Basic Stats

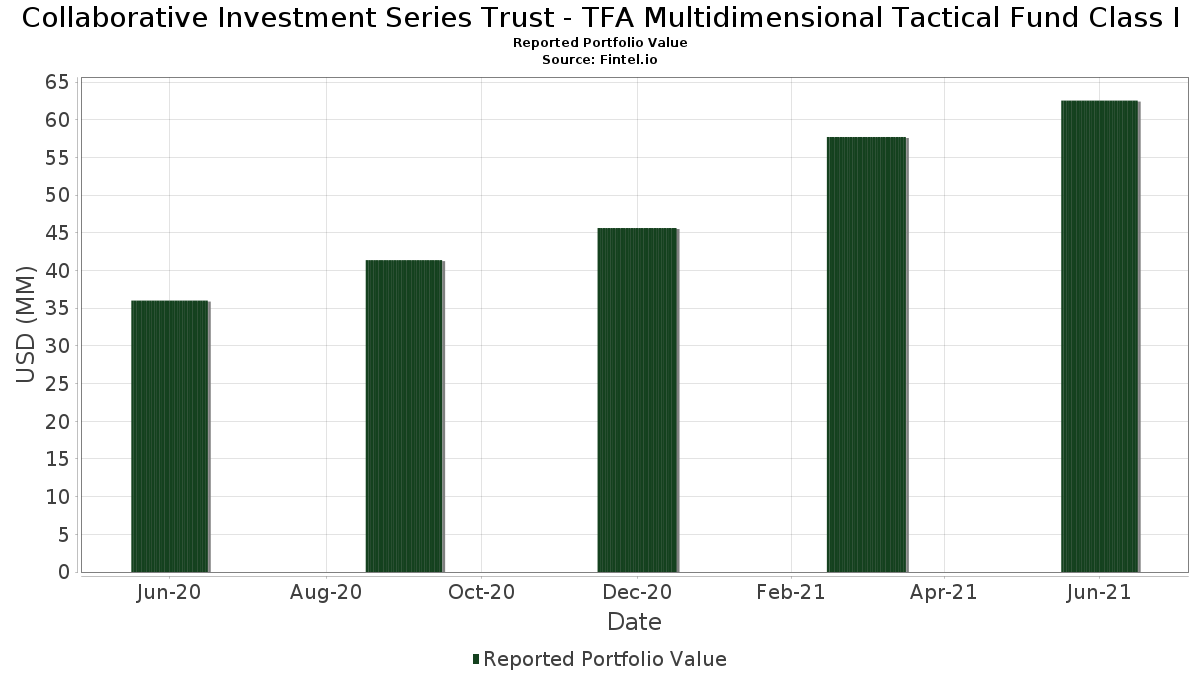

| Portfolio Value | $ 62,539,208 |

| Current Positions | 52 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Collaborative Investment Series Trust - TFA Multidimensional Tactical Fund Class I has disclosed 52 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 62,539,208 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Collaborative Investment Series Trust - TFA Multidimensional Tactical Fund Class I’s top holdings are Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , Repligen Corporation (US:RGEN) , Liberty Broadband Corporation (US:LBRDA) , Meta Platforms, Inc. (US:META) , and First American Funds Inc - First American Treasury Obligations Fund Class X (US:FXFXX) . Collaborative Investment Series Trust - TFA Multidimensional Tactical Fund Class I’s new positions include Repligen Corporation (US:RGEN) , Royal Gold, Inc. (US:RGLD) , News Corporation (US:NWSA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.33 | 2.1200 | 2.1200 | |

| 0.01 | 1.27 | 2.0300 | 2.0300 | |

| 0.05 | 1.23 | 1.9700 | 1.9700 | |

| 0.01 | 1.31 | 2.1000 | 0.4600 | |

| 0.04 | 1.12 | 1.8000 | 0.2000 | |

| 0.03 | 1.19 | 1.9100 | 0.1700 | |

| 0.01 | 1.12 | 1.7900 | 0.1600 | |

| 0.02 | 1.21 | 1.9400 | 0.1500 | |

| 0.00 | 1.32 | 2.1200 | 0.1400 | |

| 0.02 | 1.19 | 1.9000 | 0.1000 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.11 | 2.11 | 3.3800 | -5.3000 | |

| 1.32 | 1.32 | 2.1100 | -1.5800 | |

| 0.01 | 1.23 | 1.9700 | -0.7700 | |

| 0.01 | 1.14 | 1.8300 | -0.4500 | |

| 0.01 | 1.19 | 1.9100 | -0.3700 | |

| 0.01 | 1.24 | 1.9900 | -0.3400 | |

| 0.02 | 1.17 | 1.8700 | -0.3100 | |

| 0.00 | 1.10 | 1.7600 | -0.2700 | |

| 0.00 | 1.10 | 1.7500 | -0.2100 | |

| 0.00 | 1.16 | 1.8600 | -0.1900 |

13F and Fund Filings

This form was filed on 2021-08-18 for the reporting period 2021-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 2.11 | -57.88 | 2.11 | -57.88 | 3.3800 | -5.3000 | |||

| RGEN / Repligen Corporation | 0.01 | 1.33 | 2.1200 | 2.1200 | |||||

| LBRDA / Liberty Broadband Corporation | 0.00 | -0.81 | 1.32 | 15.96 | 2.1200 | 0.1400 | |||

| META / Meta Platforms, Inc. | 0.00 | -11.63 | 1.32 | 4.34 | 2.1100 | -0.0900 | |||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 1.32 | -38.12 | 1.32 | -38.15 | 2.1100 | -1.5800 | |||

| FTNT / Fortinet, Inc. | 0.01 | 7.81 | 1.31 | 39.19 | 2.1000 | 0.4600 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | 8.38 | 1.30 | 8.58 | 2.0900 | 0.0100 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -1.06 | 1.29 | 10.07 | 2.0600 | 0.0300 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | -0.53 | 1.29 | 5.93 | 2.0600 | -0.0500 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 2.27 | 1.29 | 10.29 | 2.0600 | 0.0400 | |||

| ETSY / Etsy, Inc. | 0.01 | 8.77 | 1.28 | 11.05 | 2.0400 | 0.0500 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.02 | -10.50 | 1.28 | 7.78 | 2.0400 | -0.0100 | |||

| SEDG / SolarEdge Technologies, Inc. | 0.00 | 12.20 | 1.27 | 7.89 | 2.0300 | -0.0100 | |||

| RGLD / Royal Gold, Inc. | 0.01 | 1.27 | 2.0300 | 2.0300 | |||||

| GRMN / Garmin Ltd. | 0.01 | -15.69 | 1.24 | -7.51 | 1.9900 | -0.3400 | |||

| CMCSA / Comcast Corporation | 0.02 | 7.39 | 1.24 | 13.21 | 1.9900 | 0.0900 | |||

| QDEL / QuidelOrtho Corporation | 0.01 | 12.79 | 1.24 | 12.91 | 1.9900 | 0.0800 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.01 | 5.75 | 1.24 | 9.28 | 1.9800 | 0.0200 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.01 | 6.87 | 1.23 | 7.88 | 1.9700 | -0.0100 | |||

| NWSA / News Corporation | 0.05 | 1.23 | 1.9700 | 1.9700 | |||||

| ADP / Automatic Data Processing, Inc. | 0.01 | 0.00 | 1.23 | 5.39 | 1.9700 | -0.0600 | |||

| PEP / PepsiCo, Inc. | 0.01 | -2.35 | 1.23 | 2.25 | 1.9700 | -0.1100 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.01 | -17.24 | 1.23 | -17.03 | 1.9700 | -0.7700 | |||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.01 | 0.00 | 1.23 | 6.52 | 1.9600 | -0.0400 | |||

| DOX / Amdocs Limited | 0.02 | 6.80 | 1.21 | 17.75 | 1.9400 | 0.1500 | |||

| MBB / iShares Trust - iShares MBS ETF | 0.01 | 4.67 | 1.21 | 4.48 | 1.9400 | -0.0700 | |||

| FOX / Fox Corporation | 0.03 | 5.23 | 1.20 | 5.99 | 1.9300 | -0.0400 | |||

| BWX / SPDR Series Trust - SPDR Bloomberg International Treasury Bond ETF | 0.04 | 4.35 | 1.20 | 5.09 | 1.9200 | -0.0500 | |||

| ENPH / Enphase Energy, Inc. | 0.01 | -19.75 | 1.19 | -9.14 | 1.9100 | -0.3700 | |||

| ON / ON Semiconductor Corporation | 0.03 | 29.24 | 1.19 | 18.98 | 1.9100 | 0.1700 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 7.34 | 1.19 | 14.59 | 1.9000 | 0.1000 | |||

| NTAP / NetApp, Inc. | 0.01 | -1.37 | 1.18 | 11.13 | 1.8800 | 0.0400 | |||

| HSIC / Henry Schein, Inc. | 0.02 | -13.19 | 1.17 | -6.98 | 1.8700 | -0.3100 | |||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0.01 | 0.00 | 1.17 | 3.27 | 1.8700 | -0.0900 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 4.93 | 1.16 | -1.44 | 1.8600 | -0.1900 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.01 | 8.94 | 1.15 | 8.87 | 1.8500 | 0.0100 | |||

| AGZ / iShares Trust - iShares Agency Bond ETF | 0.01 | -13.43 | 1.14 | -13.00 | 1.8300 | -0.4500 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.01 | 0.00 | 1.14 | 2.24 | 1.8300 | -0.1100 | |||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.01 | 0.00 | 1.14 | 0.44 | 1.8200 | -0.1400 | |||

| CSX / CSX Corporation | 0.04 | 265.00 | 1.12 | 21.51 | 1.8000 | 0.2000 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.01 | 22.86 | 1.12 | 19.13 | 1.7900 | 0.1600 | |||

| POOL / Pool Corporation | 0.00 | -29.41 | 1.10 | -6.22 | 1.7600 | -0.2700 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.00 | 5.88 | 1.10 | 11.84 | 1.7500 | 0.0500 | |||

| GOOGL / Alphabet Inc. | 0.00 | -18.21 | 1.10 | -3.18 | 1.7500 | -0.2100 | |||

| ZBRA / Zebra Technologies Corporation | 0.00 | 3.85 | 1.06 | 13.32 | 1.6900 | 0.0800 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | -6.42 | 1.03 | 10.01 | 1.6500 | 0.0200 | |||

| WDC / Western Digital Corporation | 0.01 | 2.30 | 1.01 | 9.04 | 1.6200 | 0.0100 | |||

| CZR / Caesars Entertainment, Inc. | 0.01 | -11.11 | 1.00 | 5.51 | 1.5900 | -0.0500 | |||

| SRPT / Sarepta Therapeutics, Inc. | 0.01 | 8.84 | 1.00 | 13.58 | 1.5900 | 0.0700 | |||

| VTRS / Viatris Inc. | 0.07 | 6.77 | 0.99 | 9.26 | 1.5900 | 0.0200 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.01 | -4.55 | 0.98 | 5.48 | 1.5700 | -0.0400 | |||

| LBTYA / Liberty Global Ltd. | 0.04 | -2.23 | 0.95 | 3.47 | 1.5300 | -0.0700 |