Basic Stats

| Portfolio Value | $ 245,487,676 |

| Current Positions | 43 |

Latest Holdings, Performance, AUM (from 13F, 13D)

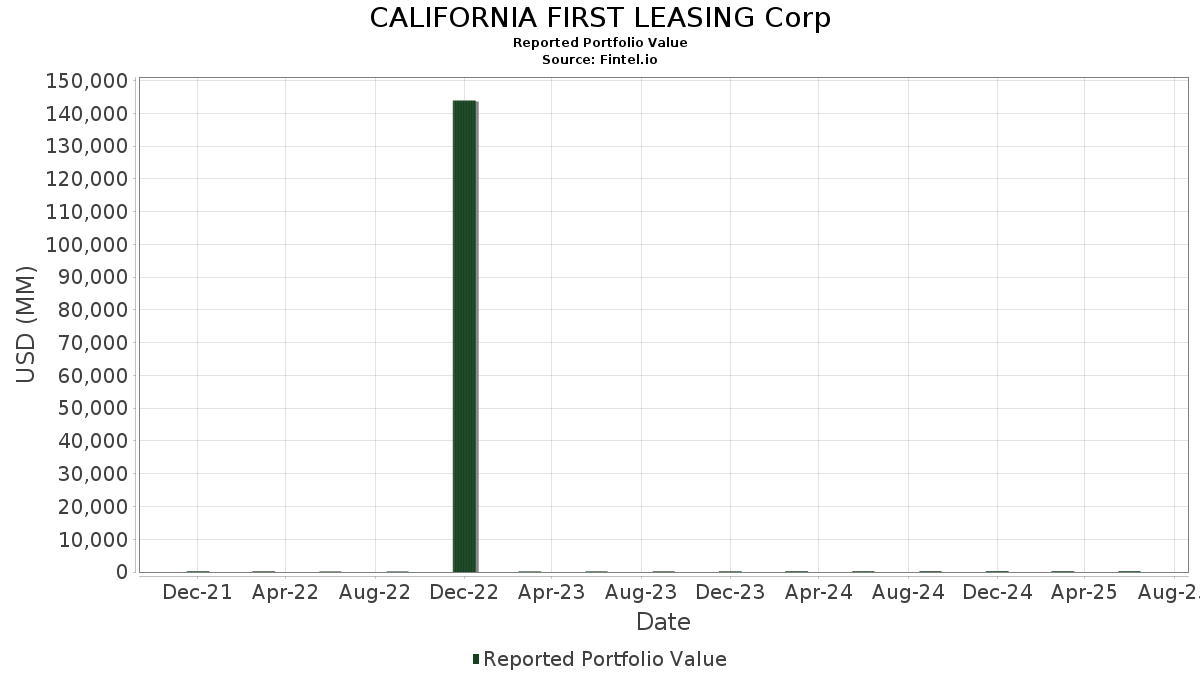

CALIFORNIA FIRST LEASING Corp has disclosed 43 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 245,487,676 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). CALIFORNIA FIRST LEASING Corp’s top holdings are Alphabet Inc. (US:GOOGL) , Exxon Mobil Corporation (US:XOM) , Applied Materials, Inc. (US:AMAT) , The Goldman Sachs Group, Inc. (US:GS) , and Meta Platforms, Inc. (US:META) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.97 | 1.9360 | 1.9360 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 18.52 | 7.2140 | -0.4868 | |

| 0.16 | 17.33 | 6.7510 | -0.4561 | |

| 0.09 | 17.00 | 6.6190 | -0.4472 | |

| 0.02 | 16.42 | 6.3950 | -0.4319 | |

| 0.02 | 13.09 | 5.0990 | -0.3447 | |

| 0.09 | 10.65 | 4.1470 | -0.2805 | |

| 0.03 | 10.15 | 3.9540 | -0.2669 | |

| 0.13 | 10.12 | 3.9430 | -0.2662 | |

| 0.06 | 9.34 | 3.6380 | -0.2455 | |

| 0.11 | 8.52 | 3.3200 | -0.2243 |

13F and Fund Filings

This form was filed on 2025-08-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 0.11 | 0.00 | 18.52 | 0.00 | 7.2140 | -0.4868 | |||

| XOM / Exxon Mobil Corporation | 0.16 | 0.00 | 17.33 | 0.00 | 6.7510 | -0.4561 | |||

| AMAT / Applied Materials, Inc. | 0.09 | 0.00 | 17.00 | 0.00 | 6.6190 | -0.4472 | |||

| GS / The Goldman Sachs Group, Inc. | 0.02 | 0.00 | 16.42 | 0.00 | 6.3950 | -0.4319 | |||

| META / Meta Platforms, Inc. | 0.02 | 0.00 | 13.09 | 0.00 | 5.0990 | -0.3447 | |||

| MU / Micron Technology, Inc. | 0.09 | 0.00 | 10.65 | 0.00 | 4.1470 | -0.2805 | |||

| CI / The Cigna Group | 0.03 | 0.00 | 10.15 | 0.00 | 3.9540 | -0.2669 | |||

| MRVL / Marvell Technology, Inc. | 0.13 | 0.00 | 10.12 | 0.00 | 3.9430 | -0.2662 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | 0.00 | 9.34 | 0.00 | 3.6380 | -0.2455 | |||

| WFC / Wells Fargo & Company | 0.11 | 0.00 | 8.52 | 0.00 | 3.3200 | -0.2243 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 8.28 | 0.00 | 3.2240 | -0.2178 | |||

| AMD / Advanced Micro Devices, Inc. | 0.05 | 0.00 | 7.66 | 0.00 | 2.9840 | -0.2019 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.03 | 0.00 | 6.41 | 0.00 | 2.4970 | -0.1681 | |||

| ALGN / Align Technology, Inc. | 0.03 | 0.00 | 5.83 | 0.00 | 2.2700 | -0.1537 | |||

| BAC / Bank of America Corporation | 0.12 | 0.00 | 5.56 | 0.00 | 2.1660 | -0.1457 | |||

| Treasury Bill / DBT (912797PP6) | 4.97 | 1.9360 | 1.9360 | ||||||

| FIX / Comfort Systems USA, Inc. | 0.01 | 0.00 | 4.68 | 0.00 | 1.8210 | -0.1230 | |||

| TWLO / Twilio Inc. | 0.04 | 0.00 | 4.50 | 0.00 | 1.7530 | -0.1187 | |||

| SLB / Schlumberger Limited | 0.13 | 0.00 | 4.36 | 0.00 | 1.6980 | -0.1148 | |||

| PYPL / PayPal Holdings, Inc. | 0.06 | 0.00 | 4.13 | 0.00 | 1.6080 | -0.1085 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.04 | 0.00 | 4.02 | 0.00 | 1.5650 | -0.1052 | |||

| MTN / Vail Resorts, Inc. | 0.02 | 0.00 | 3.73 | 0.00 | 1.4510 | -0.0978 | |||

| DD / DuPont de Nemours, Inc. | 0.05 | 0.00 | 3.70 | 0.00 | 1.4410 | -0.0972 | |||

| LAD / Lithia Motors, Inc. | 0.01 | 0.00 | 3.63 | 0.00 | 1.4160 | -0.0952 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 3.55 | 0.00 | 1.3820 | -0.0934 | |||

| ITRI / Itron, Inc. | 0.03 | 0.00 | 3.55 | 0.00 | 1.3820 | -0.0929 | |||

| ONON / On Holding AG | 0.06 | 0.00 | 3.28 | 0.00 | 1.2790 | -0.0865 | |||

| CHTR / Charter Communications, Inc. | 0.01 | 0.00 | 3.13 | 0.00 | 1.2190 | -0.0825 | |||

| ZETA / Zeta Global Holdings Corp. | 0.20 | 0.00 | 3.12 | 0.00 | 1.2140 | -0.0815 | |||

| LDOS / Leidos Holdings, Inc. | 0.02 | 0.00 | 3.03 | 0.00 | 1.1820 | -0.0794 | |||

| EG / Everest Group, Ltd. | 0.01 | 0.00 | 2.63 | 0.00 | 1.0240 | -0.0697 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.03 | 0.00 | 2.56 | 0.00 | 0.9970 | -0.0671 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 2.48 | 0.00 | 0.9680 | -0.0651 | |||

| FVRR / Fiverr International Ltd. | 0.08 | 0.00 | 2.33 | 0.00 | 0.9090 | -0.0618 | |||

| LRN / Stride, Inc. | 0.02 | 0.00 | 2.28 | 0.00 | 0.8870 | -0.0598 | |||

| EME / EMCOR Group, Inc. | 0.00 | 0.00 | 2.18 | 0.00 | 0.8480 | -0.0571 | |||

| CEIX / CONSOL Energy Inc. | 0.03 | 0.00 | 1.97 | 0.00 | 0.7660 | -0.0517 | |||

| DOCN / DigitalOcean Holdings, Inc. | 0.07 | 0.00 | 1.93 | 0.00 | 0.7520 | -0.0507 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.63 | 0.00 | 0.6360 | -0.0434 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 1.27 | 0.00 | 0.4950 | -0.0329 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.78 | 0.00 | 0.3020 | -0.0208 | |||

| CACC / Credit Acceptance Corporation | 0.00 | 0.00 | 0.62 | 0.00 | 0.2420 | -0.0164 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.56 | 0.00 | 0.2160 | -0.0150 |