Basic Stats

| Portfolio Value | $ 11,684,000 |

| Current Positions | 29 |

Latest Holdings, Performance, AUM (from 13F, 13D)

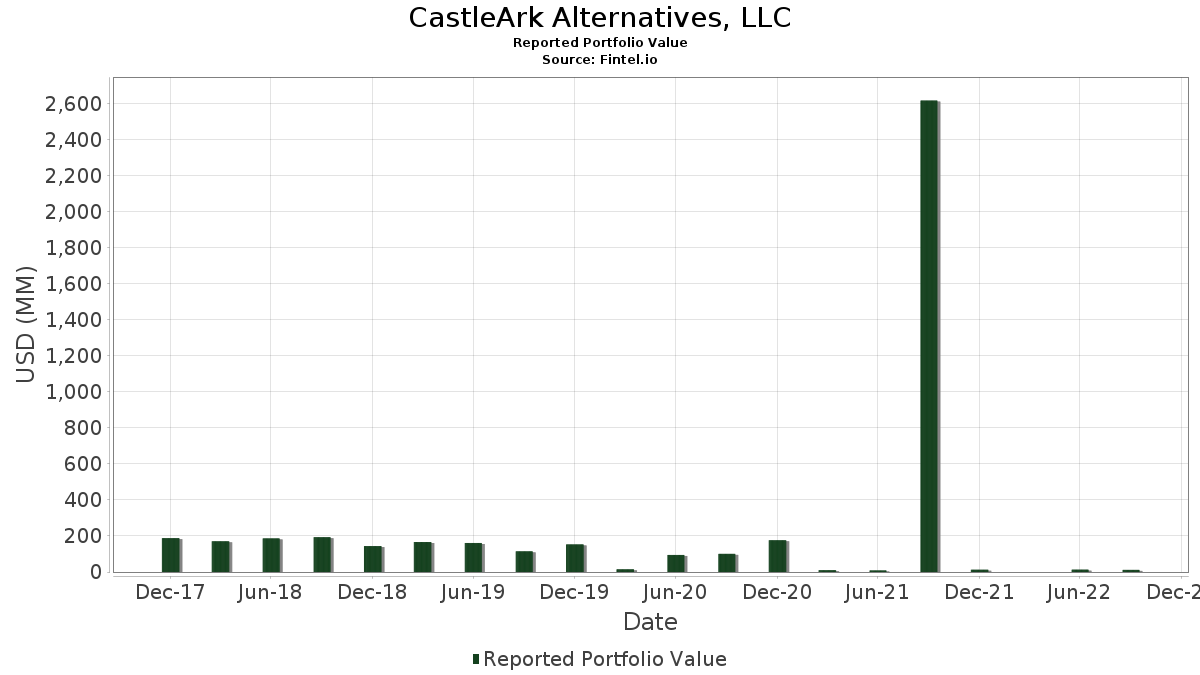

CastleArk Alternatives, LLC has disclosed 29 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 11,684,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). CastleArk Alternatives, LLC’s top holdings are ProShares Trust - ProShares UltraPro QQQ (US:TQQQ) , Southwestern Energy Company (US:SWN) , EQT Corporation (US:EQT) , Cheniere Energy, Inc. (US:LNG) , and Invesco QQQ Trust, Series 1 (US:QQQ) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.44 | 3.7744 | 3.7744 | |

| 0.03 | 0.39 | 3.3208 | 3.3208 | |

| 0.02 | 0.66 | 5.6145 | 1.3449 | |

| 0.00 | 0.57 | 4.8528 | 1.3398 | |

| 0.01 | 0.50 | 4.2965 | 1.0923 | |

| 0.00 | 0.49 | 4.2109 | 0.8755 | |

| 0.01 | 0.43 | 3.6631 | 0.6366 | |

| 0.01 | 0.44 | 3.7316 | 0.5275 | |

| 0.12 | 0.71 | 6.0596 | 0.4774 | |

| 0.01 | 0.38 | 3.2095 | 0.4300 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.9957 | ||

| 0.00 | 0.10 | 0.8216 | -2.3207 | |

| 0.01 | 0.20 | 1.7289 | -2.1470 | |

| 0.00 | 0.10 | 0.8388 | -1.6782 | |

| 0.01 | 0.16 | 1.3865 | -1.6400 | |

| 0.01 | 0.20 | 1.7374 | -1.3818 | |

| 0.00 | 0.17 | 1.4379 | -1.1332 | |

| 0.00 | 0.16 | 1.3437 | -1.0883 | |

| 0.10 | 1.83 | 15.7052 | -0.9717 | |

| 0.01 | 0.30 | 2.5419 | -0.3765 |

13F and Fund Filings

This form was filed on 2022-11-18 for the reporting period 2022-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TQQQ / ProShares Trust - ProShares UltraPro QQQ | 0.10 | 5.56 | 1.83 | -15.05 | 15.7052 | -0.9717 | |||

| SWN / Southwestern Energy Company | 0.12 | 0.00 | 0.71 | -2.07 | 6.0596 | 0.4774 | |||

| EQT / EQT Corporation | 0.02 | 0.00 | 0.66 | 18.63 | 5.6145 | 1.3449 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.00 | 0.57 | 24.62 | 4.8528 | 1.3398 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.54 | -4.63 | 4.5789 | 0.2475 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 0.00 | 0.50 | 20.96 | 4.2965 | 1.0923 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.49 | 13.89 | 4.2109 | 0.8755 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.46 | 0.44 | 3.8942 | 0.3967 | |||

| CTRA / Coterra Energy Inc. | 0.02 | 0.00 | 0.44 | 1.14 | 3.7830 | 0.4090 | |||

| SLB / Schlumberger Limited | 0.01 | 0.44 | 3.7744 | 3.7744 | |||||

| MTDR / Matador Resources Company | 0.01 | 0.00 | 0.44 | 5.06 | 3.7316 | 0.5275 | |||

| DVN / Devon Energy Corporation | 0.01 | 0.00 | 0.43 | 9.18 | 3.6631 | 0.6366 | |||

| AR / Antero Resources Corporation | 0.01 | 0.00 | 0.40 | -0.49 | 3.4492 | 0.3222 | |||

| PTEN / Patterson-UTI Energy, Inc. | 0.03 | 0.39 | 3.3208 | 3.3208 | |||||

| MGY / Magnolia Oil & Gas Corporation | 0.02 | 0.00 | 0.38 | -5.68 | 3.2694 | 0.1425 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | 0.00 | 0.38 | 4.17 | 3.2095 | 0.4300 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.34 | -0.59 | 2.8928 | 0.2678 | |||

| HP / Helmerich & Payne, Inc. | 0.01 | 0.00 | 0.33 | -14.17 | 2.7987 | -0.1429 | |||

| PDCE / PDC Energy Inc | 0.01 | 0.00 | 0.30 | -5.94 | 2.5762 | 0.1055 | |||

| HAL / Halliburton Company | 0.01 | 0.00 | 0.30 | -21.43 | 2.5419 | -0.3765 | |||

| IWML / ETRACS 2x Leveraged US Size Factor TR ETN | 0.01 | 0.00 | 0.20 | -4.67 | 1.7460 | 0.0937 | |||

| MRO / Marathon Oil Corporation | 0.01 | -49.99 | 0.20 | -49.75 | 1.7374 | -1.3818 | |||

| DK / Delek US Holdings, Inc. | 0.01 | -61.59 | 0.20 | -59.76 | 1.7289 | -2.1470 | |||

| EOG / EOG Resources, Inc. | 0.00 | -50.05 | 0.17 | -49.55 | 1.4379 | -1.1332 | |||

| RRC / Range Resources Corporation | 0.01 | -59.47 | 0.16 | -58.67 | 1.3865 | -1.6400 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | -50.00 | 0.16 | -50.16 | 1.3437 | -1.0883 | |||

| PXD / Pioneer Natural Resources Company | 0.00 | -69.04 | 0.10 | -69.94 | 0.8388 | -1.6782 | |||

| TS / Tenaris S.A. - Depositary Receipt (Common Stock) | 0.00 | -76.44 | 0.10 | -76.41 | 0.8216 | -2.3207 | |||

| LBRT / Liberty Energy Inc. | 0.01 | 0.00 | 0.09 | 0.00 | 0.7360 | 0.0721 | |||

| BKR / Baker Hughes Company | 0.00 | -100.00 | 0.00 | -100.00 | -2.9957 |