Basic Stats

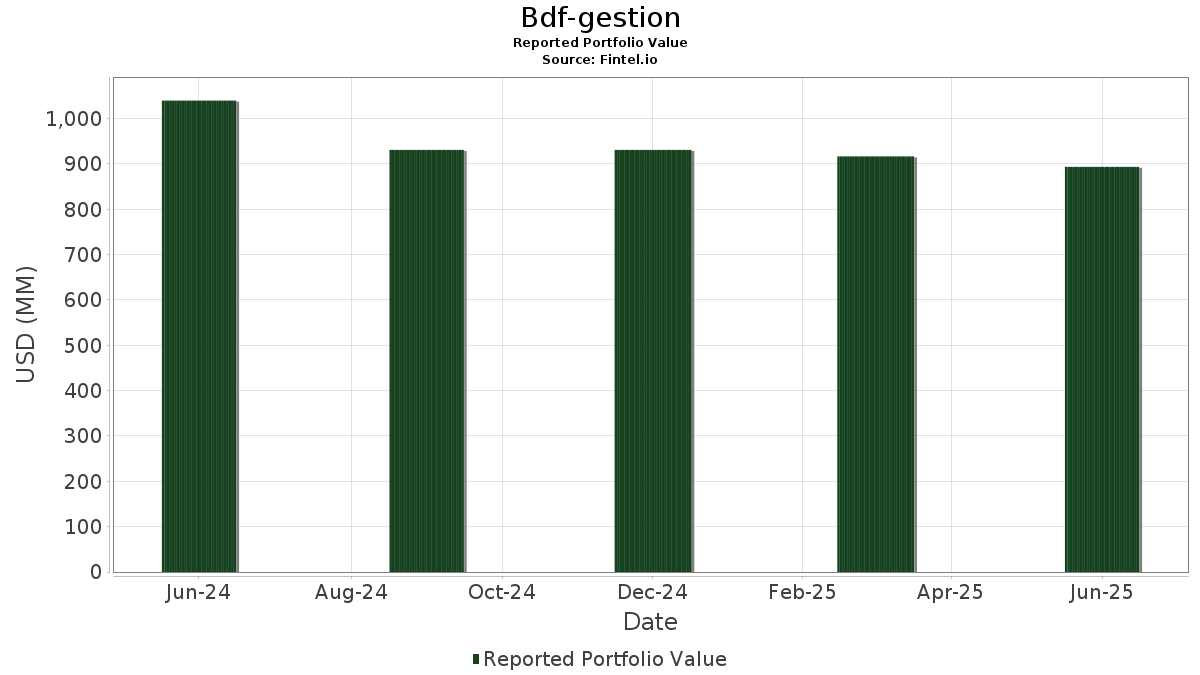

| Portfolio Value | $ 893,525,135 |

| Current Positions | 137 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Bdf-gestion has disclosed 137 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 893,525,135 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Bdf-gestion’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Meta Platforms, Inc. (US:META) , and Broadcom Inc. (US:AVGO) . Bdf-gestion’s new positions include Netflix, Inc. (US:NFLX) , Wells Fargo & Company (US:WFC) , Lam Research Corporation (US:LRCX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.60 | 94.69 | 10.5970 | 3.5105 | |

| 0.12 | 33.34 | 3.7318 | 1.4929 | |

| 0.18 | 91.11 | 10.1965 | 1.3139 | |

| 0.05 | 38.09 | 4.2625 | 1.2953 | |

| 0.01 | 9.37 | 1.0491 | 1.0491 | |

| 0.08 | 22.38 | 2.5052 | 0.5726 | |

| 0.03 | 4.41 | 0.4935 | 0.4935 | |

| 0.05 | 4.01 | 0.4483 | 0.4483 | |

| 0.19 | 4.20 | 0.4699 | 0.3751 | |

| 0.03 | 6.95 | 0.7777 | 0.3403 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.34 | 70.66 | 7.9081 | -1.3476 | |

| 0.02 | 6.46 | 0.7228 | -1.2182 | |

| 0.00 | 0.02 | 0.0026 | -1.1863 | |

| 0.14 | 24.29 | 2.7180 | -0.9511 | |

| 0.00 | 0.00 | -0.7740 | ||

| 0.06 | 4.52 | 0.5054 | -0.4982 | |

| 0.01 | 2.15 | 0.2407 | -0.4412 | |

| 0.04 | 7.74 | 0.8663 | -0.3649 | |

| 0.02 | 18.79 | 2.1024 | -0.3056 | |

| 0.00 | 0.73 | 0.0819 | -0.2535 |

13F and Fund Filings

This form was filed on 2025-07-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.60 | 0.00 | 94.69 | 45.78 | 10.5970 | 3.5105 | |||

| MSFT / Microsoft Corporation | 0.18 | -15.55 | 91.11 | 11.90 | 10.1965 | 1.3139 | |||

| AAPL / Apple Inc. | 0.34 | -9.82 | 70.66 | -16.71 | 7.9081 | -1.3476 | |||

| META / Meta Platforms, Inc. | 0.05 | 9.35 | 38.09 | 40.04 | 4.2625 | 1.2953 | |||

| AVGO / Broadcom Inc. | 0.12 | -1.31 | 33.34 | 62.48 | 3.7318 | 1.4929 | |||

| GOOG / Alphabet Inc. | 0.14 | -36.40 | 24.29 | -27.79 | 2.7180 | -0.9511 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | 6.92 | 22.38 | 26.37 | 2.5052 | 0.5726 | |||

| LLY / Eli Lilly and Company | 0.02 | -9.83 | 18.79 | -14.89 | 2.1024 | -0.3056 | |||

| V / Visa Inc. | 0.04 | -9.83 | 15.49 | -8.64 | 1.7336 | -0.1163 | |||

| MA / Mastercard Incorporated | 0.02 | -9.83 | 11.25 | -7.56 | 1.2591 | -0.0687 | |||

| HD / The Home Depot, Inc. | 0.03 | -9.83 | 11.16 | -9.79 | 1.2493 | -0.1007 | |||

| BAC / Bank of America Corporation | 0.23 | -28.70 | 10.72 | -19.15 | 1.1999 | -0.2469 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.02 | -30.53 | 10.69 | -10.00 | 1.1961 | -0.0994 | |||

| AMD / Advanced Micro Devices, Inc. | 0.07 | 0.00 | 10.26 | 38.12 | 1.1486 | 0.3379 | |||

| NFLX / Netflix, Inc. | 0.01 | 9.37 | 1.0491 | 1.0491 | |||||

| CRM / Salesforce, Inc. | 0.03 | 27.78 | 8.76 | 29.84 | 0.9803 | 0.2443 | |||

| VZ / Verizon Communications Inc. | 0.19 | -9.82 | 8.03 | -13.98 | 0.8987 | -0.1197 | |||

| ABT / Abbott Laboratories | 0.06 | -9.83 | 7.99 | -7.54 | 0.8944 | -0.0486 | |||

| PG / The Procter & Gamble Company | 0.05 | -9.83 | 7.86 | -15.70 | 0.8795 | -0.1375 | |||

| NOW / ServiceNow, Inc. | 0.01 | 0.00 | 7.84 | 29.15 | 0.8778 | 0.2151 | |||

| ABBV / AbbVie Inc. | 0.04 | -22.58 | 7.74 | -31.41 | 0.8663 | -0.3649 | |||

| MSI / Motorola Solutions, Inc. | 0.02 | -9.83 | 7.12 | -13.40 | 0.7973 | -0.1002 | |||

| TXN / Texas Instruments Incorporated | 0.03 | 50.00 | 6.95 | 73.33 | 0.7777 | 0.3403 | |||

| ORCL / Oracle Corporation | 0.03 | -9.83 | 6.90 | 41.02 | 0.7722 | 0.2384 | |||

| CSCO / Cisco Systems, Inc. | 0.10 | -9.82 | 6.69 | 1.39 | 0.7488 | 0.0288 | |||

| KO / The Coca-Cola Company | 0.09 | -9.82 | 6.58 | -10.92 | 0.7368 | -0.0695 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -5.89 | 6.53 | 3.26 | 0.7311 | 0.0409 | |||

| TJX / The TJX Companies, Inc. | 0.05 | 13.67 | 6.46 | 15.25 | 0.7234 | 0.1115 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -39.06 | 6.46 | -63.70 | 0.7228 | -1.2182 | |||

| C / Citigroup Inc. | 0.07 | -22.38 | 6.31 | -6.94 | 0.7066 | -0.0335 | |||

| ACN / Accenture plc | 0.02 | -9.83 | 6.05 | -13.62 | 0.6771 | -0.0871 | |||

| TMUS / T-Mobile US, Inc. | 0.02 | 42.37 | 5.82 | 27.20 | 0.6512 | 0.1521 | |||

| BKT / BlackRock Income Trust, Inc. | 0.01 | -9.84 | 5.51 | -0.05 | 0.6166 | 0.0152 | |||

| MDLZ / Mondelez International, Inc. | 0.08 | -9.83 | 5.50 | -10.38 | 0.6158 | -0.0540 | |||

| DDOG / Datadog, Inc. | 0.04 | -9.82 | 5.40 | 22.10 | 0.6041 | 0.1218 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | -9.83 | 5.16 | -9.00 | 0.5774 | -0.0410 | |||

| ADSK / Autodesk, Inc. | 0.02 | -9.83 | 5.14 | 6.62 | 0.5747 | 0.0493 | |||

| LIN / Linde plc | 0.01 | -9.84 | 5.05 | -9.15 | 0.5656 | -0.0413 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -9.83 | 4.99 | -26.53 | 0.5585 | -0.1825 | |||

| AXP / American Express Company | 0.02 | -9.83 | 4.97 | 6.91 | 0.5560 | 0.0490 | |||

| ALL / The Allstate Corporation | 0.02 | -9.83 | 4.89 | -12.33 | 0.5467 | -0.0612 | |||

| PLD / Prologis, Inc. | 0.05 | -9.83 | 4.85 | -15.21 | 0.5424 | -0.0812 | |||

| EA / Electronic Arts Inc. | 0.03 | -9.83 | 4.61 | -0.35 | 0.5160 | 0.0112 | |||

| MRK / Merck & Co., Inc. | 0.06 | -44.34 | 4.52 | -50.91 | 0.5054 | -0.4982 | |||

| PLTR / Palantir Technologies Inc. | 0.03 | 4.41 | 0.4935 | 0.4935 | |||||

| RSG / Republic Services, Inc. | 0.02 | -9.83 | 4.38 | -8.16 | 0.4902 | -0.0302 | |||

| MET / MetLife, Inc. | 0.05 | -9.83 | 4.21 | -9.69 | 0.4717 | -0.0374 | |||

| INTC / Intel Corporation | 0.19 | 390.24 | 4.20 | 383.64 | 0.4699 | 0.3751 | |||

| SPGI / S&P Global Inc. | 0.01 | -9.83 | 4.17 | -6.42 | 0.4666 | -0.0195 | |||

| SPG / Simon Property Group, Inc. | 0.03 | -9.83 | 4.15 | -12.73 | 0.4641 | -0.0542 | |||

| ADI / Analog Devices, Inc. | 0.02 | 0.00 | 4.13 | 18.02 | 0.4620 | 0.0804 | |||

| EQR / Equity Residential | 0.06 | -9.83 | 4.11 | -14.98 | 0.4600 | -0.0674 | |||

| ADBE / Adobe Inc. | 0.01 | -9.84 | 4.09 | -9.04 | 0.4572 | -0.0328 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.03 | -9.83 | 4.01 | -7.54 | 0.4487 | -0.0244 | |||

| WFC / Wells Fargo & Company | 0.05 | 4.01 | 0.4483 | 0.4483 | |||||

| DXCM / DexCom, Inc. | 0.05 | -5.89 | 4.00 | 20.33 | 0.4478 | 0.0849 | |||

| BSX / Boston Scientific Corporation | 0.04 | -9.83 | 3.97 | -4.01 | 0.4447 | -0.0068 | |||

| SYK / Stryker Corporation | 0.01 | -9.83 | 3.97 | -4.16 | 0.4438 | -0.0077 | |||

| ZS / Zscaler, Inc. | 0.01 | 0.00 | 3.92 | 58.23 | 0.4392 | 0.1686 | |||

| WDAY / Workday, Inc. | 0.02 | -9.83 | 3.91 | -7.35 | 0.4376 | -0.0227 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.02 | -9.83 | 3.89 | -9.61 | 0.4356 | -0.0342 | |||

| VTR / Ventas, Inc. | 0.06 | -9.83 | 3.65 | -17.20 | 0.4089 | -0.0724 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -9.83 | 3.54 | 13.74 | 0.3967 | 0.0567 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.01 | -9.83 | 3.53 | -6.96 | 0.3951 | -0.0189 | |||

| EW / Edwards Lifesciences Corporation | 0.04 | -9.83 | 3.48 | -2.69 | 0.3894 | -0.0007 | |||

| DHR / Danaher Corporation | 0.02 | -9.83 | 3.40 | -13.11 | 0.3806 | -0.0464 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -9.83 | 3.38 | -6.50 | 0.3784 | -0.0162 | |||

| CSX / CSX Corporation | 0.10 | -9.83 | 3.37 | -0.03 | 0.3775 | 0.0094 | |||

| ELV / Elevance Health, Inc. | 0.01 | -9.84 | 3.34 | -19.37 | 0.3742 | -0.0782 | |||

| INTU / Intuit Inc. | 0.00 | -9.85 | 3.33 | 15.67 | 0.3726 | 0.0585 | |||

| HOLX / Hologic, Inc. | 0.05 | -9.83 | 3.19 | -4.86 | 0.3571 | -0.0089 | |||

| RGLD / Royal Gold, Inc. | 0.02 | -9.83 | 3.19 | -1.94 | 0.3569 | 0.0021 | |||

| JNJ / Johnson & Johnson | 0.03 | -9.83 | 3.12 | 18.90 | 0.3494 | 0.0629 | |||

| ICE / Intercontinental Exchange, Inc. | 0.02 | -9.83 | 3.05 | -4.09 | 0.3410 | -0.0056 | |||

| AZO / AutoZone, Inc. | 0.00 | -9.92 | 3.03 | -12.32 | 0.3394 | -0.0379 | |||

| EHC / Encompass Health Corporation | 0.02 | -9.83 | 3.02 | 9.15 | 0.3378 | 0.0362 | |||

| CL / Colgate-Palmolive Company | 0.03 | -9.83 | 2.96 | -12.53 | 0.3313 | -0.0379 | |||

| LRCX / Lam Research Corporation | 0.03 | 2.94 | 0.3285 | 0.3285 | |||||

| CTSH / Cognizant Technology Solutions Corporation | 0.04 | -9.83 | 2.93 | -8.01 | 0.3280 | -0.0196 | |||

| NDAQ / Nasdaq, Inc. | 0.03 | 162.73 | 2.86 | 209.64 | 0.3200 | 0.2192 | |||

| FI / Fiserv, Inc. | 0.02 | -9.83 | 2.86 | -29.61 | 0.3199 | -0.1231 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | -9.84 | 2.83 | -0.60 | 0.3164 | 0.0061 | |||

| SNOW / Snowflake Inc. | 0.01 | -9.83 | 2.82 | 38.03 | 0.3161 | 0.0929 | |||

| DE / Deere & Company | 0.01 | -9.84 | 2.81 | -2.33 | 0.3148 | 0.0006 | |||

| CAT / Caterpillar Inc. | 0.01 | -9.84 | 2.79 | 6.13 | 0.3119 | 0.0254 | |||

| URI / United Rentals, Inc. | 0.00 | -9.85 | 2.79 | 8.40 | 0.3118 | 0.0313 | |||

| ANET / Arista Networks Inc | 0.03 | -9.83 | 2.78 | 19.10 | 0.3106 | 0.0563 | |||

| HON / Honeywell International Inc. | 0.01 | -9.83 | 2.75 | -0.83 | 0.3081 | 0.0052 | |||

| RMD / ResMed Inc. | 0.01 | -9.83 | 2.74 | 3.94 | 0.3070 | 0.0190 | |||

| PAYX / Paychex, Inc. | 0.02 | -9.83 | 2.74 | -14.97 | 0.3064 | -0.0449 | |||

| MAR / Marriott International, Inc. | 0.01 | -9.83 | 2.72 | 3.43 | 0.3040 | 0.0175 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | -9.84 | 2.70 | -5.63 | 0.3020 | -0.0100 | |||

| OC / Owens Corning | 0.02 | -9.83 | 2.67 | -13.16 | 0.2991 | -0.0367 | |||

| TRU / TransUnion | 0.03 | -9.83 | 2.59 | -4.36 | 0.2895 | -0.0057 | |||

| LH / Labcorp Holdings Inc. | 0.01 | -9.83 | 2.59 | 1.69 | 0.2894 | 0.0120 | |||

| CI / The Cigna Group | 0.01 | -9.83 | 2.50 | -9.39 | 0.2796 | -0.0212 | |||

| GM / General Motors Company | 0.05 | -9.83 | 2.44 | -5.65 | 0.2730 | -0.0091 | |||

| SNPS / Synopsys, Inc. | 0.00 | -9.85 | 2.43 | 7.77 | 0.2716 | 0.0259 | |||

| OTIS / Otis Worldwide Corporation | 0.02 | -9.83 | 2.39 | -13.49 | 0.2677 | -0.0339 | |||

| STE / STERIS plc | 0.01 | -9.84 | 2.31 | -4.43 | 0.2584 | -0.0052 | |||

| DECK / Deckers Outdoor Corporation | 0.02 | -9.83 | 2.29 | -16.88 | 0.2568 | -0.0444 | |||

| ETN / Eaton Corporation plc | 0.01 | -9.85 | 2.28 | 18.40 | 0.2550 | 0.0450 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | -9.83 | 2.27 | 4.09 | 0.2535 | 0.0161 | |||

| STT / State Street Corporation | 0.02 | -9.83 | 2.24 | 7.12 | 0.2511 | 0.0225 | |||

| EQIX / Equinix, Inc. | 0.00 | -9.87 | 2.23 | -12.08 | 0.2495 | -0.0271 | |||

| CDW / CDW Corporation | 0.01 | -69.12 | 2.15 | -65.59 | 0.2407 | -0.4412 | |||

| BL / BlackLine, Inc. | 0.04 | -9.83 | 2.04 | 5.48 | 0.2286 | 0.0173 | |||

| A / Agilent Technologies, Inc. | 0.02 | -9.83 | 1.98 | -9.02 | 0.2213 | -0.0159 | |||

| J / Jacobs Solutions Inc. | 0.02 | -9.83 | 1.97 | -1.99 | 0.2210 | 0.0013 | |||

| G / Genpact Limited | 0.04 | -9.83 | 1.92 | -21.26 | 0.2144 | -0.0509 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -9.84 | 1.90 | -13.77 | 0.2132 | -0.0278 | |||

| PKG / Packaging Corporation of America | 0.01 | -9.84 | 1.83 | -14.19 | 0.2051 | -0.0279 | |||

| DD / DuPont de Nemours, Inc. | 0.03 | -9.83 | 1.78 | -17.16 | 0.1988 | -0.0352 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | -9.85 | 1.72 | -0.06 | 0.1930 | 0.0048 | |||

| TEL / TE Connectivity plc | 0.01 | -9.84 | 1.65 | 7.63 | 0.1848 | 0.0174 | |||

| CMI / Cummins Inc. | 0.01 | -9.85 | 1.65 | -5.82 | 0.1848 | -0.0065 | |||

| DELL / Dell Technologies Inc. | 0.01 | -9.83 | 1.62 | 21.29 | 0.1811 | 0.0355 | |||

| REG / Regency Centers Corporation | 0.02 | -9.83 | 1.59 | -12.92 | 0.1781 | -0.0213 | |||

| GIS / General Mills, Inc. | 0.03 | -9.83 | 1.58 | -21.89 | 0.1766 | -0.0437 | |||

| CHD / Church & Dwight Co., Inc. | 0.02 | -9.83 | 1.57 | -21.28 | 0.1759 | -0.0419 | |||

| PTC / PTC Inc. | 0.01 | -9.83 | 1.51 | 0.27 | 0.1693 | 0.0047 | |||

| SWK / Stanley Black & Decker, Inc. | 0.02 | -9.83 | 1.47 | -20.54 | 0.1641 | -0.0372 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -9.83 | 1.44 | -10.13 | 0.1609 | -0.0136 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.01 | -9.83 | 1.43 | -10.26 | 0.1596 | -0.0137 | |||

| MSA / MSA Safety Incorporated | 0.01 | -9.83 | 1.39 | 2.97 | 0.1554 | 0.0083 | |||

| MSCI / MSCI Inc. | 0.00 | -9.86 | 1.39 | -8.02 | 0.1552 | -0.0094 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.02 | -9.83 | 1.38 | -17.27 | 0.1545 | -0.0275 | |||

| MOH / Molina Healthcare, Inc. | 0.00 | -9.86 | 1.27 | -18.47 | 0.1423 | -0.0279 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -9.83 | 1.19 | 3.74 | 0.1336 | 0.0080 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -50.84 | 1.15 | -59.31 | 0.1286 | -0.1795 | |||

| ALV / Autoliv, Inc. | 0.01 | -9.84 | 1.11 | 14.15 | 0.1246 | 0.0181 | |||

| RPRX / Royalty Pharma plc | 0.03 | -9.83 | 1.10 | 4.38 | 0.1229 | 0.0081 | |||

| HUM / Humana Inc. | 0.00 | -74.25 | 0.73 | -76.22 | 0.0819 | -0.2535 | |||

| MRNA / Moderna, Inc. | 0.02 | -9.83 | 0.69 | -12.28 | 0.0769 | -0.0085 | |||

| APTV / Aptiv PLC | 0.01 | -9.83 | 0.60 | 3.29 | 0.0668 | 0.0038 | |||

| TROX / Tronox Holdings plc | 0.07 | -9.83 | 0.34 | -35.24 | 0.0382 | -0.0191 | |||

| AMTM / Amentum Holdings, Inc. | 0.00 | -94.64 | 0.02 | -99.80 | 0.0026 | -1.1863 | |||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KDP / Keurig Dr Pepper Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BURL / Burlington Stores, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COO / The Cooper Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MCK / McKesson Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TFX / Teleflex Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SCI / Service Corporation International | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PPG / PPG Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FITB / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSLA / Tesla, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7740 |