Basic Stats

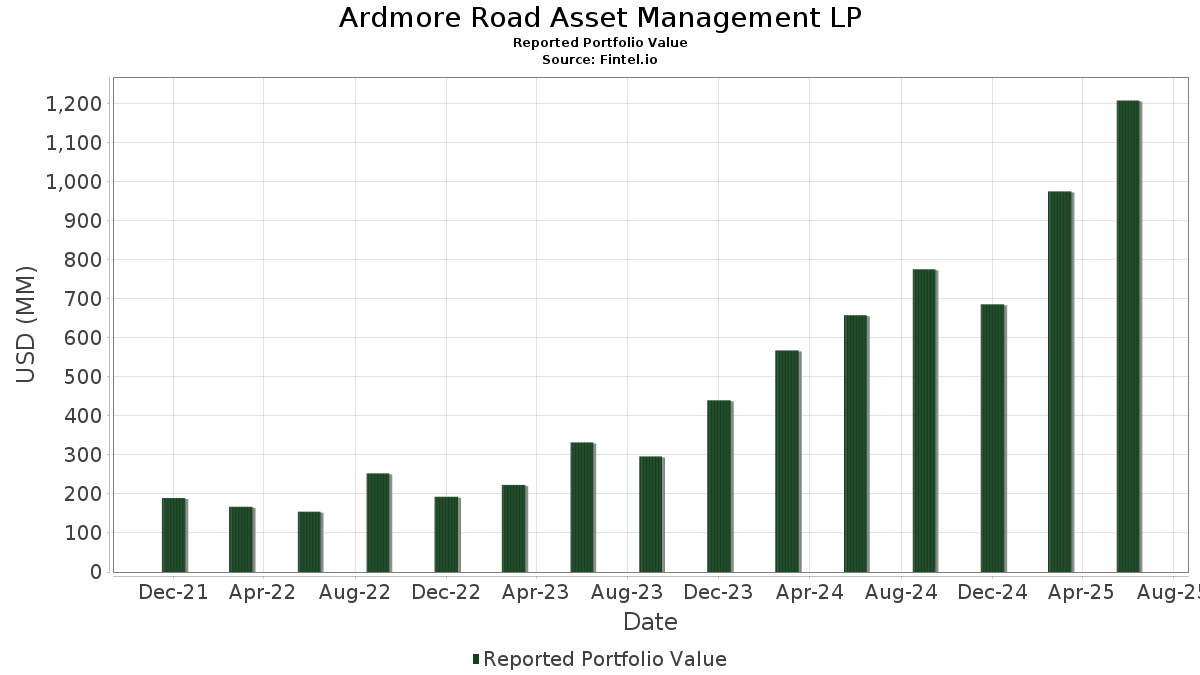

| Portfolio Value | $ 1,208,226,267 |

| Current Positions | 39 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Ardmore Road Asset Management LP has disclosed 39 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,208,226,267 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ardmore Road Asset Management LP’s top holdings are Alphabet Inc. (US:GOOGL) , Advanced Micro Devices, Inc. (US:AMD) , AT&T Inc. (US:T) , Cisco Systems, Inc. (US:CSCO) , and Amazon.com, Inc. (US:AMZN) . Ardmore Road Asset Management LP’s new positions include The Walt Disney Company (US:DIS) , Core Scientific, Inc. (US:CORZ) , Celestica Inc. (US:CLS) , Etsy, Inc. (US:ETSY) , and ON Semiconductor Corporation (US:ON) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.60 | 105.74 | 8.7515 | 8.7515 | |

| 2.50 | 72.35 | 5.9881 | 5.9881 | |

| 0.60 | 85.14 | 7.0467 | 5.4665 | |

| 0.29 | 64.28 | 5.3203 | 5.3203 | |

| 0.20 | 55.13 | 4.5629 | 4.5629 | |

| 0.33 | 52.29 | 4.3277 | 4.3277 | |

| 0.40 | 49.60 | 4.1055 | 4.1055 | |

| 0.35 | 27.09 | 2.2421 | 2.2421 | |

| 0.70 | 25.10 | 2.0776 | 2.0776 | |

| 0.05 | 24.87 | 2.0584 | 2.0584 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 22.14 | 1.8327 | -6.4413 | |

| 0.03 | 4.22 | 0.3490 | -2.9260 | |

| 0.55 | 37.36 | 3.0923 | -2.7573 | |

| 0.25 | 21.97 | 1.8186 | -1.9734 | |

| 0.90 | 29.38 | 2.4313 | -0.9418 | |

| 0.01 | 40.52 | 3.3541 | -0.8974 | |

| 0.34 | 21.06 | 1.7427 | -0.5996 | |

| 0.15 | 13.99 | 1.1583 | -0.3359 | |

| 0.20 | 57.15 | 4.7302 | -0.2676 | |

| 0.80 | 5.55 | 0.4595 | -0.2533 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 0.60 | 105.74 | 8.7515 | 8.7515 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.60 | 300.00 | 85.14 | 452.46 | 7.0467 | 5.4665 | |||

| T / AT&T Inc. | 2.50 | 72.35 | 5.9881 | 5.9881 | |||||

| CSCO / Cisco Systems, Inc. | 1.00 | 25.00 | 69.38 | 40.54 | 5.7423 | 0.6801 | |||

| AMZN / Amazon.com, Inc. | 0.29 | 64.28 | 5.3203 | 5.3203 | |||||

| FLUT / Flutter Entertainment plc | 0.20 | -9.09 | 57.15 | 17.26 | 4.7302 | -0.2676 | |||

| AVGO / Broadcom Inc. | 0.20 | 55.13 | 4.5629 | 4.5629 | |||||

| NVDA / NVIDIA Corporation | 0.33 | 52.29 | 4.3277 | 4.3277 | |||||

| DIS / The Walt Disney Company | 0.40 | 49.60 | 4.1055 | 4.1055 | |||||

| PYPL / PayPal Holdings, Inc. | 0.65 | 116.67 | 48.31 | 146.78 | 3.9983 | 1.9910 | |||

| BKNG / Booking Holdings Inc. | 0.01 | -22.22 | 40.52 | -2.26 | 3.3541 | -0.8974 | |||

| XYZ / Block, Inc. | 0.55 | -47.62 | 37.36 | -34.51 | 3.0923 | -2.7573 | |||

| DKNG / DraftKings Inc. | 0.85 | 41.67 | 36.46 | 82.96 | 3.0174 | 0.9742 | |||

| AFRM / Affirm Holdings, Inc. | 0.50 | -16.67 | 34.57 | 27.50 | 2.8612 | 0.0810 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.90 | 12.50 | 29.38 | -10.70 | 2.4313 | -0.9418 | |||

| MRVL / Marvell Technology, Inc. | 0.35 | 27.09 | 2.2421 | 2.2421 | |||||

| PINS / Pinterest, Inc. | 0.70 | 25.10 | 2.0776 | 2.0776 | |||||

| DASH / DoorDash, Inc. | 0.10 | 26.25 | 24.90 | 70.28 | 2.0607 | 0.5614 | |||

| MSFT / Microsoft Corporation | 0.05 | 24.87 | 2.0584 | 2.0584 | |||||

| META / Meta Platforms, Inc. | 0.03 | -78.57 | 22.14 | -72.56 | 1.8327 | -6.4413 | |||

| ROKU / Roku, Inc. | 0.25 | -52.38 | 21.97 | -40.59 | 1.8186 | -1.9734 | |||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.20 | 21.90 | 1.8126 | 1.8126 | |||||

| IBIT / iShares Bitcoin Trust ETF | 0.34 | -29.51 | 21.06 | -7.82 | 1.7427 | -0.5996 | |||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.35 | 20.52 | 1.6987 | 1.6987 | |||||

| APP / AppLovin Corporation | 0.05 | 17.47 | 1.4458 | 1.4458 | |||||

| CHWY / Chewy, Inc. | 0.40 | 17.22 | 1.4255 | 1.4255 | |||||

| CORZ / Core Scientific, Inc. | 1.00 | 17.07 | 1.4128 | 1.4128 | |||||

| CLS / Celestica Inc. | 0.10 | 15.61 | 1.2921 | 1.2921 | |||||

| ETSY / Etsy, Inc. | 0.30 | 15.10 | 1.2496 | 1.2496 | |||||

| UBER / Uber Technologies, Inc. | 0.15 | -25.00 | 13.99 | -3.96 | 1.1583 | -0.3359 | |||

| RBLX / Roblox Corporation | 0.12 | 13.15 | 1.0884 | 1.0884 | |||||

| ON / ON Semiconductor Corporation | 0.25 | 13.10 | 1.0844 | 1.0844 | |||||

| DOCU / DocuSign, Inc. | 0.16 | 41.82 | 12.15 | 35.69 | 1.0057 | 0.0875 | |||

| EQIX / Equinix, Inc. | 0.01 | 6.88 | 0.5693 | 0.5693 | |||||

| PTON / Peloton Interactive, Inc. | 0.80 | -27.27 | 5.55 | -20.14 | 0.4595 | -0.2533 | |||

| APLD / Applied Digital Corporation | 0.45 | 4.57 | 0.3779 | 0.3779 | |||||

| EXPE / Expedia Group, Inc. | 0.03 | -86.84 | 4.22 | -86.80 | 0.3490 | -2.9260 | |||

| IREN / IREN Limited | 0.29 | 4.21 | 0.3484 | 0.3484 | |||||

| MBLY / Mobileye Global Inc. | 0.04 | 0.72 | 0.0595 | 0.0595 | |||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TEAM / Atlassian Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NFLX / Netflix, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FOXA / Fox Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ESTC / Elastic N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WDC / Western Digital Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TTD / The Trade Desk, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CART / Maplebear Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ARKK / ARK ETF Trust - ARK Innovation ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BEKE / KE Holdings Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MU / Micron Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTU / Intuit Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVNA / Carvana Co. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SNOW / Snowflake Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DDOG / Datadog, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |