Basic Stats

| Portfolio Value | $ 9,212,665,094 |

| Current Positions | 146 |

Latest Holdings, Performance, AUM (from 13F, 13D)

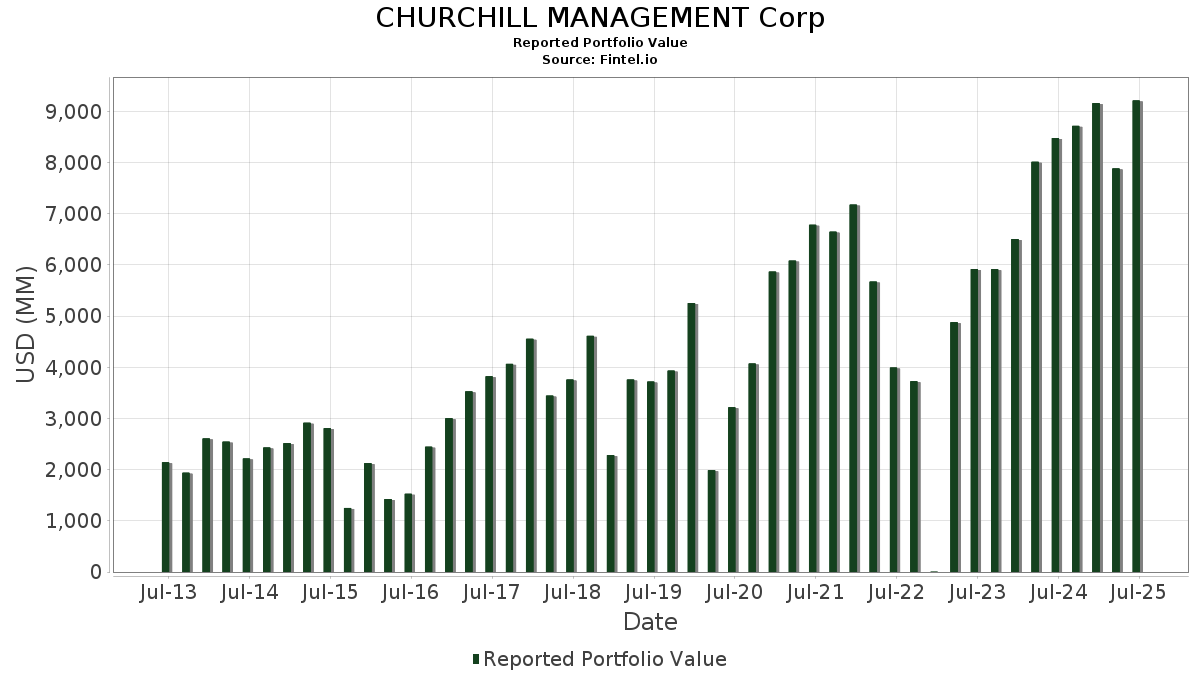

CHURCHILL MANAGEMENT Corp has disclosed 146 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 9,212,665,094 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). CHURCHILL MANAGEMENT Corp’s top holdings are The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) , Invesco QQQ Trust, Series 1 (US:QQQ) , SPDR S&P 500 ETF (US:SPY) , The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund (US:XLF) , and iShares Trust - iShares Core S&P 500 ETF (US:IVV) . CHURCHILL MANAGEMENT Corp’s new positions include iShares Trust - iShares MSCI USA Momentum Factor ETF (US:MTUM) , Palantir Technologies Inc. (US:PLTR) , WisdomTree Trust - WisdomTree Efficient Gold Plus Equity Strategy Fund (US:GDE) , Coinbase Global, Inc. (US:COIN) , and Guidewire Software, Inc. (US:GWRE) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.69 | 454.53 | 4.9338 | 4.9338 | |

| 0.95 | 224.22 | 2.4338 | 2.4338 | |

| 0.92 | 220.29 | 2.3911 | 2.3911 | |

| 4.81 | 1,218.01 | 13.2211 | 1.1221 | |

| 0.17 | 23.74 | 0.2577 | 0.2577 | |

| 0.29 | 79.35 | 0.8613 | 0.2301 | |

| 0.04 | 50.98 | 0.5533 | 0.1627 | |

| 0.39 | 61.40 | 0.6665 | 0.1547 | |

| 0.16 | 18.13 | 0.1968 | 0.1352 | |

| 0.05 | 12.40 | 0.1346 | 0.1346 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.58 | 246.84 | 2.6794 | -3.6523 | |

| 2.31 | 310.81 | 3.3738 | -1.6087 | |

| 2.56 | 452.76 | 4.9146 | -0.6879 | |

| 10.08 | 527.76 | 5.7286 | -0.6600 | |

| 2.34 | 189.85 | 2.0607 | -0.3448 | |

| 0.86 | 490.81 | 5.3275 | -0.3234 | |

| 0.83 | 513.10 | 5.5695 | -0.2977 | |

| 0.53 | 234.72 | 2.5478 | -0.2826 | |

| 1.07 | 659.32 | 7.1567 | -0.2616 | |

| 1.31 | 721.07 | 7.8270 | -0.2423 |

13F and Fund Filings

This form was filed on 2025-07-18 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 4.81 | 4.11 | 1,218.01 | 27.69 | 13.2211 | 1.1221 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 1.31 | -3.66 | 721.07 | 13.34 | 7.8270 | -0.2423 | |||

| SPY / SPDR S&P 500 ETF | 1.07 | 2.06 | 659.32 | 12.73 | 7.1567 | -0.2616 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 10.08 | -0.35 | 527.76 | 4.78 | 5.7286 | -0.6600 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.83 | 0.38 | 513.10 | 10.92 | 5.5695 | -0.2977 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.86 | -0.33 | 490.81 | 10.16 | 5.3275 | -0.3234 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.69 | 454.53 | 4.9338 | 4.9338 | |||||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 2.56 | 0.18 | 452.76 | 2.50 | 4.9146 | -0.6879 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 3.99 | -0.68 | 433.21 | 11.76 | 4.7024 | -0.2140 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 2.31 | -14.29 | 310.81 | -20.88 | 3.3738 | -1.6087 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.80 | 0.78 | 271.31 | 11.56 | 2.9450 | -0.1395 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 1.71 | -0.71 | 251.55 | 11.75 | 2.7305 | -0.1245 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.58 | -57.95 | 246.84 | -50.55 | 2.6794 | -3.6523 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.53 | 0.22 | 234.72 | 5.18 | 2.5478 | -0.2826 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.95 | 224.22 | 2.4338 | 2.4338 | |||||

| MTUM / iShares Trust - iShares MSCI USA Momentum Factor ETF | 0.92 | 220.29 | 2.3911 | 2.3911 | |||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 1.00 | -0.21 | 218.24 | 9.83 | 2.3689 | -0.1514 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 2.34 | 0.97 | 189.85 | 0.10 | 2.0607 | -0.3448 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.98 | 0.05 | 79.74 | 3.61 | 0.8655 | -0.1106 | |||

| AVGO / Broadcom Inc. | 0.29 | -3.16 | 79.35 | 59.43 | 0.8613 | 0.2301 | |||

| NVDA / NVIDIA Corporation | 0.39 | 4.40 | 61.40 | 52.18 | 0.6665 | 0.1547 | |||

| MSFT / Microsoft Corporation | 0.10 | 2.76 | 52.17 | 36.16 | 0.5663 | 0.0803 | |||

| NFLX / Netflix, Inc. | 0.04 | 15.26 | 50.98 | 65.52 | 0.5533 | 0.1627 | |||

| AAPL / Apple Inc. | 0.23 | 3.94 | 48.15 | -4.00 | 0.5226 | -0.1135 | |||

| CAH / Cardinal Health, Inc. | 0.24 | 0.44 | 40.81 | 22.47 | 0.4429 | 0.0204 | |||

| GOOGL / Alphabet Inc. | 0.20 | 1.06 | 35.55 | 15.17 | 0.3859 | -0.0056 | |||

| GE / General Electric Company | 0.12 | 16.79 | 31.38 | 50.18 | 0.3406 | 0.0756 | |||

| META / Meta Platforms, Inc. | 0.04 | 0.29 | 29.25 | 28.43 | 0.3175 | 0.0286 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.06 | 0.36 | 28.23 | 44.98 | 0.3064 | 0.0594 | |||

| STX / Seagate Technology Holdings plc | 0.18 | 0.07 | 26.32 | 70.03 | 0.2857 | 0.0894 | |||

| HD / The Home Depot, Inc. | 0.07 | -0.36 | 24.84 | -0.32 | 0.2696 | -0.0464 | |||

| GEV / GE Vernova Inc. | 0.05 | 0.22 | 24.78 | 73.71 | 0.2690 | 0.0880 | |||

| WRB / W. R. Berkley Corporation | 0.33 | -0.25 | 24.48 | 2.99 | 0.2657 | -0.0357 | |||

| PLTR / Palantir Technologies Inc. | 0.17 | 23.74 | 0.2577 | 0.2577 | |||||

| OKE / ONEOK, Inc. | 0.28 | -0.71 | 22.85 | -18.32 | 0.2481 | -0.1068 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | 109.89 | 21.75 | 148.08 | 0.2361 | 0.1249 | |||

| BSX / Boston Scientific Corporation | 0.20 | -0.52 | 21.02 | 5.92 | 0.2281 | -0.0235 | |||

| WFC / Wells Fargo & Company | 0.25 | 1.36 | 20.38 | 13.12 | 0.2212 | -0.0073 | |||

| IBM / International Business Machines Corporation | 0.07 | -0.40 | 20.35 | 18.08 | 0.2209 | 0.0023 | |||

| AMZN / Amazon.com, Inc. | 0.09 | -5.81 | 18.96 | 8.61 | 0.2058 | -0.0156 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.04 | 1.76 | 18.79 | -7.19 | 0.2040 | -0.0528 | |||

| GILD / Gilead Sciences, Inc. | 0.16 | 277.32 | 18.13 | 273.35 | 0.1968 | 0.1352 | |||

| PM / Philip Morris International Inc. | 0.09 | -0.04 | 16.82 | 14.70 | 0.1826 | -0.0034 | |||

| V / Visa Inc. | 0.05 | 1.67 | 16.67 | 3.01 | 0.1810 | -0.0243 | |||

| TDG / TransDigm Group Incorporated | 0.01 | 45.92 | 16.11 | 60.42 | 0.1748 | 0.0475 | |||

| DGX / Quest Diagnostics Incorporated | 0.09 | 0.44 | 15.95 | 6.64 | 0.1732 | -0.0166 | |||

| CCL / Carnival Corporation & plc | 0.56 | 2.89 | 15.81 | 48.15 | 0.1716 | 0.0363 | |||

| XOM / Exxon Mobil Corporation | 0.14 | 0.63 | 15.62 | -8.79 | 0.1695 | -0.0476 | |||

| AIG / American International Group, Inc. | 0.18 | 2.80 | 15.37 | 1.20 | 0.1668 | -0.0258 | |||

| MO / Altria Group, Inc. | 0.26 | 0.42 | 15.14 | -1.91 | 0.1643 | -0.0314 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.19 | -1.45 | 14.91 | 8.78 | 0.1618 | -0.0120 | |||

| KMI / Kinder Morgan, Inc. | 0.50 | 0.96 | 14.72 | 4.04 | 0.1598 | -0.0197 | |||

| AZO / AutoZone, Inc. | 0.00 | 3.28 | 14.62 | 0.54 | 0.1587 | -0.0257 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.11 | -1.80 | 14.58 | 15.91 | 0.1583 | -0.0013 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.16 | -1.28 | 14.42 | 7.98 | 0.1565 | -0.0129 | |||

| GWW / W.W. Grainger, Inc. | 0.01 | 3.02 | 14.24 | 8.49 | 0.1546 | -0.0119 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.29 | -0.86 | 13.95 | 9.44 | 0.1514 | -0.0103 | |||

| JXN / Jackson Financial Inc. | 0.16 | -1.10 | 13.86 | 4.82 | 0.1505 | -0.0173 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.07 | -1.46 | 12.92 | 1.72 | 0.1402 | -0.0209 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.23 | 0.80 | 12.87 | 12.72 | 0.1397 | -0.0051 | |||

| AB / AllianceBernstein Holding L.P. - Limited Partnership | 0.31 | -2.01 | 12.86 | 4.44 | 0.1395 | -0.0166 | |||

| DASH / DoorDash, Inc. | 0.05 | 492.90 | 12.74 | 699.62 | 0.1383 | 0.1181 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.05 | 12.40 | 0.1346 | 0.1346 | |||||

| ORI / Old Republic International Corporation | 0.32 | -2.30 | 12.33 | -4.24 | 0.1338 | -0.0295 | |||

| J / Jacobs Solutions Inc. | 0.09 | 12.10 | 0.1313 | 0.1313 | |||||

| BIPC / Brookfield Infrastructure Corporation | 0.29 | 1.36 | 11.91 | 16.51 | 0.1293 | -0.0004 | |||

| AROC / Archrock, Inc. | 0.48 | 3.54 | 11.81 | -2.02 | 0.1282 | -0.0247 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.07 | -0.55 | 11.80 | 3.92 | 0.1281 | -0.0159 | |||

| VICI / VICI Properties Inc. | 0.34 | 1.97 | 11.23 | 1.91 | 0.1219 | -0.0179 | |||

| ADI / Analog Devices, Inc. | 0.04 | 4.46 | 10.66 | 23.29 | 0.1157 | 0.0060 | |||

| LNC / Lincoln National Corporation | 0.30 | 1.36 | 10.39 | -2.33 | 0.1128 | -0.0221 | |||

| F / Ford Motor Company | 0.95 | 10.33 | 0.1121 | 0.1121 | |||||

| GDE / WisdomTree Trust - WisdomTree Efficient Gold Plus Equity Strategy Fund | 0.22 | 10.29 | 0.1117 | 0.1117 | |||||

| EVRG / Evergy, Inc. | 0.15 | 4.98 | 10.15 | 4.95 | 0.1102 | -0.0125 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | -16.64 | 9.79 | -23.46 | 0.1063 | -0.0560 | |||

| EXR / Extra Space Storage Inc. | 0.06 | 4.37 | 9.53 | 3.63 | 0.1034 | -0.0132 | |||

| CARR / Carrier Global Corporation | 0.13 | -1.02 | 9.49 | 14.27 | 0.1030 | -0.0023 | |||

| COIN / Coinbase Global, Inc. | 0.03 | 9.40 | 0.1020 | 0.1020 | |||||

| T / AT&T Inc. | 0.32 | 1.50 | 9.38 | 3.86 | 0.1018 | -0.0127 | |||

| FNF / Fidelity National Financial, Inc. | 0.17 | -1.93 | 9.35 | -15.53 | 0.1015 | -0.0389 | |||

| DG / Dollar General Corporation | 0.08 | 2.92 | 9.29 | 33.88 | 0.1009 | 0.0128 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.33 | 9.01 | 4.33 | 0.0978 | -0.0117 | |||

| PFE / Pfizer Inc. | 0.37 | 13.53 | 9.00 | 8.61 | 0.0976 | -0.0074 | |||

| PFG / Principal Financial Group, Inc. | 0.11 | 2.99 | 8.94 | -3.04 | 0.0971 | -0.0199 | |||

| DUK / Duke Energy Corporation | 0.07 | -0.61 | 8.82 | -3.85 | 0.0958 | -0.0206 | |||

| KEY / KeyCorp | 0.51 | 4.23 | 8.81 | 13.55 | 0.0956 | -0.0028 | |||

| MET / MetLife, Inc. | 0.11 | -2.03 | 8.58 | -1.88 | 0.0931 | -0.0178 | |||

| GWRE / Guidewire Software, Inc. | 0.04 | 8.51 | 0.0924 | 0.0924 | |||||

| SPOT / Spotify Technology S.A. | 0.01 | 122.59 | 8.42 | 210.55 | 0.0914 | 0.0570 | |||

| AES / The AES Corporation | 0.77 | 2.34 | 8.10 | -13.31 | 0.0879 | -0.0306 | |||

| AMD / Advanced Micro Devices, Inc. | 0.06 | 7.89 | 0.0857 | 0.0857 | |||||

| UBER / Uber Technologies, Inc. | 0.08 | 7.83 | 0.0850 | 0.0850 | |||||

| FFIV / F5, Inc. | 0.03 | 7.76 | 0.0842 | 0.0842 | |||||

| JHG / Janus Henderson Group plc | 0.20 | -2.29 | 7.66 | 4.98 | 0.0831 | -0.0094 | |||

| VZ / Verizon Communications Inc. | 0.17 | 3.52 | 7.36 | -1.25 | 0.0799 | -0.0147 | |||

| DIS / The Walt Disney Company | 0.06 | -0.67 | 7.03 | 24.80 | 0.0763 | 0.0049 | |||

| ETR / Entergy Corporation | 0.08 | 9.83 | 6.86 | 6.79 | 0.0745 | -0.0070 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.03 | -1.00 | 6.70 | -11.30 | 0.0727 | -0.0231 | |||

| D / Dominion Energy, Inc. | 0.12 | 6.57 | 0.0713 | 0.0713 | |||||

| QCOM / QUALCOMM Incorporated | 0.03 | -23.62 | 5.54 | -20.81 | 0.0601 | -0.0286 | |||

| ORCL / Oracle Corporation | 0.02 | 1.75 | 5.10 | 59.11 | 0.0554 | 0.0147 | |||

| FE / FirstEnergy Corp. | 0.13 | 5.06 | 0.0550 | 0.0550 | |||||

| EXEL / Exelixis, Inc. | 0.11 | 4.64 | 0.0504 | 0.0504 | |||||

| ATGE / Adtalem Global Education Inc. | 0.04 | 4.47 | 0.0486 | 0.0486 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.02 | -7.30 | 4.40 | -2.74 | 0.0478 | -0.0096 | |||

| UHS / Universal Health Services, Inc. | 0.02 | -0.91 | 4.02 | -4.49 | 0.0437 | -0.0097 | |||

| CAVA / CAVA Group, Inc. | 0.05 | -1.90 | 3.82 | -4.38 | 0.0415 | -0.0092 | |||

| MCK / McKesson Corporation | 0.01 | 3.74 | 0.0406 | 0.0406 | |||||

| PEN / Penumbra, Inc. | 0.01 | 3.73 | 0.0405 | 0.0405 | |||||

| APP / AppLovin Corporation | 0.01 | -0.56 | 3.67 | 31.41 | 0.0399 | 0.0044 | |||

| KEYS / Keysight Technologies, Inc. | 0.02 | -0.76 | 3.49 | 8.58 | 0.0379 | -0.0029 | |||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.01 | 3.30 | 0.0358 | 0.0358 | |||||

| ZS / Zscaler, Inc. | 0.01 | -1.57 | 3.24 | 55.69 | 0.0352 | 0.0088 | |||

| TALEN ENERGY CORP COM / (87422J105) | 0.01 | 3.14 | 0.0000 | ||||||

| CPRT / Copart, Inc. | 0.06 | -0.40 | 3.02 | -13.63 | 0.0327 | -0.0116 | |||

| WMT / Walmart Inc. | 0.03 | 3.00 | 0.0325 | 0.0325 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | 2.78 | 0.0302 | 0.0302 | |||||

| BTSG / BrightSpring Health Services, Inc. | 0.12 | -2.69 | 2.71 | 26.88 | 0.0295 | 0.0023 | |||

| CR / Crane Company | 0.01 | 2.36 | 0.0256 | 0.0256 | |||||

| CPNG / Coupang, Inc. | 0.08 | -1.17 | 2.31 | 35.01 | 0.0251 | 0.0034 | |||

| GLW / Corning Incorporated | 0.04 | -1.82 | 2.24 | 12.76 | 0.0243 | -0.0009 | |||

| SHAK / Shake Shack Inc. | 0.02 | 2.21 | 0.0240 | 0.0240 | |||||

| RKLB / Rocket Lab Corporation | 0.06 | 2.18 | 0.0237 | 0.0237 | |||||

| FTNT / Fortinet, Inc. | 0.02 | -2.46 | 2.15 | 7.12 | 0.0234 | -0.0021 | |||

| WAY / Waystar Holding Corp. | 0.05 | -2.06 | 2.02 | 7.17 | 0.0219 | -0.0020 | |||

| SEIC / SEI Investments Company | 0.02 | -1.89 | 1.88 | 13.58 | 0.0204 | -0.0006 | |||

| CVX / Chevron Corporation | 0.01 | -2.23 | 1.76 | -16.29 | 0.0191 | -0.0076 | |||

| IR / Ingersoll Rand Inc. | 0.02 | -1.63 | 1.49 | 2.26 | 0.0162 | -0.0023 | |||

| PWR / Quanta Services, Inc. | 0.00 | -1.76 | 1.47 | 46.09 | 0.0160 | 0.0032 | |||

| MA / Mastercard Incorporated | 0.00 | -1.60 | 1.42 | 0.85 | 0.0154 | -0.0024 | |||

| SPYG / SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF | 0.01 | 4.99 | 1.35 | 24.45 | 0.0147 | 0.0009 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -1.70 | 1.35 | 7.83 | 0.0147 | -0.0012 | |||

| TOST / Toast, Inc. | 0.03 | -1.20 | 1.32 | 31.86 | 0.0143 | 0.0016 | |||

| DXJ / WisdomTree Trust - WisdomTree Japan Hedged Equity Fund | 0.01 | 1.30 | 0.0141 | 0.0141 | |||||

| ETN / Eaton Corporation plc | 0.00 | 1.29 | 0.0139 | 0.0139 | |||||

| MELI / MercadoLibre, Inc. | 0.00 | -1.22 | 1.27 | 32.36 | 0.0138 | 0.0016 | |||

| BA / The Boeing Company | 0.01 | 1.15 | 0.0125 | 0.0125 | |||||

| C / Citigroup Inc. | 0.01 | 1.14 | 0.0124 | 0.0124 | |||||

| FXI / iShares Trust - iShares China Large-Cap ETF | 0.03 | -1.43 | 0.92 | 1.10 | 0.0100 | -0.0016 | |||

| CYBR / CyberArk Software Ltd. | 0.00 | -0.47 | 0.85 | 19.94 | 0.0093 | 0.0002 | |||

| HNGE / Hinge Health, Inc. | 0.02 | 0.83 | 0.0090 | 0.0090 | |||||

| AS / Amer Sports, Inc. | 0.02 | 0.65 | 0.0070 | 0.0070 | |||||

| UPS / United Parcel Service, Inc. | 0.01 | 0.52 | 0.0056 | 0.0056 | |||||

| GOOG / Alphabet Inc. | 0.00 | -0.85 | 0.37 | 12.69 | 0.0041 | -0.0002 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | -29.89 | 0.29 | -21.49 | 0.0031 | -0.0015 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.00 | -86.91 | 0.22 | -85.55 | 0.0024 | -0.0169 | |||

| FBCG / Fidelity Covington Trust - Fidelity Blue Chip Growth ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOW / ServiceNow, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DOCU / DocuSign, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| 30162U104 / ExeLED Holdings, Inc. | 0.50 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| DOC / Healthpeak Properties, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CIWV / Citizens Financial Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SIMBA ESSEL ENERGY INC COM / (82857V103) | 0.03 | 0.00 | 0.0000 | ||||||

| ARCADIA RES INC COM / (039209101) | 0.36 | 0.00 | 0.0000 | ||||||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ASPIRE INTL INC COM / (04537N103) | 0.01 | 0.00 | 0.0000 | ||||||

| ENERGULF RES INC COM / (29266X105) | 0.02 | 0.00 | 0.0000 | ||||||

| HIMS / Hims & Hers Health, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0062 | ||||

| BAC / Bank of America Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VALENTINE BEAUTY INC COM / (91912D107) | 0.01 | 0.00 | 0.0000 | ||||||

| ENTERTAINMENT SHS / (738ESC995) | 0.08 | 0.00 | 0.0000 | ||||||

| RKLB / Rocket Lab Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VIRTUAL ED LINK INC RESTRICTED / (92826J990) | 0.12 | 0.00 | 0.0000 | ||||||

| FIRSTPLUS FINL GROUP INC COM / (33763B103) | 0.18 | 0.00 | 0.0000 | ||||||

| IBIZ TECHNOLOGY CORP NEW / (45103B205) | 0.01 | 0.00 | 0.0000 | ||||||

| INTERNATIONAL GOLD RES INC COM / (45956C201) | 0.02 | 0.00 | 0.0000 | ||||||

| NBVG / NutriPure Beverages, Inc. | 0.10 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| NEWPORT DIGITAL TECH INC COM / (651833105) | 0.01 | 0.00 | 0.0000 | ||||||

| CLBT / Cellebrite DI Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INCY / Incyte Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1421 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLV / iShares Silver Trust | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US699CVR0317 / Paratek Pharmaceuticals Inc SHS | 0.01 | 0.00 | 0.0000 | 0.0000 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XYZ / Block, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IEX / IDEX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CAT / Caterpillar Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EMN / Eastman Chemical Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IOT / Samsara Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VPOR / Vapor Group, Inc. | 0.15 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| AIZ / Assurant, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMNE / American Green Group, Inc. | 0.09 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| LHHMQ / Lehman Brothers Holdings Capital Trust V - 6% PRF REDEEM 22/04/2053 USD 25 - Ser M | 0.03 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| TXT / Textron Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IUSV / iShares Trust - iShares Core S&P U.S. Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BLTA / Baltia Air Lines, Inc. | 0.07 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VST / Vistra Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDT / Medtronic plc | 0.00 | -100.00 | 0.00 | 0.0000 |