Basic Stats

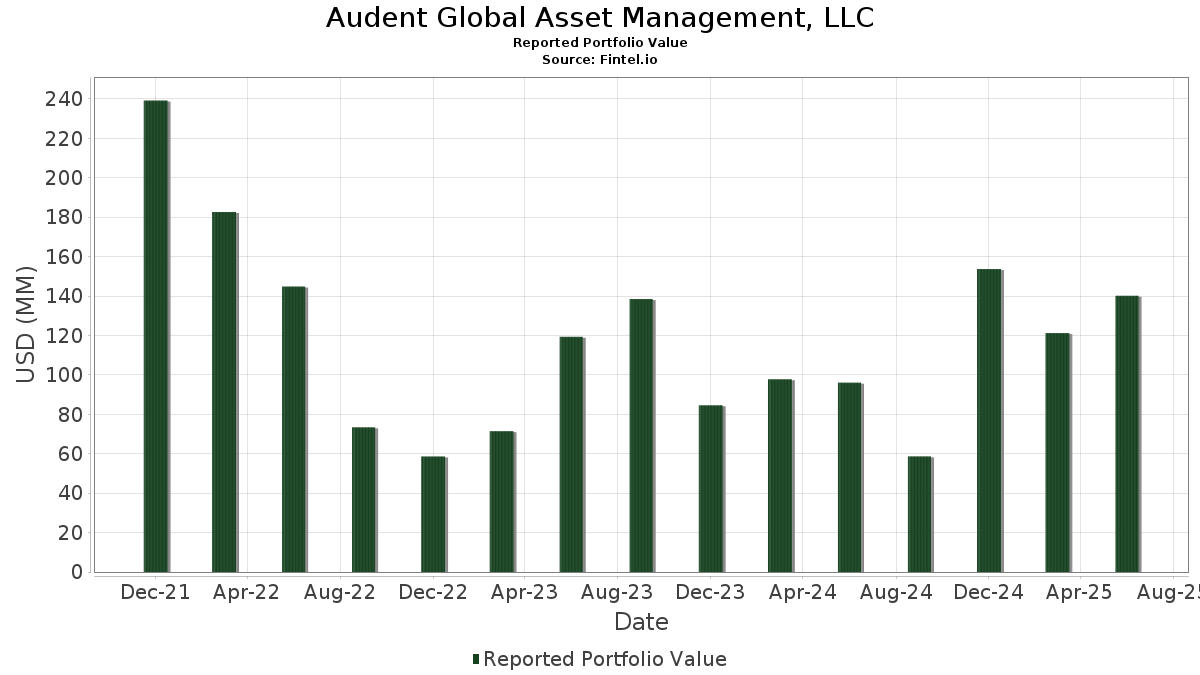

| Portfolio Value | $ 140,125,241 |

| Current Positions | 52 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Audent Global Asset Management, LLC has disclosed 52 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 140,125,241 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Audent Global Asset Management, LLC’s top holdings are Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares (US:NVDD) , Alphabet Inc. (US:GOOGL) , Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , and SPDR S&P 500 ETF (US:SPY) . Audent Global Asset Management, LLC’s new positions include Invesco S&P 500 Equal Weight Income Advantage ETF (US:RSPA) , Walmart Inc. (US:WMT) , APA Corporation (US:APA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 12.37 | 8.8286 | 1.8000 | |

| 0.01 | 1.65 | 1.1800 | 1.1800 | |

| 0.01 | 1.62 | 1.1582 | 1.1582 | |

| 0.01 | 7.08 | 5.0536 | 0.9230 | |

| 0.01 | 3.41 | 2.4352 | 0.6971 | |

| 0.01 | 7.43 | 5.3001 | 0.6448 | |

| 0.01 | 0.86 | 0.6111 | 0.6111 | |

| 0.03 | 4.67 | 3.3341 | 0.5471 | |

| 0.01 | 5.02 | 3.5826 | 0.3791 | |

| 0.01 | 0.70 | 0.5030 | 0.3068 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 6.72 | 4.7954 | -1.2502 | |

| 0.00 | 0.41 | 0.2957 | -0.8656 | |

| 0.08 | 4.76 | 3.3975 | -0.8269 | |

| 0.03 | 5.75 | 4.1033 | -0.5067 | |

| 0.04 | 1.31 | 0.9357 | -0.4140 | |

| 0.03 | 3.24 | 2.3121 | -0.3841 | |

| 0.01 | 3.40 | 2.4296 | -0.3603 | |

| 0.02 | 1.60 | 1.1429 | -0.3109 | |

| 0.02 | 1.63 | 1.1606 | -0.2713 | |

| 0.01 | 1.54 | 1.1007 | -0.2654 |

13F and Fund Filings

This form was filed on 2025-08-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.08 | -0.39 | 12.37 | 45.22 | 8.8286 | 1.8000 | |||

| GOOGL / Alphabet Inc. | 0.04 | -0.18 | 7.43 | 13.74 | 5.3043 | -0.0863 | |||

| MSFT / Microsoft Corporation | 0.01 | -0.67 | 7.43 | 31.62 | 5.3001 | 0.6448 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -0.39 | 7.41 | 14.86 | 5.2859 | -0.0343 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 1.76 | 7.16 | 12.71 | 5.1088 | -0.1310 | |||

| NFLX / Netflix, Inc. | 0.01 | -1.51 | 7.08 | 41.45 | 5.0536 | 0.9230 | |||

| AAPL / Apple Inc. | 0.03 | -0.72 | 6.72 | -8.31 | 4.7954 | -1.2502 | |||

| MTUM / iShares Trust - iShares MSCI USA Momentum Factor ETF | 0.03 | 0.38 | 6.70 | 19.35 | 4.7808 | 0.1499 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.03 | -4.88 | 5.75 | 2.90 | 4.1033 | -0.5067 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -0.21 | 5.02 | 29.28 | 3.5826 | 0.3791 | |||

| IYH / iShares Trust - iShares U.S. Healthcare ETF | 0.08 | 0.23 | 4.76 | -7.03 | 3.3975 | -0.8269 | |||

| AMD / Advanced Micro Devices, Inc. | 0.03 | 0.13 | 4.67 | 38.28 | 3.3341 | 0.5471 | |||

| META / Meta Platforms, Inc. | 0.01 | -1.83 | 3.73 | 25.75 | 2.6627 | 0.2143 | |||

| LULU / lululemon athletica inc. | 0.01 | 92.97 | 3.41 | 62.01 | 2.4352 | 0.6971 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.01 | -5.44 | 3.40 | 0.68 | 2.4296 | -0.3603 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.03 | 0.22 | 3.24 | -0.89 | 2.3121 | -0.3841 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -0.48 | 3.24 | 17.64 | 2.3087 | 0.0395 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.04 | 0.00 | 3.19 | 9.40 | 2.2751 | -0.1296 | |||

| PYPL / PayPal Holdings, Inc. | 0.04 | 0.00 | 2.70 | 13.89 | 1.9251 | -0.0288 | |||

| NKE / NIKE, Inc. | 0.04 | -0.54 | 2.50 | 11.94 | 1.7868 | -0.0587 | |||

| AMAT / Applied Materials, Inc. | 0.01 | -0.27 | 2.42 | 25.83 | 1.7243 | 0.1399 | |||

| ADBE / Adobe Inc. | 0.01 | -0.47 | 2.05 | 0.39 | 1.4650 | -0.2218 | |||

| ACN / Accenture plc | 0.01 | 0.00 | 1.79 | -4.22 | 1.2798 | -0.2648 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 1.65 | 1.1800 | 1.1800 | |||||

| IEO / iShares Trust - iShares U.S. Oil & Gas Exploration & Production ETF | 0.02 | 0.03 | 1.63 | -6.28 | 1.1606 | -0.2713 | |||

| RSPA / Invesco S&P 500 Equal Weight Income Advantage ETF | 0.01 | 1.62 | 1.1582 | 1.1582 | |||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.02 | 0.14 | 1.60 | -9.14 | 1.1429 | -0.3109 | |||

| MCD / McDonald's Corporation | 0.01 | -0.42 | 1.54 | -6.83 | 1.1007 | -0.2654 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.03 | 0.00 | 1.51 | 10.34 | 1.0745 | -0.0507 | |||

| EOG / EOG Resources, Inc. | 0.01 | -0.63 | 1.44 | -7.33 | 1.0294 | -0.2545 | |||

| SLB / Schlumberger Limited | 0.04 | -1.59 | 1.31 | -19.87 | 0.9357 | -0.4140 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.02 | 0.47 | 1.30 | 5.62 | 0.9262 | -0.0874 | |||

| V / Visa Inc. | 0.00 | -0.64 | 1.15 | 0.61 | 0.8240 | -0.1223 | |||

| CAT / Caterpillar Inc. | 0.00 | -0.44 | 1.06 | 17.24 | 0.7577 | 0.0103 | |||

| XYZ / Block, Inc. | 0.01 | -0.38 | 0.95 | 24.58 | 0.6805 | 0.0489 | |||

| ICF / iShares Trust - iShares Select U.S. REIT ETF | 0.02 | 0.92 | 0.94 | 0.32 | 0.6683 | -0.1019 | |||

| DIS / The Walt Disney Company | 0.01 | -25.91 | 0.92 | -6.59 | 0.6587 | -0.1562 | |||

| OIH / VanEck ETF Trust - VanEck Oil Services ETF | 0.00 | 0.36 | 0.91 | -11.83 | 0.6490 | -0.2019 | |||

| WMT / Walmart Inc. | 0.01 | 0.86 | 0.6111 | 0.6111 | |||||

| C / Citigroup Inc. | 0.01 | 147.19 | 0.70 | 197.05 | 0.5030 | 0.3068 | |||

| UBER / Uber Technologies, Inc. | 0.01 | -0.76 | 0.70 | 27.24 | 0.4968 | 0.0449 | |||

| MA / Mastercard Incorporated | 0.00 | -1.29 | 0.69 | 1.18 | 0.4901 | -0.0698 | |||

| ROKU / Roku, Inc. | 0.01 | 1.05 | 0.52 | 26.23 | 0.3676 | 0.0306 | |||

| TSLA / Tesla, Inc. | 0.00 | 20.71 | 0.51 | 48.09 | 0.3607 | 0.0789 | |||

| SBUX / Starbucks Corporation | 0.01 | -1.32 | 0.46 | -7.85 | 0.3273 | -0.0832 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -67.52 | 0.41 | -70.58 | 0.2957 | -0.8656 | |||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | 0.00 | 1.09 | 0.41 | 0.00 | 0.2943 | -0.0457 | |||

| DOCU / DocuSign, Inc. | 0.01 | -3.86 | 0.40 | -8.03 | 0.2863 | -0.0735 | |||

| BA / The Boeing Company | 0.00 | 1.85 | 0.36 | 24.91 | 0.2547 | 0.0194 | |||

| APA / APA Corporation | 0.02 | 0.35 | 0.2480 | 0.2480 | |||||

| ATAI / Atai Life Sciences N.V. | 0.02 | 0.00 | 0.04 | 63.64 | 0.0263 | 0.0074 | |||

| UP / Wheels Up Experience Inc. | 0.02 | 0.00 | 0.02 | 6.25 | 0.0124 | -0.0011 | |||

| RBA / RB Global, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -100.00 | 0.00 | 0.0000 |