Basic Stats

| Portfolio Value | $ 2,763,540,776 |

| Current Positions | 112 |

Latest Holdings, Performance, AUM (from 13F, 13D)

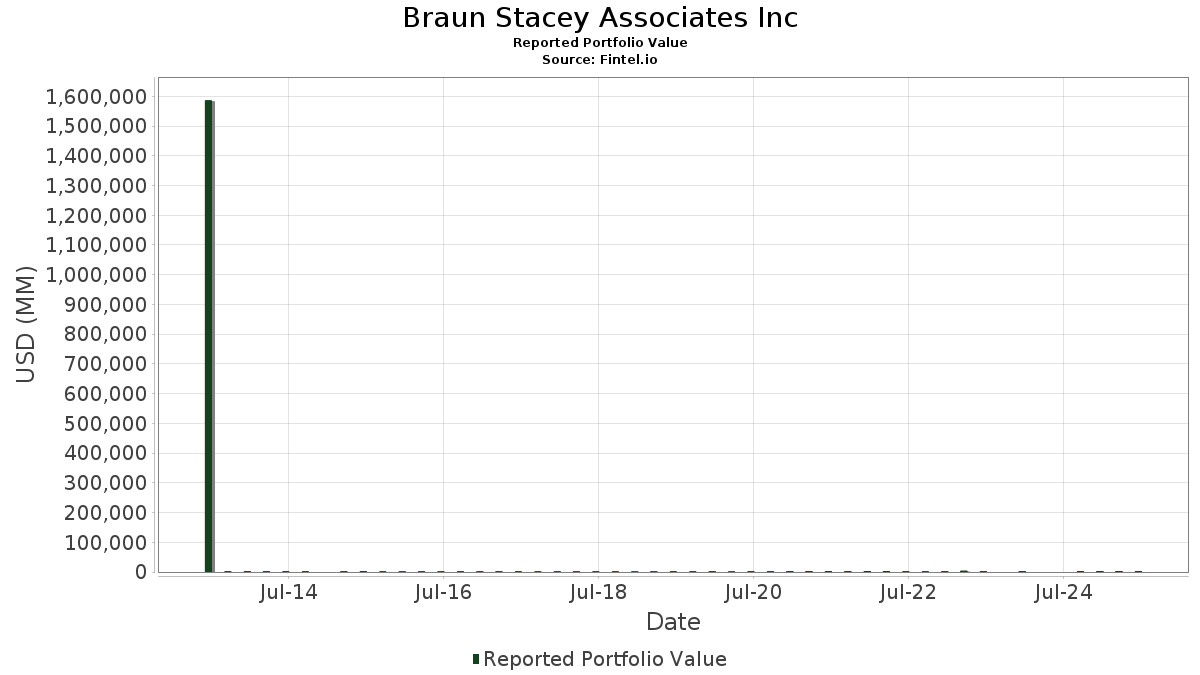

Braun Stacey Associates Inc has disclosed 112 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,763,540,776 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Braun Stacey Associates Inc’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Braun Stacey Associates Inc’s new positions include Credo Technology Group Holding Ltd (US:CRDO) , QXO, Inc. (US:QXO) , Quest Diagnostics Incorporated (US:DGX) , VeriSign, Inc. (US:VRSN) , and Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.15 | 181.68 | 6.5742 | 1.3578 | |

| 0.31 | 29.01 | 1.0496 | 1.0496 | |

| 0.02 | 28.31 | 1.0245 | 1.0245 | |

| 0.33 | 165.24 | 5.9792 | 0.9924 | |

| 1.24 | 26.74 | 0.9675 | 0.9675 | |

| 0.09 | 24.78 | 0.8968 | 0.8968 | |

| 0.14 | 24.42 | 0.8837 | 0.8837 | |

| 0.17 | 21.41 | 0.7749 | 0.7749 | |

| 0.24 | 66.83 | 2.4183 | 0.7199 | |

| 0.41 | 52.26 | 1.8912 | 0.7145 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.61 | 124.20 | 4.4941 | -1.1595 | |

| 0.29 | 21.08 | 0.7630 | -0.9495 | |

| 0.00 | 0.88 | 0.0319 | -0.8330 | |

| 0.12 | 28.83 | 1.0432 | -0.3987 | |

| 0.32 | 18.73 | 0.6778 | -0.3686 | |

| 0.05 | 37.15 | 1.3442 | -0.3554 | |

| 0.39 | 41.58 | 1.5046 | -0.3523 | |

| 0.48 | 22.62 | 0.8185 | -0.3394 | |

| 0.32 | 14.96 | 0.5412 | -0.3250 | |

| 0.07 | 22.60 | 0.8179 | -0.3175 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 1.15 | -2.30 | 181.68 | 42.43 | 6.5742 | 1.3578 | |||

| MSFT / Microsoft Corporation | 0.33 | 2.26 | 165.24 | 35.50 | 5.9792 | 0.9924 | |||

| AAPL / Apple Inc. | 0.61 | -2.74 | 124.20 | -10.17 | 4.4941 | -1.1595 | |||

| AMZN / Amazon.com, Inc. | 0.45 | -4.07 | 98.45 | 10.62 | 3.5624 | -0.0771 | |||

| META / Meta Platforms, Inc. | 0.11 | -11.51 | 83.56 | 13.32 | 3.0238 | 0.0083 | |||

| AVGO / Broadcom Inc. | 0.24 | -2.26 | 66.83 | 60.92 | 2.4183 | 0.7199 | |||

| JPM / JPMorgan Chase & Co. | 0.19 | -0.65 | 54.62 | 17.41 | 1.9765 | 0.0741 | |||

| GOOGL / Alphabet Inc. | 0.31 | -7.22 | 53.99 | 5.73 | 1.9538 | -0.1345 | |||

| VRT / Vertiv Holdings Co | 0.41 | 2.12 | 52.26 | 81.63 | 1.8912 | 0.7145 | |||

| HWM / Howmet Aerospace Inc. | 0.26 | -24.84 | 48.99 | 7.84 | 1.7726 | -0.0850 | |||

| APP / AppLovin Corporation | 0.13 | -2.10 | 47.21 | 29.35 | 1.7082 | 0.2158 | |||

| XOM / Exxon Mobil Corporation | 0.39 | 1.02 | 41.58 | -8.43 | 1.5046 | -0.3523 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.08 | 0.92 | 38.35 | -7.95 | 1.3875 | -0.3160 | |||

| LLY / Eli Lilly and Company | 0.05 | -5.31 | 37.15 | -10.63 | 1.3442 | -0.3554 | |||

| WELL / Welltower Inc. | 0.23 | -2.79 | 35.03 | -2.46 | 1.2675 | -0.2011 | |||

| MA / Mastercard Incorporated | 0.06 | -4.08 | 34.68 | -1.66 | 1.2550 | -0.1872 | |||

| NDAQ / Nasdaq, Inc. | 0.38 | -1.32 | 34.19 | 16.33 | 1.2371 | 0.0352 | |||

| PWR / Quanta Services, Inc. | 0.09 | -13.57 | 33.45 | 28.56 | 1.2103 | 0.1464 | |||

| TRV / The Travelers Companies, Inc. | 0.12 | -0.83 | 31.75 | 0.33 | 1.1488 | -0.1452 | |||

| NOW / ServiceNow, Inc. | 0.03 | -8.93 | 31.00 | 17.60 | 1.1216 | 0.0438 | |||

| WFC / Wells Fargo & Company | 0.39 | -7.69 | 30.86 | 3.02 | 1.1167 | -0.1083 | |||

| TJX / The TJX Companies, Inc. | 0.24 | 2.43 | 29.04 | 3.85 | 1.0507 | -0.0927 | |||

| CRDO / Credo Technology Group Holding Ltd | 0.31 | 29.01 | 1.0496 | 1.0496 | |||||

| AZO / AutoZone, Inc. | 0.01 | 3.65 | 29.00 | 0.92 | 1.0494 | -0.1258 | |||

| TMUS / T-Mobile US, Inc. | 0.12 | -8.48 | 28.83 | -18.24 | 1.0432 | -0.3987 | |||

| ITRI / Itron, Inc. | 0.22 | -0.21 | 28.58 | 25.39 | 1.0341 | 0.1021 | |||

| NFLX / Netflix, Inc. | 0.02 | 28.31 | 1.0245 | 1.0245 | |||||

| EVR / Evercore Inc. | 0.10 | -18.47 | 28.20 | 10.22 | 1.0203 | -0.0258 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.21 | 97.91 | 28.12 | 124.13 | 1.0176 | 0.5045 | |||

| GOOG / Alphabet Inc. | 0.16 | -20.63 | 27.90 | -9.88 | 1.0096 | -0.2565 | |||

| BSX / Boston Scientific Corporation | 0.26 | -3.49 | 27.45 | 2.76 | 0.9932 | -0.0991 | |||

| FWONK / Formula One Group | 0.26 | -14.19 | 27.44 | -0.38 | 0.9928 | -0.1334 | |||

| PANW / Palo Alto Networks, Inc. | 0.13 | -7.88 | 27.25 | 10.47 | 0.9861 | -0.0226 | |||

| RTX / RTX Corporation | 0.19 | 5.33 | 27.11 | 16.12 | 0.9811 | 0.0262 | |||

| QXO / QXO, Inc. | 1.24 | 26.74 | 0.9675 | 0.9675 | |||||

| ETR / Entergy Corporation | 0.32 | -0.50 | 26.49 | -3.26 | 0.9587 | -0.1612 | |||

| MCK / McKesson Corporation | 0.04 | -0.71 | 26.17 | 8.12 | 0.9468 | -0.0429 | |||

| MU / Micron Technology, Inc. | 0.21 | -9.92 | 25.80 | 27.77 | 0.9336 | 0.1079 | |||

| TXRH / Texas Roadhouse, Inc. | 0.14 | -8.51 | 25.75 | 2.90 | 0.9318 | -0.0915 | |||

| EHC / Encompass Health Corporation | 0.20 | 66.15 | 25.10 | 101.18 | 0.9084 | 0.3981 | |||

| BLK / BlackRock, Inc. | 0.02 | -1.55 | 25.04 | 9.14 | 0.9062 | -0.0321 | |||

| LRCX / Lam Research Corporation | 0.25 | -14.87 | 24.82 | 13.98 | 0.8982 | 0.0076 | |||

| CME / CME Group Inc. | 0.09 | 24.78 | 0.8968 | 0.8968 | |||||

| MMM / 3M Company | 0.16 | 1.88 | 24.72 | 5.61 | 0.8944 | -0.0626 | |||

| DGX / Quest Diagnostics Incorporated | 0.14 | 24.42 | 0.8837 | 0.8837 | |||||

| GEV / GE Vernova Inc. | 0.05 | 26.82 | 24.24 | 119.81 | 0.8771 | 0.4262 | |||

| CELH / Celsius Holdings, Inc. | 0.52 | 212.45 | 24.02 | 306.98 | 0.8693 | 0.6279 | |||

| LTH / Life Time Group Holdings, Inc. | 0.78 | 1.95 | 23.52 | 2.39 | 0.8510 | -0.0883 | |||

| WEC / WEC Energy Group, Inc. | 0.22 | 0.74 | 23.27 | -3.68 | 0.8419 | -0.1459 | |||

| BAC / Bank of America Corporation | 0.48 | -29.55 | 22.62 | -20.12 | 0.8185 | -0.3394 | |||

| AXP / American Express Company | 0.07 | -31.34 | 22.60 | -18.60 | 0.8179 | -0.3175 | |||

| TRGP / Targa Resources Corp. | 0.13 | 2.19 | 22.37 | -11.26 | 0.8094 | -0.2213 | |||

| KO / The Coca-Cola Company | 0.31 | -0.30 | 22.18 | -1.51 | 0.8028 | -0.1183 | |||

| CSCO / Cisco Systems, Inc. | 0.32 | 122.46 | 22.02 | 150.12 | 0.7969 | 0.4368 | |||

| KD / Kyndryl Holdings, Inc. | 0.52 | 127.33 | 21.70 | 203.81 | 0.7854 | 0.4932 | |||

| CL / Colgate-Palmolive Company | 0.24 | -4.06 | 21.64 | -6.93 | 0.7830 | -0.1677 | |||

| COST / Costco Wholesale Corporation | 0.02 | -6.52 | 21.61 | -2.16 | 0.7819 | -0.1212 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.17 | 21.41 | 0.7749 | 0.7749 | |||||

| ACGL / Arch Capital Group Ltd. | 0.23 | -3.39 | 21.34 | -8.54 | 0.7720 | -0.1819 | |||

| CORT / Corcept Therapeutics Incorporated | 0.29 | -21.65 | 21.08 | -49.65 | 0.7630 | -0.9495 | |||

| PG / The Procter & Gamble Company | 0.13 | 0.24 | 20.51 | -6.29 | 0.7421 | -0.1528 | |||

| HD / The Home Depot, Inc. | 0.05 | 0.53 | 19.78 | 0.57 | 0.7157 | -0.0885 | |||

| POST / Post Holdings, Inc. | 0.18 | -14.35 | 19.58 | -19.74 | 0.7084 | -0.2891 | |||

| TKO / TKO Group Holdings, Inc. | 0.11 | 149.83 | 19.21 | 197.51 | 0.6950 | 0.4310 | |||

| APH / Amphenol Corporation | 0.19 | 19.20 | 0.6947 | 0.6947 | |||||

| SN / SharkNinja, Inc. | 0.19 | 18.00 | 19.08 | 40.04 | 0.6903 | 0.1332 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.03 | 0.75 | 19.00 | 11.36 | 0.6876 | -0.0102 | |||

| VICI / VICI Properties Inc. | 0.58 | -2.72 | 18.91 | -2.79 | 0.6841 | -0.1111 | |||

| BRBR / BellRing Brands, Inc. | 0.32 | -5.91 | 18.73 | -26.79 | 0.6778 | -0.3686 | |||

| TGTX / TG Therapeutics, Inc. | 0.52 | 3.06 | 18.64 | -5.93 | 0.6746 | -0.1359 | |||

| LDOS / Leidos Holdings, Inc. | 0.12 | -19.84 | 18.24 | -6.28 | 0.6601 | -0.1359 | |||

| AEE / Ameren Corporation | 0.19 | 0.36 | 18.04 | -4.01 | 0.6528 | -0.1157 | |||

| NUE / Nucor Corporation | 0.13 | 1.96 | 17.38 | 9.76 | 0.6290 | -0.0187 | |||

| TECK / Teck Resources Limited | 0.42 | -0.08 | 16.98 | 10.76 | 0.6144 | -0.0125 | |||

| TEAM / Atlassian Corporation | 0.08 | 50.63 | 15.79 | 44.16 | 0.5713 | 0.1234 | |||

| COP / ConocoPhillips | 0.17 | -3.56 | 15.34 | -17.60 | 0.5550 | -0.2061 | |||

| BMY / Bristol-Myers Squibb Company | 0.32 | -6.97 | 14.96 | -29.39 | 0.5412 | -0.3250 | |||

| ABBV / AbbVie Inc. | 0.08 | 2.09 | 14.91 | -9.56 | 0.5394 | -0.1346 | |||

| GS / The Goldman Sachs Group, Inc. | 0.02 | 155.14 | 13.81 | 230.60 | 0.4996 | 0.3288 | |||

| LIN / Linde plc | 0.03 | 2.59 | 13.29 | 3.37 | 0.4808 | -0.0448 | |||

| ANET / Arista Networks Inc | 0.12 | -29.63 | 12.57 | -7.07 | 0.4549 | -0.0983 | |||

| VRSN / VeriSign, Inc. | 0.04 | 12.10 | 0.4380 | 0.4380 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.16 | -25.97 | 11.51 | -32.06 | 0.4166 | -0.2763 | |||

| GTLS / Chart Industries, Inc. | 0.07 | -24.96 | 11.15 | -14.41 | 0.4034 | -0.1292 | |||

| AMGN / Amgen Inc. | 0.04 | -5.52 | 11.01 | -15.33 | 0.3986 | -0.1334 | |||

| MET / MetLife, Inc. | 0.12 | -12.18 | 9.46 | -12.04 | 0.3425 | -0.0975 | |||

| CAT / Caterpillar Inc. | 0.02 | -39.29 | 8.30 | -28.54 | 0.3004 | -0.1747 | |||

| DE / Deere & Company | 0.01 | -21.66 | 4.12 | -15.14 | 0.1491 | -0.0494 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -3.03 | 3.96 | 7.09 | 0.1431 | -0.0079 | |||

| MCD / McDonald's Corporation | 0.01 | 1.46 | 3.05 | -5.11 | 0.1102 | -0.0210 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 2.51 | -1.68 | 0.0908 | -0.0136 | |||

| IBM / International Business Machines Corporation | 0.01 | 60.58 | 1.95 | 90.35 | 0.0707 | 0.0287 | |||

| V / Visa Inc. | 0.00 | 0.00 | 1.62 | 1.32 | 0.0585 | -0.0068 | |||

| EXE / Expand Energy Corporation | 0.01 | 3.82 | 1.59 | 9.07 | 0.0574 | -0.0021 | |||

| US9229087104 / VANGUARD 500 INDEX FUND VANGUARD 500 INDEX ADM | 0.00 | 3.37 | 1.32 | 14.32 | 0.0477 | 0.0005 | |||

| QSR / Restaurant Brands International Inc. | 0.02 | 0.12 | 1.08 | -0.37 | 0.0390 | -0.0053 | |||

| CTAS / Cintas Corporation | 0.00 | 0.00 | 1.08 | 8.47 | 0.0389 | -0.0016 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | -19.03 | 0.97 | -14.05 | 0.0352 | -0.0111 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -92.99 | 0.88 | -95.83 | 0.0319 | -0.8330 | |||

| ATO / Atmos Energy Corporation | 0.01 | 0.00 | 0.78 | -0.26 | 0.0282 | -0.0038 | |||

| UBER / Uber Technologies, Inc. | 0.01 | -31.70 | 0.67 | -12.58 | 0.0242 | -0.0071 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -0.03 | 0.60 | 4.90 | 0.0217 | -0.0017 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | -4.95 | 0.59 | -0.17 | 0.0215 | -0.0028 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | -25.52 | 0.38 | -12.41 | 0.0138 | -0.0040 | |||

| VONV / Vanguard Scottsdale Funds - Vanguard Russell 1000 Value ETF | 0.00 | 26.15 | 0.33 | 29.92 | 0.0120 | 0.0016 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | -8.39 | 0.31 | -0.97 | 0.0111 | -0.0015 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | -0.42 | 0.30 | 22.22 | 0.0108 | 0.0008 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.29 | 0.0105 | 0.0105 | |||||

| VIGRX / Vanguard Index Funds - Vanguard Index Trust Growth Index Fund | 0.00 | -37.88 | 0.26 | -26.63 | 0.0094 | -0.0051 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | -1.88 | 0.26 | 1.59 | 0.0092 | -0.0010 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | -0.52 | 0.22 | 2.76 | 0.0081 | -0.0008 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | 0.21 | 0.0077 | 0.0077 | |||||

| GPN / Global Payments Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALKT / Alkami Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRRM / Verra Mobility Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DKNG / DraftKings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NYT / The New York Times Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TTD / The Trade Desk, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MRVL / Marvell Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DY / Dycom Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SRPT / Sarepta Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |