Basic Stats

| Portfolio Value | $ 488,017,097 |

| Current Positions | 69 |

Latest Holdings, Performance, AUM (from 13F, 13D)

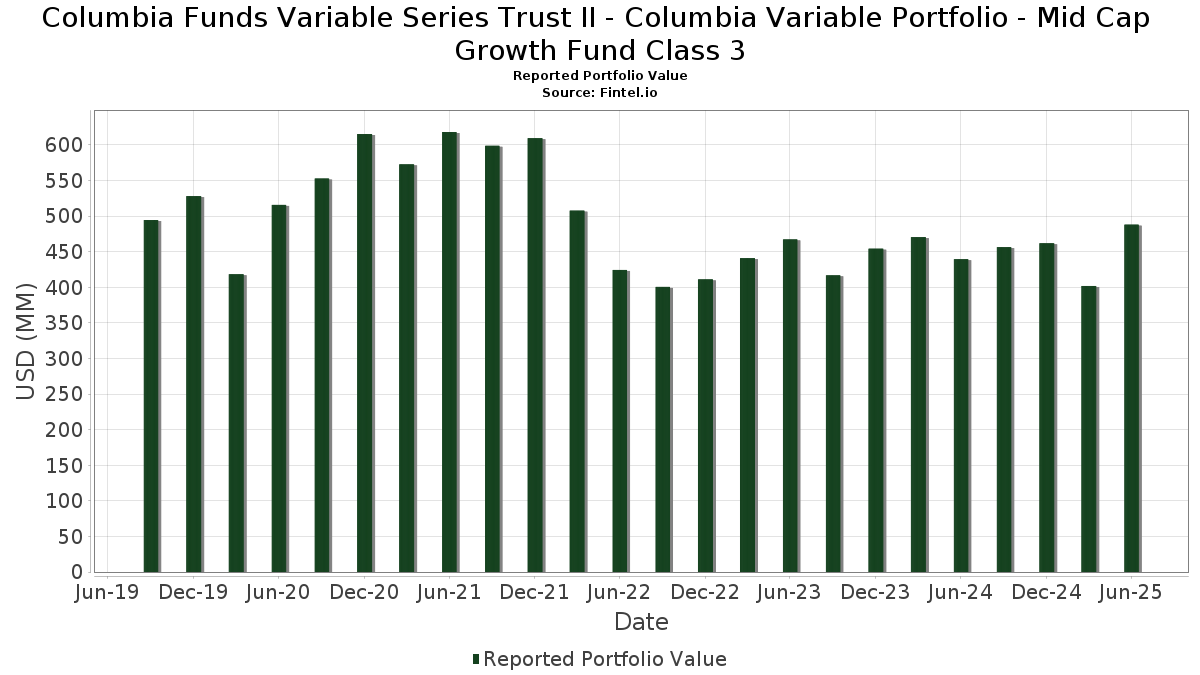

Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Mid Cap Growth Fund Class 3 has disclosed 69 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 488,017,097 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Mid Cap Growth Fund Class 3’s top holdings are Spotify Technology S.A. (US:SPOT) , COLUMBIA SHORT TERM CASH FUND (US:19766H239) , Vertiv Holdings Co (US:VRT) , Vistra Corp. (US:VST) , and Howmet Aerospace Inc. (US:HWM) . Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Mid Cap Growth Fund Class 3’s new positions include EQT Corporation (US:EQT) , Ferguson Enterprises Inc. (US:FERG) , NRG Energy, Inc. (US:NRG) , Texas Pacific Land Corporation (US:TPL) , and Stanley Black & Decker, Inc. (US:SWK) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 18.72 | 18.72 | 3.8368 | 2.5172 | |

| 0.03 | 8.05 | 1.6504 | 1.6504 | |

| 0.02 | 6.91 | 1.4171 | 1.4171 | |

| 0.15 | 13.75 | 2.8183 | 1.3631 | |

| 0.06 | 5.52 | 1.1306 | 1.1306 | |

| 0.08 | 14.70 | 3.0125 | 1.0254 | |

| 0.04 | 11.16 | 2.2878 | 0.9678 | |

| 0.07 | 9.44 | 1.9351 | 0.9554 | |

| 0.07 | 4.33 | 0.8866 | 0.8866 | |

| 0.08 | 11.13 | 2.2805 | 0.8684 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 4.39 | 0.9004 | -2.2782 | |

| 0.01 | 5.73 | 1.1745 | -1.2713 | |

| 0.01 | 2.42 | 0.4966 | -1.2328 | |

| 0.00 | 0.00 | -1.2028 | ||

| 0.01 | 2.89 | 0.5928 | -1.0989 | |

| 0.02 | 7.93 | 1.6260 | -0.9840 | |

| 0.06 | 7.56 | 1.5488 | -0.9223 | |

| 0.01 | 5.73 | 1.1753 | -0.8338 | |

| 0.05 | 9.42 | 1.9302 | -0.7596 | |

| 0.04 | 8.81 | 1.8064 | -0.5889 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPOT / Spotify Technology S.A. | 0.03 | -1.34 | 20.12 | 37.63 | 4.1236 | 0.4850 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 18.72 | 253.12 | 18.72 | 253.10 | 3.8368 | 2.5172 | |||

| VRT / Vertiv Holdings Co | 0.13 | 2.84 | 16.66 | 16.24 | 3.4140 | 0.3108 | |||

| VST / Vistra Corp. | 0.08 | 11.57 | 14.70 | 84.13 | 3.0125 | 1.0254 | |||

| HWM / Howmet Aerospace Inc. | 0.08 | -10.61 | 14.37 | 28.26 | 2.9463 | 0.1565 | |||

| HOOD / Robinhood Markets, Inc. | 0.15 | 4.56 | 13.75 | 135.23 | 2.8183 | 1.3631 | |||

| RBC / RBC Bearings Incorporated | 0.03 | -0.95 | 13.23 | 18.45 | 2.7120 | -0.0686 | |||

| TRGP / Targa Resources Corp. | 0.07 | 19.11 | 12.88 | 3.43 | 2.6408 | -0.4601 | |||

| TLN / Talen Energy Corporation | 0.04 | 44.55 | 11.16 | 110.51 | 2.2878 | 0.9678 | |||

| BWXT / BWX Technologies, Inc. | 0.08 | 34.31 | 11.13 | 96.14 | 2.2805 | 0.8684 | |||

| LPLA / LPL Financial Holdings Inc. | 0.03 | -1.03 | 10.23 | 13.43 | 2.0978 | -0.1481 | |||

| SNOW / Snowflake Inc. | 0.04 | -0.34 | 9.77 | 52.58 | 2.0017 | 0.4084 | |||

| DDOG / Datadog, Inc. | 0.07 | 77.17 | 9.44 | 139.90 | 1.9351 | 0.9554 | |||

| NET / Cloudflare, Inc. | 0.05 | -49.85 | 9.42 | -12.86 | 1.9302 | -0.7596 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.04 | -20.37 | 9.41 | -6.80 | 1.9287 | -0.5845 | |||

| CASY / Casey's General Stores, Inc. | 0.02 | -1.30 | 9.05 | 16.04 | 1.8555 | -0.0866 | |||

| CELH / Celsius Holdings, Inc. | 0.19 | 39.31 | 8.87 | 81.43 | 1.8186 | 0.6012 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.04 | -21.84 | 8.81 | -8.42 | 1.8064 | -0.5889 | |||

| FLUT / Flutter Entertainment plc | 0.03 | -22.86 | 8.81 | -0.51 | 1.8056 | -0.3984 | |||

| AXON / Axon Enterprise, Inc. | 0.01 | -35.98 | 8.76 | 0.77 | 1.7955 | -0.3683 | |||

| DASH / DoorDash, Inc. | 0.03 | -12.54 | 8.52 | 17.96 | 1.7459 | -0.0515 | |||

| CRS / Carpenter Technology Corporation | 0.03 | 7.08 | 8.48 | 63.33 | 1.7377 | 0.4457 | |||

| RBLX / Roblox Corporation | 0.08 | 7.26 | 8.42 | 95.00 | 1.7269 | 0.7913 | |||

| NTRA / Natera, Inc. | 0.05 | 23.40 | 8.16 | 47.43 | 1.6724 | 0.2946 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.02 | -9.93 | 8.11 | -4.39 | 1.6626 | -0.1966 | |||

| ZS / Zscaler, Inc. | 0.03 | 8.05 | 1.6504 | 1.6504 | |||||

| APP / AppLovin Corporation | 0.02 | -42.73 | 7.93 | -24.34 | 1.6260 | -0.9840 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | 62.39 | 7.91 | 147.51 | 1.6211 | 0.8257 | |||

| CHWY / Chewy, Inc. | 0.18 | -5.05 | 7.57 | 24.47 | 1.5526 | 0.0378 | |||

| XPO / XPO, Inc. | 0.06 | -35.16 | 7.56 | -23.88 | 1.5488 | -0.9223 | |||

| COIN / Coinbase Global, Inc. | 0.02 | 6.91 | 1.4171 | 1.4171 | |||||

| DKNG / DraftKings Inc. | 0.16 | -24.46 | 6.83 | -17.34 | 1.4004 | -0.4112 | |||

| WST / West Pharmaceutical Services, Inc. | 0.03 | -0.97 | 6.33 | -3.21 | 1.2980 | -0.3308 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.04 | -1.25 | 6.21 | 6.50 | 1.2732 | -0.1786 | |||

| VIK / Viking Holdings Ltd | 0.11 | -1.08 | 5.75 | 32.63 | 1.1792 | 0.0993 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.01 | -20.94 | 5.73 | -37.45 | 1.1753 | -0.8338 | |||

| HUBS / HubSpot, Inc. | 0.01 | -40.14 | 5.73 | -41.69 | 1.1745 | -1.2713 | |||

| CAH / Cardinal Health, Inc. | 0.03 | 5.52 | 5.72 | 28.68 | 1.1728 | 0.0659 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.02 | 31.86 | 5.70 | 76.99 | 1.1685 | 0.4353 | |||

| ROKU / Roku, Inc. | 0.06 | 5.52 | 1.1306 | 1.1306 | |||||

| TTD / The Trade Desk, Inc. | 0.07 | 149.47 | 5.21 | 228.31 | 1.0674 | 0.6724 | |||

| GKOS / Glaukos Corporation | 0.05 | -10.31 | 5.02 | -5.89 | 1.0291 | -0.2987 | |||

| FWONK / Formula One Group | 0.05 | -0.74 | 5.00 | 15.24 | 1.0243 | -0.0552 | |||

| ALAB / Astera Labs, Inc. | 0.05 | 26.31 | 4.86 | 91.42 | 0.9971 | 0.3644 | |||

| INSM / Insmed Incorporated | 0.05 | -0.98 | 4.68 | 30.63 | 0.9590 | 0.0674 | |||

| TKO / TKO Group Holdings, Inc. | 0.03 | -23.00 | 4.65 | -8.31 | 0.9540 | -0.3097 | |||

| ARES / Ares Management Corporation | 0.03 | -70.88 | 4.39 | -65.60 | 0.9004 | -2.2782 | |||

| TXRH / Texas Roadhouse, Inc. | 0.02 | -12.65 | 4.36 | -1.76 | 0.8942 | -0.2112 | |||

| EQT / EQT Corporation | 0.07 | 4.33 | 0.8866 | 0.8866 | |||||

| FND / Floor & Decor Holdings, Inc. | 0.06 | 24.65 | 4.24 | 17.65 | 0.8690 | -0.0280 | |||

| VMC / Vulcan Materials Company | 0.02 | -32.50 | 4.22 | -24.53 | 0.8644 | -0.5267 | |||

| LYV / Live Nation Entertainment, Inc. | 0.03 | 10.91 | 3.99 | 28.47 | 0.8186 | 0.0449 | |||

| FERG / Ferguson Enterprises Inc. | 0.02 | 3.98 | 0.8164 | 0.8164 | |||||

| TOST / Toast, Inc. | 0.09 | 34.71 | 3.91 | 63.66 | 0.8023 | 0.2844 | |||

| FIX / Comfort Systems USA, Inc. | 0.01 | -33.26 | 3.87 | 11.02 | 0.7927 | -0.0744 | |||

| SN / SharkNinja, Inc. | 0.04 | 23.60 | 3.69 | 25.67 | 0.7556 | 0.1204 | |||

| EXPE / Expedia Group, Inc. | 0.02 | 29.95 | 3.66 | 30.41 | 0.7507 | 0.0515 | |||

| NRG / NRG Energy, Inc. | 0.02 | 3.47 | 0.7109 | 0.7109 | |||||

| TPL / Texas Pacific Land Corporation | 0.00 | 3.35 | 0.6875 | 0.6875 | |||||

| DUOL / Duolingo, Inc. | 0.01 | -25.64 | 3.29 | -1.82 | 0.6738 | -0.1597 | |||

| SWK / Stanley Black & Decker, Inc. | 0.05 | 3.20 | 0.6560 | 0.6560 | |||||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.03 | 3.17 | 0.6491 | 0.6491 | |||||

| TPR / Tapestry, Inc. | 0.03 | 2.96 | 0.6073 | 0.6073 | |||||

| MDB / MongoDB, Inc. | 0.01 | -58.96 | 2.89 | -62.99 | 0.5928 | -1.0989 | |||

| PLNT / Planet Fitness, Inc. | 0.02 | 2.67 | 0.5474 | 0.5474 | |||||

| PODD / Insulet Corporation | 0.01 | -70.85 | 2.42 | -65.14 | 0.4966 | -1.2328 | |||

| BLD / TopBuild Corp. | 0.01 | 2.38 | 0.4875 | 0.4875 | |||||

| DECK / Deckers Outdoor Corporation | 0.02 | 2.14 | 0.4393 | 0.4393 | |||||

| RKT / Rocket Companies, Inc. | 0.11 | 1.55 | 0.3179 | 0.3179 | |||||

| YUM / Yum! Brands, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2028 |