Basic Stats

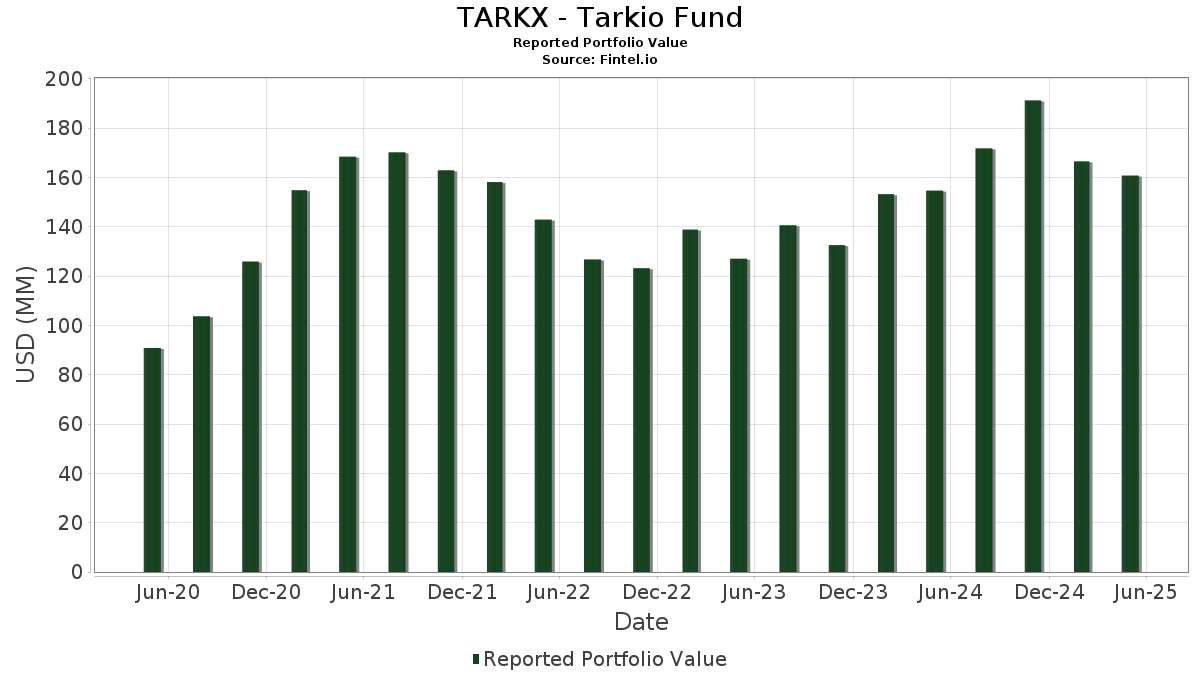

| Portfolio Value | $ 160,672,865 |

| Current Positions | 33 |

Latest Holdings, Performance, AUM (from 13F, 13D)

TARKX - Tarkio Fund has disclosed 33 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 160,672,865 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). TARKX - Tarkio Fund’s top holdings are The Hershey Company (US:HSY) , Lumen Technologies, Inc. (US:LUMN) , Cognex Corporation (US:CGNX) , The Manitowoc Company, Inc. (US:MTW) , and GE Vernova Inc. (US:GEV) . TARKX - Tarkio Fund’s new positions include Azenta, Inc. (US:AZTA) , Standard BioTools Inc. (US:LAB) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 10.39 | 6.4700 | 1.7000 | |

| 0.10 | 24.50 | 15.2500 | 1.3200 | |

| 0.06 | 1.61 | 1.0000 | 1.0000 | |

| 0.04 | 2.07 | 1.2900 | 0.6800 | |

| 1.36 | 14.28 | 8.8900 | 0.2800 | |

| 0.05 | 4.42 | 2.7500 | 0.2700 | |

| 0.06 | 2.78 | 1.7300 | 0.2100 | |

| 0.00 | 1.73 | 1.0800 | 0.1900 | |

| 0.22 | 6.29 | 3.9100 | 0.1700 | |

| 0.05 | 3.93 | 2.4400 | 0.0900 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.20 | 16.48 | 10.2600 | -1.6600 | |

| 0.12 | 3.65 | 2.2700 | -0.8800 | |

| 0.48 | 14.46 | 9.0000 | -0.6600 | |

| 0.01 | 4.50 | 2.8000 | -0.5700 | |

| 0.14 | 5.03 | 3.1300 | -0.4700 | |

| 0.06 | 7.27 | 4.5300 | -0.4100 | |

| 0.32 | 5.32 | 3.3100 | -0.3500 | |

| 0.04 | 7.32 | 4.5500 | -0.2800 | |

| 0.03 | 1.28 | 0.8000 | -0.2800 | |

| 0.02 | 1.76 | 1.0900 | -0.2200 |

13F and Fund Filings

This form was filed on 2025-07-30 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HSY / The Hershey Company | 0.10 | -11.07 | 24.50 | 5.66 | 15.2500 | 1.3200 | |||

| LUMN / Lumen Technologies, Inc. | 4.20 | 0.04 | 16.48 | -16.92 | 10.2600 | -1.6600 | |||

| CGNX / Cognex Corporation | 0.48 | -1.55 | 14.46 | -10.04 | 9.0000 | -0.6600 | |||

| MTW / The Manitowoc Company, Inc. | 1.36 | -1.84 | 14.28 | -0.32 | 8.8900 | 0.2800 | |||

| GEV / GE Vernova Inc. | 0.02 | -7.18 | 10.39 | 30.98 | 6.4700 | 1.7000 | |||

| DHR / Danaher Corporation | 0.04 | -0.52 | 7.32 | -9.07 | 4.5500 | -0.2800 | |||

| ESAB / ESAB Corporation | 0.06 | -9.90 | 7.27 | -11.57 | 4.5300 | -0.4100 | |||

| ATS / ATS Corporation | 0.22 | 1.35 | 6.29 | 0.95 | 3.9100 | 0.1700 | |||

| PH / Parker-Hannifin Corporation | 0.01 | -1.16 | 5.67 | -1.72 | 3.5300 | 0.0700 | |||

| MLKN / MillerKnoll, Inc. | 0.32 | 11.45 | 5.32 | -12.55 | 3.3100 | -0.3500 | |||

| VNT / Vontier Corporation | 0.14 | -12.33 | 5.03 | -16.10 | 3.1300 | -0.4700 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -18.31 | 4.50 | -19.88 | 2.8000 | -0.5700 | |||

| MOD / Modine Manufacturing Company | 0.05 | 0.00 | 4.42 | 7.38 | 2.7500 | 0.2700 | |||

| COHR / Coherent Corp. | 0.05 | 0.00 | 3.93 | 0.59 | 2.4400 | 0.0900 | |||

| ENOV / Enovis Corporation | 0.12 | -13.96 | 3.65 | -30.32 | 2.2700 | -0.8800 | |||

| CIEN / Ciena Corporation | 0.04 | 0.00 | 2.99 | 0.64 | 1.8600 | 0.0800 | |||

| TEX / Terex Corporation | 0.06 | -0.96 | 2.78 | 9.54 | 1.7300 | 0.2100 | |||

| CMCO / Columbus McKinnon Corporation | 0.19 | 16.10 | 2.76 | -3.02 | 1.7200 | 0.0100 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.35 | 2.16 | -3.14 | 1.3400 | 0.0000 | |||

| IP / International Paper Company | 0.04 | 141.14 | 2.07 | 104.55 | 1.2900 | 0.6800 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.02 | 0.00 | 1.76 | -19.25 | 1.0900 | -0.2200 | |||

| FRFHF / Fairfax Financial Holdings Limited | 0.00 | 0.00 | 1.73 | 17.64 | 1.0800 | 0.1900 | |||

| TILE / Interface, Inc. | 0.08 | -1.08 | 1.65 | -1.79 | 1.0300 | 0.0200 | |||

| AZTA / Azenta, Inc. | 0.06 | 1.61 | 1.0000 | 1.0000 | |||||

| NUE / Nucor Corporation | 0.01 | 0.00 | 1.40 | -20.48 | 0.8700 | -0.1900 | |||

| VLTO / Veralto Corporation | 0.01 | 0.00 | 1.32 | 1.23 | 0.8200 | 0.0400 | |||

| JOE / The St. Joe Company | 0.03 | -23.65 | 1.28 | -28.82 | 0.8000 | -0.2800 | |||

| LITE / Lumentum Holdings Inc. | 0.02 | 0.00 | 1.21 | 2.72 | 0.7500 | 0.0400 | |||

| GPN / Global Payments Inc. | 0.01 | 0.00 | 1.03 | -28.17 | 0.6400 | -0.2200 | |||

| GLW / Corning Incorporated | 0.01 | 0.00 | 0.67 | -1.04 | 0.4200 | 0.0100 | |||

| GOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD | 0.64 | 18.14 | 0.64 | 18.01 | 0.4000 | 0.0700 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.06 | -3.17 | 0.0400 | 0.0000 | |||

| LAB / Standard BioTools Inc. | 0.06 | 0.06 | 0.0300 | 0.0300 | |||||

| ATKR / Atkore Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0700 |