Basic Stats

| Portfolio Value | $ 200,528 |

| Current Positions | 65 |

Latest Holdings, Performance, AUM (from 13F, 13D)

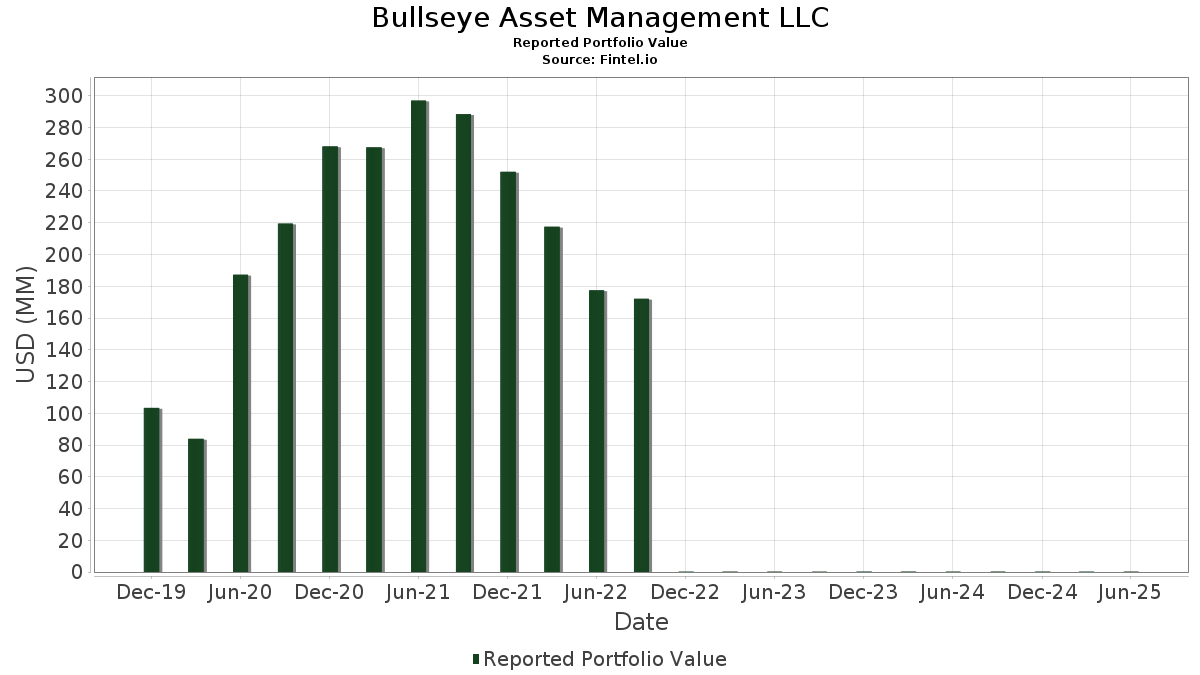

Bullseye Asset Management LLC has disclosed 65 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 200,528 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Bullseye Asset Management LLC’s top holdings are Primo Brands Corporation (US:PRMB) , Hamilton Lane Incorporated (US:HLNE) , RB Global, Inc. (US:RBA) , Norwegian Cruise Line Holdings Ltd. (US:NCLH) , and Zeta Global Holdings Corp. (US:ZETA) . Bullseye Asset Management LLC’s new positions include ACV Auctions Inc. (US:ACVA) , Waystar Holding Corp. (US:WAY) , DocuSign, Inc. (US:DOCU) , DigitalOcean Holdings, Inc. (US:DOCN) , and Karooooo Ltd. (US:KARO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.26 | 0.00 | 2.0975 | 2.0975 | |

| 0.19 | 0.00 | 2.4894 | 1.9609 | |

| 0.03 | 0.00 | 2.0695 | 1.8999 | |

| 0.08 | 0.00 | 1.5898 | 1.5898 | |

| 0.03 | 0.00 | 2.2615 | 0.8619 | |

| 0.02 | 0.01 | 2.9577 | 0.8108 | |

| 0.02 | 0.00 | 0.7769 | 0.7769 | |

| 0.04 | 0.00 | 1.8486 | 0.6382 | |

| 0.01 | 0.00 | 0.7361 | 0.5718 | |

| 0.08 | 0.00 | 1.0871 | 0.5505 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 0.01 | 3.6514 | -2.5409 | |

| 0.09 | 0.00 | 0.4678 | -2.1461 | |

| 0.00 | 0.00 | 0.2070 | -1.9583 | |

| 0.29 | 0.01 | 4.2134 | -1.2569 | |

| 0.04 | 0.00 | 2.4854 | -0.8946 | |

| 0.04 | 0.00 | 2.3383 | -0.7716 | |

| 0.05 | 0.01 | 3.8289 | -0.5120 | |

| 0.23 | 0.00 | 1.1764 | -0.4172 | |

| 0.23 | 0.00 | 0.8273 | -0.2848 | |

| 0.14 | 0.00 | 0.6782 | -0.2188 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PRMB / Primo Brands Corporation | 0.29 | 0.00 | 0.01 | -20.00 | 4.2134 | -1.2569 | |||

| HLNE / Hamilton Lane Incorporated | 0.05 | 0.00 | 0.01 | -12.50 | 3.8289 | -0.5120 | |||

| RBA / RB Global, Inc. | 0.07 | -39.65 | 0.01 | -36.36 | 3.6514 | -2.5409 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.35 | 0.29 | 0.01 | 16.67 | 3.5267 | -0.0360 | |||

| ZETA / Zeta Global Holdings Corp. | 0.46 | 7.04 | 0.01 | 40.00 | 3.5252 | 0.4013 | |||

| FOUR / Shift4 Payments, Inc. | 0.07 | 0.00 | 0.01 | 20.00 | 3.2619 | 0.3482 | |||

| CLH / Clean Harbors, Inc. | 0.03 | 0.00 | 0.01 | 0.00 | 2.9657 | 0.2259 | |||

| WING / Wingstop Inc. | 0.02 | 0.00 | 0.01 | 66.67 | 2.9577 | 0.8108 | |||

| PSTG / Pure Storage, Inc. | 0.09 | 6.02 | 0.01 | 66.67 | 2.5298 | 0.5418 | |||

| FOXF / Fox Factory Holding Corp. | 0.19 | 358.85 | 0.00 | 2.4894 | 1.9609 | ||||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.04 | -29.64 | 0.00 | -33.33 | 2.4854 | -0.8946 | |||

| RRR / Red Rock Resorts, Inc. | 0.10 | 0.00 | 0.00 | 0.00 | 2.4730 | 0.2390 | |||

| NTNX / Nutanix, Inc. | 0.06 | -5.50 | 0.00 | 0.00 | 2.4256 | -0.1142 | |||

| NCNO / nCino, Inc. | 0.17 | 21.42 | 0.00 | 33.33 | 2.3732 | 0.2933 | |||

| INSP / Inspire Medical Systems, Inc. | 0.04 | 0.00 | 0.00 | -20.00 | 2.3383 | -0.7716 | |||

| FIVE / Five Below, Inc. | 0.03 | 0.00 | 0.00 | 100.00 | 2.2615 | 0.8619 | |||

| SHAK / Shake Shack Inc. | 0.03 | -36.83 | 0.00 | 0.00 | 2.2157 | -0.1680 | |||

| ACVA / ACV Auctions Inc. | 0.26 | 0.00 | 2.0975 | 2.0975 | |||||

| GTLS / Chart Industries, Inc. | 0.03 | 1,058.80 | 0.00 | 2.0695 | 1.8999 | ||||

| CWAN / Clearwater Analytics Holdings, Inc. | 0.19 | 62.08 | 0.00 | 33.33 | 2.0242 | 0.3706 | |||

| VERX / Vertex, Inc. | 0.11 | 24.03 | 0.00 | 0.00 | 1.9683 | 0.2645 | |||

| FROG / JFrog Ltd. | 0.09 | 0.00 | 0.00 | 50.00 | 1.8701 | 0.3921 | |||

| CROX / Crocs, Inc. | 0.04 | 73.47 | 0.00 | 50.00 | 1.8486 | 0.6382 | |||

| BL / BlackLine, Inc. | 0.06 | 0.00 | 0.00 | 0.00 | 1.8082 | 0.1325 | |||

| CDNA / CareDx, Inc | 0.18 | 0.00 | 0.00 | 0.00 | 1.7783 | 0.0280 | |||

| TENB / Tenable Holdings, Inc. | 0.10 | 0.00 | 0.00 | 0.00 | 1.6696 | -0.2039 | |||

| TMDX / TransMedics Group, Inc. | 0.02 | -49.61 | 0.00 | 0.00 | 1.6083 | -0.1280 | |||

| WAY / Waystar Holding Corp. | 0.08 | 0.00 | 1.5898 | 1.5898 | |||||

| PHR / Phreesia, Inc. | 0.11 | 11.83 | 0.00 | 50.00 | 1.5714 | 0.2037 | |||

| ALIT / Alight, Inc. | 0.55 | 0.00 | 0.00 | 0.00 | 1.5654 | -0.2119 | |||

| ALKT / Alkami Technology, Inc. | 0.10 | 11.13 | 0.00 | 50.00 | 1.5005 | 0.2263 | |||

| OPRX / OptimizeRx Corporation | 0.21 | 0.00 | 0.00 | 100.00 | 1.3903 | 0.4236 | |||

| VVX / V2X, Inc. | 0.06 | 9.60 | 0.00 | 0.00 | 1.3824 | 0.0011 | |||

| FIVN / Five9, Inc. | 0.10 | 0.00 | 0.00 | 0.00 | 1.3539 | -0.1505 | |||

| BWXT / BWX Technologies, Inc. | 0.02 | 0.00 | 0.00 | 100.00 | 1.2562 | 0.3240 | |||

| SNDR / Schneider National, Inc. | 0.10 | 0.00 | 0.00 | 0.00 | 1.2542 | -0.0314 | |||

| IMXI / International Money Express, Inc. | 0.23 | 0.07 | 0.00 | 0.00 | 1.1764 | -0.4172 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.05 | 0.00 | 0.00 | 0.00 | 1.0886 | -0.0716 | |||

| BRZE / Braze, Inc. | 0.08 | 182.11 | 0.00 | 1.0871 | 0.5505 | ||||

| SIBN / SI-BONE, Inc. | 0.11 | 0.00 | 0.00 | 0.00 | 0.9934 | 0.1904 | |||

| CYRX / Cryoport, Inc. | 0.26 | 22.97 | 0.00 | 0.00 | 0.9679 | 0.2730 | |||

| FLYW / Flywire Corporation | 0.15 | 0.00 | 0.00 | 0.00 | 0.8513 | 0.1017 | |||

| CXM / Sprinklr, Inc. | 0.20 | 48.63 | 0.00 | 0.00 | 0.8383 | 0.2352 | |||

| FVRR / Fiverr International Ltd. | 0.06 | 0.00 | 0.00 | 0.00 | 0.8328 | 0.1038 | |||

| NEO / NeoGenomics, Inc. | 0.23 | 4.61 | 0.00 | -50.00 | 0.8273 | -0.2848 | |||

| DV / DoubleVerify Holdings, Inc. | 0.11 | 72.52 | 0.00 | 0.7994 | 0.3509 | ||||

| WEX / WEX Inc. | 0.01 | 0.00 | 0.00 | 0.00 | 0.7869 | -0.1247 | |||

| DOCU / DocuSign, Inc. | 0.02 | 0.00 | 0.7769 | 0.7769 | |||||

| PCTY / Paylocity Holding Corporation | 0.01 | 144.63 | 0.00 | 0.7640 | 0.4138 | ||||

| AIT / Applied Industrial Technologies, Inc. | 0.01 | 370.37 | 0.00 | 0.7361 | 0.5718 | ||||

| THRY / Thryv Holdings, Inc. | 0.12 | 0.87 | 0.00 | 0.00 | 0.7031 | -0.0923 | |||

| PRO / PROS Holdings, Inc. | 0.09 | 0.00 | 0.00 | 0.00 | 0.6907 | -0.2182 | |||

| JAMF / Jamf Holding Corp. | 0.14 | 4.67 | 0.00 | 0.00 | 0.6782 | -0.2188 | |||

| S / SentinelOne, Inc. | 0.07 | 0.00 | 0.00 | 0.00 | 0.6064 | -0.0469 | |||

| SPT / Sprout Social, Inc. | 0.05 | 0.00 | 0.00 | 0.00 | 0.5226 | -0.0734 | |||

| PCOR / Procore Technologies, Inc. | 0.01 | 0.00 | 0.00 | 0.5067 | -0.0224 | ||||

| LUCK / Lucky Strike Entertainment Corporation | 0.10 | 0.00 | 0.00 | -100.00 | 0.4757 | -0.0760 | |||

| CTLP / Cantaloupe, Inc. | 0.09 | -86.11 | 0.00 | -100.00 | 0.4678 | -2.1461 | |||

| DOCN / DigitalOcean Holdings, Inc. | 0.03 | 0.00 | 0.3845 | 0.3845 | |||||

| KARO / Karooooo Ltd. | 0.01 | 0.00 | 0.3431 | 0.3431 | |||||

| BROS / Dutch Bros Inc. | 0.01 | 0.00 | 0.00 | 0.2728 | 0.0058 | ||||

| LPLA / LPL Financial Holdings Inc. | 0.00 | -90.95 | 0.00 | -100.00 | 0.2070 | -1.9583 | |||

| GLXY / Galaxy Digital Inc. | 0.01 | 0.00 | 0.1641 | 0.1641 | |||||

| SSNT / SilverSun Technologies, Inc. | 0.01 | 0.00 | 0.1611 | 0.1611 | |||||

| TTAN / ServiceTitan, Inc. | 0.00 | 0.00 | 0.1606 | 0.1606 | |||||

| GWRE / Guidewire Software, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKX / Skechers U.S.A., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EGAN / eGain Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |