Basic Stats

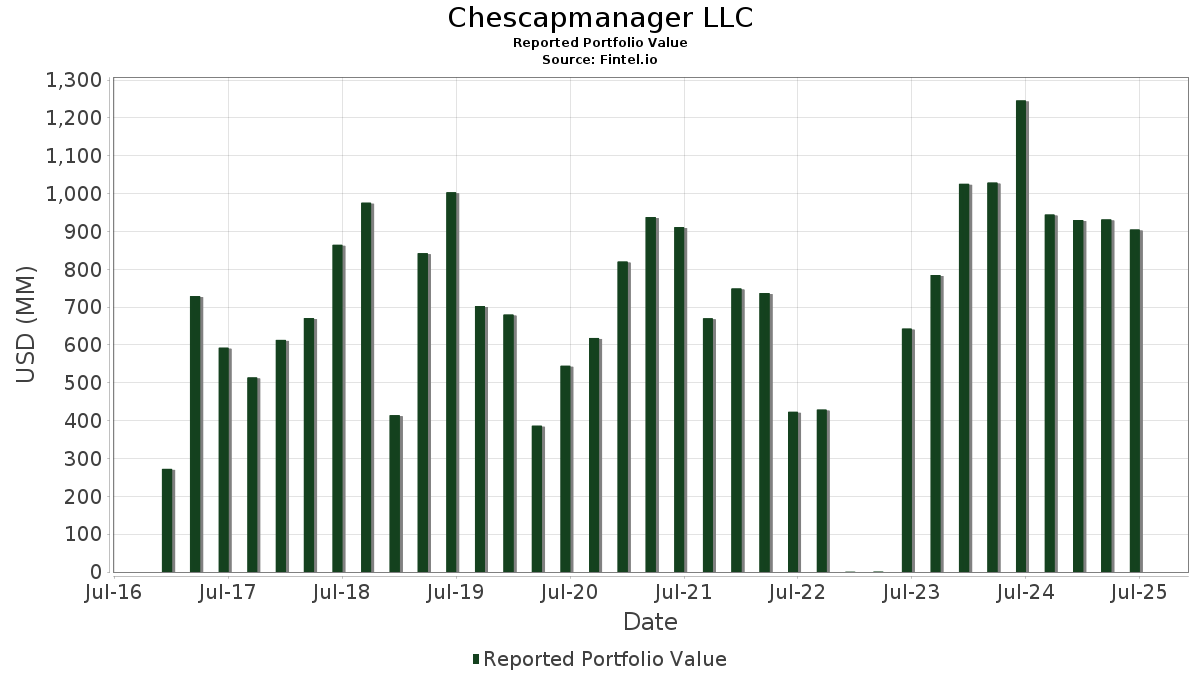

| Portfolio Value | $ 904,930,510 |

| Current Positions | 25 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Chescapmanager LLC has disclosed 25 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 904,930,510 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Chescapmanager LLC’s top holdings are NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , NVIDIA Corporation (US:NVDA) , Vertiv Holdings Co (US:VRT) , and Vertiv Holdings Co (US:VRT) . Chescapmanager LLC’s new positions include Cognition Therapeutics, Inc. (US:CGTX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.75 | 118.49 | 13.0941 | 10.1854 | |

| 0.25 | 44.06 | 4.8686 | 4.8686 | |

| 0.50 | 64.20 | 7.0950 | 3.2196 | |

| 0.48 | 62.18 | 6.8708 | 3.1179 | |

| 0.46 | 73.08 | 8.0762 | 2.6941 | |

| 0.12 | 60.13 | 6.6450 | 1.7732 | |

| 0.32 | 27.33 | 3.0201 | 1.7621 | |

| 0.44 | 32.93 | 3.6392 | 1.6789 | |

| 0.29 | 41.79 | 4.6176 | 1.5987 | |

| 0.35 | 76.79 | 8.4853 | 1.3367 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 5.24 | 0.5786 | -4.7707 | |

| 0.00 | 0.00 | -1.6853 | ||

| 0.00 | 0.00 | -1.1047 | ||

| 0.46 | 8.90 | 0.9834 | -0.0132 | |

| 0.58 | 27.87 | 3.0803 | -0.0021 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | Call | 0.75 | 200.00 | 118.49 | 337.32 | 13.0941 | 10.1854 | ||

| AMZN / Amazon.com, Inc. | Call | 0.35 | 0.00 | 76.79 | 15.31 | 8.4853 | 1.3367 | ||

| NVDA / NVIDIA Corporation | 0.46 | 0.00 | 73.08 | 45.78 | 8.0762 | 2.6941 | |||

| VRT / Vertiv Holdings Co | Call | 0.50 | 0.00 | 64.20 | 77.85 | 7.0950 | 3.2196 | ||

| VRT / Vertiv Holdings Co | 0.48 | 0.00 | 62.18 | 77.86 | 6.8708 | 3.1179 | |||

| MSFT / Microsoft Corporation | 0.12 | 0.00 | 60.13 | 32.50 | 6.6450 | 1.7732 | |||

| GOOGL / Alphabet Inc. | 0.28 | 0.00 | 48.55 | 13.96 | 5.3652 | 0.7917 | |||

| GOOGL / Alphabet Inc. | Call | 0.25 | 44.06 | 4.8686 | 4.8686 | ||||

| USFD / US Foods Holding Corp. | 0.57 | -1.73 | 43.78 | 15.61 | 4.8376 | 0.7726 | |||

| BWXT / BWX Technologies, Inc. | 0.29 | 1.75 | 41.79 | 48.59 | 4.6176 | 1.5987 | |||

| CCJ / Cameco Corporation | 0.44 | 0.00 | 32.93 | 80.35 | 3.6392 | 1.6789 | |||

| MIR / Mirion Technologies, Inc. | 1.33 | 0.00 | 28.59 | 48.48 | 3.1593 | 1.0923 | |||

| KBR / KBR, Inc. | 0.58 | 0.87 | 27.87 | -2.92 | 3.0803 | -0.0021 | |||

| C / Citigroup Inc. | 0.32 | 94.50 | 27.33 | 133.22 | 3.0201 | 1.7621 | |||

| DIS / The Walt Disney Company | 0.22 | 0.00 | 26.97 | 25.64 | 2.9806 | 0.6760 | |||

| AMZN / Amazon.com, Inc. | 0.12 | 0.00 | 26.22 | 15.31 | 2.8971 | 0.4564 | |||

| WSC / WillScot Holdings Corporation | 0.90 | 0.00 | 24.56 | -1.44 | 2.7137 | 0.0390 | |||

| FTI / TechnipFMC plc | 0.60 | 0.00 | 20.65 | 8.68 | 2.2814 | 0.2421 | |||

| FUN / Six Flags Entertainment Corporation | 0.64 | 59.02 | 19.39 | 35.65 | 2.1432 | 0.6084 | |||

| CRON / Cronos Group Inc. | 7.95 | 0.00 | 15.18 | 5.53 | 1.6780 | 0.1332 | |||

| OWL / Blue Owl Capital Inc. | 0.46 | 0.00 | 8.90 | -4.14 | 0.9834 | -0.0132 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.15 | 0.00 | 7.85 | 5.08 | 0.8679 | 0.0655 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | Call | 0.10 | -90.00 | 5.24 | -89.49 | 0.5786 | -4.7707 | ||

| CGTX / Cognition Therapeutics, Inc. | 0.50 | 0.16 | 0.0172 | 0.0172 | |||||

| GRABW / Grab Holdings Limited - Equity Warrant | 0.10 | 0.00 | 0.04 | 2.63 | 0.0043 | 0.0002 | |||

| SPY / SPDR S&P 500 ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CCJ / Cameco Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.1047 | |||

| GRAB / Grab Holdings Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WSC / WillScot Holdings Corporation | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.6853 | |||

| SNOW / Snowflake Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CPNG / Coupang, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |