Basic Stats

| Portfolio Value | $ 212,824,151 |

| Current Positions | 83 |

Latest Holdings, Performance, AUM (from 13F, 13D)

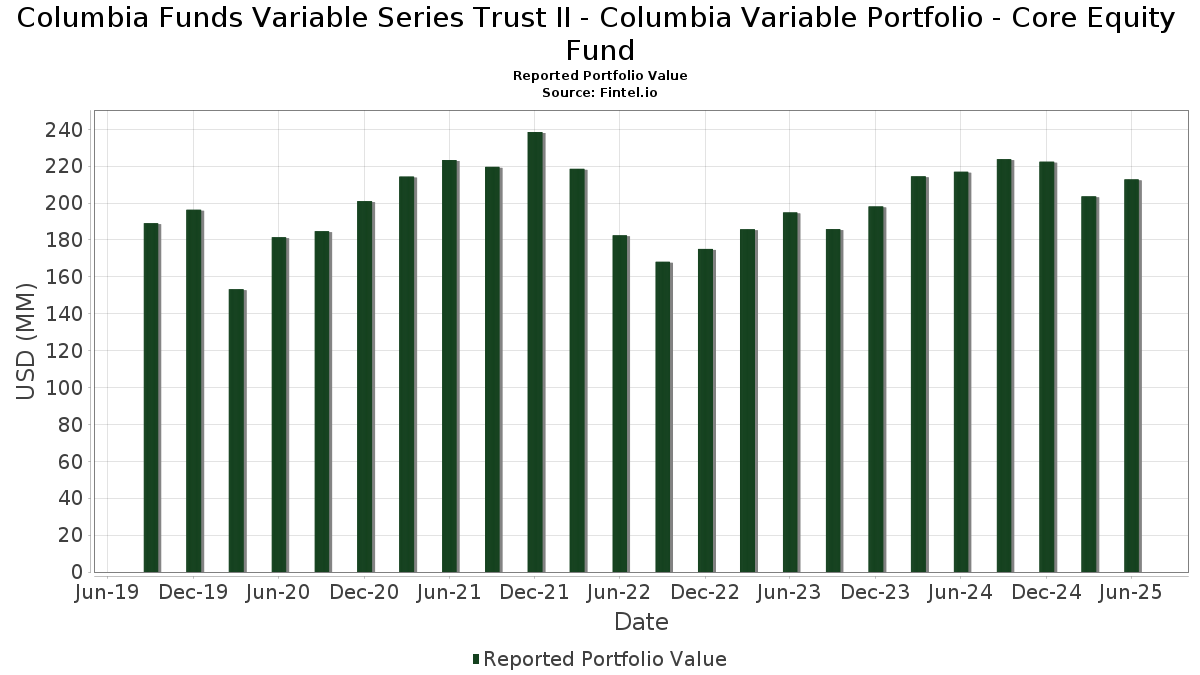

Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Core Equity Fund has disclosed 83 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 212,824,151 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Core Equity Fund’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Meta Platforms, Inc. (US:META) . Columbia Funds Variable Series Trust II - Columbia Variable Portfolio - Core Equity Fund’s new positions include Conagra Brands, Inc. (US:CAG) , Uber Technologies, Inc. (US:UBER) , Eastman Chemical Company (US:EMN) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 18.95 | 8.9039 | 2.2875 | |

| 0.03 | 3.65 | 1.7145 | 1.7145 | |

| 0.03 | 14.28 | 6.7084 | 1.0571 | |

| 0.01 | 3.33 | 1.5657 | 0.9577 | |

| 0.01 | 10.29 | 4.8347 | 0.7450 | |

| 0.02 | 1.86 | 0.8741 | 0.6353 | |

| 0.04 | 3.85 | 1.8110 | 0.5725 | |

| 0.06 | 1.21 | 0.5690 | 0.5690 | |

| 0.01 | 2.58 | 1.2099 | 0.4342 | |

| 0.00 | 0.84 | 0.3935 | 0.3935 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 11.37 | 5.3422 | -0.9230 | |

| 2.34 | 2.34 | 1.0977 | -0.8892 | |

| 0.00 | 0.98 | 0.4584 | -0.7562 | |

| 0.00 | 0.39 | 0.1822 | -0.7354 | |

| 0.01 | 1.71 | 0.8022 | -0.6962 | |

| 0.00 | 2.10 | 0.9843 | -0.5543 | |

| 0.01 | 0.41 | 0.1948 | -0.5536 | |

| 0.02 | 1.97 | 0.9265 | -0.5420 | |

| 0.02 | 1.18 | 0.5545 | -0.5007 | |

| 0.00 | 0.32 | 0.1503 | -0.4896 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.12 | -3.58 | 18.95 | 40.55 | 8.9039 | 2.2875 | |||

| MSFT / Microsoft Corporation | 0.03 | -6.43 | 14.28 | 23.98 | 6.7084 | 1.0571 | |||

| AAPL / Apple Inc. | 0.06 | -3.58 | 11.37 | -10.94 | 5.3422 | -0.9230 | |||

| GOOGL / Alphabet Inc. | 0.06 | -3.58 | 10.58 | 9.88 | 4.9723 | 0.2460 | |||

| META / Meta Platforms, Inc. | 0.01 | -3.58 | 10.29 | 23.48 | 4.8347 | 0.7450 | |||

| AMZN / Amazon.com, Inc. | 0.04 | -9.60 | 8.43 | 4.24 | 3.9581 | -0.0080 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -6.72 | 4.98 | 17.22 | 2.3417 | 0.2552 | |||

| C / Citigroup Inc. | 0.06 | -3.58 | 4.69 | 15.59 | 2.2014 | 0.2126 | |||

| CRM / Salesforce, Inc. | 0.02 | 10.19 | 4.40 | 11.98 | 2.0685 | 0.1389 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -3.58 | 3.98 | -0.03 | 1.8684 | -0.0836 | |||

| MO / Altria Group, Inc. | 0.07 | -10.29 | 3.93 | -12.39 | 1.8447 | -0.3540 | |||

| BLK / BlackRock, Inc. | 0.00 | -3.57 | 3.86 | 6.93 | 1.8125 | 0.0417 | |||

| ANET / Arista Networks Inc | 0.04 | 15.66 | 3.85 | 52.75 | 1.8110 | 0.5725 | |||

| FI / Fiserv, Inc. | 0.02 | 10.75 | 3.80 | -13.55 | 1.7873 | -0.3717 | |||

| SYF / Synchrony Financial | 0.06 | 4.40 | 3.78 | 31.64 | 1.7767 | 0.3668 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -16.48 | 3.70 | 0.16 | 1.7385 | -0.0744 | |||

| JCI / Johnson Controls International plc | 0.03 | 3.65 | 1.7145 | 1.7145 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | -3.58 | 3.59 | -13.62 | 1.6871 | -0.3527 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 5.90 | 3.57 | 6.88 | 1.6780 | 0.0384 | |||

| BMY / Bristol-Myers Squibb Company | 0.08 | 11.82 | 3.52 | -15.14 | 1.6516 | -0.3810 | |||

| V / Visa Inc. | 0.01 | 165.47 | 3.33 | 168.93 | 1.5657 | 0.9577 | |||

| CME / CME Group Inc. | 0.01 | 5.44 | 3.01 | 9.52 | 1.4159 | 0.0659 | |||

| RL / Ralph Lauren Corporation | 0.01 | -3.58 | 3.00 | 19.82 | 1.4088 | 0.1806 | |||

| CF / CF Industries Holdings, Inc. | 0.03 | -3.58 | 2.95 | 13.51 | 1.3861 | 0.1106 | |||

| SNA / Snap-on Incorporated | 0.01 | 29.00 | 2.70 | 19.13 | 1.2701 | 0.1564 | |||

| ADBE / Adobe Inc. | 0.01 | 61.50 | 2.58 | 62.97 | 1.2099 | 0.4342 | |||

| CVX / Chevron Corporation | 0.02 | 6.52 | 2.55 | -8.84 | 1.1973 | -0.1743 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 2.34 | -42.30 | 2.34 | -42.31 | 1.0977 | -0.8892 | |||

| MDT / Medtronic plc | 0.03 | -3.58 | 2.32 | -6.48 | 1.0911 | -0.1273 | |||

| NTAP / NetApp, Inc. | 0.02 | -21.87 | 2.28 | -5.23 | 1.0719 | -0.1095 | |||

| TPR / Tapestry, Inc. | 0.03 | 6.83 | 2.26 | 33.25 | 1.0620 | 0.2294 | |||

| PHM / PulteGroup, Inc. | 0.02 | -3.58 | 2.17 | -1.09 | 1.0187 | -0.0570 | |||

| VLO / Valero Energy Corporation | 0.02 | -9.79 | 2.11 | -8.17 | 0.9933 | -0.1367 | |||

| TT / Trane Technologies plc | 0.00 | -48.53 | 2.10 | -33.17 | 0.9843 | -0.5543 | |||

| ALL / The Allstate Corporation | 0.01 | 35.89 | 2.05 | 32.11 | 0.9646 | 0.2020 | |||

| BAX / Baxter International Inc. | 0.07 | -3.58 | 1.98 | -14.70 | 0.9322 | -0.2093 | |||

| MCK / McKesson Corporation | 0.00 | 21.98 | 1.98 | 32.89 | 0.9284 | 0.1983 | |||

| CL / Colgate-Palmolive Company | 0.02 | -32.08 | 1.97 | -34.09 | 0.9265 | -0.5420 | |||

| TSLA / Tesla, Inc. | 0.01 | -3.59 | 1.92 | 18.18 | 0.9012 | 0.1047 | |||

| TGT / Target Corporation | 0.02 | 379.44 | 1.86 | 250.28 | 0.8741 | 0.6353 | |||

| PCG / PG&E Corporation | 0.13 | -3.58 | 1.85 | -21.78 | 0.8676 | -0.2907 | |||

| DAL / Delta Air Lines, Inc. | 0.04 | -3.58 | 1.73 | 8.76 | 0.8108 | 0.0322 | |||

| AMT / American Tower Corporation | 0.01 | -44.95 | 1.71 | -44.09 | 0.8022 | -0.6962 | |||

| VTRS / Viatris Inc. | 0.18 | 3.34 | 1.61 | 6.01 | 0.7545 | 0.0107 | |||

| MAS / Masco Corporation | 0.02 | -28.03 | 1.42 | -33.38 | 0.6658 | -0.3782 | |||

| ABBV / AbbVie Inc. | 0.01 | -3.57 | 1.40 | -14.61 | 0.6567 | -0.1462 | |||

| TAP / Molson Coors Beverage Company | 0.03 | -3.58 | 1.34 | -23.81 | 0.6317 | -0.2344 | |||

| PNR / Pentair plc | 0.01 | 13.76 | 1.30 | 33.50 | 0.6104 | 0.1328 | |||

| CVS / CVS Health Corporation | 0.02 | 164.56 | 1.28 | 161.30 | 0.6030 | 0.3392 | |||

| CAG / Conagra Brands, Inc. | 0.06 | 1.21 | 0.5690 | 0.5690 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -3.60 | 1.20 | -11.49 | 0.5651 | -0.1017 | |||

| HOLX / Hologic, Inc. | 0.02 | -47.97 | 1.18 | -45.12 | 0.5545 | -0.5007 | |||

| EIX / Edison International | 0.02 | -3.58 | 1.09 | -15.55 | 0.5131 | -0.1215 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -3.58 | 1.06 | -12.57 | 0.4999 | -0.0975 | |||

| AVGO / Broadcom Inc. | 0.00 | -3.57 | 1.05 | 58.70 | 0.4930 | 0.1686 | |||

| SBAC / SBA Communications Corporation | 0.00 | -3.57 | 1.04 | 2.97 | 0.4882 | -0.0072 | |||

| NOW / ServiceNow, Inc. | 0.00 | -13.69 | 1.02 | 11.39 | 0.4781 | 0.0301 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -66.64 | 0.98 | -60.61 | 0.4584 | -0.7562 | |||

| FTNT / Fortinet, Inc. | 0.01 | -3.58 | 0.89 | 5.84 | 0.4176 | 0.0057 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -3.62 | 0.84 | 0.00 | 0.3943 | -0.0178 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.84 | 0.3935 | 0.3935 | |||||

| QRVO / Qorvo, Inc. | 0.01 | -44.56 | 0.83 | -35.00 | 0.3903 | -0.2367 | |||

| AMGN / Amgen Inc. | 0.00 | -3.59 | 0.75 | -13.59 | 0.3525 | -0.0736 | |||

| FOXA / Fox Corporation | 0.01 | 22.15 | 0.67 | 21.05 | 0.3134 | 0.0428 | |||

| IQV / IQVIA Holdings Inc. | 0.00 | -3.58 | 0.67 | -13.86 | 0.3127 | -0.0663 | |||

| UAL / United Airlines Holdings, Inc. | 0.01 | -3.58 | 0.61 | 11.19 | 0.2848 | 0.0173 | |||

| EXC / Exelon Corporation | 0.01 | 0.57 | 0.2671 | 0.2671 | |||||

| EXPE / Expedia Group, Inc. | 0.00 | -3.58 | 0.57 | -3.24 | 0.2671 | -0.0212 | |||

| NEM / Newmont Corporation | 0.01 | 0.53 | 0.2506 | 0.2506 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -3.51 | 0.50 | -20.13 | 0.2370 | -0.0729 | |||

| UBER / Uber Technologies, Inc. | 0.01 | 0.48 | 0.2244 | 0.2244 | |||||

| EMN / Eastman Chemical Company | 0.01 | 0.48 | 0.2232 | 0.2232 | |||||

| CSCO / Cisco Systems, Inc. | 0.01 | -82.52 | 0.41 | -74.51 | 0.1948 | -0.5536 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | -3.60 | 0.40 | 10.03 | 0.1857 | 0.0092 | |||

| AES / The AES Corporation | 0.04 | 0.39 | 0.1825 | 0.1825 | |||||

| CI / The Cigna Group | 0.00 | -79.36 | 0.39 | -79.30 | 0.1822 | -0.7354 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -63.80 | 0.35 | -35.60 | 0.1652 | -0.0829 | |||

| VRSN / VeriSign, Inc. | 0.00 | -82.20 | 0.32 | -70.49 | 0.1503 | -0.4896 | |||

| HST / Host Hotels & Resorts, Inc. | 0.02 | -3.58 | 0.30 | 4.50 | 0.1420 | -0.0003 | |||

| STLD / Steel Dynamics, Inc. | 0.00 | -71.68 | 0.29 | -71.06 | 0.1375 | -0.3579 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | -6.89 | 0.27 | -15.84 | 0.1277 | -0.0303 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.00 | -3.58 | 0.27 | -24.93 | 0.1274 | -0.0501 | |||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.07 | 0.0349 | 0.0349 | ||||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4030 |