Basic Stats

| Portfolio Value | $ 1,407,584,526 |

| Current Positions | 90 |

Latest Holdings, Performance, AUM (from 13F, 13D)

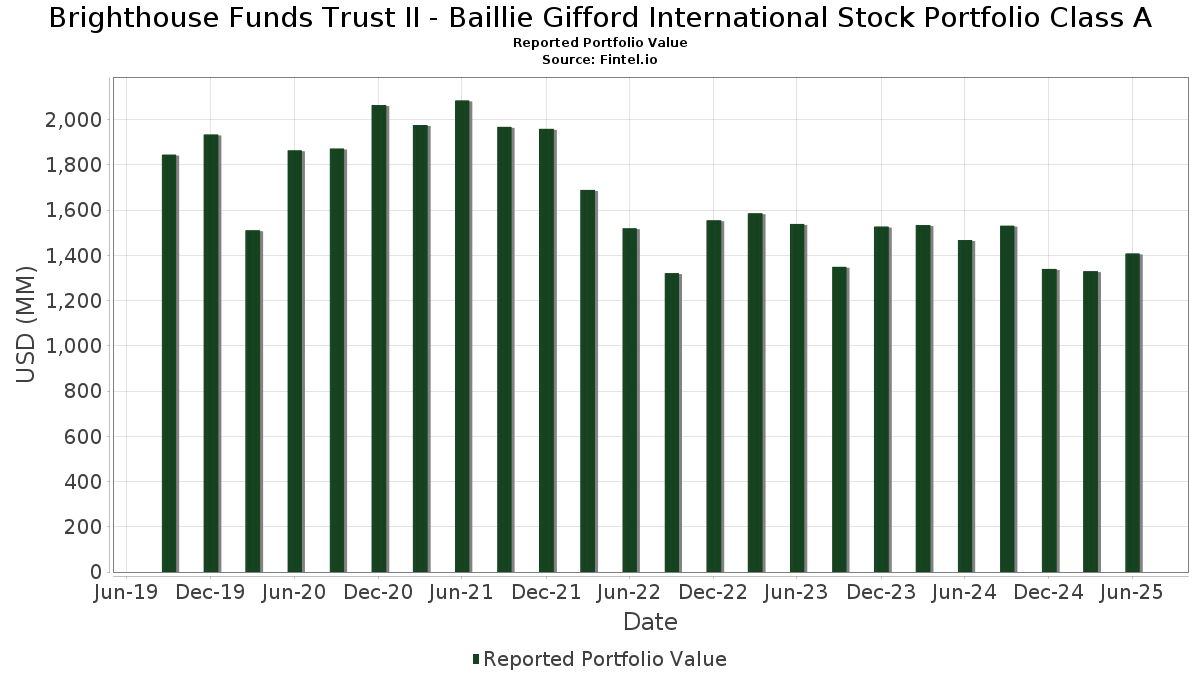

Brighthouse Funds Trust II - Baillie Gifford International Stock Portfolio Class A has disclosed 90 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,407,584,526 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Brighthouse Funds Trust II - Baillie Gifford International Stock Portfolio Class A’s top holdings are Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , MercadoLibre, Inc. (US:MELI) , Tencent Holdings Limited (DE:NNND) , Deutsche Börse AG (DE:DB1) , and Ryanair Holdings plc - Depositary Receipt (Common Stock) (US:RYAAY) . Brighthouse Funds Trust II - Baillie Gifford International Stock Portfolio Class A’s new positions include Sandoz Group AG (DE:D8Y) , Unicharm Corporation (DE:UN4) , PDD Holdings Inc. - Depositary Receipt (Common Stock) (US:PDD) , B3 S.A. - Brasil, Bolsa, Balcão (BR:B3SA3) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.26 | 14.50 | 1.0444 | 1.0444 | |

| 1.75 | 12.67 | 0.9129 | 0.9129 | |

| 11.10 | 0.7998 | 0.7998 | ||

| 1.80 | 64.99 | 4.6813 | 0.5839 | |

| 0.12 | 17.81 | 1.2829 | 0.4818 | |

| 0.02 | 58.79 | 4.2344 | 0.4672 | |

| 0.06 | 6.05 | 0.4357 | 0.4357 | |

| 0.62 | 35.48 | 2.5558 | 0.4315 | |

| 1.33 | 25.93 | 1.8679 | 0.2774 | |

| 0.02 | 18.04 | 1.2998 | 0.2541 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.06 | 27.66 | 1.9922 | -0.7760 | |

| 0.01 | 20.38 | 1.4677 | -0.5020 | |

| 0.72 | 46.10 | 3.3203 | -0.4111 | |

| 0.68 | 10.93 | 0.7872 | -0.3443 | |

| 0.35 | 20.38 | 1.4677 | -0.2801 | |

| 0.02 | 11.20 | 0.8066 | -0.2457 | |

| 0.57 | 17.70 | 1.2753 | -0.2203 | |

| 0.41 | 15.02 | 1.0821 | -0.2181 | |

| 1.54 | 21.90 | 1.5773 | -0.2085 | |

| 0.05 | 16.94 | 1.2201 | -0.1739 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 1.80 | -6.93 | 64.99 | 20.54 | 4.6813 | 0.5839 | |||

| MELI / MercadoLibre, Inc. | 0.02 | -11.48 | 58.79 | 18.59 | 4.2344 | 0.4672 | |||

| NNND / Tencent Holdings Limited | 0.72 | -6.84 | 46.10 | -6.12 | 3.3203 | -0.4111 | |||

| DB1 / Deutsche Börse AG | 0.11 | -7.12 | 36.96 | 2.83 | 2.6621 | -0.0692 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.62 | -6.74 | 35.48 | 26.94 | 2.5558 | 0.4315 | |||

| G24 / Scout24 SE | 0.26 | -12.14 | 35.37 | 16.24 | 2.5478 | 0.2353 | |||

| SAP / SAP SE | 0.11 | -6.21 | 34.28 | 7.46 | 2.4695 | 0.0448 | |||

| DS81 / DSV A/S | 0.14 | -6.56 | 33.18 | 15.96 | 2.3901 | 0.2155 | |||

| CRH / CRH plc | 0.33 | -7.31 | 30.12 | -1.69 | 2.1698 | -0.1590 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.63 | -6.21 | 27.77 | 5.00 | 2.0003 | -0.0097 | |||

| 6758 / Sony Group Corporation | 1.06 | -25.81 | 27.66 | -24.07 | 1.9922 | -0.7760 | |||

| BN / Danone S.A. | 0.34 | -5.98 | 27.38 | 0.24 | 1.9720 | -0.1036 | |||

| FBK / FinecoBank Banca Fineco S.p.A. | 1.19 | -5.48 | 26.46 | 5.89 | 1.9061 | 0.0069 | |||

| TME / Tencent Music Entertainment Group - Depositary Receipt (Common Stock) | 1.33 | -8.39 | 25.93 | 23.91 | 1.8679 | 0.2774 | |||

| HDFCB / HDFC Bank Ltd | 1.10 | -6.12 | 25.59 | 2.90 | 1.8433 | -0.0468 | |||

| 1N8 / Adyen N.V. | 0.01 | -5.08 | 24.55 | 14.02 | 1.7687 | 0.1320 | |||

| KSP / Kingspan Group PLC | 0.28 | -7.08 | 23.98 | -2.29 | 1.7271 | -0.1380 | |||

| NZM2 / Novozymes A/S | 0.32 | -7.43 | 23.04 | 14.05 | 1.6595 | 0.1243 | |||

| AMS / Amadeus IT Group, S.A. | 0.27 | -5.75 | 22.89 | 4.05 | 1.6491 | -0.0231 | |||

| EXPN / Experian plc | 0.43 | -5.97 | 22.39 | 4.52 | 1.6129 | -0.0153 | |||

| ACO5 / Atlas Copco AB (publ) | 1.54 | -7.78 | 21.90 | -6.81 | 1.5773 | -0.2085 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.13 | -8.58 | 21.32 | 12.05 | 1.5355 | 0.0896 | |||

| CNSWF / Constellation Software Inc. | 0.01 | -32.10 | 20.38 | -21.38 | 1.4677 | -0.5020 | |||

| RIO / Rio Tinto Group | 0.35 | -9.10 | 20.38 | -11.40 | 1.4677 | -0.2801 | |||

| D3H / Discovery Limited | 1.65 | -5.60 | 20.12 | 5.47 | 1.4489 | -0.0005 | |||

| TOITF / Topicus.com Inc. | 0.16 | -8.54 | 19.99 | 16.80 | 1.4400 | 0.1392 | |||

| 000333 / Midea Group Co., Ltd. | 1.94 | 34.76 | 19.48 | 25.06 | 1.4032 | 0.2195 | |||

| 1299 / AIA Group Limited | 2.16 | -8.89 | 19.41 | 8.39 | 1.3979 | 0.0371 | |||

| UNA / Unilever PLC | 0.32 | -5.67 | 19.25 | -3.55 | 1.3869 | -0.1303 | |||

| ASML / ASML Holding N.V. | 0.02 | -9.12 | 18.40 | 9.96 | 1.3253 | 0.0537 | |||

| SPF / Spotify Technology S.A. | 0.02 | -6.00 | 18.04 | 31.14 | 1.2998 | 0.2541 | |||

| SHMDF / Shimano Inc. | 0.12 | 63.38 | 17.81 | 68.96 | 1.2829 | 0.4818 | |||

| EDEN / Edenred SE | 0.57 | -5.35 | 17.70 | -10.04 | 1.2753 | -0.2203 | |||

| CPNG / Coupang, Inc. | 0.58 | -5.95 | 17.25 | 28.49 | 1.2428 | 0.2223 | |||

| ROG / Roche Holding AG | 0.05 | -7.12 | 16.94 | -7.65 | 1.2201 | -0.1739 | |||

| 7974 / Nintendo Co., Ltd. | 0.17 | -10.75 | 16.01 | 25.50 | 1.1531 | 0.1837 | |||

| 3064 / MonotaRO Co., Ltd. | 0.80 | -6.21 | 15.82 | -0.87 | 1.1396 | -0.0733 | |||

| DSY / Dassault Systèmes SE - Depositary Receipt (Common Stock) | 0.41 | -7.69 | 15.02 | -12.19 | 1.0821 | -0.2181 | |||

| IMCD / IMCD N.V. | 0.11 | -6.55 | 15.00 | -5.52 | 1.0805 | -0.1261 | |||

| 55027C106 / Lumine Group Inc | 0.43 | -7.64 | 14.99 | 15.27 | 1.0795 | 0.0914 | |||

| SHOP / Shopify Inc. | 0.13 | -7.35 | 14.85 | 12.05 | 1.0694 | 0.0624 | |||

| RELIANCE / Reliance Industries Limited | 0.85 | -10.46 | 14.82 | 5.41 | 1.0673 | -0.0010 | |||

| CFR / Compagnie Financière Richemont SA | 0.08 | -9.88 | 14.52 | -2.40 | 1.0455 | -0.0848 | |||

| D8Y / Sandoz Group AG | 0.26 | 14.50 | 1.0444 | 1.0444 | |||||

| WDH1 / Demant A/S | 0.34 | -7.58 | 14.32 | 14.78 | 1.0316 | 0.0833 | |||

| ICICIGI / ICICI Lombard General Insurance Company Limited | 0.58 | -8.88 | 13.83 | 4.35 | 0.9962 | -0.0110 | |||

| UN4 / Unicharm Corporation | 1.75 | 12.67 | 0.9129 | 0.9129 | |||||

| EXO / Exor N.V. | 0.12 | -7.58 | 12.58 | 2.43 | 0.9063 | -0.0272 | |||

| NHMAF / Nihon M&A Center Holdings Inc. | 2.47 | -8.92 | 12.50 | 19.09 | 0.9004 | 0.1027 | |||

| KNEBV / KONE Oyj | 0.19 | -9.18 | 12.29 | 8.10 | 0.8851 | 0.0213 | |||

| 6098 / Recruit Holdings Co., Ltd. | 0.20 | -7.50 | 11.83 | 4.83 | 0.8520 | -0.0055 | |||

| RAA / RATIONAL Aktiengesellschaft | 0.01 | -5.63 | 11.72 | -4.48 | 0.8441 | -0.0883 | |||

| KSPI / Joint Stock Company Kaspi.kz - Depositary Receipt (Common Stock) | 0.14 | -4.27 | 11.58 | -12.48 | 0.8343 | -0.1715 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.02 | -3.73 | 11.20 | -19.13 | 0.8066 | -0.2457 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 11.10 | 0.7998 | 0.7998 | ||||||

| 3994 / Money Forward, Inc. | 0.32 | -3.53 | 10.99 | 22.08 | 0.7919 | 0.1075 | |||

| 3690 / Meituan | 0.68 | -7.27 | 10.93 | -26.60 | 0.7872 | -0.3443 | |||

| 6861 / Keyence Corporation | 0.03 | -9.03 | 10.12 | -6.94 | 0.7289 | -0.0974 | |||

| 6273 / SMC Corporation | 0.03 | -4.91 | 9.76 | -3.77 | 0.7030 | -0.0677 | |||

| C2H / Copa Holdings, S.A. | 0.09 | -9.08 | 9.59 | 8.13 | 0.6905 | 0.0168 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.13 | -10.66 | 9.27 | -10.07 | 0.6681 | -0.1156 | |||

| OLY1 / Olympus Corporation | 0.76 | -4.73 | 9.01 | -13.94 | 0.6491 | -0.1466 | |||

| PZX / Ping An Insurance (Group) Company of China, Ltd. | 1.36 | -4.84 | 8.63 | 1.53 | 0.6216 | -0.0243 | |||

| NEX / National Express Group PLC | 0.07 | -5.72 | 8.59 | 25.31 | 0.6185 | 0.0977 | |||

| 600519 / Kweichow Moutai Co., Ltd. | 0.04 | -4.74 | 8.32 | -12.80 | 0.5993 | -0.1258 | |||

| DIM / Sartorius Stedim Biotech S.A. | 0.03 | -5.07 | 8.25 | 14.23 | 0.5944 | 0.0454 | |||

| 6B6 / monday.com Ltd. | 0.03 | -5.58 | 7.96 | 22.11 | 0.5733 | 0.0780 | |||

| STLJF / Stella-Jones Inc. | 0.13 | -6.84 | 7.72 | 13.25 | 0.5560 | 0.0380 | |||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 0.27 | -4.83 | 7.45 | -5.14 | 0.5369 | -0.0603 | |||

| TFII / TFI International Inc. | 0.08 | -5.59 | 7.45 | 9.45 | 0.5363 | 0.0194 | |||

| 6415 / Silergy Corp. | 0.56 | -5.55 | 6.84 | 0.40 | 0.4926 | -0.0250 | |||

| TPRO / Technoprobe S.p.A. | 0.76 | -6.55 | 6.66 | 30.54 | 0.4794 | 0.0919 | |||

| BME / B&M European Value Retail S.A. | 1.77 | -5.30 | 6.61 | 4.73 | 0.4764 | -0.0036 | |||

| BNTX / BioNTech SE - Depositary Receipt (Common Stock) | 0.06 | -6.75 | 6.28 | 9.03 | 0.4522 | 0.0146 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.06 | 6.05 | 0.4357 | 0.4357 | |||||

| 7M1 / Mips AB (publ) | 0.13 | 0.00 | 5.94 | 22.00 | 0.4279 | 0.0578 | |||

| US25160RLM33 / MD ST GO DB-8076 Q=DB D7 | 3.52 | 0.2538 | 0.2538 | ||||||

| Nomura Securities International Inc / RA (000000000) | 3.50 | 0.2521 | 0.2521 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 3.00 | 0.2161 | 0.2161 | ||||||

| CF Secured LLC / RA (000000000) | 3.00 | 0.2161 | 0.2161 | ||||||

| B3SA3 / B3 S.A. - Brasil, Bolsa, Balcão | 0.83 | 2.22 | 0.1598 | 0.1598 | |||||

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 1.00 | -50.00 | 1.00 | -50.00 | 0.0720 | -0.0800 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 1.00 | -50.00 | 1.00 | -50.00 | 0.0720 | -0.0800 | |||

| Barclays Capital Inc / RA (000000000) | 1.00 | 0.0720 | 0.0720 | ||||||

| ING Financial Markets LLC / RA (000000000) | 1.00 | 0.0720 | 0.0720 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 1.00 | 0.0720 | 0.0720 | ||||||

| TD Prime Services LLC / RA (000000000) | 1.00 | 0.0720 | 0.0720 | ||||||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 0.50 | -50.00 | 0.50 | -50.00 | 0.0360 | -0.0400 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 0.50 | -50.00 | 0.50 | -50.00 | 0.0360 | -0.0400 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 0.50 | -50.00 | 0.50 | -50.00 | 0.0360 | -0.0400 | |||

| MNOD / MMC Norilsk Nickel PJSC | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| GMKN / Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel | 3.92 | 0.00 | 0.00 | 0.0000 | -0.0000 |