Basic Stats

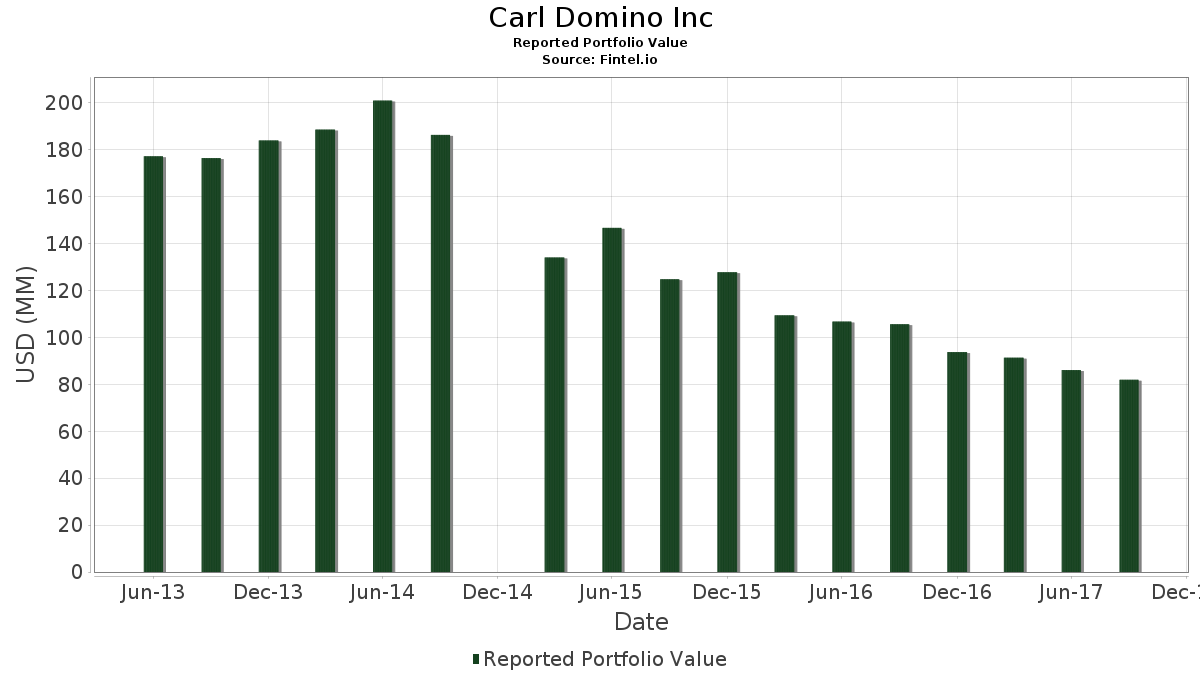

| Portfolio Value | $ 81,960,000 |

| Current Positions | 115 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Carl Domino Inc has disclosed 115 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 81,960,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Carl Domino Inc’s top holdings are Huntsman Corporation (US:HUN) , Apple Inc. (US:AAPL) , Prologis, Inc. (US:PLD) , Bank of America Corporation (US:BAC) , and JPMorgan Chase & Co. (US:JPM) . Carl Domino Inc’s new positions include Lumen Technologies, Inc. (US:LUMN) , Vivani Medical Inc (US:EYES) , Neurotrope Inc (DE:47W) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 1.50 | 1.8302 | 1.8302 | |

| 0.02 | 1.39 | 1.6923 | 1.6923 | |

| 0.08 | 1.97 | 2.4048 | 1.4849 | |

| 0.02 | 1.11 | 1.3531 | 1.3531 | |

| 0.06 | 1.10 | 1.3372 | 1.3372 | |

| 0.04 | 1.09 | 1.3299 | 1.3299 | |

| 0.07 | 0.96 | 1.1713 | 1.1713 | |

| 0.02 | 0.95 | 1.1579 | 1.1579 | |

| 0.02 | 1.43 | 1.7399 | 1.1196 | |

| 0.02 | 0.42 | 0.5185 | 0.5185 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.3729 | ||

| 0.00 | 0.00 | -1.1580 | ||

| 0.00 | 0.00 | -0.8642 | ||

| 0.00 | 0.00 | -0.5807 | ||

| 0.00 | 0.00 | -0.4902 | ||

| 0.00 | 0.00 | -0.4263 | ||

| 0.03 | 1.12 | 1.3690 | -0.2978 | |

| 0.00 | 0.00 | -0.2915 | ||

| 0.02 | 1.11 | 1.3568 | -0.2391 | |

| 0.01 | 1.07 | 1.3055 | -0.1917 |

13F and Fund Filings

This form was filed on 2017-11-07 for the reporting period 2017-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HUN / Huntsman Corporation | 0.09 | -5.11 | 2.56 | 0.67 | 3.1259 | 0.1699 | |||

| AAPL / Apple Inc. | 0.01 | -3.64 | 2.23 | 3.15 | 2.7208 | 0.2097 | |||

| PLD / Prologis, Inc. | 0.03 | -5.28 | 2.16 | 2.52 | 2.6354 | 0.1882 | |||

| BAC / Bank of America Corporation | 0.08 | 138.16 | 1.97 | 148.86 | 2.4048 | 1.4849 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | -6.56 | 1.97 | -2.38 | 2.3987 | 0.0595 | |||

| LVS / Las Vegas Sands Corp. | 0.03 | -7.16 | 1.78 | -6.77 | 2.1669 | -0.0457 | |||

| HD / The Home Depot, Inc. | 0.01 | -6.69 | 1.65 | -0.54 | 2.0168 | 0.0864 | |||

| MSFT / Microsoft Corporation | 0.02 | -6.88 | 1.59 | 0.63 | 1.9375 | 0.1047 | |||

| CMI / Cummins Inc. | 0.01 | -8.40 | 1.57 | -5.15 | 1.9107 | -0.0069 | |||

| CY / Cypress Semiconductor Corp. | 0.10 | -10.36 | 1.50 | -1.38 | 1.8302 | 1.8302 | |||

| GLW / Corning Incorporated | 0.05 | -8.44 | 1.43 | -8.82 | 1.7399 | -0.0767 | |||

| DOW / Dow Inc. | 0.02 | 211.24 | 1.43 | 167.04 | 1.7399 | 1.1196 | |||

| HPQ / HP Inc. | 0.07 | -10.83 | 1.43 | 1.78 | 1.7399 | 0.1126 | |||

| HWC / Hancock Whitney Corporation | 0.03 | -9.32 | 1.39 | -10.36 | 1.6996 | -0.1054 | |||

| VFC / V.F. Corporation | 0.02 | 35.96 | 1.39 | 50.11 | 1.6923 | 1.6923 | |||

| CCL / Carnival Corporation & plc | 0.02 | -8.29 | 1.37 | -9.68 | 1.6740 | -0.0903 | |||

| IVZ / Invesco Ltd. | 0.04 | -8.79 | 1.34 | -9.13 | 1.6398 | -0.0780 | |||

| UNP / Union Pacific Corporation | 0.01 | -9.40 | 1.32 | -3.50 | 1.6166 | 0.0219 | |||

| CAIAF / CA Immobilien Anlagen AG | 0.04 | 16.97 | 1.31 | 13.30 | 1.6008 | 0.2558 | |||

| US0549371070 / BB&T Corp. | 0.03 | -7.01 | 1.30 | -3.92 | 1.5849 | 0.0146 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -8.33 | 1.26 | -0.47 | 1.5398 | 0.0670 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | -8.45 | 1.24 | -1.66 | 1.5178 | 0.0485 | |||

| US8865471085 / Tiffany & Co. | 0.01 | -10.46 | 1.22 | -12.46 | 1.4910 | -0.1305 | |||

| SLB / Schlumberger Limited | 0.02 | 6.26 | 1.22 | 12.56 | 1.4873 | 0.2294 | |||

| AMGN / Amgen Inc. | 0.01 | -9.65 | 1.20 | -2.19 | 1.4690 | 0.0392 | |||

| EXAS / Exact Sciences Corporation | 0.03 | 0.00 | 1.18 | 33.26 | 1.4373 | 0.4105 | |||

| MRK / Merck & Co., Inc. | 0.02 | -8.36 | 1.17 | -8.51 | 1.4300 | -0.0579 | |||

| GE / General Electric Company | 0.05 | -5.62 | 1.16 | -15.54 | 1.4190 | -0.1804 | |||

| EMR / Emerson Electric Co. | 0.02 | 4.93 | 1.14 | 10.59 | 1.3885 | 0.1933 | |||

| PNR / Pentair plc | 0.02 | -8.50 | 1.13 | -6.59 | 1.3836 | -0.0265 | |||

| TPR / Tapestry, Inc. | 0.03 | -8.11 | 1.12 | -21.81 | 1.3690 | -0.2978 | |||

| AIG / American International Group, Inc. | 0.02 | -17.56 | 1.11 | -19.07 | 1.3568 | -0.2391 | |||

| OXY / Occidental Petroleum Corporation | 0.02 | 21.24 | 1.11 | 30.01 | 1.3531 | 1.3531 | |||

| LUMN / Lumen Technologies, Inc. | 0.06 | 1.10 | 1.3372 | 1.3372 | |||||

| VIAB / Viacom, Inc. | 0.04 | 31.53 | 1.09 | 9.11 | 1.3299 | 1.3299 | |||

| MTG / MGIC Investment Corporation | 0.09 | 0.00 | 1.09 | 11.91 | 1.3299 | 0.1986 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -8.91 | 1.07 | -16.99 | 1.3055 | -0.1917 | |||

| DE / Deere & Company | 0.01 | -16.85 | 1.07 | -15.53 | 1.3006 | -0.1652 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -5.03 | 1.06 | 8.69 | 1.2970 | 0.1610 | |||

| WY / Weyerhaeuser Company | 0.03 | -8.01 | 1.05 | -6.57 | 1.2848 | -0.0242 | |||

| WYNN / Wynn Resorts, Limited | 0.01 | -11.43 | 1.02 | -1.64 | 1.2469 | 0.0402 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -7.74 | 1.00 | -13.14 | 1.2262 | -0.1176 | |||

| KMI / Kinder Morgan, Inc. | 0.05 | -9.07 | 0.98 | -8.98 | 1.1994 | -0.0550 | |||

| MET / MetLife, Inc. | 0.02 | -6.03 | 0.97 | -11.12 | 1.1896 | -0.0846 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -12.32 | 0.96 | 0.31 | 1.1713 | 0.0598 | |||

| PBI / Pitney Bowes Inc. | 0.07 | 21.04 | 0.96 | 12.28 | 1.1713 | 1.1713 | |||

| HOG / Harley-Davidson, Inc. | 0.02 | -7.53 | 0.96 | -17.52 | 1.1664 | -0.1797 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -11.63 | 0.95 | -17.05 | 1.1579 | 1.1579 | |||

| CL / Colgate-Palmolive Company | 0.01 | -10.66 | 0.93 | -12.25 | 1.1359 | -0.0964 | |||

| SIRI / Sirius XM Holdings Inc. | 0.12 | -1.05 | 0.67 | -0.15 | 0.8126 | 0.0379 | |||

| SRPT / Sarepta Therapeutics, Inc. | 0.01 | 0.00 | 0.59 | 34.70 | 0.7199 | 0.2111 | |||

| PFE / Pfizer Inc. | 0.02 | 3.79 | 0.54 | 10.27 | 0.6552 | 0.0896 | |||

| / TD AmeriTrade Holding Corp. | 0.01 | 0.00 | 0.49 | 13.49 | 0.5954 | 0.0960 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | 0.00 | 0.47 | 8.47 | 0.5783 | 0.0708 | |||

| T / AT&T Inc. | 0.01 | 5.42 | 0.46 | 9.33 | 0.5576 | 0.0721 | |||

| US2692464017 / E*TRADE Financial, Inc. | 0.01 | 0.00 | 0.44 | 14.74 | 0.5320 | 0.0906 | |||

| BOX / Box, Inc. | 0.02 | 0.00 | 0.42 | 5.99 | 0.5185 | 0.5185 | |||

| DHI / D.R. Horton, Inc. | 0.01 | 0.00 | 0.42 | 15.43 | 0.5112 | 0.0896 | |||

| CARB / Carbonite, Inc. | 0.02 | 0.00 | 0.42 | 0.97 | 0.5100 | 0.0291 | |||

| EXP / Eagle Materials Inc. | 0.00 | 0.00 | 0.38 | 15.32 | 0.4685 | 0.0817 | |||

| MGM / MGM Resorts International | 0.01 | 0.00 | 0.38 | 4.10 | 0.4649 | 0.0398 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.37 | 1.36 | 0.4539 | 0.0276 | |||

| EGHT / 8x8, Inc. | 0.03 | 0.00 | 0.36 | -7.12 | 0.4453 | -0.0111 | |||

| NAT / Nordic American Tankers Limited | 0.07 | 20.16 | 0.35 | 1.16 | 0.4270 | 0.0252 | |||

| AMRN / Amarin Corporation plc - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 0.34 | -13.16 | 0.4185 | -0.0403 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 0.00 | 0.32 | 7.74 | 0.3904 | 0.0455 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.32 | 3.26 | 0.3868 | 0.0302 | |||

| 91911K102 / Bausch Health Companies | 0.02 | 0.00 | 0.32 | -17.32 | 0.3843 | 0.3843 | |||

| VRAY / ViewRay Inc. | 0.05 | -1.82 | 0.31 | -12.64 | 0.3795 | 0.3795 | |||

| OMCL / Omnicell, Inc. | 0.01 | -14.29 | 0.31 | 1.32 | 0.3734 | 0.0226 | |||

| US00401C1080 / Acacia Communications, Inc. | 0.01 | 18.18 | 0.31 | 34.21 | 0.3734 | 0.3734 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.00 | 0.29 | 4.69 | 0.3538 | 0.0321 | |||

| STML / Stemline Therapeutics, Inc. | 0.03 | 0.00 | 0.29 | 20.92 | 0.3526 | 0.0750 | |||

| FTNT / Fortinet, Inc. | 0.01 | 0.00 | 0.29 | -4.33 | 0.3502 | 0.0017 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.28 | -1.73 | 0.3465 | 0.0108 | |||

| SGEN / Seagen Inc | 0.01 | 0.00 | 0.28 | 5.20 | 0.3453 | 0.0328 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.28 | 0.3355 | 0.3355 | |||||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.27 | -14.78 | 0.3306 | -0.0387 | |||

| AKAM / Akamai Technologies, Inc. | 0.01 | 0.00 | 0.26 | -2.23 | 0.3209 | 0.0084 | |||

| RIG / Transocean Ltd. | 0.02 | 33.33 | 0.26 | 74.32 | 0.3148 | 0.1429 | |||

| REPH / Societal CDMO Inc | 0.03 | -6.74 | 0.25 | 18.96 | 0.3062 | 0.3062 | |||

| INTC / Intel Corporation | 0.01 | 0.24 | 0.2977 | 0.2977 | |||||

| EXTR / Extreme Networks, Inc. | 0.02 | -6.82 | 0.24 | 20.20 | 0.2977 | 0.2977 | |||

| SMCI / Super Micro Computer, Inc. | 0.01 | 0.00 | 0.24 | -10.33 | 0.2965 | -0.0183 | |||

| SGYPQ / SYNERGY PHARMACEUTICALS INC DEL | 0.08 | -6.74 | 0.24 | -39.14 | 0.2940 | 0.2940 | |||

| VZ / Verizon Communications Inc. | 0.00 | -9.77 | 0.24 | 0.00 | 0.2928 | 0.0141 | |||

| TWLO / Twilio Inc. | 0.01 | 0.00 | 0.24 | 2.58 | 0.2916 | 0.2916 | |||

| GOOG / Alphabet Inc. | 0.00 | 4.26 | 0.23 | 9.81 | 0.2867 | 0.0382 | |||

| FRPT / Freshpet, Inc. | 0.01 | 0.00 | 0.23 | -5.62 | 0.2867 | 0.2867 | |||

| VIP / VimpelCom Ltd. | 0.06 | 0.00 | 0.23 | 6.98 | 0.2806 | 0.2806 | |||

| EKSO / Ekso Bionics Holdings, Inc. | 0.18 | 125.20 | 0.22 | 17.89 | 0.2733 | 0.0526 | |||

| INOV / Innovator ETFs Trust - Innovator International Developed Power Buffer ETF - November | 0.01 | -18.75 | 0.22 | 5.71 | 0.2709 | 0.2709 | |||

| MVIS / MicroVision, Inc. | 0.08 | 0.00 | 0.22 | 30.59 | 0.2709 | 0.0734 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.04 | -1.34 | 0.22 | -4.37 | 0.2672 | 0.0012 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.22 | 6.83 | 0.2672 | 0.0291 | |||

| PMD / Psychemedics Corporation | 0.01 | -22.43 | 0.21 | -42.66 | 0.2526 | 0.2526 | |||

| CAT / Caterpillar Inc. | 0.00 | -16.46 | 0.21 | -2.83 | 0.2513 | 0.0051 | |||

| BRCD / Brocade Communications Systems, Inc. | 0.02 | -66.01 | 0.21 | -67.81 | 0.2513 | 0.2513 | |||

| NUAN / Nuance Communications Inc | 0.01 | 0.00 | 0.20 | -9.73 | 0.2489 | -0.0136 | |||

| TXMD / TherapeuticsMD, Inc. | 0.04 | -17.98 | 0.19 | -17.87 | 0.2355 | -0.0375 | |||

| TWTR / Twitter Inc | 0.01 | 0.00 | 0.19 | -5.58 | 0.2269 | -0.0019 | |||

| AMRS / Amyris Inc | 0.06 | 0.18 | 0.2221 | 0.2221 | |||||

| VUZI / Vuzix Corporation | 0.03 | -15.38 | 0.18 | -29.41 | 0.2196 | 0.2196 | |||

| OCGN / Ocugen, Inc. | 0.09 | 6.13 | 0.17 | 17.12 | 0.2086 | 0.0391 | |||

| MBI / MBIA Inc. | 0.02 | 0.00 | 0.15 | -7.50 | 0.1806 | -0.0053 | |||

| VHC / VirnetX Holding Corporation | 0.04 | -2.78 | 0.14 | -16.46 | 0.1672 | -0.0233 | |||

| EYES / Vivani Medical Inc | 0.11 | 0.14 | 0.1647 | -0.0002 | |||||

| LCTX / Lineage Cell Therapeutics, Inc. | 0.04 | 12.12 | 0.10 | 0.96 | 0.1281 | 0.1281 | |||

| ATRS / Antares Pharma Inc | 0.03 | 0.00 | 0.10 | 0.00 | 0.1281 | 0.0062 | |||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.02 | 0.00 | 0.10 | -3.74 | 0.1257 | 0.0014 | |||

| GERN / Geron Corporation | 0.04 | 0.00 | 0.09 | -21.93 | 0.1086 | -0.0238 | |||

| 47W / Neurotrope Inc | 0.01 | 0.07 | 0.0915 | 0.0915 | |||||

| MDGN / Medgenics, Inc. | 0.04 | 0.00 | 0.06 | -5.17 | 0.0671 | 0.0671 | |||

| ARAY / Accuray Incorporated | 0.01 | 0.00 | 0.05 | -16.07 | 0.0573 | -0.0077 | |||

| EYES / Vivani Medical Inc | 0.03 | 0.00 | 0.01 | -20.00 | 0.0098 | -0.0019 | |||

| MBLY / Mobileye Global Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2915 | ||||

| WLL / Whiting Petroleum Corp (New) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| RDUS / Radius Recycling, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1580 | ||||

| HRB / H&R Block, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5807 | ||||

| US0268741560 / American International Group, Inc. Warrants | 0.00 | -100.00 | 0.00 | -100.00 | -0.4902 | ||||

| MAS / Masco Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4263 | ||||

| PAYX / Paychex, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3729 | ||||

| MAT / Mattel, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8642 |