Basic Stats

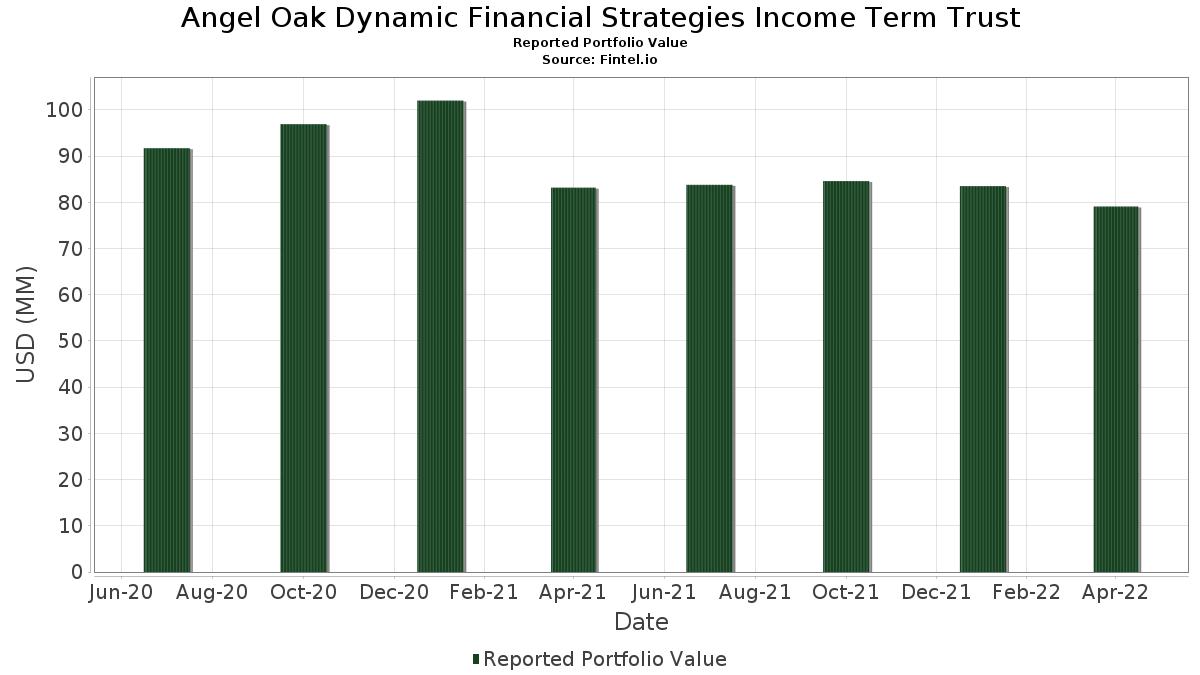

| Portfolio Value | $ 79,098,113 |

| Current Positions | 103 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Angel Oak Dynamic Financial Strategies Income Term Trust has disclosed 103 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 79,098,113 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Angel Oak Dynamic Financial Strategies Income Term Trust’s top holdings are Equity Bancshares Inc (US:US29460XAC39) , Byline Bancorp Inc (US:US124411AA74) , Obsidian Insurance Holdings Inc (US:US67449JAA43) , PREMIA HLDGS LTD SB 144A NT6.9% 30 (US:US74049MAB54) , and Clear Blue Financial Holdings LLC (PR:US18452FAB76) . Angel Oak Dynamic Financial Strategies Income Term Trust’s new positions include Equity Bancshares Inc (US:US29460XAC39) , Byline Bancorp Inc (US:US124411AA74) , Obsidian Insurance Holdings Inc (US:US67449JAA43) , PREMIA HLDGS LTD SB 144A NT6.9% 30 (US:US74049MAB54) , and Clear Blue Financial Holdings LLC (PR:US18452FAB76) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.49 | 1.8627 | 1.8627 | ||

| 0.96 | 1.2032 | 1.2032 | ||

| 0.02 | 0.52 | 0.6458 | 0.6458 | |

| 1.55 | 1.9411 | 0.2296 | ||

| 2.99 | 3.7319 | 0.2127 | ||

| 3.05 | 3.8115 | 0.1865 | ||

| 3.05 | 3.8068 | 0.1863 | ||

| 2.99 | 3.7335 | 0.1724 | ||

| 2.70 | 3.3714 | 0.1650 | ||

| 0.08 | 2.10 | 2.6159 | 0.1280 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -1.93 | -2.4111 | -3.0326 | ||

| -1.85 | -2.3163 | -2.9377 | ||

| -1.82 | -2.2688 | -2.8903 | ||

| -1.80 | -2.2451 | -2.8666 | ||

| -1.57 | -1.9566 | -2.5781 | ||

| -1.56 | -1.9516 | -2.5731 | ||

| -1.53 | -1.9067 | -2.5282 | ||

| -1.47 | -1.8355 | -2.4570 | ||

| -1.25 | -1.5546 | -2.1761 | ||

| -1.24 | -1.5433 | -2.1648 |

13F and Fund Filings

This form was filed on 2022-06-27 for the reporting period 2022-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US29460XAC39 / Equity Bancshares Inc | 3.21 | -2.85 | 4.0041 | 0.0849 | |||||

| US124411AA74 / Byline Bancorp Inc | 3.10 | -4.15 | 3.8648 | 0.0290 | |||||

| US67449JAA43 / Obsidian Insurance Holdings Inc | 3.05 | 0.00 | 3.8115 | 0.1865 | |||||

| US74049MAB54 / PREMIA HLDGS LTD SB 144A NT6.9% 30 | 3.05 | 0.00 | 3.8068 | 0.1863 | |||||

| TFIN.PR / Triumph Financial, Inc. - Preferred Stock | 2.99 | 2.96 | 3.7335 | 0.1724 | |||||

| US18452FAB76 / Clear Blue Financial Holdings LLC | 2.99 | 0.84 | 3.7319 | 0.2127 | |||||

| US124782AC73 / CB&T Holding Corp | 2.70 | 0.00 | 3.3714 | 0.1650 | |||||

| US23204HBM97 / Customers Bank | 2.60 | -3.77 | 3.2485 | 0.0373 | |||||

| US598511AC76 / MidWestOne Financial Group, Inc. | 2.59 | -1.89 | 3.2366 | 0.0990 | |||||

| US67740QAG10 / Ohio National Financial Services Inc | 2.58 | -11.19 | 3.2207 | -0.2282 | |||||

| US33767UAA51 / Firstsun Capital Bancorp | 2.54 | -4.63 | 3.1678 | 0.0090 | |||||

| US84861DAA19 / Spirit of Texas Bancshares Inc | 2.51 | -3.75 | 3.1370 | 0.0365 | |||||

| US720104AA63 / Piedmont Bancorp Inc/GA | 2.47 | -4.63 | 3.0867 | 0.0087 | |||||

| US18468HAC34 / Clear Street Capital LLC | 2.44 | -1.81 | 3.0512 | 0.0961 | |||||

| US8964425065 / Trinity Capital Inc | 0.08 | 0.00 | 2.10 | 0.00 | 2.6159 | 0.1280 | |||

| US12634QAJ04 / CRB Group Inc | 2.07 | -8.41 | 2.5823 | -0.0998 | |||||

| PPEB0G5N9 / BIG POPPY HOLDIN | 2.06 | 0.00 | 2.5785 | 0.1262 | |||||

| US223622AG65 / Cowen, Inc. | 2.05 | -3.75 | 2.5622 | 0.0304 | |||||

| US31431BAC37 / FedNat Holding Co. | 2.05 | -2.89 | 2.5597 | 0.0540 | |||||

| US29911QAA76 / Evans Bancorp Inc | 2.04 | -1.92 | 2.5515 | 0.0772 | |||||

| US07272MAA53 / BayCom Corp | 2.03 | -4.56 | 2.5380 | 0.0096 | |||||

| US293668AE99 / ENTERPRISE BANCORP INC MASS SUB GLBL NT 30 | 2.02 | -4.93 | 2.5281 | -0.0012 | |||||

| US843395AB03 / Southern National Bancorp of Virginia Inc | 2.02 | -4.62 | 2.5244 | 0.0074 | |||||

| US04004XAA37 / Arena Finance II LLC | 2.00 | 0.00 | 2.5004 | 0.1223 | |||||

| US174903AC80 / Citizens Community Bancorp Inc/WI | 1.99 | -3.12 | 2.4843 | 0.0458 | |||||

| RCC / Ready Capital Corporation - Corporate Bond/Note | 0.08 | 0.00 | 1.98 | -2.98 | 2.4773 | 0.0481 | |||

| FirstBank/Nashville TN / DBT (US33766NAJ37) | 1.98 | -0.85 | 2.4722 | 0.0300 | |||||

| US337930AD30 / Flagstar Bancorp Inc | 1.97 | -5.12 | 2.4539 | -0.0058 | |||||

| USMT / US Metro Bancorp, Inc. | 1.94 | -4.86 | 2.4232 | 0.0016 | |||||

| US69320NAA54 / PCAP Holdings LP | 1.92 | -3.66 | 2.3984 | 0.0315 | |||||

| US89642CAC47 / Trinitas Capital Management LLC | 1.90 | -1.91 | 2.3712 | 0.0729 | |||||

| US40624QAB05 / Hallmark Financial Services, Inc. | 1.87 | -4.59 | 2.3350 | 0.0074 | |||||

| US05990KAD81 / Banc of California NA | 1.65 | -4.73 | 2.0618 | 0.0031 | |||||

| UIHC / American Coastal Insurance Corp | 1.62 | -3.97 | 2.0221 | 0.0191 | |||||

| US56607VAA89 / Marble Point Loan Financing Ltd / MPLF Funding I LLC | 1.55 | 7.84 | 1.9411 | 0.2296 | |||||

| US26845AAA97 / EF Holdco / EF Cayman Hold / Ellington Fin REIT Cayman/TRS / EF Cayman Non-MTM | 1.49 | 1.8627 | 1.8627 | ||||||

| US45384BAC00 / Independent Bank Group Inc | 1.49 | -2.99 | 1.8611 | 0.0361 | |||||

| US06644AAB26 / BANK OF GUAM | 1.46 | -0.41 | 1.8276 | 0.0821 | |||||

| US64828T7063 / NEW RESIDENTIAL INVESTMENT CORP SER D 7%/VAR PFD PERP | 0.06 | 0.00 | 1.41 | -6.02 | 1.7546 | -0.0210 | |||

| US31846V2117 / FIRST AM GOV OBLIG-U | 1.20 | -49.09 | 1.20 | -49.13 | 1.5033 | -1.3053 | |||

| RILYL / B. Riley Financial, Inc. - Preferred Stock | 0.04 | 0.00 | 1.04 | 3.28 | 1.2981 | 0.0673 | |||

| NPB / Northpointe Bancshares, Inc. | 0.04 | 0.00 | 1.03 | 1.78 | 1.2869 | 0.0695 | |||

| / B. Riley Financial Inc | 0.04 | 0.00 | 1.02 | 0.40 | 1.2696 | 0.0669 | |||

| US05969AAA34 / Bancorp Bank/The | 1.01 | -1.08 | 1.2620 | 0.0486 | |||||

| US748249AA78 / Queensborough Co/The | 1.01 | -2.04 | 1.2571 | 0.0371 | |||||

| US19058XAA63 / CoastalSouth Bancshares Inc | 1.00 | -1.18 | 1.2534 | 0.0475 | |||||

| Clear Street Group Inc / EP (US18469C3079) | 0.04 | 0.00 | 1.00 | 0.00 | 1.2487 | 0.0795 | |||

| NLY.PRF / Annaly Capital Management, Inc. - Preferred Stock | 0.04 | 0.00 | 0.99 | -0.30 | 1.2402 | 0.0574 | |||

| US85917AAC45 / Sterling Bancorp/DE | 0.99 | -5.36 | 1.2338 | -0.0071 | |||||

| US154760AC68 / Central Pacific Financial Corp | 0.99 | -5.19 | 1.2333 | -0.0030 | |||||

| AGNC / AGNC Investment Corp. | 0.04 | 0.00 | 0.98 | -1.99 | 1.2297 | 0.0364 | |||

| US038923AW89 / Arbor Realty Trust Inc | 0.97 | -2.31 | 1.2160 | 0.0330 | |||||

| US00180VAA17 / ANB Corp | 0.97 | -2.90 | 1.2127 | 0.0245 | |||||

| US84046SAF56 / SOUTH STREET SECURITIES FUNDING LLC 144A 6.250000% 12/30/2026 | 0.96 | -1.53 | 1.2036 | 0.0410 | |||||

| US92891CCH34 / VyStar Credit Union | 0.96 | 1.2032 | 1.2032 | ||||||

| US317580AA61 / Financial Institutions Inc | 0.96 | -4.21 | 1.1927 | 0.0076 | |||||

| US565126AA74 / Maple Financial Holdings Inc | 0.95 | -3.25 | 1.1914 | 0.0195 | |||||

| US66982EAA01 / A10 Capital LLC | 0.95 | -5.11 | 1.1833 | -0.0027 | |||||

| US07279BAA26 / FIRST HOME | 0.94 | -3.67 | 1.1792 | 0.0152 | |||||

| US12479GAA94 / CB Financial Services Inc | 0.94 | -4.77 | 1.1719 | 0.0014 | |||||

| US43785VAE20 / HomeStreet Inc | 0.94 | -6.50 | 1.1677 | -0.0204 | |||||

| US20161DAA28 / Commercial Credit Group Inc | 0.93 | -5.96 | 1.1635 | -0.0134 | |||||

| US87266M2061 / TPG RE Finance Trust Inc | 0.03 | 0.00 | 0.63 | -12.32 | 0.7820 | -0.0663 | |||

| / Dime Community Bancshares, Inc., Series A, 5.50% | 0.03 | 0.00 | 0.55 | -12.10 | 0.6899 | -0.0565 | |||

| CCNEP / CNB Financial Corporation - Preferred Stock | 0.02 | 0.00 | 0.53 | -2.78 | 0.6558 | 0.0230 | |||

| FRMEP / First Merchants Corporation - Preferred Stock | 0.02 | 0.52 | 0.6458 | 0.6458 | |||||

| US04911A2069 / Atlantic Union Bankshares Corp | 0.02 | 0.00 | 0.51 | -4.64 | 0.6423 | 0.0013 | |||

| / OceanFirst Financial Corp. | 0.02 | 0.00 | 0.51 | -2.69 | 0.6340 | 0.0148 | |||

| / CORPORATE BONDS | 0.02 | 0.00 | 0.51 | -5.77 | 0.6318 | -0.0059 | |||

| RCB / Ready Capital Corporation - Corporate Bond/Note | 0.02 | 0.00 | 0.50 | -0.60 | 0.6253 | 0.0273 | |||

| / B RILEY FINL INC 5.5% PFD 03/31/26 | 0.02 | 0.00 | 0.50 | -1.39 | 0.6203 | 0.0223 | |||

| EFC.PRA / Ellington Financial Inc. - Preferred Stock | 0.02 | 0.00 | 0.48 | -3.78 | 0.6041 | 0.0079 | |||

| US432748AE14 / Hilltop Holdings Inc | 0.26 | -6.16 | 0.3243 | -0.0046 | |||||

| REVREPO00180VAA1 / RA (N/A) | -0.15 | -128.74 | -0.1823 | -0.8038 | |||||

| REVREPO43785VAE2 / RA (N/A) | -0.57 | -212.01 | -0.7105 | -1.3320 | |||||

| REVREPO20161DAA2 / RA (N/A) | -0.57 | -212.20 | -0.7117 | -1.3332 | |||||

| REVREPO91741UAC0 / RA (N/A) | -0.58 | -214.76 | -0.7280 | -1.3495 | |||||

| REVREPO85917AAC4 / RA (N/A) | -0.59 | -217.13 | -0.7429 | -1.3644 | |||||

| REVREPO05969AAA3 / RA (N/A) | -0.61 | -219.29 | -0.7567 | -1.3782 | |||||

| REVREPO45384BAC0 / RA (N/A) | -0.90 | -276.77 | -1.1213 | -1.7428 | |||||

| REVREPO56607VAA8 / RA (N/A) | -0.94 | -284.06 | -1.1675 | -1.7890 | |||||

| REVREPO598511AC7 / RA (N/A) | -0.94 | -284.25 | -1.1687 | -1.7902 | |||||

| REVREPO910710AA0 / RA (N/A) | -0.97 | -291.34 | -1.2137 | -1.8352 | |||||

| REVREPO05990KAD8 / RA (N/A) | -0.99 | -295.87 | -1.2424 | -1.8639 | |||||

| REVREPO69320NAA5 / RA (N/A) | -1.16 | -329.13 | -1.4534 | -2.0749 | |||||

| REVREPO337930AD3 / RA (N/A) | -1.18 | -333.07 | -1.4784 | -2.0999 | |||||

| REVREPO18452FAB7 / RA (N/A) | -1.19 | -334.25 | -1.4859 | -2.1074 | |||||

| REVREPO33766NAJ3 / RA (N/A) | -1.19 | -334.45 | -1.4871 | -2.1086 | |||||

| REVREPO04004XAA3 / RA (N/A) | -1.20 | -336.22 | -1.4984 | -2.1199 | |||||

| REVREPO843395AB0 / RA (N/A) | -1.22 | -339.57 | -1.5196 | -2.1411 | |||||

| REVREPO31431BAC3 / RA (N/A) | -1.22 | -340.94 | -1.5284 | -2.1498 | |||||

| REVREPO07272MAA5 / RA (N/A) | -1.22 | -340.94 | -1.5284 | -2.1498 | |||||

| REVREPO29911QAA7 / RA (N/A) | -1.23 | -342.13 | -1.5358 | -2.1573 | |||||

| REVREPO223622AG6 / RA (N/A) | -1.24 | -343.31 | -1.5433 | -2.1648 | |||||

| REVREPO12634QAJ0 / RA (N/A) | -1.25 | -345.08 | -1.5546 | -2.1761 | |||||

| REVREPO18468HAC3 / RA (N/A) | -1.47 | -389.37 | -1.8355 | -2.4570 | |||||

| REVREPO33767UAA5 / RA (N/A) | -1.53 | -400.59 | -1.9067 | -2.5282 | |||||

| REVREPO67740QAG1 / RA (N/A) | -1.56 | -407.68 | -1.9516 | -2.5731 | |||||

| REVREPO23204HBM9 / RA (N/A) | -1.57 | -408.46 | -1.9566 | -2.5781 | |||||

| REVREPO89679EAB8 / RA (N/A) | -1.80 | -453.94 | -2.2451 | -2.8666 | |||||

| REVREPO67449JAA4 / RA (N/A) | -1.82 | -457.68 | -2.2688 | -2.8903 | |||||

| REVREPO124411AA7 / RA (N/A) | -1.85 | -465.16 | -2.3163 | -2.9377 | |||||

| REVREPO29460XAC3 / RA (N/A) | -1.93 | -480.12 | -2.4111 | -3.0326 |