Basic Stats

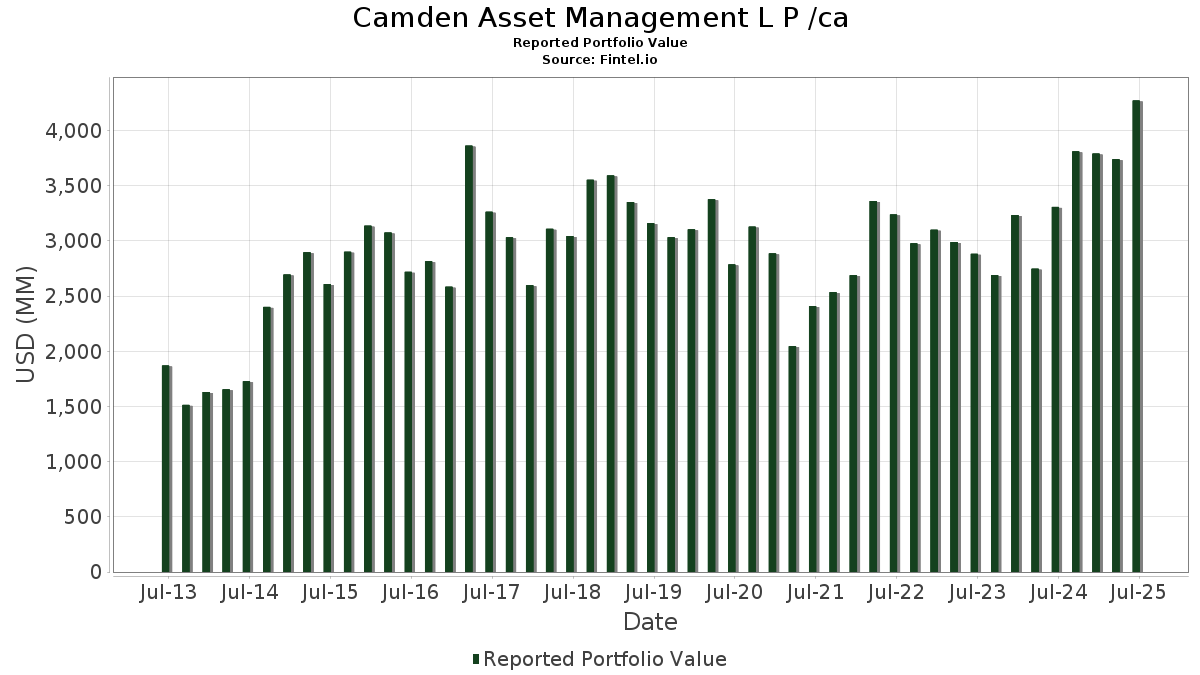

| Portfolio Value | $ 4,271,184,643 |

| Current Positions | 96 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Camden Asset Management L P /ca has disclosed 96 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 4,271,184,643 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Camden Asset Management L P /ca’s top holdings are CONVERTIBLE ZERO (US:US345370CZ16) , CONVERTIBLE ZERO (US:US009066AB74) , Bank of America Corporation - Preferred Stock (US:BAC.PRL) , CONVERTIBLE ZERO (US:US30212PBE43) , and CONVERTIBLE ZERO (US:US90353TAJ97) . Camden Asset Management L P /ca’s new positions include CONVERTIBLE ZERO (US:US345370CZ16) , CONVERTIBLE ZERO (US:US009066AB74) , CONVERTIBLE ZERO (US:US30212PBE43) , CONVERTIBLE ZERO (US:US90353TAJ97) , and Shopify Inc. (US:SHOP) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 145.03 | 3.3956 | 0.8814 | |

| 0.03 | 36.67 | 0.8585 | 0.7841 | |

| 17.28 | 0.4045 | 0.4045 | ||

| 26.74 | 0.6259 | 0.3671 | ||

| 216.59 | 5.0710 | 0.2676 | ||

| 41.78 | 0.9782 | 0.2391 | ||

| 29.62 | 0.6936 | 0.2242 | ||

| 77.38 | 1.8116 | 0.1713 | ||

| 0.15 | 7.08 | 0.1657 | 0.1657 | |

| 69.48 | 1.6268 | 0.1244 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.57 | 62.48 | 1.4627 | -0.7998 | |

| 12.35 | 0.2890 | -0.6284 | ||

| 0.02 | 1.07 | 0.0251 | -0.4782 | |

| 23.22 | 0.5436 | -0.4073 | ||

| 165.23 | 3.8685 | -0.4072 | ||

| 79.05 | 1.8507 | -0.4028 | ||

| 17.05 | 0.3993 | -0.3878 | ||

| 82.97 | 1.9424 | -0.2901 | ||

| 0.04 | 1.93 | 0.0453 | -0.2670 | |

| 68.71 | 1.6088 | -0.2099 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US345370CZ16 / CONVERTIBLE ZERO | 216.59 | 20.59 | 5.0710 | 0.2676 | |||||

| NEXTERA ENERGY CAP HLDGS INC NOTE 3.000PERCENT 3/0 / CNV (65339KCY4) | 208.43 | 0.0000 | |||||||

| EVERGY INC NOTE 4.500PERCENT12/1 / CNV (30034WAD8) | 167.12 | 0.0000 | |||||||

| US009066AB74 / CONVERTIBLE ZERO | 165.23 | 3.35 | 3.8685 | -0.4072 | |||||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0.12 | 57.20 | 145.03 | 54.27 | 3.3956 | 0.8814 | |||

| VENTAS RLTY LTD PARTNERSHIP NOTE 3.750PERCENT 6/0 / CNV (92277GAZ0) | 91.73 | 0.0000 | |||||||

| BLACKLINE INC NOTE 1.000PERCENT 6/0 ADDED / CNV (09239BAF6) | 90.40 | 0.0000 | |||||||

| US30212PBE43 / CONVERTIBLE ZERO | 89.37 | 21.15 | 2.0924 | 0.1197 | |||||

| US90353TAJ97 / CONVERTIBLE ZERO | 82.97 | -0.62 | 1.9424 | -0.2901 | |||||

| SHOP / Shopify Inc. | 81.53 | 3.06 | 1.9088 | -0.2068 | |||||

| PPL CAP FDG INC NOTE 2.875PERCENT 3/1 / CNV (69352PAS2) | 79.95 | 0.0000 | |||||||

| US84921RAB69 / Spotify USA Inc | 79.05 | -6.19 | 1.8507 | -0.4028 | |||||

| IONIS PHARMACEUTICALS INC NOTE 1.750PERCENT 6/1 / CNV (462222AF7) | 78.35 | 0.0000 | |||||||

| WEC ENERGY GROUP INC NOTE 4.375PERCENT 6/0 ADDED / CNV (92939UAP1) | 78.00 | 0.0000 | |||||||

| US40637HAF64 / CONV. NOTE | 77.38 | 26.15 | 1.8116 | 0.1713 | |||||

| SEAGATE HDD CAYMAN NOTE 3.500PERCENT 6/0 / CNV (81180WBL4) | 76.31 | 0.0000 | |||||||

| US15677JAD00 / CONV. NOTE | 69.48 | 23.68 | 1.6268 | 0.1244 | |||||

| US91688FAB04 / CONV. NOTE | 68.71 | 1.04 | 1.6088 | -0.2099 | |||||

| WEC ENERGY GROUP INC NOTE 4.375PERCENT 6/0 ADDED / CNV (92939UAR7) | 68.59 | 0.0000 | |||||||

| DUKE ENERGY CORP NEW NOTE 4.125PERCENT 4/1 / CNV (26441CBY0) | 67.68 | 0.0000 | |||||||

| UBER TECHNOLOGIES INC NOTE 0.875PERCENT12/0 / CNV (90353TAM2) | 66.81 | 0.0000 | |||||||

| WORLD KINECT CORPORATION NOTE 3.250PERCENT 7/0 / CNV (98149GAB6) | 63.19 | 0.0000 | |||||||

| DEXCOM INC NOTE 0.375PERCENT 5/1 / CNV (252131AM9) | 63.06 | 0.0000 | |||||||

| NEE.PRR / NextEra Energy, Inc. - Preferred Security | 1.57 | -24.13 | 62.48 | -26.15 | 1.4627 | -0.7998 | |||

| HAEMONETICS CORP MASS NOTE 2.500PERCENT 6/0 ADDED / CNV (405024AD2) | 56.27 | 0.0000 | |||||||

| US83304AAF30 / CONVERTIBLE ZERO | 55.88 | 10.49 | 1.3084 | -0.0442 | |||||

| EP.PRC / El Paso Energy Capital Trust I - Preferred Security | 1.13 | -0.54 | 55.47 | -0.09 | 1.2986 | -0.1860 | |||

| US29786AAN63 / CONV. NOTE | 55.46 | 14.19 | 1.2985 | -0.0004 | |||||

| TETRA TECH INC NEW DBCV 2.250PERCENT 8/1 / CNV (88162GAB9) | 53.49 | 0.0000 | |||||||

| AMERICAN WTR CAP CORP NOTE 3.625PERCENT 6/1 / CNV (03040WBE4) | 51.98 | 0.0000 | |||||||

| US25402DAB82 / CONVERTIBLE ZERO | 50.25 | 4.21 | 1.1764 | -0.1130 | |||||

| PAGERDUTY INC NOTE 1.500PERCENT10/1 / CNV (69553PAD2) | 48.70 | 0.0000 | |||||||

| MKS INC. NOTE 1.250PERCENT 6/0 ADDED / CNV (55306NAB0) | 45.85 | 0.0000 | |||||||

| US852234AK99 / CONV. NOTE | 45.49 | 1.42 | 1.0651 | -0.1345 | |||||

| US679295AF24 / CONV. NOTE | 44.17 | 0.00 | 1.0341 | -0.1471 | |||||

| US207410AH48 / CONV. NOTE | 43.11 | -2.22 | 1.0093 | -0.1697 | |||||

| US852234AJ27 / CONVERTIBLE ZERO | 42.60 | 6.41 | 0.9975 | -0.0732 | |||||

| ON SEMICONDUCTOR CORP NOTE 0.500PERCENT 3/0 / CNV (682189AU9) | 42.37 | 0.0000 | |||||||

| PINNACLE WEST CAP CORP NOTE 4.750PERCENT 6/1 ADDED / CNV (723484AK7) | 41.94 | 0.0000 | |||||||

| US91332UAB70 / CONVERTIBLE ZERO | 41.78 | 51.18 | 0.9782 | 0.2391 | |||||

| CHEFS WHSE INC NOTE 2.375PERCENT12/1 / CNV (163086AE1) | 41.07 | 0.0000 | |||||||

| US17243VAB80 / Cinemark Holdings Inc | 40.90 | 21.48 | 0.9577 | 0.0572 | |||||

| WESTERN DIGITAL CORP NOTE 3.000PERCENT11/1 / CNV (958102AT2) | 39.98 | 0.0000 | |||||||

| US538034BA63 / CONV. NOTE | 39.90 | 10.54 | 0.9341 | -0.0311 | |||||

| US819047AB70 / CONVERTIBLE ZERO | 38.76 | 6.32 | 0.9076 | -0.0675 | |||||

| PROGRESS SOFTWARE CORP NOTE 3.500PERCENT 3/0 / CNV (743312AD2) | 38.28 | 0.0000 | |||||||

| WFC.PRL / Wells Fargo & Company - Preferred Stock | 0.03 | 1,250.73 | 36.67 | 1,218.96 | 0.8585 | 0.7841 | |||

| RAPID7 INC NOTE 1.250PERCENT 3/1 / CNV (753422AH7) | 36.31 | 0.0000 | |||||||

| XEROX HOLDINGS CORP NOTE 3.750PERCENT 3/1 / CNV (98421MAE6) | 36.12 | 0.0000 | |||||||

| LUMENTUM HLDGS INC NOTE 1.500PERCENT12/1 / CNV (55024UAH2) | 35.35 | 0.0000 | |||||||

| US70509VAA89 / Pebblebrook Hotel Trust | 32.69 | 4.14 | 0.7653 | -0.0741 | |||||

| ARBOR REALTY TRUST INC NOTE 7.500PERCENT 8/0 / CNV (038923BA5) | 32.28 | 0.0000 | |||||||

| ENVISTA HOLDINGS CORPORATION NOTE 1.750PERCENT 8/1 / CNV (29415FAD6) | 31.63 | 0.0000 | |||||||

| ITRON INC NOTE 1.375PERCENT 7/1 ADDED / CNV (465741AQ9) | 30.97 | 0.0000 | |||||||

| ZIFF DAVIS INC DEBT 3.625PERCENT 3/0 / CNV (48123VAH5) | 30.49 | 0.0000 | |||||||

| MICROCHIP TECHNOLOGY INC. NOTE 0.750PERCENT 6/0 ADDED / CNV (595017BG8) | 29.71 | 0.0000 | |||||||

| US30063PAC95 / EXACT SCIENCES CORP CONV 0.375% 03/01/2028 | 29.62 | 68.79 | 0.6936 | 0.2242 | |||||

| US477839AB04 / CONV. NOTE | 27.74 | -0.33 | 0.6494 | -0.0949 | |||||

| US87918AAF21 / CONV. NOTE | 26.74 | 176.25 | 0.6259 | 0.3671 | |||||

| FLUOR CORP NOTE 1.125PERCENT 8/1 / CNV (343412AJ1) | 26.04 | 0.0000 | |||||||

| US45781MAD39 / Innoviva, Inc. | 26.04 | 6.41 | 0.6096 | -0.0448 | |||||

| MARRIOTT VACATIONS WORLDWIDE NOTE 3.250PERCENT12/1 / CNV (57164YAF4) | 24.44 | 0.0000 | |||||||

| AMPHASTAR PHARMACEUTICALS IN NOTE 2.000PERCENT 3/1 / CNV (03209RAB9) | 23.72 | 0.0000 | |||||||

| US94419LAP67 / CONV. NOTE | 23.22 | -34.70 | 0.5436 | -0.4073 | |||||

| WORKIVA INC NOTE 1.250PERCENT 8/1 / CNV (98139AAD7) | 22.60 | 0.0000 | |||||||

| VISHAY INTERTECHNOLOGY INC NOTE 2.250PERCENT 9/1 / CNV (928298AR9) | 21.93 | 0.0000 | |||||||

| FIVE9 INC NOTE 1.000PERCENT 3/1 / CNV (338307AF8) | 20.26 | 0.0000 | |||||||

| IMMUNOCORE HLDGS PLC NOTE 2.500PERCENT 2/0 / CNV (45258DAB1) | 19.40 | 0.0000 | |||||||

| US29355AAK34 / CONVERTIBLE ZERO | 18.07 | 4.68 | 0.4230 | -0.0386 | |||||

| AKAMAI TECHNOLOGIES INC NOTE 1.125PERCENT 2/1 / CNV (00971TAN1) | 17.96 | 0.0000 | |||||||

| US516544AB96 / CONV. NOTE | 17.77 | -10.00 | 0.4160 | -0.1120 | |||||

| SOUTHERN CO NOTE 4.500PERCENT 6/1 ADDED / CNV (842587DZ7) | 17.64 | 0.0000 | |||||||

| ALARM COM HLDGS INC NOTE 2.250PERCENT 6/0 ADDED / CNV (011642AD7) | 17.42 | 0.0000 | |||||||

| US69366JAD37 / PTC Therapeutics, Inc. | 17.28 | 0.4045 | 0.4045 | ||||||

| US67059NAH17 / NUTANIX INC SR UNSECURED 10/27 0.25 | 17.05 | -42.06 | 0.3993 | -0.3878 | |||||

| WINNEBAGO INDS INC NOTE 3.250PERCENT 1/1 / CNV (974637AF7) | 16.81 | 0.0000 | |||||||

| BLOOM ENERGY CORP NOTE 3.000PERCENT 6/0 / CNV (093712AK3) | 16.01 | 0.0000 | |||||||

| EPR.PRC / EPR Properties - Preferred Stock | 0.55 | 0.00 | 14.01 | 10.01 | 0.3280 | -0.0126 | |||

| TANDEM DIABETES CARE INC NOTE 1.500PERCENT 3/1 / CNV (875372AD6) | 13.44 | 0.0000 | |||||||

| US977852AD45 / CONV. NOTE | 13.05 | 15.12 | 0.3055 | 0.0024 | |||||

| US40637HAD17 / CONV. NOTE | 12.35 | -64.02 | 0.2890 | -0.6284 | |||||

| US29975EAD13 / Eventbrite, Inc. | 12.14 | -0.54 | 0.2843 | -0.0422 | |||||

| CMS ENERGY CORP NOTE 3.375PERCENT 5/0 / CNV (125896BX7) | 11.52 | 0.0000 | |||||||

| AMC NETWORKS INC NOTE 4.250PERCENT 2/1 ADDED / CNV (00164VAJ2) | 11.20 | 0.0000 | |||||||

| ADVANCED ENERGY INDS NOTE 2.500PERCENT 9/1 / CNV (007973AE0) | 8.62 | 0.0000 | |||||||

| US12685JAG04 / CONV. NOTE | 7.12 | 56.17 | 0.1668 | 0.0448 | |||||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.15 | 7.08 | 0.1657 | 0.1657 | |||||

| EPR.PRE / EPR Properties - Preferred Stock | 0.18 | 0.00 | 5.56 | 4.03 | 0.1301 | -0.0128 | |||

| US26210CAD65 / Dropbox, Inc. | 4.49 | 4.23 | 0.1051 | -0.0101 | |||||

| US011642AB16 / CONVERTIBLE ZERO | 4.48 | 1.52 | 0.1050 | -0.0131 | |||||

| ALLIANT ENERGY CORP NOTE 3.875PERCENT 3/1 / CNV (018802AC2) | 3.85 | 0.0000 | |||||||

| GLOBAL PMTS INC NOTE 1.500PERCENT 3/0 / CNV (37940XAU6) | 3.69 | 0.0000 | |||||||

| US00971TAL52 / CONV. NOTE | 3.46 | 0.76 | 0.0810 | -0.0108 | |||||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.04 | -83.09 | 1.93 | -83.44 | 0.0453 | -0.2670 | |||

| KKR.PRD / KKR & Co. Inc. - Preferred Stock | 0.02 | -94.81 | 1.07 | -94.31 | 0.0251 | -0.4782 | |||

| SOUTHERN CO NOTE 3.875PERCENT12/1 / CNV (842587DP9) | 1.00 | 0.0000 | |||||||

| CORZW / Core Scientific, Inc. - Equity Warrant | 0.00 | 0.0000 | 0.0000 |