Basic Stats

| Portfolio Value | $ 475,436,544 |

| Current Positions | 27 |

Latest Holdings, Performance, AUM (from 13F, 13D)

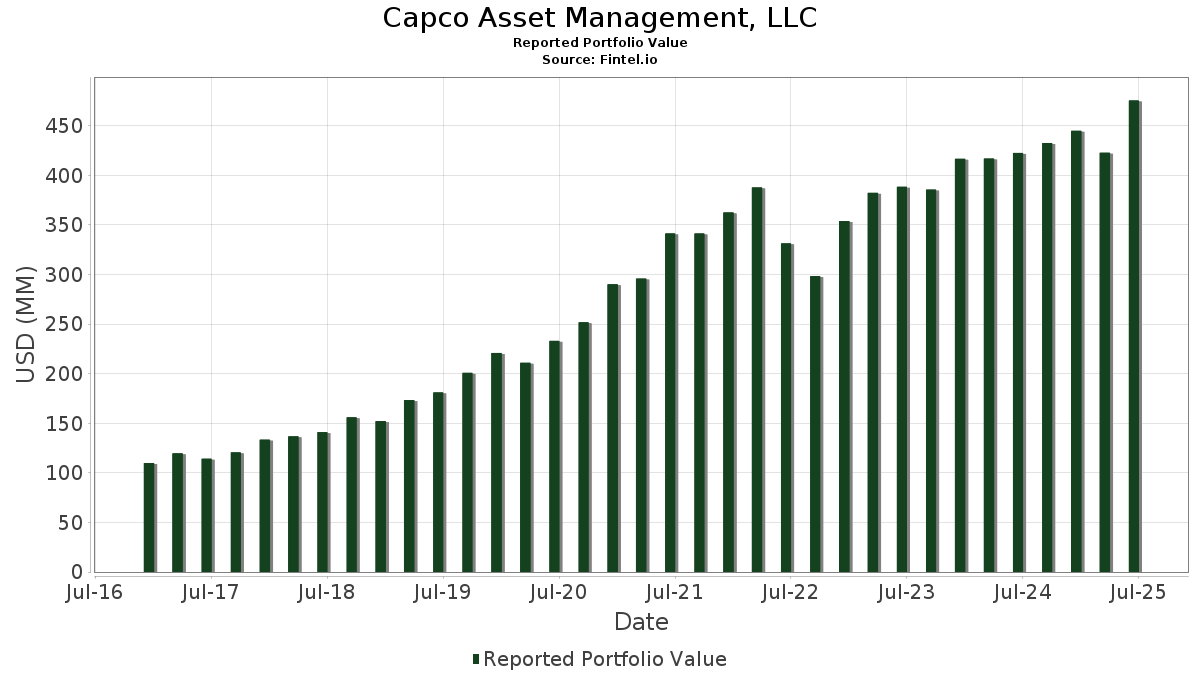

Capco Asset Management, LLC has disclosed 27 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 475,436,544 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Capco Asset Management, LLC’s top holdings are Marriott International, Inc. (US:MAR) , Markel Group Inc. (US:MKL) , The Progressive Corporation (US:PGR) , Microsoft Corporation (US:MSFT) , and Gogo Inc. (US:GOGO) . Capco Asset Management, LLC’s new positions include Certara, Inc. (US:CERT) , Workday, Inc. (US:WDAY) , Alphabet Inc. (US:GOOG) , monday.com Ltd. (US:MNDY) , and Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.96 | 43.39 | 9.1259 | 3.0736 | |

| 0.10 | 48.62 | 10.2266 | 1.3666 | |

| 0.03 | 19.69 | 4.1423 | 0.8154 | |

| 0.25 | 24.27 | 5.1039 | 0.8084 | |

| 0.14 | 31.27 | 6.5762 | 0.2591 | |

| 0.09 | 28.46 | 5.9860 | 0.2427 | |

| 0.25 | 67.36 | 14.1676 | 0.1850 | |

| 0.00 | 0.11 | 0.0224 | 0.0224 | |

| 0.01 | 0.10 | 0.0218 | 0.0218 | |

| 0.00 | 0.10 | 0.0202 | 0.0202 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 53.66 | 11.2862 | -5.6352 | |

| 0.03 | 54.01 | 11.3592 | -0.6569 | |

| 2.94 | 33.71 | 7.0908 | -0.3371 | |

| 0.10 | 41.89 | 8.8106 | -0.1851 | |

| 0.40 | 27.69 | 5.8250 | -0.0876 | |

| 0.00 | 0.18 | 0.0380 | -0.0082 | |

| 0.00 | 0.38 | 0.0791 | -0.0059 | |

| 0.00 | 0.05 | 0.0102 | -0.0024 | |

| 0.00 | 0.01 | 0.0011 | -0.0002 | |

| 0.00 | 0.00 | 0.0003 | -0.0001 |

13F and Fund Filings

This form was filed on 2025-08-08 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MAR / Marriott International, Inc. | 0.25 | -0.66 | 67.36 | 13.95 | 14.1676 | 0.1850 | |||

| MKL / Markel Group Inc. | 0.03 | -0.49 | 54.01 | 6.31 | 11.3592 | -0.6569 | |||

| PGR / The Progressive Corporation | 0.20 | -20.45 | 53.66 | -24.99 | 11.2862 | -5.6352 | |||

| MSFT / Microsoft Corporation | 0.10 | -2.04 | 48.62 | 29.80 | 10.2266 | 1.3666 | |||

| GOGO / Gogo Inc. | 2.96 | -0.43 | 43.39 | 69.57 | 9.1259 | 3.0736 | |||

| CHTR / Charter Communications, Inc. | 0.10 | -0.71 | 41.89 | 10.14 | 8.8106 | -0.1851 | |||

| WBD / Warner Bros. Discovery, Inc. | 2.94 | 0.52 | 33.71 | 7.36 | 7.0908 | -0.3371 | |||

| AMZN / Amazon.com, Inc. | 0.14 | 1.53 | 31.27 | 17.07 | 6.5762 | 0.2591 | |||

| ADSK / Autodesk, Inc. | 0.09 | -0.88 | 28.46 | 17.21 | 5.9860 | 0.2427 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.40 | -0.75 | 27.69 | 10.79 | 5.8250 | -0.0876 | |||

| LRCX / Lam Research Corporation | 0.25 | -0.20 | 24.27 | 33.62 | 5.1039 | 0.8084 | |||

| ROP / Roper Technologies, Inc. | 0.03 | 45.64 | 19.69 | 40.01 | 4.1423 | 0.8154 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.38 | 4.74 | 0.0791 | -0.0059 | |||

| LSTR / Landstar System, Inc. | 0.00 | 0.00 | 0.18 | -7.69 | 0.0380 | -0.0082 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.11 | 0.0224 | 0.0224 | |||||

| CERT / Certara, Inc. | 0.01 | 0.10 | 0.0218 | 0.0218 | |||||

| WDAY / Workday, Inc. | 0.00 | 0.10 | 0.0202 | 0.0202 | |||||

| GOOG / Alphabet Inc. | 0.00 | 0.09 | 0.0187 | 0.0187 | |||||

| MNDY / monday.com Ltd. | 0.00 | 0.08 | 0.0175 | 0.0175 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.08 | 0.0171 | 0.0171 | |||||

| WDC / Western Digital Corporation | 0.00 | 0.08 | 0.0168 | 0.0168 | |||||

| FIX / Comfort Systems USA, Inc. | 0.00 | 0.08 | 0.0164 | 0.0164 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | 413.64 | 0.07 | 475.00 | 0.0147 | 0.0118 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.05 | -9.43 | 0.0102 | -0.0024 | |||

| TEAM / Atlassian Corporation | 0.00 | 0.03 | 0.0053 | 0.0053 | |||||

| FRPH / FRP Holdings, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0011 | -0.0002 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0003 | -0.0001 |