Basic Stats

| Portfolio Value | $ 783,027,741 |

| Current Positions | 142 |

Latest Holdings, Performance, AUM (from 13F, 13D)

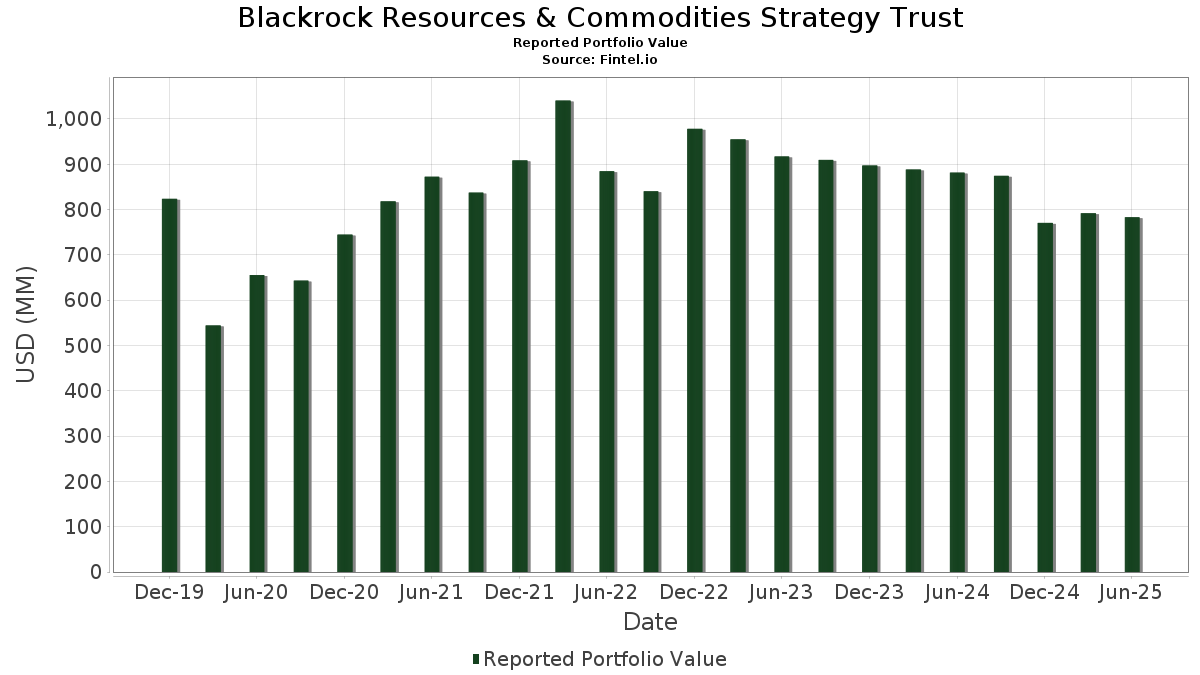

Blackrock Resources & Commodities Strategy Trust has disclosed 142 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 783,027,741 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Blackrock Resources & Commodities Strategy Trust’s top holdings are Shell plc - Depositary Receipt (Common Stock) (US:SHEL) , Nutrien Ltd. (US:NTR) , Exxon Mobil Corporation (US:XOM) , Wheaton Precious Metals Corp. (US:WPM) , and Corteva, Inc. (US:CTVA) . Blackrock Resources & Commodities Strategy Trust’s new positions include The Mosaic Company (US:MOS) , Allied Gold Corp (CA:CA01921DAA33) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.21 | 35.64 | 4.5592 | 4.5592 | |

| 0.73 | 26.52 | 3.3929 | 3.3929 | |

| 1.00 | 58.16 | 7.4405 | 3.2913 | |

| 0.55 | 32.25 | 4.1260 | 2.1737 | |

| 0.71 | 30.78 | 3.9375 | 1.9950 | |

| 0.57 | 42.43 | 5.4285 | 1.6067 | |

| 6.08 | 23.68 | 3.0294 | 1.4544 | |

| 1.18 | 20.97 | 2.6823 | 1.2440 | |

| 0.48 | 15.12 | 1.9347 | 1.0869 | |

| 0.65 | 24.46 | 3.1297 | 0.9780 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 22.27 | 22.27 | 2.8497 | -1.7246 | |

| 2.56 | 14.68 | 1.8775 | -1.6655 | |

| 0.84 | 59.02 | 7.5513 | -1.0857 | |

| 0.00 | 0.00 | -0.9945 | ||

| 0.00 | 0.00 | -0.8312 | ||

| 0.01 | 0.63 | 0.0806 | -0.6915 | |

| 0.08 | 14.65 | 1.8738 | -0.6372 | |

| 0.99 | 20.52 | 2.6254 | -0.5811 | |

| 0.18 | 25.91 | 3.3150 | -0.5364 | |

| 0.69 | 14.46 | 1.8500 | -0.4167 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.84 | -9.81 | 59.02 | -13.34 | 7.5513 | -1.0857 | |||

| NTR / Nutrien Ltd. | 1.00 | 51.59 | 58.16 | 77.75 | 7.4405 | 3.2913 | |||

| XOM / Exxon Mobil Corporation | 0.48 | 11.18 | 51.41 | 0.78 | 6.5775 | 0.1081 | |||

| WPM / Wheaton Precious Metals Corp. | 0.49 | -12.32 | 43.84 | 1.43 | 5.6090 | 0.1273 | |||

| CTVA / Corteva, Inc. | 0.57 | 18.88 | 42.43 | 40.79 | 5.4285 | 1.6067 | |||

| AAL / Anglo American plc | 1.21 | 35.64 | 4.5592 | 4.5592 | |||||

| NEM / Newmont Corporation | 0.55 | 73.60 | 32.25 | 109.48 | 4.1260 | 2.1737 | |||

| FCX / Freeport-McMoRan Inc. | 0.71 | 75.48 | 30.78 | 100.92 | 3.9375 | 1.9950 | |||

| Smurfit WestRock PLC / EC (IE00028FXN24) | 0.65 | 5.25 | 27.87 | 0.78 | 3.5660 | 0.0589 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 2.86 | -5.23 | 27.77 | -7.79 | 3.5531 | -0.2665 | |||

| MOS / The Mosaic Company | 0.73 | 26.52 | 3.3929 | 3.3929 | |||||

| CVX / Chevron Corporation | 0.18 | -0.32 | 25.91 | -14.68 | 3.3150 | -0.5364 | |||

| SU / Suncor Energy Inc. | 0.65 | 49.02 | 24.46 | 44.17 | 3.1297 | 0.9780 | |||

| GLEN / Glencore plc | 6.08 | 79.08 | 23.68 | 90.65 | 3.0294 | 1.4544 | |||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 22.27 | -38.25 | 22.27 | -38.25 | 2.8497 | -1.7246 | |||

| FQVLF / First Quantum Minerals Ltd. | 1.18 | 39.92 | 20.97 | 84.85 | 2.6823 | 1.2440 | |||

| B / Barrick Mining Corporation | 0.99 | -24.22 | 20.52 | -18.84 | 2.6254 | -0.5811 | |||

| EOG / EOG Resources, Inc. | 0.14 | 27.63 | 16.25 | 19.05 | 2.0795 | 0.3480 | |||

| MT / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 0.48 | 106.63 | 15.12 | 126.17 | 1.9347 | 1.0869 | |||

| TECK / Teck Resources Limited | 0.37 | -7.57 | 15.09 | 2.44 | 1.9301 | 0.0627 | |||

| NOH1 / Norsk Hydro ASA | 2.56 | -46.97 | 14.68 | -47.47 | 1.8775 | -1.6655 | |||

| PKG / Packaging Corporation of America | 0.08 | -22.28 | 14.65 | -26.03 | 1.8738 | -0.6372 | |||

| GPK / Graphic Packaging Holding Company | 0.69 | -0.32 | 14.46 | -19.10 | 1.8500 | -0.4167 | |||

| HES / Hess Corporation | 0.10 | 21.54 | 14.34 | 5.42 | 1.8340 | 0.1095 | |||

| UPM / UPM-Kymmene Oyj | 0.50 | -0.32 | 13.54 | 1.45 | 1.7329 | 0.0399 | |||

| CRH / CRH plc | 0.13 | 44.81 | 12.27 | 51.10 | 1.5696 | 0.5400 | |||

| MNDI / Mondi plc | 0.65 | -0.32 | 10.54 | 9.19 | 1.3486 | 0.1243 | |||

| HEI / Heidelberg Materials AG | 0.04 | -27.59 | 8.72 | -1.08 | 1.1157 | -0.0022 | |||

| EQT / EQT Corporation | 0.14 | -9.67 | 8.45 | -1.40 | 1.0806 | -0.0057 | |||

| CA01921DAA33 / Allied Gold Corp | 7.56 | 5.00 | 0.9672 | 0.0542 | |||||

| KGC / Kinross Gold Corporation | 0.47 | -25.44 | 7.39 | -7.59 | 0.9459 | -0.0686 | |||

| CH1300646267 / Bunge Global SA | 0.09 | -1.44 | 7.34 | 1.75 | 0.9393 | 0.0005 | |||

| Hofseth International / EC (000000000) | 18.99 | 7.24 | 0.9257 | 0.9257 | |||||

| DAR / Darling Ingredients Inc. | 0.19 | 7.15 | 0.9151 | 0.9151 | |||||

| FTI / TechnipFMC plc | 0.20 | -0.32 | 6.89 | 8.34 | 0.8811 | 0.0749 | |||

| PR / Permian Resources Corporation | 0.38 | -0.32 | 5.16 | -1.97 | 0.6607 | -0.0074 | |||

| RPHA / Valterra Platinum Limited | 0.11 | -5.79 | 4.79 | 2.90 | 0.6134 | 0.0225 | |||

| US0669225197 / BlackRock Cash Funds: Institutional, SL Agency Shares | 3.60 | -27.15 | 3.61 | -27.16 | 0.4613 | -0.1664 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | -91.21 | 0.63 | -89.65 | 0.0806 | -0.6915 | |||

| CH0013283368 / PRECIOUS WOODS HLDG AG REG COMMON STOCK CHF1. | 0.02 | 0.00 | 0.13 | 2.42 | 0.0163 | 0.0005 | |||

| OGZD / Public Joint Stock Company Gazprom - Depositary Receipt (Common Stock) | 5.43 | 0.00 | 0.00 | 0.0001 | 0.0000 | ||||

| PLZL / Public Joint Stock Company Polyus | 1.05 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| GIMB / Gimv NV | 0.00 | 0.0000 | 0.0000 | ||||||

| LBHI GUARANTEE CLAIM USD LBHI GUAR TCL USD / LON (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| INP / International Paper Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.8312 | ||||

| 1TRGP / Targa Resources Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9945 | ||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0000 | -0.0000 | ||||||

| SUNCOR ENERGY INC / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| JUL25 UPM FH C @ 26.0366 / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| SUNCOR ENERGY INC / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| JUL25 NHY NO C @ 59.466 / DE (000000000) | -0.00 | -0.0001 | -0.0001 | ||||||

| HESS CORP / DE (000000000) | -0.00 | -0.0002 | -0.0002 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.00 | -0.0003 | -0.0003 | ||||||

| CRH PLC / DE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| PERMIAN RESOURCES CORP / DE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| JUL25 MNDI LN C @ 12.1737 / DE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.01 | -0.0007 | -0.0007 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.01 | -0.0009 | -0.0009 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.01 | -0.0011 | -0.0011 | ||||||

| SMURFIT WESTROCK PLC / DE (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| VALE US FLEX / DE (000000000) | -0.01 | -0.0012 | -0.0012 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.01 | -0.0013 | -0.0013 | ||||||

| ARCELORMITTAL SA / DE (000000000) | -0.01 | -0.0014 | -0.0014 | ||||||

| PR US FLEX / DE (000000000) | -0.01 | -0.0014 | -0.0014 | ||||||

| TECK RESOURCES LTD / DE (000000000) | -0.01 | -0.0017 | -0.0017 | ||||||

| ARCELORMITTAL SA / DE (000000000) | -0.01 | -0.0017 | -0.0017 | ||||||

| EOG RESOURCES INC / DE (000000000) | -0.01 | -0.0018 | -0.0018 | ||||||

| VALE US FLEX / DE (000000000) | -0.01 | -0.0018 | -0.0018 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.01 | -0.0019 | -0.0019 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0020 | -0.0020 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.02 | -0.0024 | -0.0024 | ||||||

| AUG25 MNDI LN C @ 12.0523 / DE (000000000) | -0.02 | -0.0025 | -0.0025 | ||||||

| SW US FLEX / DE (000000000) | -0.02 | -0.0026 | -0.0026 | ||||||

| EOG RESOURCES INC / DE (000000000) | -0.02 | -0.0026 | -0.0026 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.02 | -0.0028 | -0.0028 | ||||||

| EQT CORP / DE (000000000) | -0.02 | -0.0028 | -0.0028 | ||||||

| SUNCOR ENERGY INC / DE (000000000) | -0.02 | -0.0032 | -0.0032 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.03 | -0.0032 | -0.0032 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.03 | -0.0032 | -0.0032 | ||||||

| GB00H240B223 / LME Nickel Base Metal | -0.03 | -0.0034 | -0.0034 | ||||||

| VALE SA / DE (000000000) | -0.03 | -0.0034 | -0.0034 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.03 | -0.0036 | -0.0036 | ||||||

| CRH PLC / DE (000000000) | -0.03 | -0.0038 | -0.0038 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.03 | -0.0039 | -0.0039 | ||||||

| VALE US FLEX / DE (000000000) | -0.03 | -0.0039 | -0.0039 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.03 | -0.0040 | -0.0040 | ||||||

| PACKAGING CORP OF AMERICA / DE (000000000) | -0.03 | -0.0041 | -0.0041 | ||||||

| SUNCOR ENERGY INC / DE (000000000) | -0.03 | -0.0041 | -0.0041 | ||||||

| ARCELORMITTAL SA / DE (000000000) | -0.04 | -0.0046 | -0.0046 | ||||||

| CHEVRON CORP / DE (000000000) | -0.04 | -0.0047 | -0.0047 | ||||||

| CHEVRON CORP / DE (000000000) | -0.04 | -0.0048 | -0.0048 | ||||||

| SUNCOR ENERGY INC / DE (000000000) | -0.04 | -0.0049 | -0.0049 | ||||||

| ARCELORMITTAL SA / DE (000000000) | -0.04 | -0.0049 | -0.0049 | ||||||

| MOSAIC CO/THE / DE (000000000) | -0.04 | -0.0051 | -0.0051 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0.04 | -0.0051 | -0.0051 | ||||||

| EOG RESOURCES INC / DE (000000000) | -0.04 | -0.0052 | -0.0052 | ||||||

| TECK RESOURCES LTD / DE (000000000) | -0.04 | -0.0052 | -0.0052 | ||||||

| SHELL PLC / DE (000000000) | -0.04 | -0.0052 | -0.0052 | ||||||

| CRH PLC / DE (000000000) | -0.04 | -0.0053 | -0.0053 | ||||||

| SHELL PLC / DE (000000000) | -0.04 | -0.0055 | -0.0055 | ||||||

| CRH PLC / DE (000000000) | -0.04 | -0.0055 | -0.0055 | ||||||

| HESS CORP / DE (000000000) | -0.04 | -0.0058 | -0.0058 | ||||||

| DAR US FLEX / DE (000000000) | -0.05 | -0.0059 | -0.0059 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.05 | -0.0060 | -0.0060 | ||||||

| TECHNIPFMC PLC / DE (000000000) | -0.05 | -0.0061 | -0.0061 | ||||||

| ARCELORMITTAL SA / DE (000000000) | -0.05 | -0.0064 | -0.0064 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.05 | -0.0064 | -0.0064 | ||||||

| TECHNIPFMC PLC / DE (000000000) | -0.05 | -0.0065 | -0.0065 | ||||||

| MOSAIC CO/THE / DE (000000000) | -0.06 | -0.0073 | -0.0073 | ||||||

| BARRICK MINING CORP / DE (000000000) | -0.06 | -0.0078 | -0.0078 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.06 | -0.0078 | -0.0078 | ||||||

| VALE SA / DE (000000000) | -0.06 | -0.0080 | -0.0080 | ||||||

| SHELL PLC / DE (000000000) | -0.06 | -0.0080 | -0.0080 | ||||||

| EQT CORP / DE (000000000) | -0.06 | -0.0080 | -0.0080 | ||||||

| PACKAGING CORP OF AMERICA / DE (000000000) | -0.06 | -0.0082 | -0.0082 | ||||||

| FREEPORT-MCMORAN INC / DE (000000000) | -0.07 | -0.0096 | -0.0096 | ||||||

| BARRICK MINING CORP / DE (000000000) | -0.08 | -0.0096 | -0.0096 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.09 | -0.0109 | -0.0109 | ||||||

| TECK RESOURCES LTD / DE (000000000) | -0.09 | -0.0114 | -0.0114 | ||||||

| FIRST QUANTUM MINERALS LTD / DE (000000000) | -0.09 | -0.0115 | -0.0115 | ||||||

| MOSAIC CO/THE / DE (000000000) | -0.10 | -0.0131 | -0.0131 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.11 | -0.0141 | -0.0141 | ||||||

| VALE SA / DE (000000000) | -0.12 | -0.0149 | -0.0149 | ||||||

| FIRST QUANTUM MINERALS LTD / DE (000000000) | -0.12 | -0.0151 | -0.0151 | ||||||

| FREEPORT-MCMORAN INC / DE (000000000) | -0.12 | -0.0153 | -0.0153 | ||||||

| DARLING INGREDIENTS INC / DE (000000000) | -0.12 | -0.0157 | -0.0157 | ||||||

| FIRST QUANTUM MINERALS LTD / DE (000000000) | -0.12 | -0.0159 | -0.0159 | ||||||

| CHEVRON CORP / DE (000000000) | -0.13 | -0.0163 | -0.0163 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.13 | -0.0169 | -0.0169 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.14 | -0.0176 | -0.0176 | ||||||

| SW US FLEX / DE (000000000) | -0.14 | -0.0176 | -0.0176 | ||||||

| EXXON MOBIL CORP / DE (000000000) | -0.14 | -0.0178 | -0.0178 | ||||||

| SHELL PLC / DE (000000000) | -0.15 | -0.0195 | -0.0195 | ||||||

| SHELL PLC / DE (000000000) | -0.16 | -0.0210 | -0.0210 | ||||||

| NUTRIEN LTD / DE (000000000) | -0.17 | -0.0220 | -0.0220 | ||||||

| FREEPORT-MCMORAN INC / DE (000000000) | -0.17 | -0.0222 | -0.0222 | ||||||

| B.FLEX / DE (000000000) | -0.17 | -0.0224 | -0.0224 | ||||||

| TECK RESOURCES LTD / DE (000000000) | -0.19 | -0.0239 | -0.0239 | ||||||

| JUL25 HEI GY C @ 180.54 / DE (000000000) | -0.20 | -0.0257 | -0.0257 | ||||||

| FIRST QUANTUM MINERALS LTD / DE (000000000) | -0.33 | -0.0426 | -0.0426 | ||||||

| CORTEVA INC / DE (000000000) | -0.54 | -0.0685 | -0.0685 | ||||||

| CTVA.FLEX / DE (000000000) | -0.56 | -0.0717 | -0.0717 |