Basic Stats

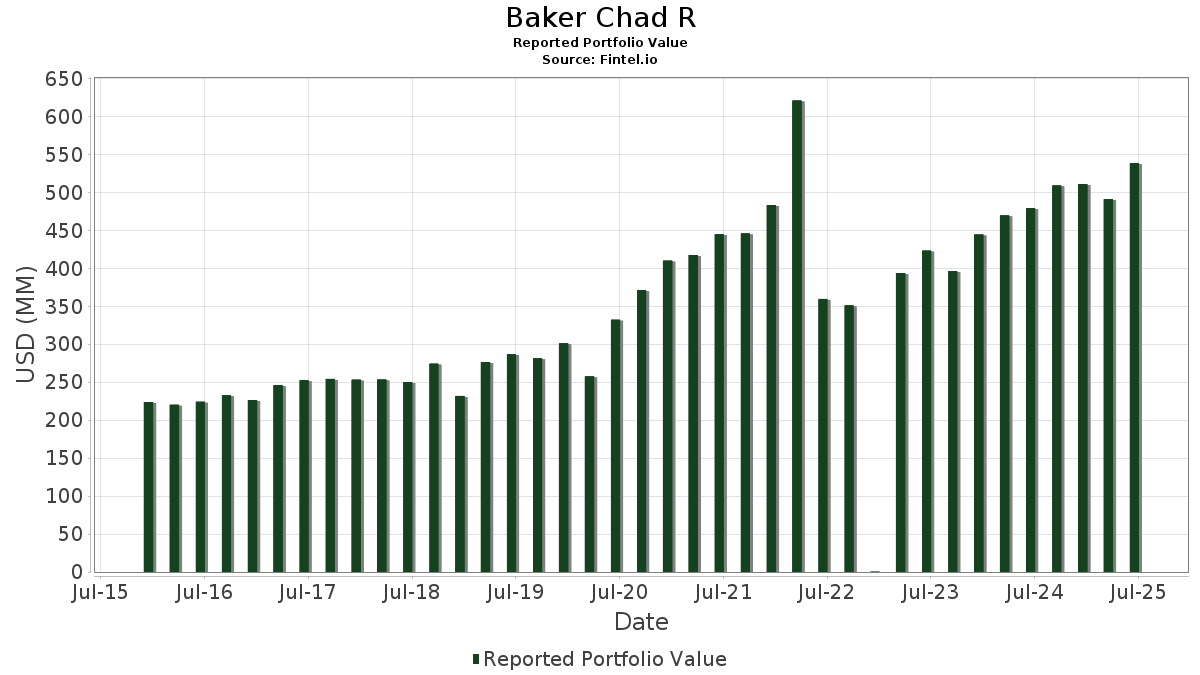

| Portfolio Value | $ 538,277,690 |

| Current Positions | 50 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Baker Chad R has disclosed 50 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 538,277,690 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Baker Chad R’s top holdings are Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Mastercard Incorporated (US:MA) , Alphabet Inc. (US:GOOGL) , and Amphenol Corporation (US:APH) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 18.78 | 3.4889 | 1.2877 | |

| 0.23 | 22.75 | 4.2257 | 1.1332 | |

| 0.05 | 26.69 | 4.9586 | 0.8557 | |

| 0.05 | 17.31 | 3.2157 | 0.4733 | |

| 0.08 | 11.93 | 2.2160 | 0.4569 | |

| 0.06 | 19.42 | 3.6075 | 0.3807 | |

| 0.17 | 12.06 | 2.2402 | 0.3390 | |

| 0.08 | 19.15 | 3.5578 | 0.2528 | |

| 0.10 | 21.90 | 4.0686 | 0.2002 | |

| 0.09 | 4.53 | 0.8422 | 0.1962 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 40.09 | 7.4473 | -1.3927 | |

| 0.07 | 17.37 | 3.2266 | -0.7334 | |

| 0.09 | 19.57 | 3.6352 | -0.3972 | |

| 0.07 | 10.60 | 1.9686 | -0.3747 | |

| 0.07 | 13.56 | 2.5199 | -0.3472 | |

| 0.12 | 10.25 | 1.9050 | -0.3409 | |

| 0.04 | 24.84 | 4.6148 | -0.3203 | |

| 0.05 | 8.40 | 1.5601 | -0.2695 | |

| 0.04 | 13.31 | 2.4725 | -0.2131 | |

| 0.11 | 14.65 | 2.7208 | -0.1885 |

13F and Fund Filings

This form was filed on 2025-07-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.20 | 0.00 | 40.09 | -7.64 | 7.4473 | -1.3927 | |||

| MSFT / Microsoft Corporation | 0.05 | 0.00 | 26.69 | 32.51 | 4.9586 | 0.8557 | |||

| MA / Mastercard Incorporated | 0.04 | 0.00 | 24.84 | 2.52 | 4.6148 | -0.3203 | |||

| GOOGL / Alphabet Inc. | 0.13 | 0.00 | 23.06 | 13.96 | 4.2843 | 0.1625 | |||

| APH / Amphenol Corporation | 0.23 | -0.50 | 22.75 | 49.81 | 4.2257 | 1.1332 | |||

| AMZN / Amazon.com, Inc. | 0.10 | 0.00 | 21.90 | 15.31 | 4.0686 | 0.2002 | |||

| WM / Waste Management, Inc. | 0.09 | 0.00 | 19.57 | -1.16 | 3.6352 | -0.3972 | |||

| TSLA / Tesla, Inc. | 0.06 | 0.00 | 19.42 | 22.57 | 3.6075 | 0.3807 | |||

| CARR / Carrier Global Corporation | 0.26 | 0.00 | 19.31 | 15.44 | 3.5883 | 0.1804 | |||

| ADI / Analog Devices, Inc. | 0.08 | 0.00 | 19.15 | 18.03 | 3.5578 | 0.2528 | |||

| NET / Cloudflare, Inc. | 0.10 | 0.00 | 18.78 | 73.79 | 3.4889 | 1.2877 | |||

| TMUS / T-Mobile US, Inc. | 0.07 | 0.00 | 17.37 | -10.67 | 3.2266 | -0.7334 | |||

| ROK / Rockwell Automation, Inc. | 0.05 | 0.00 | 17.31 | 28.56 | 3.2157 | 0.4733 | |||

| ABT / Abbott Laboratories | 0.11 | 0.00 | 14.65 | 2.53 | 2.7208 | -0.1885 | |||

| DHR / Danaher Corporation | 0.07 | 0.00 | 13.56 | -3.64 | 2.5199 | -0.3472 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 0.00 | 13.31 | 0.94 | 2.4725 | -0.2131 | |||

| XYL / Xylem Inc. | 0.10 | 0.00 | 12.87 | 8.29 | 2.3902 | -0.0298 | |||

| ATR / AptarGroup, Inc. | 0.08 | 0.00 | 12.37 | 5.42 | 2.2973 | -0.0918 | |||

| ULS / UL Solutions Inc. | 0.17 | 0.00 | 12.06 | 29.18 | 2.2402 | 0.3390 | |||

| AMD / Advanced Micro Devices, Inc. | 0.08 | 0.00 | 11.93 | 38.12 | 2.2160 | 0.4569 | |||

| JNJ / Johnson & Johnson | 0.07 | 0.00 | 10.60 | -7.89 | 1.9686 | -0.3747 | |||

| ALC / Alcon Inc. | 0.12 | 0.00 | 10.25 | -7.00 | 1.9050 | -0.3409 | |||

| WMT / Walmart Inc. | 0.10 | 0.00 | 10.07 | 11.38 | 1.8714 | 0.0293 | |||

| RELX / RELX PLC - Depositary Receipt (Common Stock) | 0.17 | 0.00 | 9.18 | 7.79 | 1.7063 | -0.0292 | |||

| VLTO / Veralto Corporation | 0.09 | 0.00 | 8.87 | 3.58 | 1.6485 | -0.0962 | |||

| NSC / Norfolk Southern Corporation | 0.03 | 0.00 | 8.68 | 8.07 | 1.6123 | -0.0234 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.05 | 0.00 | 8.40 | -6.51 | 1.5601 | -0.2695 | |||

| NYT / The New York Times Company | 0.14 | 0.00 | 8.02 | 12.87 | 1.4906 | 0.0426 | |||

| HD / The Home Depot, Inc. | 0.02 | 0.00 | 7.90 | 0.04 | 1.4675 | -0.1408 | |||

| TJX / The TJX Companies, Inc. | 0.06 | 0.00 | 7.70 | 1.38 | 1.4302 | -0.1164 | |||

| SYK / Stryker Corporation | 0.02 | 0.00 | 7.58 | 6.28 | 1.4090 | -0.0445 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | 0.00 | 6.23 | -4.87 | 1.1582 | -0.1766 | |||

| RTX / RTX Corporation | 0.04 | 0.00 | 5.60 | 10.24 | 1.0403 | 0.0057 | |||

| CRM / Salesforce, Inc. | 0.02 | 0.00 | 4.78 | 1.59 | 0.8878 | -0.0701 | |||

| CL / Colgate-Palmolive Company | 0.05 | 0.00 | 4.65 | -2.98 | 0.8646 | -0.1125 | |||

| CRSP / CRISPR Therapeutics AG | 0.09 | 0.00 | 4.53 | 42.95 | 0.8422 | 0.1962 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 0.00 | 4.34 | -8.17 | 0.8056 | -0.1562 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 3.92 | 13.56 | 0.7283 | 0.0251 | |||

| ZTS / Zoetis Inc. | 0.02 | 0.00 | 3.87 | -5.29 | 0.7190 | -0.1133 | |||

| ADBE / Adobe Inc. | 0.01 | 0.00 | 3.48 | 0.87 | 0.6469 | -0.0562 | |||

| CSX / CSX Corporation | 0.10 | 0.00 | 3.33 | 10.90 | 0.6183 | 0.0069 | |||

| ABNB / Airbnb, Inc. | 0.02 | 0.00 | 3.17 | 10.80 | 0.5890 | 0.0061 | |||

| MKC / McCormick & Company, Incorporated | 0.03 | 0.00 | 2.61 | -7.89 | 0.4841 | -0.0921 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 1.97 | 51.39 | 0.3652 | 0.1008 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 1.77 | -9.38 | 0.3284 | -0.0688 | |||

| CI / The Cigna Group | 0.01 | -10.05 | 1.74 | -9.63 | 0.3227 | -0.0687 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.00 | 1.55 | 45.81 | 0.2875 | 0.0713 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.00 | 1.24 | -11.85 | 0.2309 | -0.0561 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 0.00 | 0.93 | -24.82 | 0.1734 | -0.0794 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.33 | -0.60 | 0.0617 | -0.0064 |