Basic Stats

| Portfolio Value | $ 418,641,388 |

| Current Positions | 52 |

Latest Holdings, Performance, AUM (from 13F, 13D)

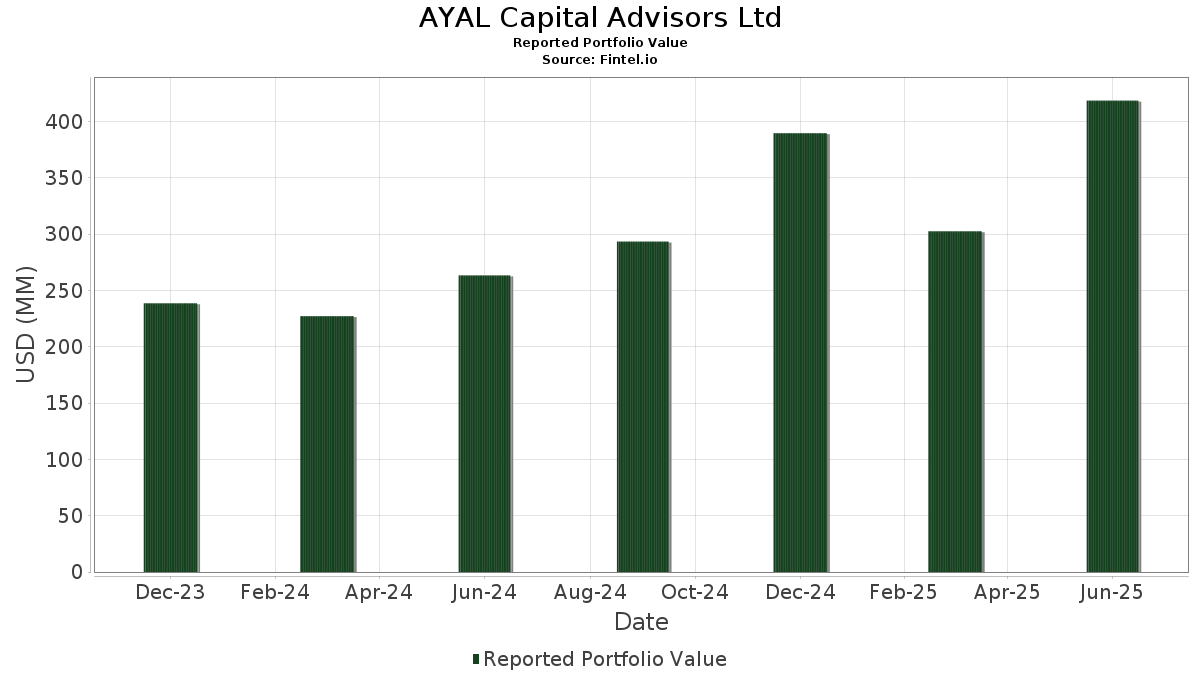

AYAL Capital Advisors Ltd has disclosed 52 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 418,641,388 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AYAL Capital Advisors Ltd’s top holdings are SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares MSCI USA Momentum Factor ETF (US:MTUM) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , VanEck ETF Trust - VanEck Uranium+Nuclear Energy ETF (US:NLR) , and Algoma Steel Group Inc. (US:ASTL) . AYAL Capital Advisors Ltd’s new positions include VanEck ETF Trust - VanEck Uranium+Nuclear Energy ETF (US:NLR) , Algoma Steel Group Inc. (US:ASTL) , Allegiant Travel Company (US:ALGT) , NETGEAR, Inc. (US:NTGR) , and GXO Logistics, Inc. (US:GXO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 34.85 | 8.3237 | 8.3237 | |

| 0.14 | 16.12 | 3.8508 | 3.8508 | |

| 2.04 | 14.09 | 3.3657 | 3.3657 | |

| 0.19 | 10.41 | 2.4860 | 2.4860 | |

| 0.18 | 8.98 | 2.1444 | 2.1444 | |

| 0.25 | 7.27 | 1.7360 | 1.7360 | |

| 0.14 | 6.57 | 1.5704 | 1.5704 | |

| 0.20 | 6.49 | 1.5495 | 1.5495 | |

| 0.04 | 5.73 | 1.3685 | 1.3685 | |

| 0.30 | 5.59 | 1.3357 | 1.3357 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.64 | 0.1523 | -1.7935 | |

| 0.12 | 5.54 | 1.3222 | -1.5588 | |

| 0.14 | 5.94 | 1.4200 | -1.4997 | |

| 0.33 | 1.41 | 0.3367 | -1.2236 | |

| 1.15 | 8.03 | 1.9182 | -1.2036 | |

| 0.31 | 4.99 | 1.1912 | -1.1961 | |

| 0.42 | 4.15 | 0.9909 | -1.1687 | |

| 0.00 | 0.00 | -0.7982 | ||

| 0.00 | 0.00 | -0.7819 | ||

| 0.00 | 0.00 | -0.7275 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.15 | 30.99 | 91.13 | 44.68 | 21.7687 | 0.9522 | ||

| MTUM / iShares Trust - iShares MSCI USA Momentum Factor ETF | Put | 0.14 | 34.85 | 8.3237 | 8.3237 | ||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.39 | 36.84 | 31.45 | 39.90 | 7.5132 | 0.0827 | ||

| NLR / VanEck ETF Trust - VanEck Uranium+Nuclear Energy ETF | Put | 0.14 | 16.12 | 3.8508 | 3.8508 | ||||

| ASTL / Algoma Steel Group Inc. | Call | 2.04 | 14.09 | 3.3657 | 3.3657 | ||||

| OFIX / Orthofix Medical Inc. | 0.94 | 74.74 | 10.52 | 19.46 | 2.5121 | -0.3974 | |||

| ALGT / Allegiant Travel Company | Call | 0.19 | 10.41 | 2.4860 | 2.4860 | ||||

| FLR / Fluor Corporation | 0.18 | 8.98 | 2.1444 | 2.1444 | |||||

| SEI / Solaris Energy Infrastructure, Inc. | 0.30 | 4.43 | 8.41 | 35.78 | 2.0079 | -0.0382 | |||

| BKD / Brookdale Senior Living Inc. | 1.15 | -23.54 | 8.03 | -14.99 | 1.9182 | -1.2036 | |||

| NVRI / Enviri Corporation | 0.87 | -0.77 | 7.59 | 29.52 | 1.8133 | -0.1237 | |||

| ASTL / Algoma Steel Group Inc. | 1.09 | -12.13 | 7.52 | 11.70 | 1.7972 | -0.4287 | |||

| NTGR / NETGEAR, Inc. | 0.25 | 7.27 | 1.7360 | 1.7360 | |||||

| GXO / GXO Logistics, Inc. | 0.14 | 6.57 | 1.5704 | 1.5704 | |||||

| SRI / Stoneridge, Inc. | 0.92 | 0.00 | 6.50 | 53.40 | 1.5530 | 0.1521 | |||

| MEOH / Methanex Corporation | 0.20 | 6.49 | 1.5495 | 1.5495 | |||||

| FUN / Six Flags Entertainment Corporation | 0.21 | 31.25 | 6.39 | 11.97 | 1.5264 | -0.3597 | |||

| ATEX / Anterix Inc. | 0.24 | 143.41 | 6.16 | 70.59 | 1.4715 | 0.2780 | |||

| GLNG / Golar LNG Limited | 0.14 | -37.94 | 5.94 | -32.71 | 1.4200 | -1.4997 | |||

| CLS / Celestica Inc. | 0.04 | 5.73 | 1.3685 | 1.3685 | |||||

| LLYVA / Liberty Live Group | 0.07 | 0.00 | 5.64 | 18.20 | 1.3480 | -0.2298 | |||

| DTCR / Global X Funds - Global X Data Center & Digital Infrastructure ETF | Put | 0.30 | 5.59 | 1.3357 | 1.3357 | ||||

| IP / International Paper Company | 0.12 | -27.66 | 5.54 | -36.50 | 1.3222 | -1.5588 | |||

| AGX / Argan, Inc. | Put | 0.03 | 5.51 | 1.3166 | 1.3166 | ||||

| GSM / Ferroglobe PLC | 1.50 | 4.99 | 5.50 | 3.86 | 1.3127 | -0.4361 | |||

| AMRZ / Amrize AG | 0.11 | 5.45 | 1.3019 | 1.3019 | |||||

| GL / Globe Life Inc. | 0.04 | 5.34 | 1.2766 | 1.2766 | |||||

| KBE / SPDR Series Trust - SPDR S&P Bank ETF | Call | 0.10 | 5.30 | 1.2653 | 1.2653 | ||||

| CLMT / Calumet, Inc. | 0.34 | 5.28 | 1.2607 | 1.2607 | |||||

| AGCO / AGCO Corporation | 0.05 | 5.16 | 1.2321 | 1.2321 | |||||

| SWIM / Latham Group, Inc. | 0.80 | 40.87 | 5.10 | 39.80 | 1.2192 | 0.0124 | |||

| NOA / North American Construction Group Ltd. | 0.31 | -31.78 | 4.99 | -30.97 | 1.1912 | -1.1961 | |||

| MEOH / Methanex Corporation | Put | 0.15 | 4.96 | 1.1860 | 1.1860 | ||||

| ALGN / Align Technology, Inc. | 0.03 | 4.92 | 1.1758 | 1.1758 | |||||

| BLDR / Builders FirstSource, Inc. | 0.04 | 4.67 | 1.1149 | 1.1149 | |||||

| RCI / Rogers Communications Inc. | Call | 0.15 | 4.45 | 1.0627 | 1.0627 | ||||

| PAL / Proficient Auto Logistics, Inc. | 0.59 | 30.27 | 4.29 | 12.99 | 1.0244 | -0.2300 | |||

| SKYH / Sky Harbour Group Corporation | 0.42 | -15.47 | 4.15 | -36.52 | 0.9909 | -1.1687 | |||

| MGNI / Magnite, Inc. | 0.17 | 4.00 | 0.9560 | 0.9560 | |||||

| ANIP / ANI Pharmaceuticals, Inc. | 0.06 | -10.07 | 3.92 | -12.34 | 0.9352 | -0.5410 | |||

| GTLS / Chart Industries, Inc. | Call | 0.02 | 2.88 | 0.6883 | 0.6883 | ||||

| SGRY / Surgery Partners, Inc. | 0.12 | 2.78 | 0.6638 | 0.6638 | |||||

| CPRT / Copart, Inc. | Put | 0.05 | 2.45 | 0.5861 | 0.5861 | ||||

| DOW / Dow Inc. | Put | 0.07 | 1.99 | 0.4744 | 0.4744 | ||||

| XPOF / Xponential Fitness, Inc. | 0.20 | 1.50 | 0.3578 | 0.3578 | |||||

| AIOT / PowerFleet, Inc. | 0.33 | -61.97 | 1.41 | -70.15 | 0.3367 | -1.2236 | |||

| OSCR / Oscar Health, Inc. | Put | 0.07 | 1.39 | 0.3329 | 0.3329 | ||||

| HCI / HCI Group, Inc. | Put | 0.01 | 1.29 | 0.3090 | 0.3090 | ||||

| BXP / Boston Properties, Inc. | Put | 0.02 | 1.25 | 0.2982 | 0.2982 | ||||

| TFII / TFI International Inc. | 0.01 | 25.31 | 0.91 | 45.14 | 0.2174 | 0.0101 | |||

| KBR / KBR, Inc. | 0.01 | -88.75 | 0.64 | -89.18 | 0.1523 | -1.7935 | |||

| PROF / Profound Medical Corp. | 0.04 | -17.38 | 0.24 | -16.49 | 0.0582 | -0.0380 | |||

| VITL / Vital Farms, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| DOOO / BRP Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CNH / CNH Industrial N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DD / DuPont de Nemours, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LOGC / ContextLogic Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CWH / Camping World Holdings, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| NFE / New Fortress Energy Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| DCBO / Docebo Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ECG / Everus Construction Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFMT / Performant Healthcare, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| KBR / KBR, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.7819 | |||

| NTGR / NETGEAR, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.7275 | |||

| KEX / Kirby Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ARCC / Ares Capital Corporation | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| IIIV / i3 Verticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XOP / SPDR Series Trust - SPDR S&P Oil & Gas Exploration & Production ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| LSPD / Lightspeed Commerce Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| SEI / Solaris Energy Infrastructure, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.7982 |