Basic Stats

| Portfolio Value | $ 1,123,075 |

| Current Positions | 96 |

Latest Holdings, Performance, AUM (from 13F, 13D)

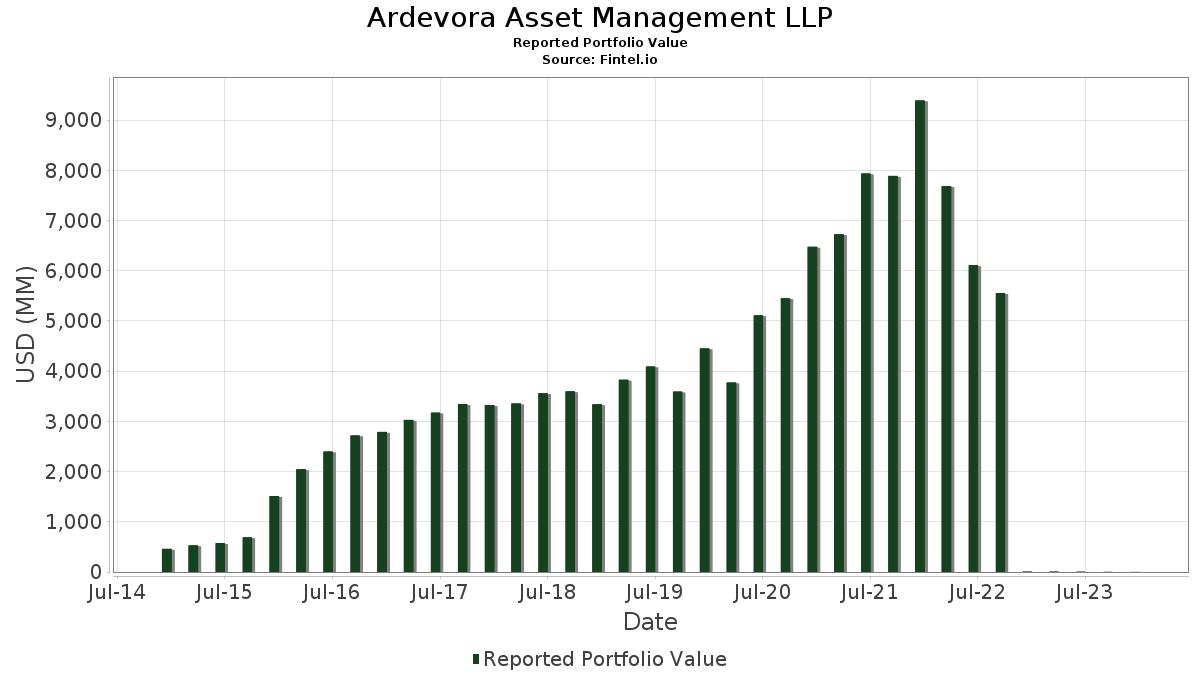

Ardevora Asset Management LLP has disclosed 96 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,123,075 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ardevora Asset Management LLP’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . Ardevora Asset Management LLP’s new positions include Alphabet Inc. (US:GOOGL) , The J. M. Smucker Company (US:SJM) , W.W. Grainger, Inc. (US:GWW) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 0.01 | 0.9925 | 0.9925 | |

| 0.01 | 0.01 | 0.9861 | 0.9861 | |

| 0.04 | 0.01 | 1.1579 | 0.6559 | |

| 0.01 | 0.01 | 1.0347 | 0.5525 | |

| 0.09 | 0.01 | 1.0396 | 0.5172 | |

| 0.04 | 0.01 | 1.0268 | 0.5106 | |

| 0.05 | 0.01 | 1.0544 | 0.5093 | |

| 0.02 | 0.01 | 1.0523 | 0.5057 | |

| 0.07 | 0.01 | 1.0610 | 0.5050 | |

| 0.03 | 0.01 | 0.5015 | 0.5015 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9059 | ||

| 0.00 | 0.00 | -0.8786 | ||

| 0.00 | 0.00 | 0.0403 | -0.8723 | |

| 0.00 | 0.00 | -0.8583 | ||

| 0.11 | 0.01 | 0.9938 | -0.5452 | |

| 0.00 | 0.00 | -0.5337 | ||

| 0.00 | 0.00 | -0.5013 | ||

| 0.00 | 0.00 | -0.4894 | ||

| 0.00 | 0.00 | -0.4825 | ||

| 0.00 | 0.00 | -0.4776 |

13F and Fund Filings

This form was filed on 2024-02-01 for the reporting period 2023-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.07 | -49.66 | 0.03 | -43.33 | 3.0860 | 0.1150 | |||

| MSFT / Microsoft Corporation | 0.09 | -53.94 | 0.03 | -45.16 | 3.0512 | -0.0182 | |||

| AAPL / Apple Inc. | 0.17 | -52.96 | 0.03 | -47.62 | 2.9721 | -0.1279 | |||

| AMZN / Amazon.com, Inc. | 0.21 | -47.60 | 0.03 | -37.25 | 2.8607 | 0.3402 | |||

| META / Meta Platforms, Inc. | 0.07 | -50.22 | 0.02 | -41.03 | 2.0787 | 0.1242 | |||

| GOOGL / Alphabet Inc. | 0.16 | 0.02 | 2.0468 | -0.0512 | |||||

| GOOG / Alphabet Inc. | 0.16 | -49.82 | 0.02 | -47.62 | 2.0432 | -0.0586 | |||

| MA / Mastercard Incorporated | 0.05 | -48.20 | 0.02 | -45.00 | 2.0244 | 0.0227 | |||

| V / Visa Inc. | 0.09 | -50.87 | 0.02 | -45.00 | 1.9945 | 0.0157 | |||

| MRK / Merck & Co., Inc. | 0.16 | -43.10 | 0.02 | -39.29 | 1.5269 | 0.1288 | |||

| COST / Costco Wholesale Corporation | 0.03 | -53.45 | 0.02 | -45.16 | 1.5161 | -0.0222 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -43.87 | 0.02 | -36.00 | 1.5125 | 0.2449 | |||

| WFC / Wells Fargo & Company | 0.34 | -53.53 | 0.02 | -44.83 | 1.4948 | 0.0213 | |||

| WM / Waste Management, Inc. | 0.09 | -51.90 | 0.02 | -44.83 | 1.4824 | 0.0350 | |||

| MCD / McDonald's Corporation | 0.06 | -50.00 | 0.02 | -44.83 | 1.4812 | 0.0289 | |||

| PEP / PepsiCo, Inc. | 0.10 | -44.64 | 0.02 | -44.83 | 1.4711 | 0.0082 | |||

| MDLZ / Mondelez International, Inc. | 0.23 | -47.02 | 0.02 | -44.83 | 1.4697 | 0.0030 | |||

| LIN / Linde plc | 0.04 | -51.27 | 0.02 | -46.67 | 1.4652 | -0.0390 | |||

| KO / The Coca-Cola Company | 0.28 | -47.91 | 0.02 | -44.83 | 1.4568 | -0.0092 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.09 | -47.21 | 0.02 | -46.67 | 1.4434 | -0.0720 | |||

| PAYX / Paychex, Inc. | 0.13 | -50.90 | 0.02 | -50.00 | 1.3928 | -0.1227 | |||

| XOM / Exxon Mobil Corporation | 0.15 | -25.10 | 0.02 | -34.78 | 1.3516 | 0.1807 | |||

| LLY / Eli Lilly and Company | 0.02 | -31.92 | 0.01 | -27.78 | 1.2432 | 0.3148 | |||

| ANSS / ANSYS, Inc. | 0.04 | 4.35 | 0.01 | 30.00 | 1.1579 | 0.6559 | |||

| AMAT / Applied Materials, Inc. | 0.07 | -10.06 | 0.01 | 0.00 | 1.0610 | 0.5050 | |||

| PWR / Quanta Services, Inc. | 0.05 | -7.49 | 0.01 | 0.00 | 1.0544 | 0.5093 | |||

| NFLX / Netflix, Inc. | 0.02 | -17.62 | 0.01 | 0.00 | 1.0523 | 0.5057 | |||

| DXCM / DexCom, Inc. | 0.09 | -17.44 | 0.01 | 10.00 | 1.0396 | 0.5172 | |||

| SLB / Schlumberger Limited | 0.22 | -52.62 | 0.01 | -59.26 | 1.0369 | -0.3159 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | -5.15 | 0.01 | 22.22 | 1.0347 | 0.5525 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.03 | -48.13 | 0.01 | -42.11 | 1.0271 | 0.0934 | |||

| AVGO / Broadcom Inc. | 0.01 | -56.85 | 0.01 | -42.11 | 1.0268 | 0.0498 | |||

| SYK / Stryker Corporation | 0.04 | 0.16 | 0.01 | 10.00 | 1.0268 | 0.5106 | |||

| DE / Deere & Company | 0.03 | -41.94 | 0.01 | -38.89 | 1.0188 | 0.1050 | |||

| KLAC / KLA Corporation | 0.02 | -55.26 | 0.01 | -45.00 | 1.0150 | 0.0273 | |||

| VLO / Valero Energy Corporation | 0.09 | -29.56 | 0.01 | -35.29 | 1.0017 | 0.1463 | |||

| PCTY / Paylocity Holding Corporation | 0.07 | -35.35 | 0.01 | -42.11 | 0.9961 | 0.0590 | |||

| APH / Amphenol Corporation | 0.11 | -69.81 | 0.01 | -64.52 | 0.9938 | -0.5452 | |||

| ADBE / Adobe Inc. | 0.02 | -60.32 | 0.01 | -54.17 | 0.9933 | -0.1874 | |||

| SJM / The J. M. Smucker Company | 0.09 | 0.01 | 0.9925 | 0.9925 | |||||

| RMD / ResMed Inc. | 0.06 | -53.19 | 0.01 | -45.00 | 0.9917 | -0.0131 | |||

| HSIC / Henry Schein, Inc. | 0.15 | -41.50 | 0.01 | -38.89 | 0.9900 | 0.0743 | |||

| GWW / W.W. Grainger, Inc. | 0.01 | 0.01 | 0.9861 | 0.9861 | |||||

| MCHP / Microchip Technology Incorporated | 0.12 | -51.88 | 0.01 | -42.11 | 0.9838 | 0.0074 | |||

| ROP / Roper Technologies, Inc. | 0.02 | -55.25 | 0.01 | -47.62 | 0.9834 | -0.0937 | |||

| RSG / Republic Services, Inc. | 0.07 | -48.80 | 0.01 | -38.89 | 0.9817 | 0.0674 | |||

| COR / Cencora, Inc. | 0.05 | -45.46 | 0.01 | -41.18 | 0.9774 | 0.1109 | |||

| ABNB / Airbnb, Inc. | 0.08 | -51.33 | 0.01 | -54.55 | 0.9738 | -0.1389 | |||

| MRO / Marathon Oil Corporation | 0.45 | 20.41 | 0.01 | 11.11 | 0.9671 | 0.4764 | |||

| NOW / ServiceNow, Inc. | 0.02 | -53.55 | 0.01 | -44.44 | 0.9646 | 0.0580 | |||

| CTAS / Cintas Corporation | 0.02 | -49.99 | 0.01 | -41.18 | 0.9645 | 0.1151 | |||

| TDG / TransDigm Group Incorporated | 0.01 | -4.15 | 0.01 | 11.11 | 0.9622 | 0.5005 | |||

| WDAY / Workday, Inc. | 0.04 | -14.21 | 0.01 | 11.11 | 0.9568 | 0.4779 | |||

| LNG / Cheniere Energy, Inc. | 0.06 | -43.99 | 0.01 | -44.44 | 0.9553 | 0.0405 | |||

| LYV / Live Nation Entertainment, Inc. | 0.11 | -51.52 | 0.01 | -47.37 | 0.9512 | -0.0091 | |||

| EW / Edwards Lifesciences Corporation | 0.14 | -47.19 | 0.01 | -44.44 | 0.9445 | 0.0478 | |||

| FWONK / Formula One Group | 0.17 | -46.07 | 0.01 | -47.37 | 0.9422 | -0.0091 | |||

| BSX / Boston Scientific Corporation | 0.18 | -48.60 | 0.01 | -44.44 | 0.9414 | 0.0183 | |||

| ROL / Rollins, Inc. | 0.24 | -51.14 | 0.01 | -44.44 | 0.9342 | 0.0322 | |||

| AME / AMETEK, Inc. | 0.06 | -46.10 | 0.01 | -41.18 | 0.9280 | 0.0766 | |||

| MCK / McKesson Corporation | 0.02 | -39.68 | 0.01 | -37.50 | 0.9220 | 0.1298 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.08 | -49.30 | 0.01 | -41.18 | 0.9112 | 0.0640 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | -42.57 | 0.01 | -41.18 | 0.9097 | 0.0735 | |||

| GILD / Gilead Sciences, Inc. | 0.13 | -46.68 | 0.01 | -41.18 | 0.9085 | 0.0387 | |||

| AON / Aon plc | 0.03 | -44.36 | 0.01 | -50.00 | 0.8944 | -0.0937 | |||

| WMB / The Williams Companies, Inc. | 0.29 | -49.92 | 0.01 | -47.37 | 0.8915 | -0.0585 | |||

| MELI / MercadoLibre, Inc. | 0.01 | -19.21 | 0.01 | 11.11 | 0.8912 | 0.4002 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -43.83 | 0.01 | -38.46 | 0.7720 | 0.0877 | |||

| MNDY / monday.com Ltd. | 0.04 | -36.62 | 0.01 | -30.00 | 0.6680 | 0.1750 | |||

| AMD / Advanced Micro Devices, Inc. | 0.05 | -63.89 | 0.01 | -50.00 | 0.5939 | -0.0391 | |||

| FTNT / Fortinet, Inc. | 0.11 | -46.00 | 0.01 | -45.45 | 0.5668 | -0.0138 | |||

| LRCX / Lam Research Corporation | 0.01 | -58.54 | 0.01 | -50.00 | 0.5608 | -0.0365 | |||

| LULU / lululemon athletica inc. | 0.01 | -56.97 | 0.01 | -40.00 | 0.5464 | 0.0180 | |||

| PINS / Pinterest, Inc. | 0.16 | -59.69 | 0.01 | -45.45 | 0.5429 | 0.0006 | |||

| HUBS / HubSpot, Inc. | 0.01 | -44.71 | 0.01 | -33.33 | 0.5421 | 0.0832 | |||

| CDNS / Cadence Design Systems, Inc. | 0.02 | -52.78 | 0.01 | -45.45 | 0.5379 | -0.0028 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | -52.46 | 0.01 | -40.00 | 0.5379 | 0.0460 | |||

| EXAS / Exact Sciences Corporation | 0.08 | -42.63 | 0.01 | -44.44 | 0.5301 | 0.0600 | |||

| HES / Hess Corporation | 0.04 | -45.86 | 0.01 | -54.55 | 0.5296 | -0.0433 | |||

| MSCI / MSCI Inc. | 0.01 | -44.64 | 0.01 | -44.44 | 0.5212 | 0.0500 | |||

| TTD / The Trade Desk, Inc. | 0.08 | -41.79 | 0.01 | -50.00 | 0.5064 | -0.0149 | |||

| H / Hyatt Hotels Corporation | 0.04 | -50.46 | 0.01 | -44.44 | 0.5058 | 0.0476 | |||

| SNPS / Synopsys, Inc. | 0.01 | -54.60 | 0.01 | -54.55 | 0.5034 | -0.0420 | |||

| CPRT / Copart, Inc. | 0.11 | -48.42 | 0.01 | -44.44 | 0.5017 | 0.0298 | |||

| NUE / Nucor Corporation | 0.03 | 0.01 | 0.5015 | 0.5015 | |||||

| WST / West Pharmaceutical Services, Inc. | 0.02 | -41.93 | 0.01 | -50.00 | 0.5000 | -0.0062 | |||

| ROST / Ross Stores, Inc. | 0.04 | -56.17 | 0.01 | -50.00 | 0.4977 | -0.0138 | |||

| EOG / EOG Resources, Inc. | 0.05 | -40.17 | 0.01 | -44.44 | 0.4887 | 0.0164 | |||

| COP / ConocoPhillips | 0.05 | -43.06 | 0.01 | -44.44 | 0.4874 | -0.0000 | |||

| DVN / Devon Energy Corporation | 0.12 | -67.99 | 0.01 | -70.59 | 0.4858 | -0.3958 | |||

| APA / APA Corporation | 0.15 | -64.47 | 0.01 | -70.59 | 0.4818 | -0.3753 | |||

| GE / General Electric Company | 0.04 | -70.61 | 0.01 | -66.67 | 0.4784 | -0.2997 | |||

| OXY / Occidental Petroleum Corporation | 0.09 | -34.69 | 0.01 | -37.50 | 0.4707 | 0.0386 | |||

| PCG / PG&E Corporation | 0.29 | -48.74 | 0.01 | -37.50 | 0.4590 | 0.0170 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | -97.99 | 0.00 | -100.00 | 0.0403 | -0.8723 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -96.24 | 0.00 | -100.00 | 0.0391 | -0.4572 | |||

| IPGP / IPG Photonics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8583 | ||||

| IPG / The Interpublic Group of Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4776 | ||||

| FFIN / First Financial Bankshares, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1413 | ||||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1158 | ||||

| DOX / Amdocs Limited | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0469 | ||||

| KEYS / Keysight Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4894 | ||||

| FCX / Freeport-McMoRan Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0804 | ||||

| HCA / HCA Healthcare, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4304 | ||||

| A / Agilent Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1491 | ||||

| SCI / Service Corporation International | 0.00 | -100.00 | 0.00 | -100.00 | -0.1510 | ||||

| SQ / Block, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0385 | ||||

| DRI / Darden Restaurants, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4825 | ||||

| ADI / Analog Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9059 | ||||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.5013 | ||||

| ABCZF / Abcam Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSCO / Tractor Supply Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0775 | ||||

| LLYVK / Liberty Live Group | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0019 | ||||

| EWBC / East West Bancorp, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1486 | ||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0289 | ||||

| AEE / Ameren Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | -0.0261 | ||||

| KMI / Kinder Morgan, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8786 | ||||

| CFR / Cullen/Frost Bankers, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0525 | ||||

| RS / Reliance, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5337 | ||||

| OGS / ONE Gas, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4703 | ||||

| ENPH / Enphase Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0820 |