Basic Stats

| Portfolio Value | $ 1,873,966,817 |

| Current Positions | 51 |

Latest Holdings, Performance, AUM (from 13F, 13D)

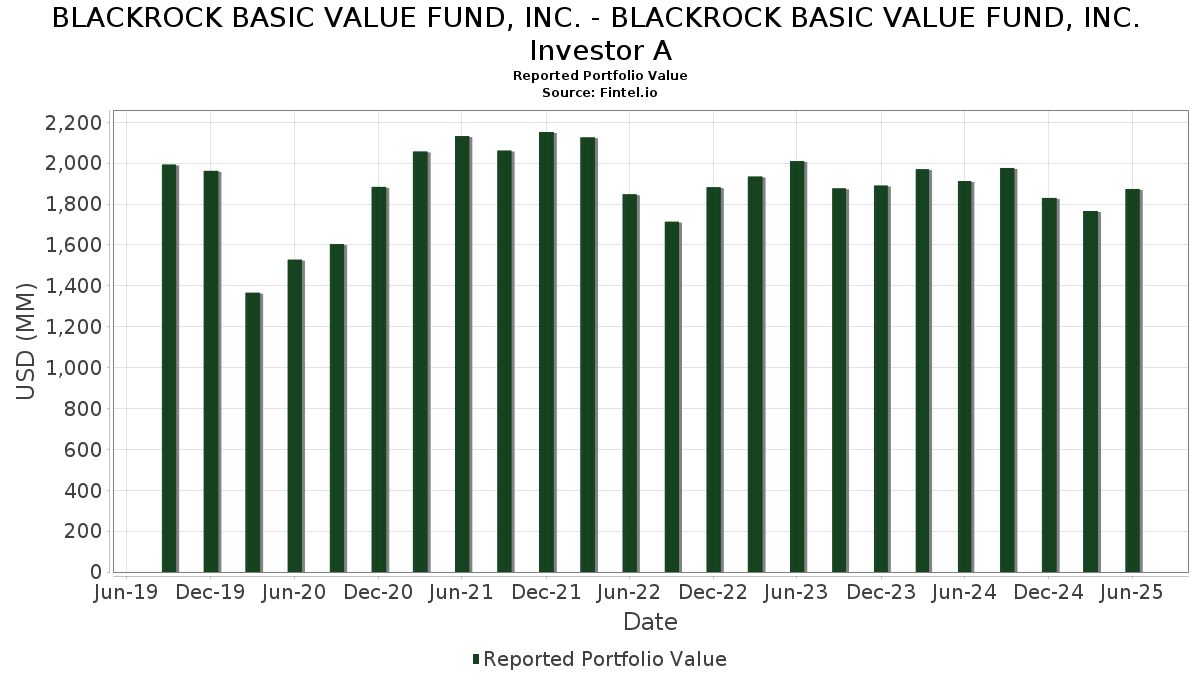

BLACKROCK BASIC VALUE FUND, INC. - BLACKROCK BASIC VALUE FUND, INC. Investor A has disclosed 51 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,873,966,817 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). BLACKROCK BASIC VALUE FUND, INC. - BLACKROCK BASIC VALUE FUND, INC. Investor A’s top holdings are Citigroup Inc. (US:C) , Wells Fargo & Company (US:WFC) , First Citizens BancShares, Inc. (US:FCNCA) , Samsung Electronics Co., Ltd. (KR:005930) , and Amazon.com, Inc. (US:AMZN) . BLACKROCK BASIC VALUE FUND, INC. - BLACKROCK BASIC VALUE FUND, INC. Investor A’s new positions include Dollar General Corporation (US:DG) , Hasbro, Inc. (US:HAS) , The Campbell's Company (US:CPB) , Hewlett Packard Enterprise Company (US:HPE) , and NVIDIA Corporation (US:NVDA) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.45 | 51.68 | 2.7844 | 2.7844 | |

| 0.49 | 36.48 | 1.9653 | 1.9653 | |

| 1.12 | 34.20 | 1.8425 | 1.8425 | |

| 1.64 | 33.53 | 1.8066 | 1.8066 | |

| 0.29 | 63.43 | 3.4172 | 1.4526 | |

| 30.62 | 30.63 | 1.6505 | 1.3757 | |

| 0.94 | 60.37 | 3.2525 | 1.3186 | |

| 1.47 | 65.00 | 3.5019 | 1.1384 | |

| 0.13 | 20.66 | 1.1134 | 1.1134 | |

| 0.11 | 19.51 | 1.0510 | 1.0510 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.9625 | ||

| 1.10 | 7.74 | 0.4169 | -1.7493 | |

| 0.14 | 19.23 | 1.0361 | -1.3262 | |

| 0.64 | 44.30 | 2.3867 | -1.0924 | |

| 0.07 | 10.86 | 0.5850 | -0.6541 | |

| 1.41 | 42.70 | 2.3005 | -0.6007 | |

| 1.28 | 33.40 | 1.7997 | -0.5530 | |

| 0.07 | 28.71 | 1.5468 | -0.4916 | |

| 1.54 | 46.06 | 2.4814 | -0.4904 | |

| 0.59 | 33.08 | 1.7824 | -0.4296 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| C / Citigroup Inc. | 0.88 | -2.32 | 74.57 | 17.13 | 4.0179 | 0.4178 | |||

| WFC / Wells Fargo & Company | 0.90 | -1.96 | 72.07 | 9.42 | 3.8830 | 0.1586 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.03 | 15.44 | 65.91 | 21.81 | 3.5513 | 0.4917 | |||

| 005930 / Samsung Electronics Co., Ltd. | 1.47 | 39.40 | 65.00 | 55.49 | 3.5019 | 1.1384 | |||

| AMZN / Amazon.com, Inc. | 0.29 | 58.30 | 63.43 | 82.54 | 3.4172 | 1.4526 | |||

| WDC / Western Digital Corporation | 0.94 | 11.52 | 60.37 | 76.50 | 3.2525 | 1.3186 | |||

| FIS / Fidelity National Information Services, Inc. | 0.71 | -1.19 | 57.43 | 7.71 | 3.0943 | 0.0794 | |||

| CAH / Cardinal Health, Inc. | 0.33 | -21.39 | 55.23 | -4.14 | 2.9759 | -0.2822 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.66 | 17.83 | 54.99 | 16.80 | 2.9626 | 0.3008 | |||

| DG / Dollar General Corporation | 0.45 | 51.68 | 2.7844 | 2.7844 | |||||

| STM / STMicroelectronics N.V. - Depositary Receipt (Common Stock) | 1.68 | 17.10 | 51.13 | 62.16 | 2.7547 | 0.9719 | |||

| LHX / L3Harris Technologies, Inc. | 0.20 | -8.29 | 48.96 | 9.91 | 2.6380 | 0.1191 | |||

| SHEL / Shell plc | 1.37 | 21.64 | 47.93 | 16.59 | 2.5825 | 0.2580 | |||

| CMCSA / Comcast Corporation | 1.30 | -0.93 | 46.35 | -4.17 | 2.4973 | -0.2377 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 1.54 | -1.07 | 46.06 | -12.37 | 2.4814 | -0.4904 | |||

| ICE / Intercontinental Exchange, Inc. | 0.25 | 1.47 | 45.43 | 7.92 | 2.4474 | 0.0675 | |||

| CVS / CVS Health Corporation | 0.64 | -29.29 | 44.30 | -28.01 | 2.3867 | -1.0924 | |||

| BAX / Baxter International Inc. | 1.41 | -5.93 | 42.70 | -16.78 | 2.3005 | -0.6007 | |||

| BA / The Boeing Company | 0.19 | -1.36 | 40.71 | 21.18 | 2.1936 | 0.2939 | |||

| Aptiv PLC / EC (JE00BTDN8H13) | 0.59 | -1.04 | 40.49 | 13.46 | 2.1814 | 0.1637 | |||

| LH / Labcorp Holdings Inc. | 0.15 | -9.30 | 38.92 | 2.29 | 2.0969 | -0.0543 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 7.81 | 42.65 | 37.66 | 51.66 | 2.0290 | 0.6249 | |||

| SRE / Sempra | 0.49 | 12.42 | 37.28 | 19.36 | 2.0086 | 0.2426 | |||

| MDT / Medtronic plc | 0.42 | 12.73 | 36.89 | 9.36 | 1.9876 | 0.0802 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.78 | -17.58 | 36.78 | -5.70 | 1.9815 | -0.2237 | |||

| HAS / Hasbro, Inc. | 0.49 | 36.48 | 1.9653 | 1.9653 | |||||

| D / Dominion Energy, Inc. | 0.64 | -0.90 | 36.38 | -0.11 | 1.9603 | -0.0991 | |||

| PPG / PPG Industries, Inc. | 0.32 | 32.75 | 36.15 | 38.09 | 1.9475 | 0.4674 | |||

| EA / Electronic Arts Inc. | 0.22 | -1.36 | 35.05 | 9.00 | 1.8885 | 0.0702 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.72 | -1.13 | 34.98 | -13.88 | 1.8846 | -0.4120 | |||

| CPB / The Campbell's Company | 1.12 | 34.20 | 1.8425 | 1.8425 | |||||

| HPE / Hewlett Packard Enterprise Company | 1.64 | 33.53 | 1.8066 | 1.8066 | |||||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 1.28 | -21.69 | 33.40 | -19.72 | 1.7997 | -0.5530 | |||

| FNF / Fidelity National Financial, Inc. | 0.59 | -1.83 | 33.08 | -15.44 | 1.7824 | -0.4296 | |||

| US0669225197 / BlackRock Cash Funds: Institutional, SL Agency Shares | 30.62 | 530.40 | 30.63 | 530.44 | 1.6505 | 1.3757 | |||

| ELV / Elevance Health, Inc. | 0.07 | -10.95 | 28.71 | -20.37 | 1.5468 | -0.4916 | |||

| SEE / Sealed Air Corporation | 0.91 | 0.00 | 28.17 | 7.37 | 1.5178 | 0.0343 | |||

| GM / General Motors Company | 0.53 | -1.36 | 25.92 | 3.21 | 1.3966 | -0.0235 | |||

| NVDA / NVIDIA Corporation | 0.13 | 20.66 | 1.1134 | 1.1134 | |||||

| GOOG / Alphabet Inc. | 0.11 | 19.51 | 1.0510 | 1.0510 | |||||

| HES / Hess Corporation | 0.14 | -46.93 | 19.23 | -53.97 | 1.0361 | -1.3262 | |||

| BMY / Bristol-Myers Squibb Company | 0.39 | 146.80 | 18.00 | 110.66 | 0.9699 | 0.5326 | |||

| PDD / PDD Holdings Inc. - Depositary Receipt (Common Stock) | 0.16 | 30.51 | 17.14 | 15.41 | 0.9236 | 0.0838 | |||

| BB2 / Burberry Group plc | 0.99 | 16.14 | 0.8698 | 0.8698 | |||||

| FTV / Fortive Corporation | 0.30 | 15.89 | 0.8561 | 0.8561 | |||||

| PINS / Pinterest, Inc. | 0.43 | 15.34 | 0.8265 | 0.8265 | |||||

| US09248U7182 / BlackRock Liquidity Funds: T-Fund, Institutional Shares | 11.66 | 83.68 | 11.66 | 83.70 | 0.6284 | 0.2694 | |||

| UHR / The Swatch Group AG | 0.07 | -47.67 | 10.86 | -50.45 | 0.5850 | -0.6541 | |||

| FLG / Flagstar Financial, Inc. | 0.75 | 7.92 | 0.4264 | 0.4264 | |||||

| 0WP / WPP plc | 1.10 | -78.20 | 7.74 | -79.80 | 0.4169 | -1.7493 | |||

| RAL / Ralliant Corporation | 0.10 | 4.93 | 0.2654 | 0.2654 | |||||

| VOYA / Voya Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9625 |