Basic Stats

| Insider Profile | ABERDEEN TOTAL DYNAMIC DIVIDEND FUND |

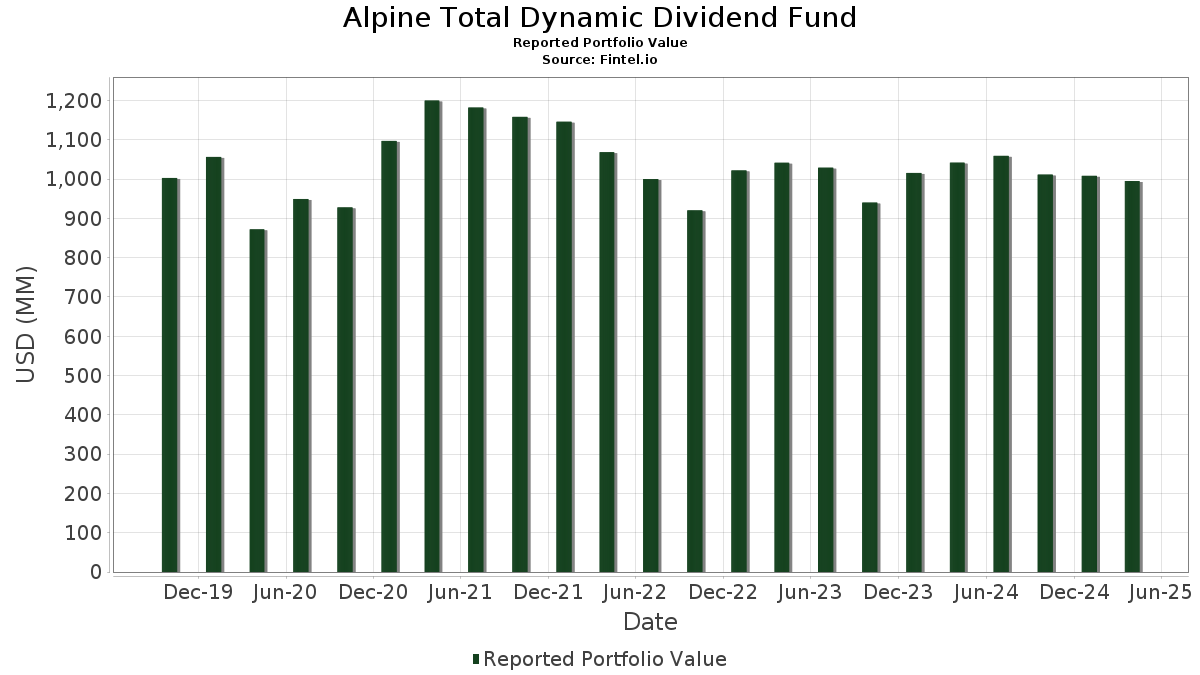

| Portfolio Value | $ 995,147,513 |

| Current Positions | 87 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Alpine Total Dynamic Dividend Fund has disclosed 87 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 995,147,513 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Alpine Total Dynamic Dividend Fund’s top holdings are Microsoft Corporation (US:MSFT) , Broadcom Inc. (US:AVGO) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOG) , and Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München - Depositary Receipt (Common Stock) (US:MURGY) . Alpine Total Dynamic Dividend Fund’s new positions include Becton, Dickinson and Company (US:BDX) , Pandora A/S (DE:3P7) , Playtech plc (DE:PL8) , Contemporary Amperex Technology Co., Limited (DE:C7A) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 9.49 | 9.49 | 0.9871 | 0.9859 | |

| 0.05 | 9.36 | 0.9737 | 0.9737 | |

| 0.03 | 19.44 | 2.0225 | 0.9599 | |

| 0.05 | 7.03 | 0.7309 | 0.7309 | |

| 6.96 | 10.94 | 1.1376 | 0.7212 | |

| 0.78 | 16.15 | 1.6795 | 0.6257 | |

| 0.54 | 5.45 | 0.5669 | 0.5669 | |

| 0.23 | 10.26 | 1.0671 | 0.4668 | |

| 0.14 | 4.45 | 0.4633 | 0.4633 | |

| 0.16 | 10.38 | 1.0801 | 0.4173 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.18 | 28.38 | 2.9523 | -0.6387 | |

| 0.10 | 8.13 | 0.8456 | -0.3806 | |

| 0.03 | 15.00 | 1.5607 | -0.3479 | |

| 0.15 | 28.99 | 3.0152 | -0.2842 | |

| 0.28 | 7.08 | 0.7364 | -0.2414 | |

| 0.06 | 8.13 | 0.8453 | -0.2366 | |

| 0.64 | 18.00 | 1.8722 | -0.2267 | |

| 0.02 | 8.19 | 0.8517 | -0.2172 | |

| 0.08 | 11.69 | 1.2164 | -0.2039 | |

| 0.11 | 6.18 | 0.6430 | -0.1915 |

13F and Fund Filings

This form was filed on 2025-06-13 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.09 | 0.00 | 35.22 | -4.77 | 3.6635 | 0.0018 | |||

| AVGO / Broadcom Inc. | 0.15 | 0.00 | 28.99 | -13.02 | 3.0152 | -0.2842 | |||

| AAPL / Apple Inc. | 0.13 | 0.00 | 28.41 | -9.96 | 2.9554 | -0.1687 | |||

| GOOG / Alphabet Inc. | 0.18 | 0.00 | 28.38 | -21.75 | 2.9523 | -0.6387 | |||

| MURGY / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München - Depositary Receipt (Common Stock) | 0.03 | 43.43 | 19.44 | 81.16 | 2.0225 | 0.9599 | |||

| JPM / JPMorgan Chase & Co. | 0.08 | 0.00 | 18.52 | -8.49 | 1.9263 | -0.0772 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.64 | 0.00 | 18.00 | -15.10 | 1.8722 | -0.2267 | |||

| NNND / Tencent Holdings Limited | 0.27 | 0.00 | 16.54 | 16.41 | 1.7203 | 0.3137 | |||

| ENGI / Engie SA | 0.78 | 21.16 | 16.15 | 51.71 | 1.6795 | 0.6257 | |||

| TJX / The TJX Companies, Inc. | 0.12 | -11.05 | 15.54 | -8.27 | 1.6170 | -0.0609 | |||

| GS / The Goldman Sachs Group, Inc. | 0.03 | -8.97 | 15.00 | -22.17 | 1.5607 | -0.3479 | |||

| ABBV / AbbVie Inc. | 0.07 | -10.16 | 14.32 | -4.69 | 1.4897 | 0.0020 | |||

| LIN / Linde plc | 0.03 | 0.00 | 13.74 | 2.48 | 1.4294 | 0.1018 | |||

| LOW / Lowe's Companies, Inc. | 0.06 | 0.00 | 13.32 | -14.03 | 1.3860 | -0.1485 | |||

| BA. / BAE Systems plc | 0.57 | -13.63 | 13.24 | 32.46 | 1.3770 | 0.3875 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.68 | -12.08 | 13.20 | 2.72 | 1.3732 | 0.1008 | |||

| MFZ / Mitsubishi UFJ Financial Group, Inc. | 1.05 | 0.00 | 13.17 | -0.37 | 1.3701 | 0.0611 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.18 | 0.00 | 13.14 | 1.45 | 1.3666 | 0.0845 | |||

| 05935 / Samsung Electronics Co Ltd | 0.39 | 0.00 | 13.03 | 12.48 | 1.3550 | 0.2083 | |||

| DANOY / Danone S.A. - Depositary Receipt (Common Stock) | 0.15 | 0.00 | 12.88 | 22.85 | 1.3399 | 0.3017 | |||

| SAN / Santander UK plc - Preferred Stock | 0.12 | -17.30 | 12.76 | -16.76 | 1.3268 | -0.1904 | |||

| OVCHY / Oversea-Chinese Banking Corporation Limited - Depositary Receipt (Common Stock) | 1.03 | -7.78 | 12.71 | -10.51 | 1.3218 | -0.0842 | |||

| TTA / Time to Act Plc | 0.22 | 0.00 | 12.47 | -2.03 | 1.2969 | 0.0369 | |||

| WMB / The Williams Companies, Inc. | 0.21 | -18.74 | 12.42 | -14.14 | 1.2916 | -0.1402 | |||

| CME / CME Group Inc. | 0.04 | -9.68 | 12.41 | 5.81 | 1.2913 | 0.1297 | |||

| KO / The Coca-Cola Company | 0.17 | -7.93 | 12.38 | 5.23 | 1.2883 | 0.1230 | |||

| KDP / Keurig Dr Pepper Inc. | 0.36 | -11.03 | 12.36 | -4.13 | 1.2860 | 0.0093 | |||

| ENB / Enbridge Inc. | 0.26 | -11.56 | 12.36 | -4.51 | 1.2856 | 0.0042 | |||

| CSCO / Cisco Systems, Inc. | 0.21 | -5.36 | 12.13 | -9.84 | 1.2617 | -0.0703 | |||

| BAC / Bank of America Corporation | 0.30 | 0.00 | 11.98 | -13.87 | 1.2466 | -0.1310 | |||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0.33 | 0.00 | 11.90 | 7.06 | 1.2375 | 0.1373 | |||

| FER / Ferrovial SE | 0.24 | 0.00 | 11.81 | 14.29 | 1.2289 | 0.2055 | |||

| RWEOY / RWE Aktiengesellschaft - Depositary Receipt (Common Stock) | 0.30 | 0.00 | 11.80 | 25.32 | 1.2277 | 0.2952 | |||

| LDNXF / London Stock Exchange Group plc | 0.08 | -22.10 | 11.69 | -18.49 | 1.2164 | -0.2039 | |||

| FIS / Fidelity National Information Services, Inc. | 0.15 | 0.00 | 11.51 | -3.18 | 1.1972 | 0.0203 | |||

| WM / Waste Management, Inc. | 0.05 | 0.00 | 11.48 | 5.95 | 1.1943 | 0.1214 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.03 | -14.29 | 11.38 | -10.84 | 1.1837 | -0.0800 | |||

| CMS / CMS Energy Corporation | 0.15 | 0.00 | 11.25 | 11.59 | 1.1707 | 0.1721 | |||

| MET / MetLife, Inc. | 0.15 | 0.00 | 11.21 | -12.88 | 1.1658 | -0.1078 | |||

| DOX / Amdocs Limited | 0.13 | -4.83 | 11.18 | -4.40 | 1.1629 | 0.0050 | |||

| ASML / ASML Holding N.V. | 0.02 | 0.00 | 11.05 | -9.51 | 1.1490 | -0.0595 | |||

| TWODY / Taylor Wimpey plc - Depositary Receipt (Common Stock) | 6.96 | 145.10 | 10.94 | 160.05 | 1.1376 | 0.7212 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 10.92 | 25.32 | 1.1360 | 0.2731 | |||

| NSC / Norfolk Southern Corporation | 0.05 | 0.00 | 10.80 | -12.24 | 1.1234 | -0.0950 | |||

| TGT / Target Corporation | 0.11 | 49.32 | 10.63 | 4.70 | 1.1055 | 0.1005 | |||

| BESI / BE Semiconductor Industries N.V. | 0.10 | 0.00 | 10.59 | -15.07 | 1.1018 | -0.1331 | |||

| T2V1 / Tryg A/S | 0.44 | -22.68 | 10.57 | -8.95 | 1.0997 | -0.0499 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.16 | 95.84 | 10.38 | 55.11 | 1.0801 | 0.4173 | |||

| MDLZ / Mondelez International, Inc. | 0.15 | 0.00 | 10.29 | 17.49 | 1.0702 | 0.2032 | |||

| 388 / Hong Kong Exchanges and Clearing Limited | 0.23 | 51.58 | 10.26 | 69.22 | 1.0671 | 0.4668 | |||

| AMT / American Tower Corporation | 0.05 | 0.00 | 10.23 | 21.88 | 1.0645 | 0.2332 | |||

| ADI / Analog Devices, Inc. | 0.05 | 0.00 | 10.23 | -8.01 | 1.0645 | -0.0369 | |||

| MRK / Merck & Co., Inc. | 0.12 | 10.89 | 10.06 | -4.39 | 1.0467 | 0.0047 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.04 | 0.00 | 10.02 | -7.88 | 1.0427 | -0.0346 | |||

| FE / FirstEnergy Corp. | 0.23 | 0.00 | 10.00 | 7.74 | 1.0402 | 0.1212 | |||

| CCRO3 / CCR S.A. | 4.20 | -19.32 | 9.95 | -0.50 | 1.0355 | 0.0450 | |||

| MDT / Medtronic plc | 0.12 | 0.00 | 9.87 | -6.67 | 1.0272 | -0.0204 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.20 | 0.00 | 9.70 | -1.09 | 1.0087 | 0.0380 | |||

| CLNX / Cellnex Telecom, S.A. | 0.24 | 0.00 | 9.59 | 20.83 | 0.9973 | 0.2117 | |||

| HON / Honeywell International Inc. | 0.05 | 0.00 | 9.58 | -5.91 | 0.9963 | -0.0116 | |||

| NEE / NextEra Energy, Inc. | 0.14 | 0.00 | 9.56 | -6.55 | 0.9949 | -0.0183 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 9.49 | 81,819.96 | 9.49 | 86,154.55 | 0.9871 | 0.9859 | |||

| BDX / Becton, Dickinson and Company | 0.05 | 9.36 | 0.9737 | 0.9737 | |||||

| MBG / Mercedes-Benz Group AG | 0.15 | 0.00 | 9.05 | -1.73 | 0.9416 | 0.0296 | |||

| RI / Pernod Ricard SA | 0.08 | 0.00 | 8.44 | -5.08 | 0.8784 | -0.0025 | |||

| AMADY / Amadeus IT Group, S.A. - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 8.25 | 7.56 | 0.8581 | 0.0988 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 0.00 | 8.19 | -24.16 | 0.8517 | -0.2172 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.10 | -19.18 | 8.13 | -34.36 | 0.8456 | -0.3806 | |||

| BX / Blackstone Inc. | 0.06 | 0.00 | 8.13 | -25.63 | 0.8453 | -0.2366 | |||

| ACN / Accenture plc | 0.03 | 0.00 | 8.08 | -22.28 | 0.8402 | -0.1889 | |||

| CVS / CVS Health Corporation | 0.12 | -11.87 | 8.03 | 4.10 | 0.8348 | 0.0715 | |||

| ORCL / Oracle Corporation | 0.06 | 0.00 | 7.78 | -17.26 | 0.8095 | -0.1216 | |||

| 2317 / Hon Hai Precision Industry Co., Ltd. | 1.72 | 0.00 | 7.65 | -16.56 | 0.7957 | -0.1120 | |||

| FDX / FedEx Corporation | 0.03 | 0.00 | 7.34 | -20.59 | 0.7636 | -0.1517 | |||

| TLPFY / Teleperformance SE - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 7.29 | 17.10 | 0.7582 | 0.1419 | |||

| D1NC / DNB Bank ASA | 0.28 | -48.83 | 7.08 | -26.62 | 0.7364 | -0.2414 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.01 | 0.00 | 7.03 | -24.27 | 0.7318 | -0.1879 | |||

| 3P7 / Pandora A/S | 0.05 | 7.03 | 0.7309 | 0.7309 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.12 | 0.00 | 6.97 | -1.68 | 0.7254 | 0.0232 | |||

| JNJ / Johnson & Johnson | 0.04 | 0.00 | 6.69 | 2.73 | 0.6959 | 0.0512 | |||

| NKE / NIKE, Inc. | 0.11 | 0.00 | 6.18 | -26.66 | 0.6430 | -0.1915 | |||

| SLB / Schlumberger Limited | 0.18 | 0.00 | 5.86 | -17.46 | 0.6094 | -0.0933 | |||

| NEM / Newmont Corporation | 0.11 | -34.14 | 5.58 | -18.79 | 0.5803 | -0.0998 | |||

| PL8 / Playtech plc | 0.54 | 5.45 | 0.5669 | 0.5669 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.51 | -15.06 | 4.71 | -14.88 | 0.4903 | -0.0580 | |||

| C7A / Contemporary Amperex Technology Co., Limited | 0.14 | 4.45 | 0.4633 | 0.4633 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | -1.74 | -0.1810 | -0.1810 |