Basic Stats

| Portfolio Value | $ 198,411,479 |

| Current Positions | 96 |

Latest Holdings, Performance, AUM (from 13F, 13D)

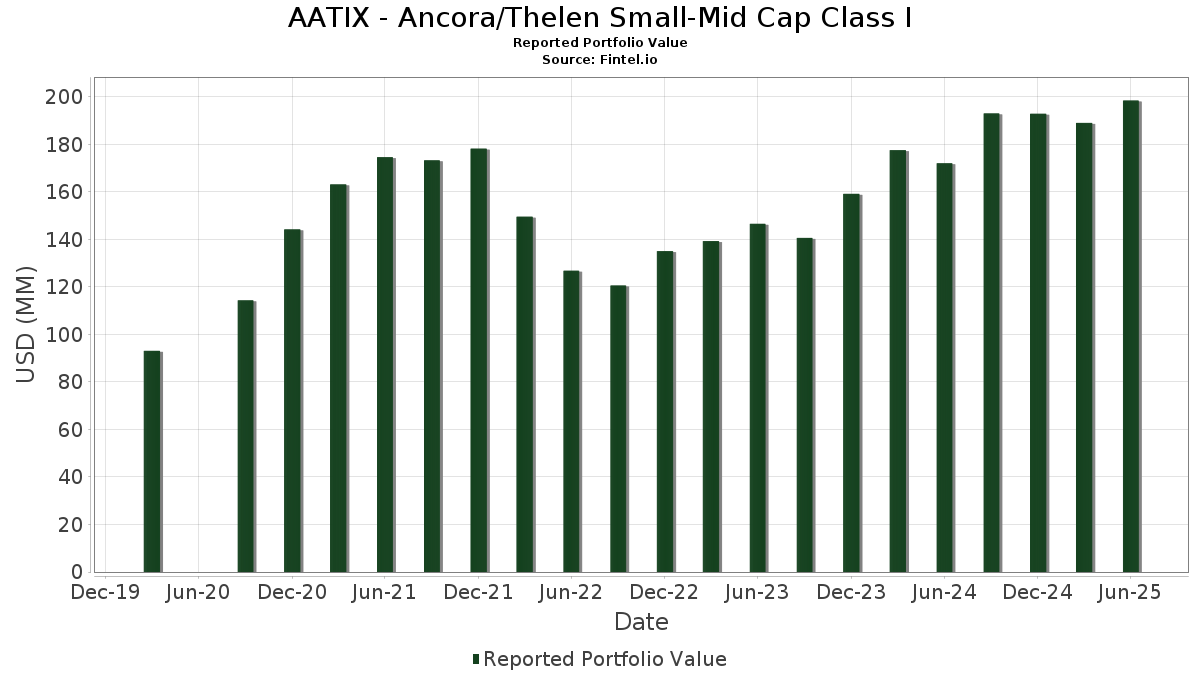

AATIX - Ancora/Thelen Small-Mid Cap Class I has disclosed 96 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 198,411,479 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AATIX - Ancora/Thelen Small-Mid Cap Class I’s top holdings are UGI Corporation (US:UGI) , Fortune Brands Home & Security Inc (US:FBHS) , Crane NXT, Co. (US:CXT) , Aramark (US:ARMK) , and Kyndryl Holdings, Inc. (US:KD) . AATIX - Ancora/Thelen Small-Mid Cap Class I’s new positions include Amcor plc (US:AMCR) , Angi Inc. (US:ANGI) , Calavo Growers, Inc. (US:CVGW) , EZCORP, Inc. (DE:EZ2A) , and Costamare Bulkers Holdings Limited (US:CMDB) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.41 | 3.80 | 1.9100 | 1.9100 | |

| 0.22 | 3.31 | 1.6700 | 1.6700 | |

| 0.11 | 3.03 | 1.5300 | 1.5300 | |

| 0.22 | 2.75 | 1.3900 | 1.3100 | |

| 0.02 | 3.03 | 1.5300 | 1.0400 | |

| 0.08 | 4.88 | 2.4600 | 0.9500 | |

| 0.07 | 3.02 | 1.5200 | 0.7400 | |

| 0.07 | 1.62 | 0.8200 | 0.5300 | |

| 0.12 | 4.89 | 2.4600 | 0.5200 | |

| 0.52 | 2.93 | 1.4800 | 0.5200 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.8500 | ||

| 0.09 | 1.51 | 0.7600 | -1.6700 | |

| 4.44 | 4.44 | 2.2400 | -1.6200 | |

| 0.16 | 1.94 | 0.9800 | -1.3400 | |

| 0.04 | 1.26 | 0.6300 | -1.1000 | |

| 0.33 | 1.58 | 0.7900 | -0.9700 | |

| 0.03 | 0.57 | 0.2800 | -0.8000 | |

| 0.05 | 2.90 | 1.4600 | -0.6500 | |

| 0.00 | 0.00 | -0.6200 | ||

| 0.07 | 0.71 | 0.3600 | -0.5300 |

13F and Fund Filings

This form was filed on 2025-08-20 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UGI / UGI Corporation | 0.18 | 0.00 | 6.52 | 10.14 | 3.2800 | 0.1500 | |||

| FBHS / Fortune Brands Home & Security Inc | 0.11 | 27.58 | 5.55 | 7.87 | 2.8000 | 0.0800 | |||

| CXT / Crane NXT, Co. | 0.10 | 9.13 | 5.45 | 14.44 | 2.7500 | 0.2300 | |||

| ARMK / Aramark | 0.13 | 2.45 | 5.24 | 24.27 | 2.6400 | 0.4100 | |||

| KD / Kyndryl Holdings, Inc. | 0.12 | 0.00 | 4.89 | 33.62 | 2.4600 | 0.5200 | |||

| ECG / Everus Construction Group, Inc. | 0.08 | 0.00 | 4.88 | 71.32 | 2.4600 | 0.9500 | |||

| GOIXX / Federated Hermes Money Market Obligations Trust - Federated Hermes Gov Oblig Fd Inst Shs USD | 4.44 | -39.22 | 4.44 | -39.22 | 2.2400 | -1.6200 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.12 | 0.00 | 4.21 | -0.85 | 2.1200 | -0.1300 | |||

| PCH / PotlatchDeltic Corporation | 0.11 | 6.96 | 4.13 | -9.06 | 2.0800 | -0.3200 | |||

| IAC / IAC Inc. | 0.11 | 8.90 | 4.00 | -11.48 | 2.0200 | -0.3700 | |||

| CR / Crane Company | 0.02 | 0.00 | 3.96 | 23.99 | 2.0000 | 0.3100 | |||

| AMCR / Amcor plc | 0.41 | 3.80 | 1.9100 | 1.9100 | |||||

| NWE / NorthWestern Energy Group, Inc. | 0.07 | -2.99 | 3.76 | -14.00 | 1.8900 | -0.4200 | |||

| VNT / Vontier Corporation | 0.10 | 0.00 | 3.65 | 12.34 | 1.8400 | 0.1200 | |||

| BATRK / Atlanta Braves Holdings, Inc. | 0.08 | -13.19 | 3.56 | 1.45 | 1.7900 | -0.0700 | |||

| NPKI / NPK International Inc. | 0.40 | 0.00 | 3.39 | 46.50 | 1.7100 | 0.4800 | |||

| ANGI / Angi Inc. | 0.22 | 3.31 | 1.6700 | 1.6700 | |||||

| APG / APi Group Corporation | 0.06 | -0.73 | 3.14 | 41.75 | 1.5800 | 0.4100 | |||

| RYN / Rayonier Inc. | 0.14 | 11.71 | 3.11 | -11.14 | 1.5700 | -0.2800 | |||

| MDU / MDU Resources Group, Inc. | 0.18 | 2.22 | 3.07 | 0.76 | 1.5400 | -0.0700 | |||

| CVGW / Calavo Growers, Inc. | 0.11 | 3.03 | 1.5300 | 1.5300 | |||||

| MIDD / The Middleby Corporation | 0.02 | 242.67 | 3.03 | 224.65 | 1.5300 | 1.0400 | |||

| PHIN / PHINIA Inc. | 0.07 | 96.50 | 3.02 | 106.01 | 1.5200 | 0.7400 | |||

| ALIT / Alight, Inc. | 0.52 | 69.02 | 2.93 | 61.38 | 1.4800 | 0.5200 | |||

| ROCK / Gibraltar Industries, Inc. | 0.05 | -27.90 | 2.90 | -27.49 | 1.4600 | -0.6500 | |||

| HHH / Howard Hughes Holdings Inc. | 0.04 | -13.97 | 2.77 | -21.62 | 1.4000 | -0.4700 | |||

| SHYF / The Shyft Group, Inc. | 0.22 | 1,009.73 | 2.75 | 1,629.56 | 1.3900 | 1.3100 | |||

| JXN / Jackson Financial Inc. | 0.03 | 0.00 | 2.62 | 5.99 | 1.3200 | 0.0100 | |||

| SFD / Smithfield Foods, Inc. | 0.11 | 15.60 | 2.62 | 33.38 | 1.3200 | 0.2800 | |||

| HLI / Houlihan Lokey, Inc. | 0.01 | 0.00 | 2.58 | 11.42 | 1.3000 | 0.0800 | |||

| ACA / Arcosa, Inc. | 0.03 | 0.00 | 2.42 | 12.42 | 1.2200 | 0.0800 | |||

| MBC / MasterBrand, Inc. | 0.21 | 0.00 | 2.35 | -16.33 | 1.1800 | -0.3000 | |||

| FTDR / Frontdoor, Inc. | 0.04 | -3.57 | 2.34 | 47.97 | 1.1800 | 0.3400 | |||

| J / Jacobs Solutions Inc. | 0.02 | 0.00 | 2.29 | 8.73 | 1.1500 | 0.0300 | |||

| EHC / Encompass Health Corporation | 0.02 | 0.00 | 2.21 | 21.05 | 1.1200 | 0.1500 | |||

| DTM / DT Midstream, Inc. | 0.02 | 0.00 | 2.17 | 13.90 | 1.0900 | 0.0800 | |||

| IIIN / Insteel Industries, Inc. | 0.06 | 24.99 | 2.16 | 76.82 | 1.0900 | 0.4400 | |||

| ORN / Orion Group Holdings, Inc. | 0.22 | -0.66 | 2.01 | 72.30 | 1.0100 | 0.3900 | |||

| MEC / Mayville Engineering Company, Inc. | 0.13 | 21.85 | 2.00 | 44.85 | 1.0100 | 0.2800 | |||

| WWW / Wolverine World Wide, Inc. | 0.11 | -1.50 | 1.94 | 28.06 | 0.9800 | 0.1800 | |||

| MAGN / Magnera Corporation | 0.16 | -33.20 | 1.94 | -55.58 | 0.9800 | -1.3400 | |||

| VTS / Vitesse Energy, Inc. | 0.09 | 49.75 | 1.93 | 34.52 | 0.9700 | 0.2100 | |||

| PNR / Pentair plc | 0.02 | 15.44 | 1.92 | 35.45 | 0.9700 | 0.2200 | |||

| CMPO / CompoSecure, Inc. | 0.13 | 77.02 | 1.88 | 129.34 | 0.9500 | 0.5200 | |||

| RBA / RB Global, Inc. | 0.02 | -16.17 | 1.87 | -11.27 | 0.9400 | -0.1700 | |||

| AGM / Federal Agricultural Mortgage Corporation | 0.01 | 0.00 | 1.85 | 3.64 | 0.9300 | -0.0200 | |||

| RJF / Raymond James Financial, Inc. | 0.01 | 0.00 | 1.79 | 10.42 | 0.9000 | 0.0400 | |||

| PRSU / Pursuit Attractions and Hospitality, Inc. | 0.06 | 16.63 | 1.73 | -4.99 | 0.8700 | -0.1000 | |||

| CNNE / Cannae Holdings, Inc. | 0.08 | 106.02 | 1.73 | 134.46 | 0.8700 | 0.4800 | |||

| MRP / Millrose Properties, Inc. | 0.06 | 30.20 | 1.69 | 39.97 | 0.8500 | 0.2100 | |||

| PRMB / Primo Brands Corporation | 0.06 | -13.87 | 1.66 | -28.13 | 0.8400 | -0.3800 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.02 | 0.00 | 1.66 | -10.28 | 0.8400 | -0.1400 | |||

| PWP / Perella Weinberg Partners | 0.08 | 0.00 | 1.64 | 5.54 | 0.8300 | 0.0100 | |||

| AMTM / Amentum Holdings, Inc. | 0.07 | 126.45 | 1.62 | 194.02 | 0.8200 | 0.5300 | |||

| SAND / Sandstorm Gold Ltd. | 0.17 | -29.09 | 1.60 | -11.73 | 0.8100 | -0.1500 | |||

| NGVT / Ingevity Corporation | 0.04 | -40.17 | 1.59 | -34.88 | 0.8000 | -0.4900 | |||

| NCMI / National CineMedia, Inc. | 0.33 | -42.77 | 1.58 | -52.53 | 0.7900 | -0.9700 | |||

| NOMD / Nomad Foods Limited | 0.09 | -61.99 | 1.51 | -67.15 | 0.7600 | -1.6700 | |||

| DRH / DiamondRock Hospitality Company | 0.20 | 13.26 | 1.49 | 12.33 | 0.7500 | 0.0500 | |||

| DBD / Diebold Nixdorf, Incorporated | 0.03 | -15.13 | 1.42 | 7.57 | 0.7200 | 0.0200 | |||

| TNL / Travel + Leisure Co. | 0.03 | 0.00 | 1.42 | 11.51 | 0.7100 | 0.0400 | |||

| FG / F&G Annuities & Life, Inc. | 0.04 | 99.90 | 1.39 | 77.42 | 0.7000 | 0.2800 | |||

| PZZA / Papa John's International, Inc. | 0.03 | 0.00 | 1.39 | 19.14 | 0.7000 | 0.0800 | |||

| RCMT / RCM Technologies, Inc. | 0.06 | 0.00 | 1.31 | 51.10 | 0.6600 | 0.2000 | |||

| ENOV / Enovis Corporation | 0.04 | -53.24 | 1.26 | -61.62 | 0.6300 | -1.1000 | |||

| CVCO / Cavco Industries, Inc. | 0.00 | 0.00 | 1.15 | -16.38 | 0.5800 | -0.1500 | |||

| PBPB / Potbelly Corporation | 0.09 | 4.23 | 1.11 | 34.26 | 0.5600 | 0.1200 | |||

| RAIL / FreightCar America, Inc. | 0.12 | 50.94 | 1.03 | 135.47 | 0.5200 | 0.2900 | |||

| RGCO / RGC Resources, Inc. | 0.05 | 6.52 | 1.02 | 14.17 | 0.5200 | 0.0500 | |||

| ZIMV / ZimVie Inc. | 0.11 | 0.47 | 1.02 | -13.00 | 0.5100 | -0.1100 | |||

| EZ2A / EZCORP, Inc. | 0.07 | 1.01 | 0.5100 | 0.5100 | |||||

| CTRI / Centuri Holdings, Inc. | 0.05 | 43.31 | 1.01 | 96.50 | 0.5100 | 0.2400 | |||

| VVX / V2X, Inc. | 0.02 | -9.44 | 1.01 | -10.35 | 0.5100 | -0.0800 | |||

| CTO / CTO Realty Growth, Inc. | 0.06 | -27.92 | 0.99 | -35.59 | 0.5000 | -0.3100 | |||

| NCR / NCR Corp. | 0.08 | 0.98 | 0.4900 | 0.4900 | |||||

| TRS / TriMas Corporation | 0.03 | 127.93 | 0.98 | 178.63 | 0.4900 | 0.3000 | |||

| CMDB / Costamare Bulkers Holdings Limited | 0.11 | 0.93 | 0.4700 | 0.4700 | |||||

| PNTG / The Pennant Group, Inc. | 0.03 | 0.00 | 0.90 | 18.68 | 0.4500 | 0.0500 | |||

| PSTL / Postal Realty Trust, Inc. | 0.06 | 0.00 | 0.88 | 3.15 | 0.4500 | 0.0000 | |||

| TTAM / Titan America SA | 0.07 | 0.87 | 0.4400 | 0.4400 | |||||

| FTV / Fortive Corporation | 0.02 | 0.87 | 0.4400 | 0.4400 | |||||

| DLTR / Dollar Tree, Inc. | 0.01 | 0.00 | 0.81 | 31.98 | 0.4100 | 0.0800 | |||

| CLW / Clearwater Paper Corporation | 0.03 | 135.50 | 0.80 | 152.70 | 0.4000 | 0.2300 | |||

| PRG / PROG Holdings, Inc. | 0.03 | -20.16 | 0.79 | -44.55 | 0.4000 | -0.3400 | |||

| CNDT / Conduent Incorporated | 0.29 | -13.90 | 0.77 | -43.63 | 0.3900 | -0.3100 | |||

| EMBC / Embecta Corp. | 0.07 | -44.05 | 0.71 | -57.48 | 0.3600 | -0.5300 | |||

| TALK / Talkspace, Inc. | 0.24 | 14.49 | 0.67 | 24.44 | 0.3400 | 0.0500 | |||

| SMG / The Scotts Miracle-Gro Company | 0.01 | 0.66 | 0.3300 | 0.3300 | |||||

| SEG / Seaport Entertainment Group Inc. | 0.03 | -68.21 | 0.57 | -72.41 | 0.2800 | -0.8000 | |||

| DINO / HF Sinclair Corporation | 0.01 | 0.45 | 0.2300 | 0.2300 | |||||

| DSGR / Distribution Solutions Group, Inc. | 0.02 | 0.00 | 0.42 | -1.85 | 0.2100 | -0.0200 | |||

| RDVT / Red Violet, Inc. | 0.01 | -60.32 | 0.29 | -48.14 | 0.1500 | -0.1500 | |||

| RHLD / Resolute Holdings Management, Inc. | 0.01 | 0.28 | 0.1400 | 0.1400 | |||||

| VOXR / Vox Royalty Corp. | 0.07 | 0.00 | 0.21 | 8.21 | 0.1100 | 0.0100 | |||

| ARKO / Arko Corp. | 0.03 | 0.14 | 0.0700 | 0.0700 | |||||

| ESAB / ESAB Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| NEOG / Neogen Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6200 | ||||

| WOOF / Petco Health and Wellness Company, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3200 | ||||

| ATEX / Anterix Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2000 | ||||

| BERY / Berry Global Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.8500 |