Basic Stats

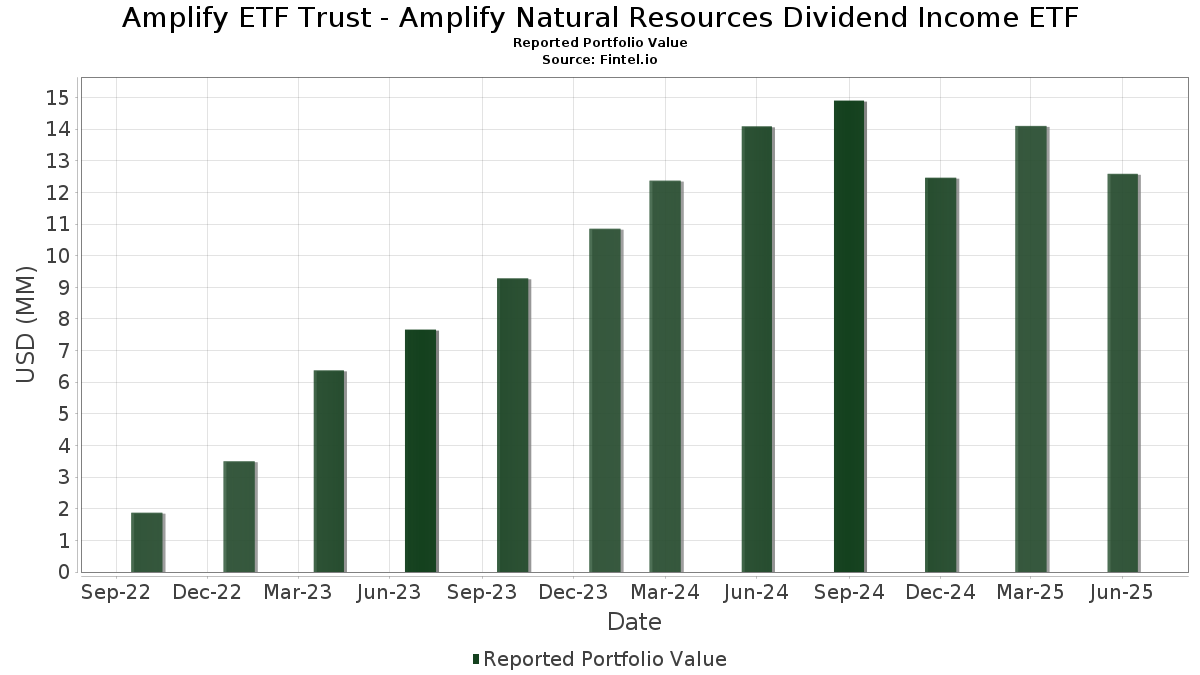

| Portfolio Value | $ 12,588,110 |

| Current Positions | 48 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF has disclosed 48 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 12,588,110 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF’s top holdings are First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) (US:PBR) , LyondellBasell Industries N.V. (US:LYB) , CVR Energy, Inc. (US:CVI) , and The Chemours Company (US:CC) . Amplify ETF Trust - Amplify Natural Resources Dividend Income ETF’s new positions include PBF Energy Inc. (US:PBF) , Atlas Energy Solutions Inc. (US:AESI) , Crescent Energy Company (US:CRGY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.41 | 3.4775 | 3.4775 | |

| 0.05 | 0.54 | 4.5412 | 2.9075 | |

| 0.01 | 0.31 | 2.6449 | 2.6449 | |

| 0.01 | 0.31 | 2.6076 | 2.6076 | |

| 0.02 | 0.44 | 3.7387 | 2.2816 | |

| 0.02 | 0.23 | 1.9780 | 1.9780 | |

| 0.01 | 0.56 | 4.7771 | 1.7706 | |

| 0.02 | 0.20 | 1.6931 | 1.6931 | |

| 0.02 | 0.52 | 4.4421 | 1.6644 | |

| 0.02 | 0.56 | 4.7120 | 1.5635 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.17 | 1.4211 | -2.4630 | |

| 0.01 | 0.16 | 1.3899 | -1.9343 | |

| 0.01 | 0.17 | 1.4665 | -1.8896 | |

| 0.01 | 0.14 | 1.2019 | -1.6975 | |

| 0.00 | 0.10 | 0.8285 | -1.4698 | |

| 0.00 | 0.13 | 1.1386 | -1.4368 | |

| 0.77 | 0.77 | 6.5337 | -1.3790 | |

| 0.00 | 0.17 | 1.4551 | -1.2948 | |

| 0.01 | 0.24 | 2.0026 | -1.2677 | |

| 0.00 | 0.13 | 1.1281 | -1.2349 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.