Basic Stats

| Portfolio Value | $ 68,478,142 |

| Current Positions | 312 |

Latest Holdings, Performance, AUM (from 13F, 13D)

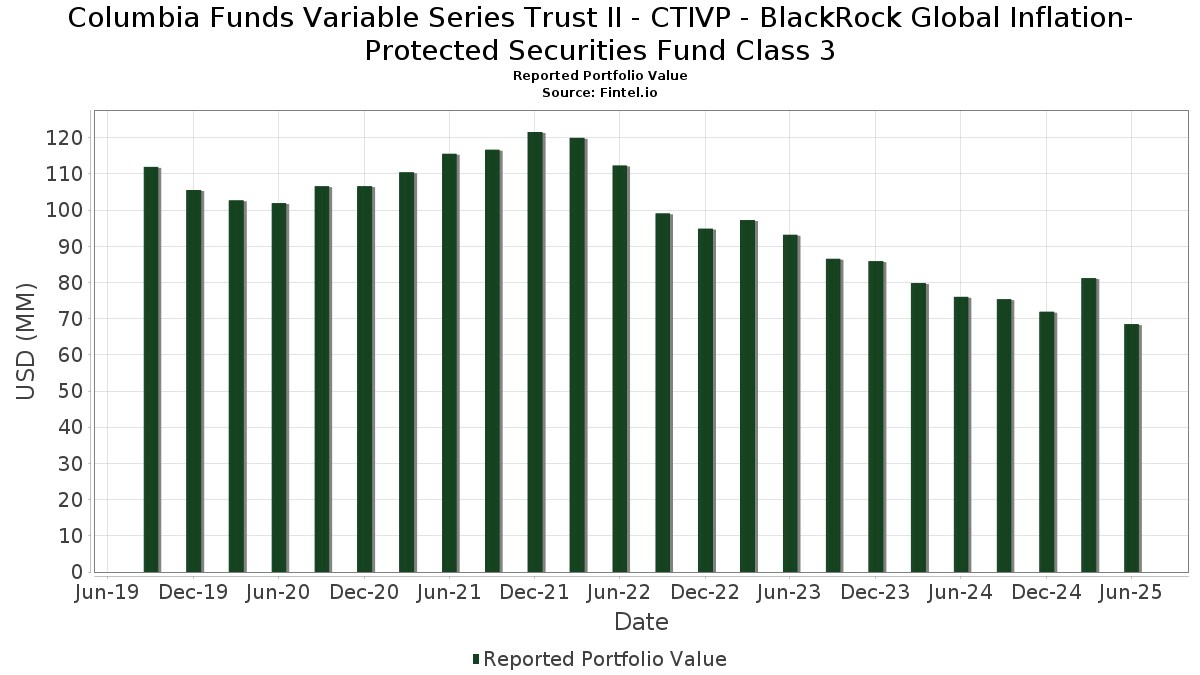

Columbia Funds Variable Series Trust II - CTIVP - BlackRock Global Inflation-Protected Securities Fund Class 3 has disclosed 312 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 68,478,142 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Columbia Funds Variable Series Trust II - CTIVP - BlackRock Global Inflation-Protected Securities Fund Class 3’s top holdings are United States Treasury Inflation Indexed Bonds (US:US91282CDX65) , United States Treasury Inflation Indexed Bonds (US:US912828ZZ63) , United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , U.S. Treasury Inflation Linked Notes (US:US91282CGK18) , and United States Treasury Inflation Indexed Bonds (US:US9128283R96) . Columbia Funds Variable Series Trust II - CTIVP - BlackRock Global Inflation-Protected Securities Fund Class 3’s new positions include United States Treasury Inflation Indexed Bonds (US:US91282CDX65) , United States Treasury Inflation Indexed Bonds (US:US912828ZZ63) , United States Treasury Inflation Indexed Bonds (US:US91282CCM10) , U.S. Treasury Inflation Linked Notes (US:US91282CGK18) , and United States Treasury Inflation Indexed Bonds (US:US9128283R96) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.54 | 2.2281 | 1.5161 | ||

| 0.52 | 0.7466 | 0.7466 | ||

| 0.33 | 0.4787 | 0.4787 | ||

| 0.45 | 0.6447 | 0.2989 | ||

| 0.91 | 1.3138 | 0.2783 | ||

| 0.13 | 0.1823 | 0.1823 | ||

| 0.56 | 0.8080 | 0.1693 | ||

| 0.55 | 0.7979 | 0.1666 | ||

| 0.69 | 1.0013 | 0.1242 | ||

| 0.08 | 0.1157 | 0.1157 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 0.0373 | -1.3834 | ||

| 0.17 | 0.2507 | -1.2213 | ||

| 0.27 | 0.3908 | -0.9736 | ||

| -0.64 | -0.9273 | -0.9273 | ||

| 0.52 | 0.7537 | -0.4631 | ||

| 0.66 | 0.9588 | -0.4400 | ||

| -0.27 | -0.3866 | -0.3866 | ||

| 0.03 | 0.0408 | -0.3060 | ||

| 0.19 | 0.19 | 0.2788 | -0.2771 | |

| 0.93 | 1.3427 | -0.2467 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TREASURY NOTE / DBT (US91282CML27) | 1.54 | 202.15 | 2.2281 | 1.5161 | |||||

| TREASURY (CPI) NOTE / DBT (US91282CLE92) | 1.19 | -5.87 | 1.7111 | -0.0442 | |||||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 1.14 | -3.71 | 1.6487 | -0.0043 | |||||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 1.13 | 1.35 | 1.6270 | 0.0761 | |||||

| TREASURY (CPI) NOTE / DBT (US91282CJY84) | 1.12 | -4.94 | 1.6101 | -0.0255 | |||||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 1.10 | -3.59 | 1.5887 | -0.0021 | |||||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 1.09 | -5.13 | 1.5729 | -0.0268 | |||||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 1.08 | 0.84 | 1.5532 | 0.0674 | |||||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 1.06 | -7.21 | 1.5223 | -0.0617 | |||||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 1.03 | -4.37 | 1.4847 | -0.0140 | |||||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 1.03 | -6.90 | 1.4791 | -0.0548 | |||||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 1.02 | -8.43 | 1.4734 | -0.0797 | |||||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 0.99 | -10.25 | 1.4273 | -0.1079 | |||||

| TREASURY (CPI) NOTE / DBT (US91282CKL45) | 0.97 | -10.97 | 1.4053 | -0.1186 | |||||

| TREASURY (CPI) NOTE / DBT (US91282CLV18) | 0.93 | -18.49 | 1.3427 | -0.2467 | |||||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 0.93 | -3.13 | 1.3395 | 0.0050 | |||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 0.93 | -8.13 | 1.3361 | -0.0675 | |||||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 0.91 | 22.48 | 1.3138 | 0.2783 | |||||

| FR0011008705 / French Republic Government Bond OAT | 0.89 | 5.46 | 1.2815 | 0.1090 | |||||

| GB00B128DH60 / TSY 1 1/4 2027 I/L GILT BONDS REGS 11/27 1.25 | 0.89 | 1.14 | 1.2775 | 0.0588 | |||||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 0.88 | -5.35 | 1.2751 | -0.0254 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.79 | -1.75 | 1.1343 | 0.0199 | |||||

| GB00BZ1NTB69 / United Kingdom Gilt Inflation Linked | 0.75 | -0.79 | 1.0875 | 0.0293 | |||||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 0.74 | -8.87 | 1.0675 | -0.0633 | |||||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 0.73 | -8.17 | 1.0544 | -0.0552 | |||||

| GB00B3Y1JG82 / United Kingdom Gilt Inflation Linked | 0.73 | -2.54 | 1.0524 | 0.0100 | |||||

| GB0031790826 / United Kingdom Gilt Inflation Linked | 0.71 | 4.58 | 1.0215 | 0.0783 | |||||

| GB00B1L6W962 / UK 1.125% 11/22/2037 (FTIPS) | 0.71 | -2.21 | 1.0203 | 0.0125 | |||||

| GB00B46CGH68 / United Kingdom Gilt Inflation Linked | 0.70 | -0.43 | 1.0137 | 0.0314 | |||||

| DE0001030559 / Deutsche Bundesrepublik Inflation Linked Bond | 0.70 | -0.71 | 1.0086 | 0.0276 | |||||

| FR0013410552 / French Republic | 0.69 | 10.33 | 1.0013 | 0.1242 | |||||

| IT0004545890 / Italy Buoni Poliennali Del Tesoro | 0.69 | 8.54 | 0.9908 | 0.1105 | |||||

| FR0000188799 / FRANCE 3.15% 7/25/2032 (FTIPS) | 0.67 | 6.49 | 0.9718 | 0.0914 | |||||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 0.66 | -33.86 | 0.9588 | -0.4400 | |||||

| GB00B3LZBF68 / United Kingdom Gilt Inflation Linked | 0.64 | 0.00 | 0.9258 | 0.0328 | |||||

| ES0000012C12 / Spain Government Inflation Linked Bond | 0.64 | -1.08 | 0.9220 | 0.0221 | |||||

| FR0010447367 / French Republic Government Bond OAT | 0.62 | 10.39 | 0.8894 | 0.1123 | |||||

| ES00000127C8 / Spain Government Inflation Linked Bond | 0.61 | 10.16 | 0.8757 | 0.1083 | |||||

| ES00000128S2 / Spain Government Inflation Linked Bond | 0.60 | 9.78 | 0.8591 | 0.1045 | |||||

| FR0011982776 / French Republic Government Bond OAT | 0.59 | 2.62 | 0.8482 | 0.0493 | |||||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 0.57 | -7.14 | 0.8251 | -0.0334 | |||||

| GB00B7RN0G65 / United Kingdom Gilt Inflation Linked | 0.57 | -0.35 | 0.8240 | 0.0259 | |||||

| GB00B3MYD345 / United Kingdom Gilt Inflation Linked | 0.56 | 0.90 | 0.8119 | 0.0354 | |||||

| GB00B421JZ66 / United Kingdom Gilt Inflation Linked | 0.56 | 22.27 | 0.8080 | 0.1693 | |||||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 0.56 | 0.54 | 0.8016 | 0.0327 | |||||

| GB00B3D4VD98 / United Kingdom Gilt Inflation Linked | 0.55 | 22.08 | 0.7979 | 0.1666 | |||||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 0.54 | -8.97 | 0.7773 | -0.0456 | |||||

| IT0005482994 / BUONI POLIENNALI DEL TES /EUR/ REGD SER CPI 0.10000000 | 0.54 | 9.37 | 0.7747 | 0.0898 | |||||

| IT0003745541 / ITALY 2.35% 9/15/2035 (FTIPS) | 0.53 | 5.33 | 0.7705 | 0.0644 | |||||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 0.52 | -40.21 | 0.7537 | -0.4631 | |||||

| IT0005246134 / Italy Buoni Poliennali Del Tesoro | 0.52 | -27.20 | 0.7534 | -0.2456 | |||||

| IT0005387052 / Italy Buoni Poliennali Del Tesoro | 0.52 | 11.40 | 0.7471 | 0.0997 | |||||

| TREASURY (CPI) NOTE / DBT (US91282CNB36) | 0.52 | 0.7466 | 0.7466 | ||||||

| GB00B0CNHZ09 / United Kingdom Gilt Inflation Linked | 0.50 | -0.99 | 0.7222 | 0.0186 | |||||

| GB00B24FFM16 / United Kingdom Gilt Inflation Linked | 0.50 | -0.20 | 0.7210 | 0.0245 | |||||

| GB0008932666 / United Kingdom Gilt Inflation Linked | 0.49 | 6.96 | 0.7104 | 0.0693 | |||||

| IT0005138828 / Italy Buoni Poliennali Del Tesoro | 0.49 | 0.82 | 0.7059 | 0.0304 | |||||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 0.49 | -8.46 | 0.7028 | -0.0381 | |||||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 0.49 | -14.26 | 0.7025 | -0.0886 | |||||

| GB00BNNGP551 / United Kingdom Gilt Inflation Linked | 0.47 | 8.58 | 0.6752 | 0.0738 | |||||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 0.47 | -5.87 | 0.6719 | -0.0163 | |||||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 0.47 | -14.84 | 0.6708 | -0.0907 | |||||

| GB00BLH38265 / United Kingdom of Great Britain and Northern Ireland | 0.46 | -1.08 | 0.6607 | 0.0153 | |||||

| FR0013238268 / French Republic Government Bond OAT | 0.46 | -8.25 | 0.6588 | -0.0338 | |||||

| IT0005543803 / Italy Buoni Poliennali Del Tesoro | 0.45 | 80.24 | 0.6447 | 0.2989 | |||||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 0.45 | -10.08 | 0.6438 | -0.0478 | |||||

| IT0004735152 / Italy Buoni Poliennali Del Tesoro | 0.45 | -8.06 | 0.6426 | -0.0315 | |||||

| FR0000186413 / French Republic Government Bond OAT | 0.43 | 4.38 | 0.6197 | 0.0469 | |||||

| GB00B73ZYW09 / United Kingdom Gilt Inflation Linked | 0.41 | -0.25 | 0.5852 | 0.0197 | |||||

| GB00BYMWG366 / United Kingdom Gilt Inflation Linked | 0.40 | -0.74 | 0.5817 | 0.0162 | |||||

| GB00BGDYHF49 / United Kingdom Gilt Inflation Linked | 0.39 | 1.03 | 0.5671 | 0.0253 | |||||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 0.39 | -10.05 | 0.5554 | -0.0407 | |||||

| EU000A3K4DY4 / European Union | 0.38 | 9.74 | 0.5526 | 0.0660 | |||||

| DE0001030575 / Deutsche Bundesrepublik Inflation Linked Bond | 0.38 | 3.53 | 0.5508 | 0.0383 | |||||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 0.38 | -11.29 | 0.5449 | -0.0475 | |||||

| FR0013327491 / French Republic | 0.37 | 11.31 | 0.5396 | 0.0708 | |||||

| TREASURY (CPI) NOTE / DBT (US912810TY47) | 0.36 | -7.40 | 0.5245 | -0.0213 | |||||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 0.36 | -10.03 | 0.5180 | -0.0389 | |||||

| FR0014001N38 / French Republic | 0.36 | 0.85 | 0.5146 | 0.0221 | |||||

| GB00B4PTCY75 / United Kingdom Gilt Inflation Linked | 0.35 | -2.48 | 0.5114 | 0.0057 | |||||

| GB00BMF9LJ15 / United Kingdom Gilt Inflation Linked | 0.34 | 7.89 | 0.4938 | 0.0512 | |||||

| ITALY (REPUBLIC OF) / DBT (IT0005631590) | 0.33 | 0.4787 | 0.4787 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 0.33 | 6.19 | 0.4710 | 0.0435 | |||||

| FHLMC_25-5482 / ABS-CBDO (US3137HHLU37) | 0.33 | -6.61 | 0.4702 | -0.0148 | |||||

| GB00BZ13DV40 / United Kingdom Gilt Inflation Linked | 0.32 | 2.55 | 0.4658 | 0.0281 | |||||

| DE0001030583 / DBRI 0.1 04/15/33 I/L | 0.32 | 5.67 | 0.4579 | 0.0396 | |||||

| ITALY (REPUBLIC OF) / DBT (IT0005588881) | 0.30 | 18.25 | 0.4300 | 0.0781 | |||||

| FR0013209871 / French Republic Government Bond OAT | 0.30 | 1.02 | 0.4290 | 0.0193 | |||||

| FR0013524014 / FRANCE .10% 3/1/2036 (FTIPS) | 0.29 | 10.15 | 0.4232 | 0.0528 | |||||

| GB00BDX8CX86 / United Kingdom Gilt Inflation Linked | 0.28 | -15.55 | 0.4008 | -0.0561 | |||||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 0.27 | -78.28 | 0.3908 | -0.9736 | |||||

| GB00BP9DLZ64 / United Kingdom Gilt Inflation Linked | 0.27 | -2.89 | 0.3886 | 0.0017 | |||||

| JP1120221H48 / Japanese Government CPI Linked Bond | 0.27 | 5.58 | 0.3826 | 0.0331 | |||||

| GB00BMF9LH90 / U.K. Treasury Inflation Linked Bonds | 0.26 | 6.45 | 0.3814 | 0.0354 | |||||

| GB00BNNGP882 / United Kingdom of Great Britain and Northern Ireland | 0.26 | 2.72 | 0.3809 | 0.0230 | |||||

| JP1120241K56 / Japanese Government CPI Linked Bond | 0.26 | 5.67 | 0.3772 | 0.0320 | |||||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0.26 | -9.19 | 0.3717 | -0.0229 | |||||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 0.26 | -11.15 | 0.3678 | -0.0324 | |||||

| JGBI / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 0.24 | 5.19 | 0.3507 | 0.0279 | |||||

| FR0014003N51 / French Republic | 0.24 | 4.78 | 0.3481 | 0.0274 | |||||

| SE0000556599 / Sweden Inflation Linked Bond | 0.24 | 6.31 | 0.3410 | 0.0312 | |||||

| US912810FQ68 / United States Treas Bds Treas Bond | 0.22 | 0.45 | 0.3220 | 0.0129 | |||||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 0.22 | -3.91 | 0.3202 | -0.0005 | |||||

| US12663DAC83 / CSMC 2022-NQM5 Trust | 0.22 | -2.26 | 0.3123 | 0.0034 | |||||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 0.21 | -12.70 | 0.3081 | -0.0329 | |||||

| FCT / Fincantieri S.p.A. | 0.21 | 1.46 | 0.3012 | 0.0152 | |||||

| US74333CAG15 / Progress Residential 2022-SFR7 Trust | 0.20 | 0.51 | 0.2873 | 0.0104 | |||||

| FR001400AQH0 / FRANCE (GOVT OF) /EUR/ REGD SER OATE 0.10000000 | 0.19 | 7.78 | 0.2810 | 0.0295 | |||||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 0.19 | -51.58 | 0.19 | -51.63 | 0.2788 | -0.2771 | |||

| TREASURY (CPI) NOTE / DBT (US912810UH94) | 0.19 | -16.59 | 0.2766 | -0.0425 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.19 | -2.62 | 0.2690 | 0.0025 | |||||

| FR0014008181 / FRANCE (REPUBLIC OF) | 0.19 | 17.72 | 0.2688 | 0.0484 | |||||

| AMI / Aurelia Metals Limited | 0.19 | 27.59 | 0.2677 | 0.0656 | |||||

| GB00BD9MZZ71 / United Kingdom Gilt Inflation Linked | 0.18 | 1.67 | 0.2643 | 0.0134 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0.18 | 10.49 | 0.2592 | 0.0334 | |||||

| CA135087VS05 / Canadian Government Real Return Bond | 0.18 | 5.29 | 0.2590 | 0.0211 | |||||

| CA135087WV25 / Canadian Government Real Return Bond | 0.18 | 4.09 | 0.2569 | 0.0176 | |||||

| AREIT_24-CRE9 / ABS-MBS (US00193AAA25) | 0.17 | -10.31 | 0.2519 | -0.0189 | |||||

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 0.17 | -84.62 | 0.2507 | -1.2213 | |||||

| CA135087ZH04 / Canadian Government Real Return Bond | 0.17 | -6.52 | 0.2494 | -0.0072 | |||||

| US91087BAR15 / Mexican Government International Bond | 0.17 | 2.44 | 0.2434 | 0.0144 | |||||

| GB00BYVP4K94 / UK .125% 11/22/2056 (FTIPS) | 0.16 | -6.90 | 0.2350 | -0.0085 | |||||

| CA135087XQ21 / Canadian Government Real Return Bond | 0.16 | 1.89 | 0.2349 | 0.0123 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.16 | 5.92 | 0.2328 | 0.0198 | |||||

| CA135087YK42 / Canadian Government Real Return Bond | 0.15 | -10.47 | 0.2235 | -0.0172 | |||||

| JP1120271N56 / Japanese Government CPI Linked Bond | 0.15 | 5.48 | 0.2231 | 0.0197 | |||||

| AMI / Aurelia Metals Limited | 0.15 | 93.67 | 0.2212 | 0.1107 | |||||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 0.15 | 21.95 | 0.2165 | 0.0441 | |||||

| US66981YAD13 / AMSR 2022-SFR3 Trust | 0.15 | 0.68 | 0.2162 | 0.0093 | |||||

| US64830RAG74 / New Residential Mortgage Loan Trust 2022-SFR2 | 0.15 | 0.68 | 0.2161 | 0.0098 | |||||

| CA135087B949 / Canada Government Bond | 0.15 | -14.45 | 0.2137 | -0.0272 | |||||

| AU0000XCLWV6 / Australia Government Bond | 0.14 | -18.86 | 0.2059 | -0.0390 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.14 | -2.08 | 0.2035 | 0.0022 | |||||

| ACRA_24-NQM1 / ABS-CBDO (US00112EAA29) | 0.14 | -2.78 | 0.2021 | 0.0010 | |||||

| US912810SF66 / Us Treasury Bond | 0.14 | -2.10 | 0.2020 | 0.0020 | |||||

| JP1120261M59 / JAPAN GOVT CPI LINKED BONDS 03/31 0.005 | 0.14 | 7.14 | 0.1961 | 0.0205 | |||||

| DK0009923724 / Denmark I/L Government Bond | 0.13 | 8.26 | 0.1902 | 0.0212 | |||||

| IT0005436701 / Italy Buoni Poliennali Del Tesoro | 0.13 | 8.40 | 0.1874 | 0.0210 | |||||

| AU000XCLWAF4 / AUSTRALIA 2.0 08/21/2035 (FTIPS) | 0.13 | 8.40 | 0.1868 | 0.0201 | |||||

| AU000XCLWAV1 / Australia Government Bond | 0.13 | 7.56 | 0.1854 | 0.0186 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.13 | 0.1823 | 0.1823 | ||||||

| NZIIBDT004C8 / New Zealand Government Inflation Linked Bond | 0.13 | 8.70 | 0.1804 | 0.0194 | |||||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 0.12 | 113.79 | 0.1795 | 0.0979 | |||||

| IT0005547812 / ITALY (REPUBLIC OF) | 0.12 | -6.11 | 0.1779 | -0.0051 | |||||

| CA135087G997 / Canadian Government Real Return Bond | 0.12 | 0.00 | 0.1768 | 0.0062 | |||||

| FR001400IKW5 / French Republic | 0.12 | -2.44 | 0.1738 | 0.0012 | |||||

| JP1120281P52 / Japanese Government CPI Linked Bond | 0.12 | -18.49 | 0.1720 | -0.0318 | |||||

| GB00BM8Z2W66 / U.K. Treasury Inflation Linked Bonds | 0.11 | 56.52 | 0.1565 | 0.0596 | |||||

| US784212AA01 / SG Residential Mortgage Trust 2021-1 | 0.11 | 0.94 | 0.1550 | 0.0072 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 0.10 | 11.11 | 0.1443 | 0.0188 | |||||

| AU000XCLWAO6 / Australia Government Bond | 0.10 | 8.79 | 0.1435 | 0.0159 | |||||

| CROSS_25-H1 / ABS-CBDO (US22758NAA54) | 0.10 | -3.06 | 0.1373 | 0.0003 | |||||

| BE0000358672 / BELGIUM KINGDOM EUR 144A LIFE/REG S 3.3% 06-22-54 | 0.09 | 9.30 | 0.1356 | 0.0157 | |||||

| US31573JAA88 / Ellington Financial Mortgage Trust 2021-3 | 0.09 | -3.26 | 0.1296 | 0.0008 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.09 | 2.33 | 0.1277 | 0.0075 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 0.09 | 1.15 | 0.1272 | 0.0050 | |||||

| NZIIBDT005C5 / New Zealand Government Inflation Linked Bond | 0.08 | -18.63 | 0.1204 | -0.0222 | |||||

| US92539NAA46 / Verus Securitization Trust 2022-7 | 0.08 | -2.38 | 0.1183 | 0.0010 | |||||

| SE0007045745 / Sweden Inflation Linked Bond | 0.08 | 8.00 | 0.1182 | 0.0130 | |||||

| AU0000171134 / Australia Government Bond | 0.08 | 8.11 | 0.1159 | 0.0128 | |||||

| ITALY (REPUBLIC OF) / DBT (IT0005647273) | 0.08 | 0.1157 | 0.1157 | ||||||

| DE0001174068 / CHINA UNIVERSAL EX INC | 0.08 | 9.86 | 0.1129 | 0.0127 | |||||

| US78434KAA51 / SG Residential Mortgage Trust 2022-2 | 0.08 | -2.53 | 0.1123 | 0.0022 | |||||

| NZIIBDT003C0 / New Zealand Government Inflation Linked Bond | 0.08 | 8.45 | 0.1116 | 0.0127 | |||||

| US69377TAA43 / PRKCM 2022-AFC2 Trust | 0.07 | -4.05 | 0.1029 | -0.0005 | |||||

| TREASURY NOTE / DBT (US91282CNC19) | 0.07 | 0.1026 | 0.1026 | ||||||

| LBA_24-BOLT / ABS-MBS (US50177BAA52) | 0.07 | 1.45 | 0.1010 | 0.0038 | |||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.07 | 0.0990 | 0.0990 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.07 | 0.0990 | 0.0990 | ||||||

| JP1120251L52 / Japanese Government CPI Linked Bond | 0.06 | 6.67 | 0.0931 | 0.0082 | |||||

| US68389XCP87 / Oracle Corp | 0.06 | 3.45 | 0.0867 | 0.0046 | |||||

| VISTRA OPERATIONS COMPANY LLC / DBT (US92840VAS16) | 0.06 | 3.64 | 0.0824 | 0.0047 | |||||

| AU0000024044 / Australia Government Bond | 0.06 | 9.62 | 0.0823 | 0.0089 | |||||

| US11135FBL40 / Broadcom Inc | 0.05 | 1.92 | 0.0772 | 0.0037 | |||||

| US 2YR NOTE SEP 25 / DIR (000000000) | 0.05 | 0.0753 | 0.0753 | ||||||

| SE0013748258 / Sweden Inflation Linked Bond | 0.05 | 9.52 | 0.0667 | 0.0070 | |||||

| HCA INC / DBT (US404121AK12) | 0.05 | 2.27 | 0.0654 | 0.0034 | |||||

| DENMARK KINGDOM OF (GOVERNMENT) / DBT (DK0009924458) | 0.04 | 8.11 | 0.0591 | 0.0064 | |||||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.04 | 2.63 | 0.0563 | 0.0026 | |||||

| HCA INC / DBT (US404119CU12) | 0.04 | 0.00 | 0.0561 | 0.0030 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.04 | 0.0519 | 0.0519 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 0.0514 | 0.0024 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.03 | 3.13 | 0.0482 | 0.0023 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.03 | 3.45 | 0.0438 | 0.0022 | |||||

| COMM_24-WCL1 / ABS-MBS (US20047DAA28) | 0.03 | 0.00 | 0.0431 | 0.0016 | |||||

| SE0016786560 / SWEDEN (KINGDOM OF) | 0.03 | 11.54 | 0.0427 | 0.0053 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 0.03 | -88.76 | 0.0408 | -0.3060 | |||||

| BANK OF AMERICA CORP / DBT (US06051GMA49) | 0.03 | 0.00 | 0.0400 | 0.0019 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0399 | 0.0019 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.0398 | 0.0020 | |||||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 0.03 | -97.55 | 0.0373 | -1.3834 | |||||

| LONG GILT SEP 25 / DIR (GB00MP6FM953) | 0.02 | 0.0341 | 0.0341 | ||||||

| GB00BMV7TC88 / United Kingdom Gilt | 0.02 | 0.0296 | 0.0296 | ||||||

| CA135087M433 / Canada Government Bond | 0.02 | 0.00 | 0.0295 | 0.0006 | |||||

| BFLD_24-VICT / ABS-MBS (US05555VAA70) | 0.02 | 0.00 | 0.0217 | 0.0008 | |||||

| US DOLLARS / DFE (000000000) | 0.01 | 0.0175 | 0.0175 | ||||||

| USD P MXN C @19.10000 EO / DFE (000000000) | 0.01 | 0.0173 | 0.0173 | ||||||

| CONE_24-DFW1 / ABS-MBS (US20682AAA88) | 0.01 | 0.00 | 0.0144 | 0.0006 | |||||

| SWP: IFS 2.589000 29-JAN-2027 USC / DIR (000000000) | 0.01 | 0.0118 | 0.0118 | ||||||

| SWP: EUR 2.513000 20-FEB-2054 EUR / DIR (000000000) | 0.01 | 0.0110 | 0.0110 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.01 | 0.0109 | 0.0109 | ||||||

| SWP: EUR 2.490000 19-FEB-2054 EUR / DIR (000000000) | 0.01 | 0.0085 | 0.0085 | ||||||

| US 5YR NOTE SEP 25 / DIR (000000000) | 0.01 | 0.0081 | 0.0081 | ||||||

| SWP: EUR 2.505500 20-FEB-2054 EUR / DIR (000000000) | 0.01 | 0.0081 | 0.0081 | ||||||

| SWP: IFS 2.547200 03-OCT-2028 USC / DIR (000000000) | 0.01 | 0.0080 | 0.0080 | ||||||

| BRITISH POUND / DFE (000000000) | 0.01 | 0.0077 | 0.0077 | ||||||

| THREE-MONTH SOFR FUTURE JUN 26 / DIR (000000000) | 0.00 | 0.0067 | 0.0067 | ||||||

| SWP: IFS 2.176200 07-AUG-2028 USC / DIR (000000000) | 0.00 | 0.0066 | 0.0066 | ||||||

| AUSTRALIA DOLLAR / DFE (000000000) | 0.00 | 0.0063 | 0.0063 | ||||||

| SWP: EUR 2.543000 22-APR-2054 EUR / DIR (000000000) | 0.00 | 0.0056 | 0.0056 | ||||||

| SWP: IFS 2.590000 15-APR-2028 USC / DIR (000000000) | 0.00 | 0.0043 | 0.0043 | ||||||

| SWP: EUR 2.510500 01-MAR-2054 EUR / DIR (000000000) | 0.00 | 0.0039 | 0.0039 | ||||||

| SWP: IFS 2.514000 15-APR-2029 USC / DIR (000000000) | 0.00 | 0.0031 | 0.0031 | ||||||

| CANADIAN DOLLAR / DFE (000000000) | 0.00 | 0.0031 | 0.0031 | ||||||

| EURO BUXL 30YR BOND SEP 25 / DIR (DE000F1NGF87) | 0.00 | 0.0026 | 0.0026 | ||||||

| SWP: IFS 2.275200 28-AUG-2028 USC / DIR (000000000) | 0.00 | 0.0022 | 0.0022 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0022 | 0.0022 | ||||||

| SWP: EUR 2.455500 22-MAR-2054 EUR / DIR (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| SWP: EUR 2.428700 19-JUN-2054 EUR / DIR (000000000) | 0.00 | 0.0020 | 0.0020 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0019 | 0.0019 | ||||||

| SWP: EUR 2.428700 20-JUN-2054 EUR / DIR (000000000) | 0.00 | 0.0018 | 0.0018 | ||||||

| SWP: IFS 2.396400 09-APR-2029 USC / DIR (000000000) | 0.00 | 0.0015 | 0.0015 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0015 | 0.0015 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0014 | 0.0014 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0012 | 0.0012 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0011 | 0.0011 | ||||||

| USD P JPY C @150.0000 EO / DFE (000000000) | 0.00 | 0.0009 | 0.0009 | ||||||

| THREE-MONTH SOFR FUTURE DEC 25 / DIR (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| SWP: EUR 2.638000 10-JUN-2055 EUR / DIR (000000000) | 0.00 | 0.0007 | 0.0007 | ||||||

| FSWP: OIS 0.675830 21-APR-2027 FTO / DIR (000000000) | 0.00 | 0.0006 | 0.0006 | ||||||

| FSWP: OIS 0.683000 21-APR-2027 FTO / DIR (000000000) | 0.00 | 0.0006 | 0.0006 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0005 | 0.0005 | ||||||

| MEXICAN PESO / DFE (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| SWP: IFS 2.428000 15-APR-2030 USC / DIR (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| FSWP: JPY 0.698000 11-MAY-2027 FTO / DIR (000000000) | 0.00 | 0.0005 | 0.0005 | ||||||

| SWP: IFS 2.687500 15-APR-2028 USC / DIR (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| SWP: IFS 2.538000 15-OCT-2029 USC / DIR (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| SWP: IFS 2.691250 15-APR-2028 USC / DIR (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| SWP: IFS 2.561500 15-APR-2029 USC / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SWP: IFS 2.531250 15-APR-2029 USC / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SWP: IFS 2.536250 15-APR-2029 USC / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SWP: IFS 2.734500 15-APR-2028 USC / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SWP: IFS 2.310000 23-AUG-2049 USC / DIR (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| US DOLLARS / DFE (000000000) | 0.00 | 0.0002 | 0.0002 | ||||||

| SWP: IFS 2.429000 15-APR-2030 USC / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| SWP: IFS 2.020000 15-MAR-2035 FRC / DIR (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 0.00 | 0.0000 | 0.0000 | ||||||

| SWP: IFS 2.467500 15-JUL-2049 USC / DIR (000000000) | -0.00 | -0.0000 | -0.0000 | ||||||

| US DOLLARS / DFE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SWP: IFS 2.648000 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SWP: IFS 2.549500 07-MAY-2049 USC / DIR (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| SWP: IFS 2.789500 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.641000 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.684000 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.685000 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.669500 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.835000 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.835500 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| SWP: IFS 2.057500 15-MAR-2035 CPT / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SWP: IFS 2.480000 10-FEB-2050 USC / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| FSWP: OIS 0.869000 09-JUN-2027 FTO / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SWP: IFS 2.832000 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0004 | -0.0004 | ||||||

| SWP: IFS 2.507000 08-NOV-2054 USC / DIR (000000000) | -0.00 | -0.0005 | -0.0005 | ||||||

| SWP: IFS 2.687500 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| SWP: IFS 2.833750 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0006 | -0.0006 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.00 | -0.0008 | -0.0008 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.00 | -0.0008 | -0.0008 | ||||||

| SWP: IFS 2.723500 15-APR-2029 USC / DIR (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| US DOLLARS / DFE (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| SWP: IFS 2.869500 15-APR-2028 USC / DIR (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| FSWP: JPY 0.997500 12-MAR-2027 FTO / DIR (000000000) | -0.00 | -0.0009 | -0.0009 | ||||||

| FSWP: OIS 4.272500 17-SEP-2025 SOF / DIR (000000000) | -0.00 | -0.0010 | -0.0010 | ||||||

| AUST 3YR BOND SEP 25 / DIR (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| EURO-BOBL SEP 25 / DIR (DE000F1NGF61) | -0.00 | -0.0011 | -0.0011 | ||||||

| AUST 10YR BOND SEP 25 / DIR (000000000) | -0.00 | -0.0011 | -0.0011 | ||||||

| SWP: IFS 2.884700 07-MAY-2027 USC / DIR (000000000) | -0.00 | -0.0012 | -0.0012 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.00 | -0.0015 | -0.0015 | ||||||

| THREE-MONTH SOFR FUTURE JUN 25 / DIR (000000000) | -0.00 | -0.0019 | -0.0019 | ||||||

| SWP: IFS 2.390000 15-APR-2030 USC / DIR (000000000) | -0.00 | -0.0022 | -0.0022 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.00 | -0.0022 | -0.0022 | ||||||

| FSWP: JPY 1.018460 12-MAR-2027 FTO / DIR (000000000) | -0.00 | -0.0024 | -0.0024 | ||||||

| SWP: EUR 2.184300 07-NOV-2054 EUR / DIR (000000000) | -0.00 | -0.0024 | -0.0024 | ||||||

| FSWP: JPY 1.026500 12-MAR-2027 FTO / DIR (000000000) | -0.00 | -0.0026 | -0.0026 | ||||||

| OCT25 SFRZ5 P @ 96 / DIR (000000000) | -0.00 | -0.0029 | -0.0029 | ||||||

| SWP: IFS 2.707000 15-JAN-2029 USC / DIR (000000000) | -0.00 | -0.0032 | -0.0032 | ||||||

| US DOLLARS / DFE (000000000) | -0.00 | -0.0034 | -0.0034 | ||||||

| SWP: EUR 2.260000 22-OCT-2054 EUR / DIR (000000000) | -0.00 | -0.0035 | -0.0035 | ||||||

| USD P MXN C @18.50000 EO / DFE (000000000) | -0.00 | -0.0042 | -0.0042 | ||||||

| SWP: IFS 2.915200 12-MAY-2027 USC / DIR (000000000) | -0.00 | -0.0053 | -0.0053 | ||||||

| SWP: IFS 2.803000 15-JUL-2027 USC / DIR (000000000) | -0.00 | -0.0060 | -0.0060 | ||||||

| US DOLLARS / DFE (000000000) | -0.00 | -0.0064 | -0.0064 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.01 | -0.0081 | -0.0081 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.01 | -0.0083 | -0.0083 | ||||||

| US ULTRA T-BOND SEP 25 / DIR (000000000) | -0.01 | -0.0090 | -0.0090 | ||||||

| US DOLLARS / DFE (000000000) | -0.01 | -0.0091 | -0.0091 | ||||||

| SWP: IFS 3.615000 15-JAN-2035 UKR / DIR (000000000) | -0.01 | -0.0098 | -0.0098 | ||||||

| US DOLLARS / DFE (000000000) | -0.01 | -0.0099 | -0.0099 | ||||||

| US 10YR NOTE SEP 25 / DIR (000000000) | -0.01 | -0.0101 | -0.0101 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.01 | -0.0117 | -0.0117 | ||||||

| US LONG BOND SEP 25 / DIR (000000000) | -0.01 | -0.0131 | -0.0131 | ||||||

| SWP: IFS 3.670200 15-MAR-2034 UKR / DIR (000000000) | -0.01 | -0.0174 | -0.0174 | ||||||

| BRITISH POUND / DFE (000000000) | -0.01 | -0.0181 | -0.0181 | ||||||

| US DOLLARS / DFE (000000000) | -0.01 | -0.0201 | -0.0201 | ||||||

| SWP: IFS 3.790000 15-MAR-2033 / DIR (000000000) | -0.02 | -0.0221 | -0.0221 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.02 | -0.0232 | -0.0232 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.02 | -0.0261 | -0.0261 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.02 | -0.0261 | -0.0261 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.07 | -0.1018 | -0.1018 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.07 | -0.1018 | -0.1018 | ||||||

| US ULTRA 10YR NOTE SEP 25 / DIR (000000000) | -0.09 | -0.1347 | -0.1347 | ||||||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | -0.27 | -0.3866 | -0.3866 | ||||||

| US DOLLARS / DFE (000000000) | -0.64 | -0.9273 | -0.9273 |