Basic Stats

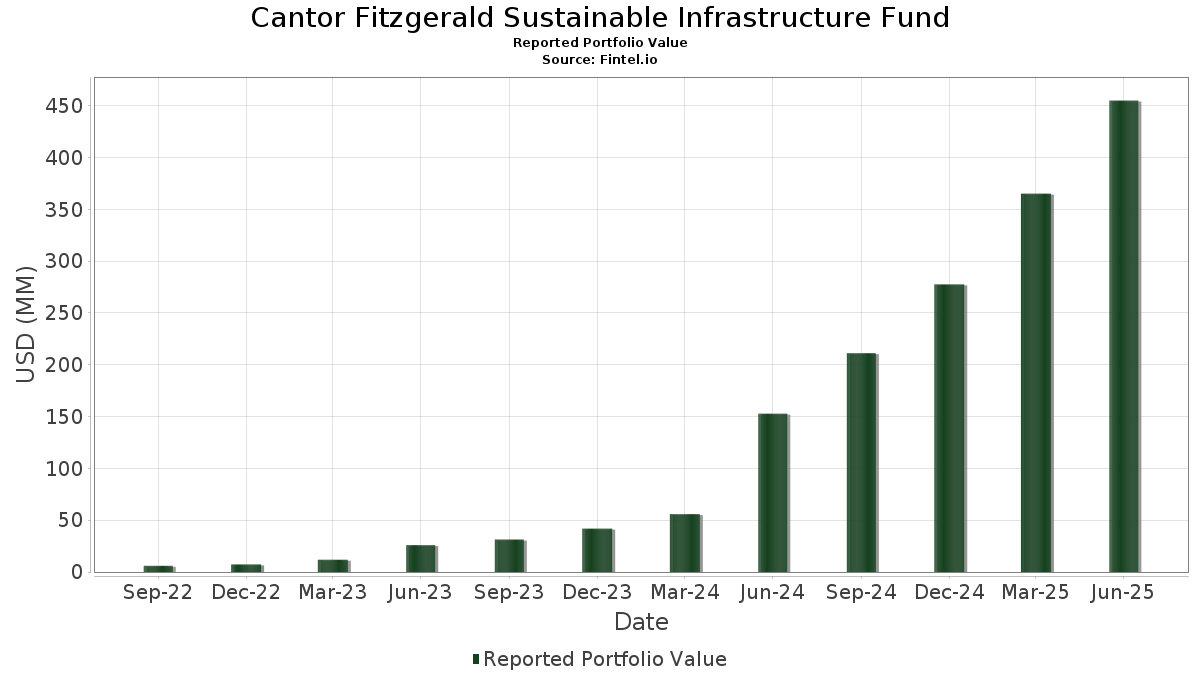

| Portfolio Value | $ 454,842,406 |

| Current Positions | 65 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Cantor Fitzgerald Sustainable Infrastructure Fund has disclosed 65 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 454,842,406 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Cantor Fitzgerald Sustainable Infrastructure Fund’s top holdings are Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Vistra Corp. (US:VST) , Constellation Energy Corporation (US:CEG) , NextEra Energy, Inc. (US:NEE) , and NRG Energy, Inc. (US:NRG) . Cantor Fitzgerald Sustainable Infrastructure Fund’s new positions include Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 35.18 | 37.76 | 8.3519 | 8.3519 | |

| 29.02 | 36.02 | 7.9665 | 7.9665 | |

| 26.65 | 27.24 | 6.0254 | 6.0254 | |

| 12.43 | 16.16 | 3.5736 | 3.5736 | |

| 0.13 | 25.14 | 5.5611 | 2.5125 | |

| 11.10 | 11.12 | 2.4584 | 2.4584 | |

| 9.71 | 9.50 | 2.1019 | 2.1019 | |

| 6.45 | 7.15 | 1.5818 | 1.5818 | |

| 6.96 | 6.99 | 1.5448 | 1.5448 | |

| 0.09 | 14.18 | 3.1363 | 1.4803 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 27.68 | 6.1224 | -5.3070 | ||

| 0.22 | 15.19 | 3.3586 | -0.8905 | |

| 0.11 | 10.56 | 2.3348 | -0.5616 | |

| 0.05 | 13.13 | 2.9047 | -0.5149 | |

| 0.19 | 12.16 | 2.6894 | -0.4807 | |

| 0.10 | 3.54 | 0.7824 | -0.4164 | |

| 0.03 | 6.52 | 1.4415 | -0.3922 | |

| 0.03 | 6.93 | 1.5323 | -0.3367 | |

| 0.15 | 6.91 | 1.5277 | -0.3228 | |

| 0.11 | 8.70 | 1.9241 | -0.3210 |

13F and Fund Filings

This form was filed on 2025-08-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Blackstone Infrastructure Partners IRH-G L.P. / (N/A) | 35.18 | 37.76 | 8.3519 | 8.3519 | |||||

| Aero Capital Solutions Fund IV LP / (N/A) | 29.02 | 36.02 | 7.9665 | 7.9665 | |||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 27.68 | -33.64 | 6.1224 | -5.3070 | |||||

| DigitalBridge AI Infrastructure B, LP / (N/A) | 26.65 | 27.24 | 6.0254 | 6.0254 | |||||

| VST / Vistra Corp. | 0.13 | 36.94 | 25.14 | 125.99 | 5.5611 | 2.5125 | |||

| CEG / Constellation Energy Corporation | 0.06 | 0.00 | 20.02 | 60.08 | 4.4285 | 1.0010 | |||

| Peppertree Capital - Fund VIII QP LP / (N/A) | 12.43 | 16.16 | 3.5736 | 3.5736 | |||||

| NEE / NextEra Energy, Inc. | 0.22 | 0.00 | 15.19 | -2.07 | 3.3586 | -0.8905 | |||

| NRG / NRG Energy, Inc. | 0.09 | 39.49 | 14.18 | 134.65 | 3.1363 | 1.4803 | |||

| EQT / EQT Corporation | 0.23 | 24.84 | 13.19 | 36.27 | 2.9174 | 0.2648 | |||

| LNG / Cheniere Energy, Inc. | 0.05 | 0.00 | 13.13 | 5.23 | 2.9047 | -0.5149 | |||

| WMB / The Williams Companies, Inc. | 0.19 | 0.00 | 12.16 | 5.11 | 2.6894 | -0.4807 | |||

| DLR / Digital Realty Trust, Inc. | 0.06 | 63.49 | 11.22 | 98.92 | 2.4821 | 0.9361 | |||

| DB Sunshine Holdings I, LP / (N/A) | 11.10 | 11.12 | 2.4584 | 2.4584 | |||||

| SO / The Southern Company | 0.11 | 0.00 | 10.56 | -0.13 | 2.3348 | -0.5616 | |||

| CP / Canadian Pacific Kansas City Limited | 0.12 | 0.00 | 9.74 | 12.91 | 2.1531 | -0.2095 | |||

| DigitalBridge Credit II (Onshore), LP / (N/A) | 9.71 | 9.50 | 2.1019 | 2.1019 | |||||

| SRE / Sempra | 0.11 | 0.00 | 8.70 | 6.18 | 1.9241 | -0.3210 | |||

| Rockland Power Partners I / (N/A) | 6.45 | 7.15 | 1.5818 | 1.5818 | |||||

| Manulife Infrastructure Fund III, L.P. / (N/A) | 6.96 | 6.99 | 1.5448 | 1.5448 | |||||

| AMT / American Tower Corporation | 0.03 | 0.00 | 6.93 | 1.57 | 1.5323 | -0.3367 | |||

| ENB / Enbridge Inc. | 0.15 | 0.00 | 6.91 | 2.28 | 1.5277 | -0.3228 | |||

| TRP / TC Energy Corporation | 0.13 | 0.00 | 6.54 | 3.33 | 1.4468 | -0.2876 | |||

| UNP / Union Pacific Corporation | 0.03 | 0.00 | 6.52 | -2.62 | 1.4415 | -0.3922 | |||

| SBAC / SBA Communications Corporation | 0.02 | 0.00 | 5.82 | 6.74 | 1.2864 | -0.2067 | |||

| DTM / DT Midstream, Inc. | 0.05 | 0.00 | 5.79 | 13.93 | 1.2804 | -0.1121 | |||

| ETR / Entergy Corporation | 0.06 | 197.88 | 4.63 | 189.67 | 1.0239 | 0.5859 | |||

| Irradiant Orchid Investors, LP / (N/A) | 5.00 | 4.51 | 0.9972 | 0.9972 | |||||

| XYL / Xylem Inc. | 0.03 | 73.70 | 4.27 | 88.10 | 0.9440 | 0.3222 | |||

| IPCC Fund L.P. / (N/A) | 4.47 | 3.61 | 0.7992 | 0.7992 | |||||

| SLB / Schlumberger Limited | 0.10 | 0.00 | 3.54 | -19.15 | 0.7824 | -0.4164 | |||

| D / Dominion Energy, Inc. | 0.06 | 0.00 | 3.41 | 0.80 | 0.7538 | -0.1727 | |||

| XEL / Xcel Energy Inc. | 0.05 | 0.00 | 3.27 | -3.79 | 0.7237 | -0.2083 | |||

| EXC / Exelon Corporation | 0.08 | 0.00 | 3.27 | -5.76 | 0.7233 | -0.2277 | |||

| CoreWeave Credit Agreement / (N/A) | 3.21 | 3.26 | 0.7213 | 0.7213 | |||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.11 | 0.37 | 3.09 | -7.79 | 0.6831 | -0.2348 | |||

| ASR / Grupo Aeroportuario del Sureste, S. A. B. de C. V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 3.04 | 16.44 | 0.6721 | -0.0429 | |||

| Nova Infrastructure Fund II / (N/A) | 3.27 | 3.03 | 0.6701 | 0.6701 | |||||

| DigitalBridge Credit (Onshore), LP / (N/A) | 3.45 | 2.97 | 0.6563 | 0.6563 | |||||

| AEP / American Electric Power Company, Inc. | 0.03 | 0.00 | 2.69 | -5.05 | 0.5946 | -0.1812 | |||

| DUK / Duke Energy Corporation | 0.02 | 0.00 | 2.67 | -3.27 | 0.5895 | -0.1654 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 0.00 | 2.54 | -5.69 | 0.5608 | -0.1760 | |||

| Peppertree Capital Fund X QP, LP / (N/A) | 1.97 | 2.29 | 0.5058 | 0.5058 | |||||

| OKE / ONEOK, Inc. | 0.03 | 0.00 | 2.29 | -17.75 | 0.5055 | -0.2557 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.03 | 0.00 | 2.22 | 2.26 | 0.4901 | -0.1035 | |||

| AES / The AES Corporation | 0.21 | 0.00 | 2.18 | -15.32 | 0.4819 | -0.2230 | |||

| WM / Waste Management, Inc. | 0.01 | 0.00 | 2.12 | -1.17 | 0.4685 | -0.1187 | |||

| IBDRY / Iberdrola, S.A. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 2.09 | 19.42 | 0.4611 | -0.0175 | |||

| RWEOY / RWE Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 1.97 | 16.97 | 0.4361 | -0.0257 | |||

| HAL / Halliburton Company | 0.09 | 0.00 | 1.85 | -19.68 | 0.4091 | -0.2218 | |||

| FE / FirstEnergy Corp. | 0.04 | 0.00 | 1.60 | -0.43 | 0.3549 | -0.0865 | |||

| NGG / National Grid plc - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 1.57 | 13.42 | 0.3478 | -0.0321 | |||

| CMS / CMS Energy Corporation | 0.02 | 0.00 | 1.55 | -7.76 | 0.3420 | -0.1174 | |||

| WTRG / Essential Utilities, Inc. | 0.03 | 0.00 | 1.16 | -6.02 | 0.2555 | -0.0814 | |||

| TAC / TransAlta Corporation | 0.10 | 43.11 | 1.07 | 65.23 | 0.2377 | 0.0594 | |||

| OMAB / Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.99 | 34.24 | 0.2185 | 0.0167 | |||

| DTE / DTE Energy Company | 0.01 | 0.00 | 0.99 | -4.28 | 0.2180 | -0.0639 | |||

| SOBO / South Bow Corporation | 0.03 | 234.53 | 0.70 | 239.81 | 0.1550 | 0.0985 | |||

| ATO / Atmos Energy Corporation | 0.00 | 0.00 | 0.55 | -0.18 | 0.1206 | -0.0293 | |||

| SEDG / SolarEdge Technologies, Inc. | 0.02 | 0.00 | 0.49 | 26.17 | 0.1078 | 0.0019 | |||

| ENLAY / Enel SpA - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.47 | 17.46 | 0.1044 | -0.0056 | |||

| EIX / Edison International | 0.01 | 0.00 | 0.47 | -12.52 | 0.1037 | -0.0430 | |||

| ENPH / Enphase Energy, Inc. | 0.01 | 0.00 | 0.43 | -36.11 | 0.0951 | -0.0893 | |||

| NI / NiSource Inc. | 0.01 | 0.00 | 0.37 | 0.81 | 0.0825 | -0.0191 | |||

| UGP / Ultrapar Participações S.A. - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 0.29 | 6.55 | 0.0649 | -0.0106 |