Basic Stats

| Portfolio Value | $ 12,853,055 |

| Current Positions | 110 |

Latest Holdings, Performance, AUM (from 13F, 13D)

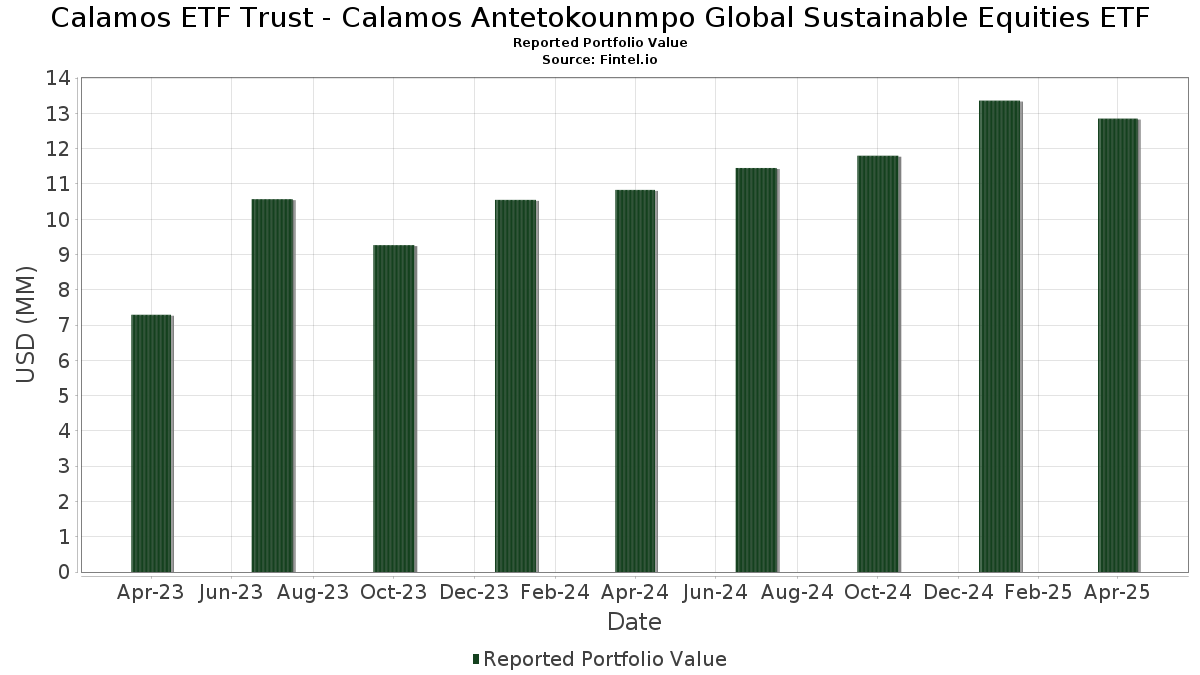

Calamos ETF Trust - Calamos Antetokounmpo Global Sustainable Equities ETF has disclosed 110 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 12,853,055 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Calamos ETF Trust - Calamos Antetokounmpo Global Sustainable Equities ETF’s top holdings are Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOGL) , Apple Inc. (US:AAPL) , NVIDIA Corporation (US:NVDA) , and SAP SE - Depositary Receipt (Common Stock) (US:SAP) . Calamos ETF Trust - Calamos Antetokounmpo Global Sustainable Equities ETF’s new positions include Walmart Inc. (US:WMT) , Bentley Systems, Incorporated (US:BSY) , Chipotle Mexican Grill, Inc. (US:CMG) , Experian plc (US:EXPGF) , and Palo Alto Networks, Inc. (US:PANW) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.13 | 0.9826 | 0.9826 | |

| 0.00 | 0.12 | 0.9449 | 0.9449 | |

| 0.00 | 0.12 | 0.8858 | 0.8858 | |

| 0.00 | 0.07 | 0.5377 | 0.5377 | |

| 0.00 | 0.22 | 1.6963 | 0.4783 | |

| 0.00 | 0.06 | 0.4729 | 0.4729 | |

| 0.00 | 0.06 | 0.4352 | 0.4352 | |

| 0.00 | 0.05 | 0.4103 | 0.4103 | |

| 0.00 | 0.21 | 1.5977 | 0.2939 | |

| 0.01 | 0.17 | 1.2633 | 0.2172 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.26 | 1.9834 | -1.1663 | |

| 0.00 | 0.55 | 4.1831 | -1.0741 | |

| 0.00 | 0.13 | 0.9943 | -0.5884 | |

| 0.00 | 0.04 | 0.3406 | -0.4910 | |

| 0.00 | 0.17 | 1.2828 | -0.3729 | |

| 0.00 | 0.35 | 2.6827 | -0.3685 | |

| 0.00 | 0.10 | 0.7668 | -0.3238 | |

| 0.00 | 0.47 | 3.5955 | -0.3106 | |

| 0.00 | 0.08 | 0.6311 | -0.3088 | |

| 0.00 | 0.11 | 0.8246 | -0.3024 |

13F and Fund Filings

This form was filed on 2025-06-27 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.59 | -4.85 | 4.4606 | -0.1214 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.55 | -22.14 | 4.1831 | -1.0741 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.47 | -10.06 | 3.5955 | -0.3106 | |||

| NVDA / NVIDIA Corporation | 0.00 | -5.19 | 0.35 | -13.87 | 2.6827 | -0.3685 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | -15.40 | 0.28 | -12.07 | 2.1533 | -0.2447 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -22.65 | 0.26 | -38.59 | 1.9834 | -1.1663 | |||

| V / Visa Inc. | 0.00 | -12.55 | 0.24 | -11.52 | 1.8056 | -0.1924 | |||

| 1211 N / BYD Company Limited | 0.00 | 0.00 | 0.22 | 35.98 | 1.6963 | 0.4783 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 0.00 | 0.22 | 2.80 | 1.6734 | 0.0860 | |||

| HDB / HDFC Bank Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.21 | 20.00 | 1.5977 | 0.2939 | |||

| AVGO / Broadcom Inc. | 0.00 | -12.87 | 0.17 | -24.22 | 1.2828 | -0.3729 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.17 | 17.73 | 1.2633 | 0.2172 | |||

| AAGIY / AIA Group Limited - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.15 | 7.75 | 1.1613 | 0.1055 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 0.15 | 7.86 | 1.1463 | 0.1054 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.15 | 5.63 | 1.1435 | 0.0877 | |||

| SIE / Siemens Aktiengesellschaft | 0.00 | 0.00 | 0.15 | 6.57 | 1.1072 | 0.0884 | |||

| PWR / Quanta Services, Inc. | 0.00 | 0.00 | 0.14 | -4.64 | 1.0951 | -0.0307 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.14 | -2.14 | 1.0376 | 0.0003 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.00 | 0.00 | 0.14 | 15.38 | 1.0267 | 0.1544 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0.00 | -13.11 | 0.13 | -7.59 | 1.0192 | -0.0591 | |||

| KRYAY / Kerry Group plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.13 | 2.33 | 1.0041 | 0.0477 | |||

| HIA1 / Hitachi, Ltd. | 0.01 | 0.00 | 0.13 | -2.94 | 1.0004 | -0.0115 | |||

| COST / Costco Wholesale Corporation | 0.00 | -39.45 | 0.13 | -38.50 | 0.9943 | -0.5884 | |||

| FI / Fiserv, Inc. | 0.00 | 0.00 | 0.13 | -14.47 | 0.9897 | -0.1435 | |||

| WMT / Walmart Inc. | 0.00 | 0.13 | 0.9826 | 0.9826 | |||||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.00 | 0.00 | 0.13 | -1.54 | 0.9767 | 0.0109 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.13 | 9.48 | 0.9667 | 0.1040 | |||

| GVA / Granite Construction Incorporated | 0.01 | 0.00 | 0.13 | -6.67 | 0.9545 | -0.0522 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.13 | -12.59 | 0.9529 | -0.1124 | |||

| BSY / Bentley Systems, Incorporated | 0.00 | 0.12 | 0.9449 | 0.9449 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.12 | -22.15 | 0.9388 | -0.2353 | |||

| RLXXF / RELX PLC | 0.00 | 0.00 | 0.12 | 9.26 | 0.8945 | 0.0888 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | 0.00 | 0.12 | -8.59 | 0.8870 | -0.0660 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | 0.12 | 0.8858 | 0.8858 | |||||

| VEOEY / Veolia Environnement SA - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.12 | 27.47 | 0.8824 | 0.2057 | |||

| JRONY / Jerónimo Martins, SGPS, S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.12 | 22.34 | 0.8720 | 0.1740 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.12 | 1.77 | 0.8719 | 0.0324 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.11 | 8.57 | 0.8661 | 0.0814 | |||

| LZAGY / Lonza Group AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.11 | 12.00 | 0.8534 | 0.1054 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.11 | 3.70 | 0.8526 | 0.0499 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.11 | -4.31 | 0.8446 | -0.0169 | |||

| KBC / KBC Group NV | 0.00 | 0.00 | 0.11 | 19.35 | 0.8443 | 0.1507 | |||

| GU81 / Aviva plc | 0.01 | 0.00 | 0.11 | 18.28 | 0.8335 | 0.1373 | |||

| ECL / Ecolab Inc. | 0.00 | -28.78 | 0.11 | -28.95 | 0.8246 | -0.3024 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.11 | -24.48 | 0.8227 | -0.2384 | |||

| VZ / Verizon Communications Inc. | 0.00 | 0.00 | 0.11 | 12.50 | 0.8213 | 0.1030 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.00 | 0.11 | 4.85 | 0.8206 | 0.0568 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.11 | -2.75 | 0.8075 | -0.0046 | |||

| IBDRY / Iberdrola, S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.11 | 28.05 | 0.7973 | 0.1844 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.10 | 6.12 | 0.7897 | 0.0586 | |||

| AZN / Astrazeneca plc | 0.00 | 0.00 | 0.10 | 2.00 | 0.7742 | 0.0292 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | -26.50 | 0.10 | -31.29 | 0.7668 | -0.3238 | |||

| BLL / Ball Corp. | 0.00 | 0.00 | 0.10 | -7.41 | 0.7647 | -0.0375 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.10 | 6.45 | 0.7541 | 0.0604 | |||

| CSLLY / CSL Limited - Depositary Receipt (Common Stock) | 0.00 | 19.38 | 0.10 | 11.24 | 0.7505 | 0.0840 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.00 | 0.10 | 0.00 | 0.7415 | 0.0226 | |||

| IFNNY / Infineon Technologies AG - Depositary Receipt (Common Stock) | 0.00 | -10.32 | 0.10 | -11.93 | 0.7325 | -0.0793 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.00 | 0.00 | 0.10 | 0.00 | 0.7303 | 0.0132 | |||

| D1NC / DNB Bank ASA | 0.00 | 0.00 | 0.10 | 17.28 | 0.7216 | 0.1179 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.09 | -28.24 | 0.7148 | -0.2595 | |||

| AMAT / Applied Materials, Inc. | 0.00 | -16.85 | 0.09 | -30.83 | 0.7043 | -0.2872 | |||

| DAR / Darling Ingredients Inc. | 0.00 | 0.00 | 0.09 | -14.02 | 0.7022 | -0.0971 | |||

| AMT / American Tower Corporation | 0.00 | 0.00 | 0.09 | 22.67 | 0.6983 | 0.1378 | |||

| ESLOY / EssilorLuxottica Société anonyme - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.09 | 4.55 | 0.6982 | 0.0406 | |||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.00 | 0.09 | -6.19 | 0.6900 | -0.0306 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.09 | -9.09 | 0.6851 | -0.0523 | |||

| 4FN / Grupo Financiero Banorte, S.A.B. de C.V. | 0.01 | 0.00 | 0.09 | 23.94 | 0.6722 | 0.1399 | |||

| SSNLF / Samsung Electronics Co., Ltd. | 0.00 | 0.00 | 0.09 | 8.64 | 0.6704 | 0.0647 | |||

| NG. / National Grid plc | 0.01 | 0.00 | 0.09 | 18.92 | 0.6698 | 0.1183 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.09 | -13.86 | 0.6614 | -0.0890 | |||

| SRE / Sempra | 0.00 | 0.00 | 0.09 | -10.31 | 0.6610 | -0.0610 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.00 | 0.09 | 21.13 | 0.6532 | 0.1263 | |||

| NVT / nVent Electric plc | 0.00 | 0.00 | 0.09 | -15.84 | 0.6455 | -0.1030 | |||

| KYCCF / Keyence Corporation | 0.00 | 0.00 | 0.08 | -3.49 | 0.6340 | -0.0085 | |||

| RCRRF / Recruit Holdings Co., Ltd. | 0.00 | -16.67 | 0.08 | -34.13 | 0.6311 | -0.3088 | |||

| AIQUY / L'Air Liquide S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.08 | 17.14 | 0.6274 | 0.1026 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.08 | -22.12 | 0.6163 | -0.1595 | |||

| LRLCY / L'Oréal S.A. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.08 | 17.91 | 0.6043 | 0.1028 | |||

| 388 / Hong Kong Exchanges and Clearing Limited | 0.00 | 0.00 | 0.08 | 13.24 | 0.5854 | 0.0803 | |||

| VRSK / Verisk Analytics, Inc. | 0.00 | 0.00 | 0.08 | 2.74 | 0.5703 | 0.0293 | |||

| NZM2 / Novozymes A/S | 0.00 | 0.00 | 0.07 | 12.12 | 0.5657 | 0.0742 | |||

| D4S / Daiichi Sankyo Company, Limited | 0.00 | 0.00 | 0.07 | -7.50 | 0.5640 | -0.0330 | |||

| MGDDY / Compagnie Générale des Établissements Michelin Société en commandite par actions - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.07 | 4.23 | 0.5639 | 0.0363 | |||

| ASML / ASML Holding N.V. | 0.00 | 0.00 | 0.07 | -12.05 | 0.5548 | -0.0618 | |||

| ITUB / Itaú Unibanco Holding S.A. - Depositary Receipt (Common Stock) | 0.01 | 9.99 | 0.07 | 20.00 | 0.5465 | 0.0998 | |||

| MH6 / Tokio Marine Holdings, Inc. | 0.00 | 0.00 | 0.07 | 20.34 | 0.5436 | 0.1005 | |||

| EXPGF / Experian plc | 0.00 | 0.07 | 0.5377 | 0.5377 | |||||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.07 | -8.00 | 0.5248 | -0.0362 | |||

| DSFIR / DSM-Firmenich AG | 0.00 | 0.00 | 0.07 | 4.62 | 0.5218 | 0.0372 | |||

| SAFCOM / Safaricom PLC | 0.49 | 0.00 | 0.07 | 4.62 | 0.5183 | 0.0317 | |||

| TSCO / Tractor Supply Company | 0.00 | 0.00 | 0.07 | -7.04 | 0.5042 | -0.0255 | |||

| MRK / Marks Electrical Group PLC | 0.00 | 0.00 | 0.06 | -9.86 | 0.4916 | -0.0373 | |||

| PLD / Prologis, Inc. | 0.00 | 0.00 | 0.06 | -13.70 | 0.4784 | -0.0676 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.00 | 0.06 | 5.00 | 0.4780 | 0.0292 | |||

| POWERGRID / Power Grid Corporation of India Limited | 0.02 | 0.00 | 0.06 | 3.33 | 0.4734 | 0.0265 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.06 | 0.4729 | 0.4729 | |||||

| BBRI / PT Bank Rakyat Indonesia (Persero) Tbk | 0.26 | 0.00 | 0.06 | -10.45 | 0.4592 | -0.0422 | |||

| 3AD1 / Epiroc AB (publ) | 0.00 | 0.00 | 0.06 | 13.21 | 0.4575 | 0.0612 | |||

| ACO4 / Atlas Copco AB (publ) | 0.00 | 0.00 | 0.06 | -7.81 | 0.4487 | -0.0267 | |||

| 300760 / Shenzhen Mindray Bio-Medical Electronics Co., Ltd. | 0.00 | 0.06 | 0.4352 | 0.4352 | |||||

| ORCL / Oracle Corporation | 0.00 | 0.05 | 0.4103 | 0.4103 | |||||

| KLBN4 / Klabin S.A. - Preferred Stock | 0.02 | 0.00 | 0.05 | -14.04 | 0.3724 | -0.0560 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.00 | 0.05 | -11.11 | 0.3696 | -0.0368 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -53.78 | 0.04 | -60.71 | 0.3406 | -0.4910 | |||

| SIKA / Sika AG | 0.00 | 0.00 | 0.04 | -4.76 | 0.3097 | -0.0015 | |||

| 6CMB / Croda International Plc | 0.00 | 0.00 | 0.04 | -7.50 | 0.2877 | -0.0090 | |||

| 300274 / Sungrow Power Supply Co., Ltd. | 0.00 | 0.00 | 0.03 | -15.79 | 0.2465 | -0.0403 | |||

| SMECF / SMC Corporation | 0.00 | 0.00 | 0.03 | -13.51 | 0.2462 | -0.0351 | |||

| 006400 / Samsung SDI Co., Ltd. | 0.00 | 0.00 | 0.03 | -18.75 | 0.1969 | -0.0408 | |||

| 006400 / Samsung SDI Co., Ltd. | 0.00 | 0.00 | 0.0053 | 0.0053 |