Basic Stats

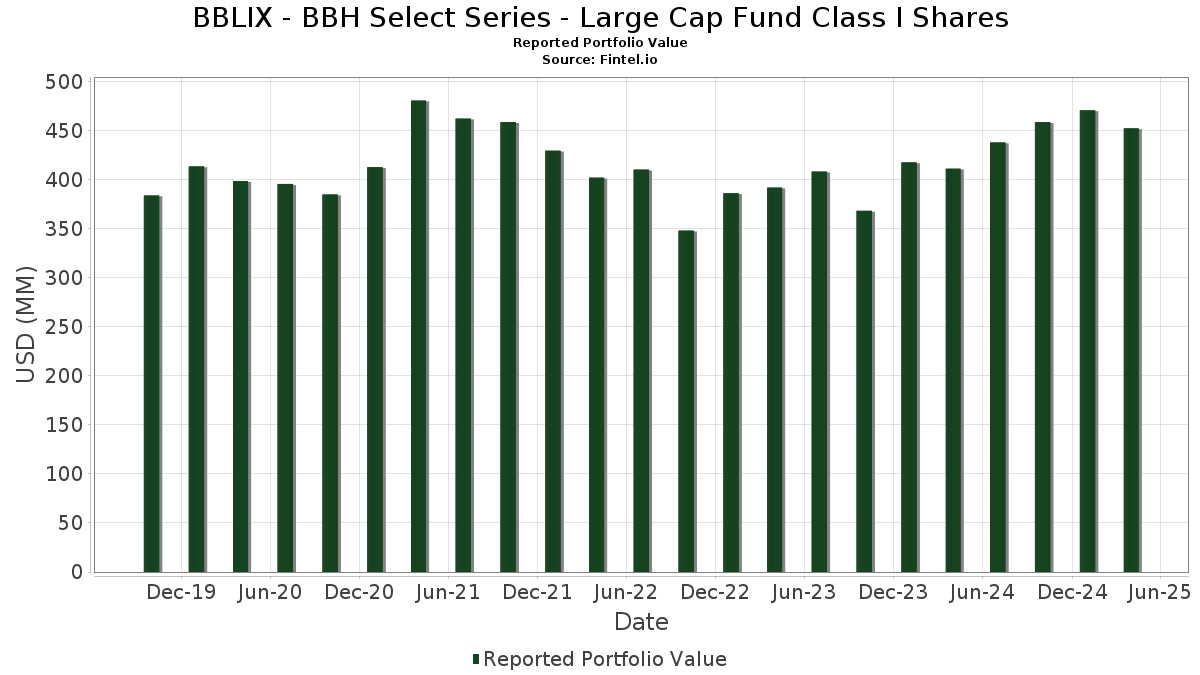

| Portfolio Value | $ 452,682,439 |

| Current Positions | 31 |

Latest Holdings, Performance, AUM (from 13F, 13D)

BBLIX - BBH Select Series - Large Cap Fund Class I Shares has disclosed 31 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 452,682,439 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). BBLIX - BBH Select Series - Large Cap Fund Class I Shares’s top holdings are Alphabet Inc. (US:GOOG) , Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , Berkshire Hathaway Inc. (US:BRK.A) , and Linde plc (US:LIN) . BBLIX - BBH Select Series - Large Cap Fund Class I Shares’s new positions include Strats Trust For Procter & Gambel Security - Preferred Security (US:GJR) , Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , Analog Devices, Inc. (US:ADI) , Apple Inc. (US:AAPL) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 5.51 | 1.2022 | 1.2022 | |

| 0.04 | 4.84 | 1.0549 | 1.0549 | |

| 0.03 | 8.48 | 1.8498 | 0.8454 | |

| 0.01 | 2.47 | 0.5392 | 0.5392 | |

| 0.01 | 2.45 | 0.5341 | 0.5341 | |

| 0.09 | 21.89 | 4.7746 | 0.4868 | |

| 0.20 | 19.43 | 4.2387 | 0.4751 | |

| 0.00 | 17.09 | 3.7272 | 0.4325 | |

| 0.06 | 18.87 | 4.1153 | 0.4302 | |

| 0.01 | 5.50 | 1.2000 | 0.4063 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.19 | 30.79 | 6.7165 | -1.4498 | |

| 0.04 | 6.87 | 1.4977 | -0.8901 | |

| 0.03 | 11.44 | 2.4955 | -0.8128 | |

| 0.16 | 22.69 | 4.9492 | -0.7416 | |

| 0.02 | 7.18 | 1.5669 | -0.3988 | |

| 0.03 | 11.45 | 2.4977 | -0.2747 | |

| 0.10 | 12.94 | 2.8232 | -0.2494 | |

| 0.05 | 7.09 | 1.5465 | -0.2143 | |

| 0.11 | 19.66 | 4.2873 | -0.1293 | |

| 0.08 | 12.81 | 2.7942 | -0.1108 |

13F and Fund Filings

This form was filed on 2025-06-27 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOG / Alphabet Inc. | 0.19 | 0.00 | 30.79 | -21.75 | 6.7165 | -1.4498 | |||

| MSFT / Microsoft Corporation | 0.07 | 0.00 | 29.00 | -4.77 | 6.3253 | 0.0056 | |||

| MA / Mastercard Incorporated | 0.05 | 0.00 | 28.64 | -1.33 | 6.2477 | 0.2233 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | -14.63 | 28.02 | -2.74 | 6.1115 | 0.1331 | |||

| LIN / Linde plc | 0.05 | 0.00 | 24.71 | 1.60 | 5.3904 | 0.3421 | |||

| KLAC / KLA Corporation | 0.03 | 0.00 | 23.74 | -4.82 | 5.1778 | 0.0021 | |||

| ORCL / Oracle Corporation | 0.16 | 0.00 | 22.69 | -17.25 | 4.9492 | -0.7416 | |||

| WM / Waste Management, Inc. | 0.09 | 0.00 | 21.89 | 5.95 | 4.7746 | 0.4868 | |||

| COST / Costco Wholesale Corporation | 0.02 | 0.00 | 20.24 | 1.49 | 4.4139 | 0.2760 | |||

| AMZN / Amazon.com, Inc. | 0.11 | 19.03 | 19.66 | -7.64 | 4.2873 | -0.1293 | |||

| ALC / Alcon Inc. | 0.20 | 0.00 | 19.43 | 7.16 | 4.2387 | 0.4751 | |||

| AJG / Arthur J. Gallagher & Co. | 0.06 | 0.00 | 18.87 | 6.26 | 4.1153 | 0.4302 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 17.09 | 7.63 | 3.7272 | 0.4325 | |||

| PGR / The Progressive Corporation | 0.05 | -12.77 | 15.46 | -0.28 | 3.3732 | 0.1548 | |||

| SPGI / S&P Global Inc. | 0.03 | 0.00 | 14.49 | -4.10 | 3.1611 | 0.0250 | |||

| ABT / Abbott Laboratories | 0.10 | -14.46 | 12.94 | -12.58 | 2.8232 | -0.2494 | |||

| ZTS / Zoetis Inc. | 0.08 | 0.00 | 12.81 | -8.49 | 2.7942 | -0.1108 | |||

| ADBE / Adobe Inc. | 0.03 | 0.00 | 11.45 | -14.28 | 2.4977 | -0.2747 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.03 | 0.00 | 11.44 | -28.23 | 2.4955 | -0.8128 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 0.00 | 10.91 | -0.79 | 2.3789 | 0.0973 | |||

| CDNS / Cadence Design Systems, Inc. | 0.03 | 75.16 | 8.48 | 75.24 | 1.8498 | 0.8454 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 0.00 | 7.18 | -24.16 | 1.5669 | -0.3988 | |||

| AMAT / Applied Materials, Inc. | 0.05 | 0.00 | 7.09 | -16.43 | 1.5465 | -0.2143 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -31.16 | 6.87 | -40.32 | 1.4977 | -0.8901 | |||

| OTIS / Otis Worldwide Corporation | 0.06 | 0.00 | 6.09 | 0.89 | 1.3288 | 0.0757 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.03 | 5.51 | 1.2022 | 1.2022 | |||||

| LLY / Eli Lilly and Company | 0.01 | 29.80 | 5.50 | 43.85 | 1.2000 | 0.4063 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.04 | 4.84 | 1.0549 | 1.0549 | |||||

| ADI / Analog Devices, Inc. | 0.01 | 2.47 | 0.5392 | 0.5392 | |||||

| AAPL / Apple Inc. | 0.01 | 2.45 | 0.5341 | 0.5341 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | 103.67 | 1.92 | 60.33 | 0.4197 | 0.1705 |