limited (US:MMYT) , Uber Technologies, Inc. (US:UBER) , Kanzhun Limited - Depositary Receipt (Common Stock) (US:BZ) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.22 | 503.91 | 8.5976 | 2.0834 | |

| 1.10 | 548.31 | 9.3552 | 1.6015 | |

| 0.46 | 358.79 | 6.1217 | 1.1851 | |

| 0.43 | 41.81 | 0.7133 | 0.7133 | |

| 1.37 | 299.83 | 5.1157 | 0.5656 | |

| 0.59 | 128.11 | 2.1858 | 0.4247 | |

| 1.78 | 314.26 | 5.3618 | 0.4218 | |

| 0.24 | 130.93 | 2.2338 | 0.3951 | |

| 0.04 | 95.19 | 1.6241 | 0.3679 | |

| 0.65 | 154.69 | 2.6394 | 0.2932 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.87 | 260.16 | 4.4388 | -2.2295 | |

| 0.36 | 281.79 | 4.8079 | -1.8105 | |

| 1.06 | 154.89 | 2.6427 | -1.0713 | |

| 2.07 | 316.15 | 5.3941 | -0.9962 | |

| 0.45 | 236.13 | 4.0288 | -0.4877 | |

| 0.10 | 1.81 | 0.0309 | -0.3418 | |

| 1.42 | 221.09 | 3.7723 | -0.3333 | |

| 0.13 | 18.04 | 0.3078 | -0.2766 | |

| 1.08 | 385.23 | 6.5727 | -0.2697 | |

| 0.27 | 55.36 | 0.9445 | -0.2243 |

13F and Fund Filings

This form was filed on 2025-08-07 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 1.10 | -4.74 | 548.31 | 26.22 | 9.3552 | 1.6015 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 2.22 | 1.20 | 503.91 | 38.07 | 8.5976 | 2.0834 | |||

| LIN / Linde plc | 0.88 | 4.17 | 413.45 | 4.97 | 7.0542 | 0.0238 | |||

| V / Visa Inc. | 1.08 | -0.81 | 385.23 | 0.49 | 6.5727 | -0.2697 | |||

| INTU / Intuit Inc. | 0.46 | 1.13 | 358.79 | 29.73 | 6.1217 | 1.1851 | |||

| JNJ / Johnson & Johnson | 2.07 | -4.13 | 316.15 | -11.69 | 5.3941 | -0.9962 | |||

| GOOGL / Alphabet Inc. | 1.78 | -0.36 | 314.26 | 13.55 | 5.3618 | 0.4218 | |||

| AMZN / Amazon.com, Inc. | 1.37 | 2.00 | 299.83 | 17.62 | 5.1157 | 0.5656 | |||

| LLY / Eli Lilly and Company | 0.36 | -19.48 | 281.79 | -24.00 | 4.8079 | -1.8105 | |||

| ACN / Accenture plc | 0.87 | -27.30 | 260.16 | -30.36 | 4.4388 | -2.2295 | |||

| SPGI / S&P Global Inc. | 0.45 | -10.08 | 236.13 | -6.68 | 4.0288 | -0.4877 | |||

| ZTS / Zoetis Inc. | 1.42 | 1.48 | 221.09 | -3.88 | 3.7723 | -0.3333 | |||

| VRSK / Verisk Analytics, Inc. | 0.52 | -2.20 | 162.91 | 2.36 | 2.7796 | -0.0611 | |||

| ICLR / ICON Public Limited Company | 1.06 | -10.45 | 154.89 | -25.56 | 2.6427 | -1.0713 | |||

| ADI / Analog Devices, Inc. | 0.65 | -0.29 | 154.69 | 17.69 | 2.6394 | 0.2932 | |||

| CPRT / Copart, Inc. | 2.97 | 32.77 | 145.71 | 15.13 | 2.4861 | 0.2271 | |||

| COST / Costco Wholesale Corporation | 0.14 | -4.79 | 135.33 | -0.34 | 2.3089 | -0.1148 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.24 | -0.49 | 130.93 | 27.09 | 2.2338 | 0.3951 | |||

| ORCL / Oracle Corporation | 0.59 | -16.97 | 128.11 | 29.84 | 2.1858 | 0.4247 | |||

| MELI / MercadoLibre, Inc. | 0.04 | 0.96 | 95.19 | 35.25 | 1.6241 | 0.3679 | |||

| AAPL / Apple Inc. | 0.27 | -8.48 | 55.36 | -15.46 | 0.9445 | -0.2243 | |||

| META / Meta Platforms, Inc. | 0.07 | 0.20 | 54.24 | 28.32 | 0.9254 | 0.1709 | |||

| VMC / Vulcan Materials Company | 0.16 | -15.32 | 41.90 | -5.33 | 0.7149 | -0.0751 | |||

| MMYT / MakeMyTrip Limited | 0.43 | 41.81 | 0.7133 | 0.7133 | |||||

| SCI / Service Corporation International | 0.49 | -5.66 | 39.55 | -4.25 | 0.6747 | -0.0625 | |||

| CTAS / Cintas Corporation | 0.17 | 0.38 | 38.12 | 8.85 | 0.6504 | 0.0253 | |||

| SYK / Stryker Corporation | 0.09 | 13.03 | 33.68 | 20.13 | 0.5747 | 0.0742 | |||

| FMX / Fomento Económico Mexicano, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.29 | -29.85 | 29.81 | -25.97 | 0.5086 | -0.2101 | |||

| AVY / Avery Dennison Corporation | 0.16 | -21.37 | 28.41 | -22.48 | 0.4847 | -0.1694 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.29 | -11.31 | 22.45 | 2.34 | 0.3831 | -0.0085 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.13 | -43.23 | 18.04 | -44.90 | 0.3078 | -0.2766 | |||

| OTIS / Otis Worldwide Corporation | 0.17 | -6.07 | 16.51 | -9.87 | 0.2816 | -0.0453 | |||

| GLOB / Globant S.A. | 0.17 | 0.00 | 15.90 | -22.84 | 0.2712 | -0.0965 | |||

| MA / Mastercard Incorporated | 0.03 | 10.93 | 15.68 | 13.73 | 0.2676 | 0.0214 | |||

| NFLX / Netflix, Inc. | 0.01 | 0.27 | 13.93 | 43.99 | 0.2376 | 0.0650 | |||

| FERG / Ferguson Enterprises Inc. | 0.06 | -3.13 | 13.89 | 31.65 | 0.2369 | 0.0487 | |||

| AXP / American Express Company | 0.04 | 70.15 | 12.00 | 101.73 | 0.2047 | 0.0985 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.07 | 6.49 | 11.51 | 55.23 | 0.1964 | 0.0641 | |||

| KSPI / Joint Stock Company Kaspi.kz - Depositary Receipt (Common Stock) | 0.13 | 0.98 | 10.88 | -7.68 | 0.1856 | -0.0247 | |||

| YUMC / Yum China Holdings, Inc. | 0.20 | -3.16 | 9.10 | -16.83 | 0.1552 | -0.0400 | |||

| FAST / Fastenal Company | 0.21 | 89.82 | 8.77 | 2.80 | 0.1497 | -0.0026 | |||

| SPOT / Spotify Technology S.A. | 0.01 | -29.89 | 8.47 | -2.20 | 0.1445 | -0.0101 | |||

| UBER / Uber Technologies, Inc. | 0.09 | 7.97 | 0.1359 | 0.1359 | |||||

| STVN / Stevanato Group S.p.A. | 0.32 | 4.52 | 7.92 | 25.05 | 0.1352 | 0.0221 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -9.93 | 7.91 | -1.19 | 0.1349 | -0.0079 | |||

| BDX / Becton, Dickinson and Company | 0.04 | -0.89 | 7.23 | -25.47 | 0.1233 | -0.0498 | |||

| TME / Tencent Music Entertainment Group - Depositary Receipt (Common Stock) | 0.30 | 26.39 | 5.91 | 70.97 | 0.1008 | 0.0391 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.05 | 19.35 | 5.33 | 5.54 | 0.0910 | 0.0008 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 4.29 | 20.94 | 0.0731 | 0.0099 | |||

| ALC / Alcon Inc. | 0.04 | 0.00 | 3.41 | -7.01 | 0.0582 | -0.0073 | |||

| MDT / Medtronic plc | 0.04 | 0.00 | 3.20 | -3.00 | 0.0545 | -0.0043 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 3.10 | 7.80 | 0.0528 | 0.0016 | |||

| WMT / Walmart Inc. | 0.03 | -21.11 | 3.08 | -12.12 | 0.0526 | -0.0100 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 2.81 | -0.60 | 0.0480 | -0.0025 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | 0.00 | 2.54 | 12.39 | 0.0433 | 0.0030 | |||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.10 | -91.45 | 1.81 | -91.32 | 0.0309 | -0.3418 | |||

| VIPS / Vipshop Holdings Limited - Depositary Receipt (Common Stock) | 0.10 | -46.16 | 1.47 | -48.35 | 0.0251 | -0.0257 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.02 | -24.36 | 1.23 | -22.90 | 0.0210 | -0.0075 | |||

| RACE / Ferrari N.V. | 0.00 | 0.00 | 1.20 | 14.61 | 0.0205 | 0.0018 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 4.05 | 0.97 | 3.43 | 0.0165 | -0.0002 | |||

| BZ / Kanzhun Limited - Depositary Receipt (Common Stock) | 0.05 | 0.89 | 0.0152 | 0.0152 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.01 | 67.33 | 0.72 | 54.39 | 0.0123 | 0.0040 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 4.05 | 0.61 | -15.19 | 0.0105 | -0.0025 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | -45.16 | 0.60 | -30.94 | 0.0102 | -0.0052 | |||

| NYT / The New York Times Company | 0.00 | -100.00 | 0.00 | 0.0000 |