Basic Stats

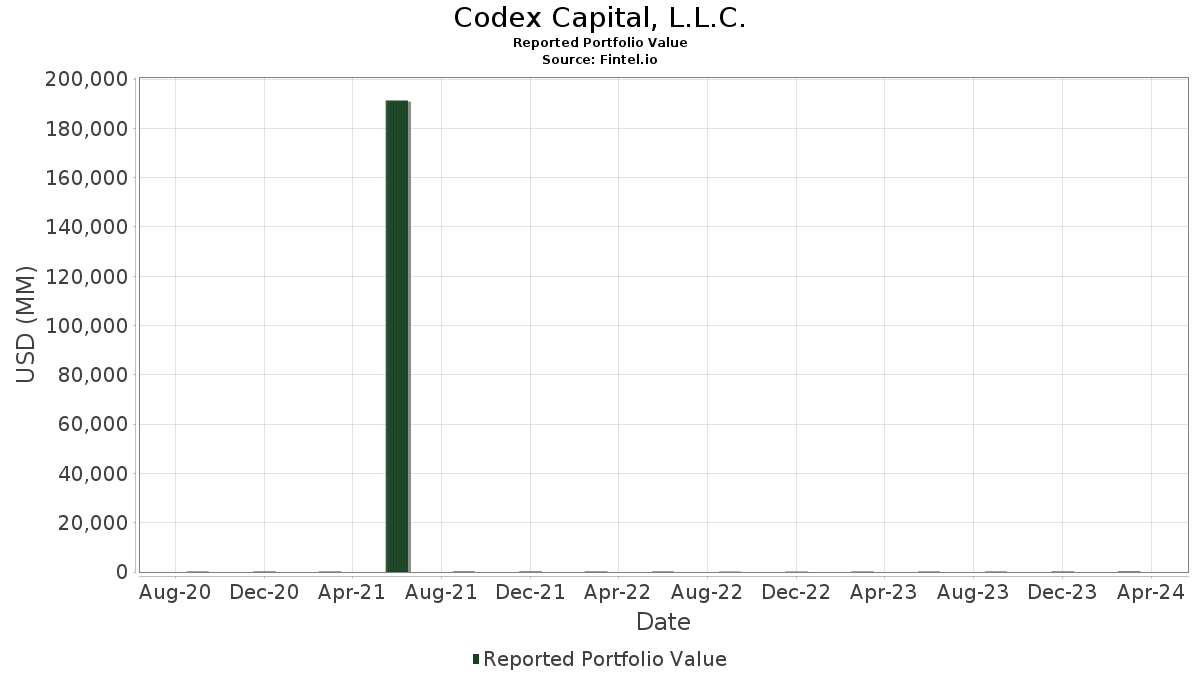

| Portfolio Value | $ 205,096,330 |

| Current Positions | 37 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Codex Capital, L.L.C. has disclosed 37 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 205,096,330 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Codex Capital, L.L.C.’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Meta Platforms, Inc. (US:META) , Eli Lilly and Company (US:LLY) , and Amazon.com, Inc. (US:AMZN) . Codex Capital, L.L.C.’s new positions include Eaton Corporation plc (US:ETN) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 4.21 | 2.0509 | 1.7255 | |

| 0.03 | 22.59 | 11.0138 | 1.7213 | |

| 0.05 | 7.13 | 3.4741 | 0.9786 | |

| 0.03 | 13.40 | 6.5345 | 0.8370 | |

| 0.02 | 13.23 | 6.4483 | 0.3291 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 6.83 | 3.3321 | -0.6535 | |

| 0.04 | 16.41 | 8.0002 | -0.5528 | |

| 0.04 | 5.29 | 2.5813 | -0.5063 | |

| 0.01 | 5.43 | 2.6488 | -0.4308 | |

| 0.00 | 2.09 | 1.0210 | -0.4229 | |

| 0.01 | 4.91 | 2.3948 | -0.3935 | |

| 0.02 | 8.48 | 4.1367 | -0.3595 | |

| 0.04 | 5.92 | 2.8884 | -0.3376 | |

| 0.01 | 6.25 | 3.0482 | -0.3304 | |

| 0.05 | 7.53 | 3.6731 | -0.3296 |

13F and Fund Filings

This form was filed on 2024-05-07 for the reporting period 2024-03-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.03 | -22.30 | 22.59 | 41.77 | 11.0138 | 1.7213 | |||

| MSFT / Microsoft Corporation | 0.04 | 0.00 | 16.41 | 11.89 | 8.0002 | -0.5528 | |||

| META / Meta Platforms, Inc. | 0.03 | 0.00 | 13.40 | 37.19 | 6.5345 | 0.8370 | |||

| LLY / Eli Lilly and Company | 0.02 | -5.56 | 13.23 | 26.05 | 6.4483 | 0.3291 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 0.00 | 8.60 | 18.72 | 4.1952 | -0.0316 | |||

| SPY / SPDR S&P 500 ETF | 0.02 | 0.00 | 8.48 | 10.05 | 4.1367 | -0.3595 | |||

| CRM / Salesforce, Inc. | 0.03 | 0.00 | 7.80 | 14.45 | 3.8034 | -0.1713 | |||

| GE / General Electric Company | 0.05 | 0.00 | 7.53 | 9.76 | 3.6731 | -0.3296 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | 0.00 | 7.37 | 17.90 | 3.5932 | -0.0520 | |||

| MRK / Merck & Co., Inc. | 0.05 | 37.58 | 7.13 | 66.51 | 3.4741 | 0.9786 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 0.00 | 6.83 | 0.00 | 3.3321 | -0.6535 | |||

| MA / Mastercard Incorporated | 0.01 | 0.00 | 6.79 | 13.09 | 3.3107 | -0.1910 | |||

| NOW / ServiceNow, Inc. | 0.01 | 0.00 | 6.25 | 7.91 | 3.0482 | -0.3304 | |||

| GOOG / Alphabet Inc. | 0.04 | 0.00 | 5.92 | 7.11 | 2.8884 | -0.3376 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 0.00 | 5.53 | 9.58 | 2.6984 | -0.2469 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 0.00 | 5.43 | 2.88 | 2.6488 | -0.4308 | |||

| GOOGL / Alphabet Inc. | 0.04 | 0.00 | 5.29 | 0.00 | 2.5813 | -0.5063 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 0.00 | 4.91 | 2.74 | 2.3948 | -0.3935 | |||

| V / Visa Inc. | 0.02 | 0.00 | 4.80 | 7.19 | 2.3404 | -0.2711 | |||

| ETN / Eaton Corporation plc | 0.01 | 4.69 | 0.0000 | ||||||

| JPM / JPMorgan Chase & Co. | 0.02 | 536.36 | 4.21 | 655.12 | 2.0509 | 1.7255 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | -4.35 | 3.97 | 17.11 | 1.9361 | -0.0412 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.04 | 0.00 | 3.74 | 17.59 | 1.8259 | -0.0315 | |||

| MRVL / Marvell Technology, Inc. | 0.05 | -5.56 | 3.61 | 11.10 | 1.7625 | -0.1349 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -7.41 | 3.10 | -0.10 | 1.5101 | -0.2982 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | 0.00 | 2.89 | 8.46 | 1.4072 | -0.1452 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 2.09 | -15.39 | 1.0210 | -0.4229 | |||

| IJK / iShares Trust - iShares S&P Mid-Cap 400 Growth ETF | 0.02 | 0.00 | 2.05 | 15.21 | 1.0011 | -0.0385 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 0.00 | 1.93 | -3.83 | 0.9420 | -0.2293 | |||

| ABNB / Airbnb, Inc. | 0.01 | 0.00 | 1.92 | 11.84 | 0.9354 | -0.0650 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 1.57 | 10.49 | 0.7651 | -0.0635 | |||

| ON / ON Semiconductor Corporation | 0.02 | 0.00 | 1.54 | -11.97 | 0.7531 | -0.2699 | |||

| NET / Cloudflare, Inc. | 0.01 | 0.00 | 1.22 | 16.30 | 0.5949 | -0.0169 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.75 | 7.93 | 0.3653 | -0.0395 | |||

| SPDW / SPDR Index Shares Funds - SPDR Portfolio Developed World ex-US ETF | 0.02 | 0.00 | 0.73 | 0.00 | 0.3570 | -0.0700 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.51 | -10.92 | 0.2508 | -0.0860 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.25 | 0.82 | 0.1204 | -0.0222 | |||

| SNOW / Snowflake Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |